A Retrospective on Critical Moments of the First World War: June 1916

Introduction: Reflecting on Pivotal Battles and Their Impact

History often hinges on key battles and moments that shape the course of wars. From the brutal combat at Stalingrad during World War II to the decisive Battle of Kursk, strategic victories and defeats can alter the trajectory of entire nations. This week, we look back exactly one hundred years to a period of significant upheaval during the First World War, highlighting critical engagements and the complex interplay of military decisions that could have changed history.

The Broad Front of War: Russian Advances and Central Powers Retreats

In early June 1916, the Russian military launched a substantial offensive across the Eastern Front. Their forces pushed eastward surrounding the Pripet Marshes in the north and advancing into southern Romania in the south. These maneuvers were remarkably successful, forcing the Austro-Hungarian army to retreat dozens of kilometers and capturing tens of thousands of prisoners.

Meanwhile, in the west, German forces achieved notable victories, seizing the fortress of Verdun's Wöburg. Effectively, Verdun's loss symbolized a significant shift, minimizing the earlier French defensive strength. In Italy, the Austro-Hungariann army's offensive efforts declined, giving the Allies some respite.

The Middle Eastern and Naval Fronts: Uprising and Tragedy

In the Middle East, Arab rebels orchestrated a revolt against Ottoman Turkish control, contributing to the destabilization of Ottoman holdings in the region. Simultaneously at sea, a tragic incident occurred when Lord Kitchener, the British Army Minister, died after his ship struck a mine, highlighting the ever-present dangers of naval warfare.

The Battle for Verdun: A Turning Point in French Defense

Back on the Western Front, the city of Verdun remained a focal point of intense combat. German forces managed to capture the fortress of Wöburg, vital for defending the city. French General Robert Nivelle faced the dire prospect of abandoning the right bank of the Meuse, with the French resistance hinging on the critical fortress of Souville. Military historians note that the French peril in this period was arguably the most severe since February, with their reserves dwindling to a single full division by June 12.

French commanders debated whether continued German assault would topple Verdun. While some believed German victory was imminent, others thought a more cautious approach might prolong French resistance. Notably, German Chief of Staff Erich von Falkenhayn had devised plans for Verdun but kept them secret from Austria-Hungary's commander, Conrad von Hötzendorf, sowing discord among the Central Powers' coalition. This lack of coordination is often cited as a critical factor in the entanglement of the Central Powers and their inability to fully leverage their strategic advantages.

The Intraparty of Strategy and Collaboration Failures

Tensions between German and Austro-Hungarian commanders, particularly Falkenhayn and Conrad, hindered effective cooperation. Conrad was dissatisfied with Falkenhayn for not sharing plans for Verdun, diverting attention to his strategic initiatives in Italy—specifically the Trentino sector. His diverted focus was compounded by the Germans’ delayed support, leaving Austro-Hungarian forces overextended and vulnerable.

In a dramatic weekend meeting in Berlin, Conrad sought German assistance to bolster his Italian campaigns. Falkenhayn responded by withdrawing a division from the Western Front, delaying operations at Verdun. This hesitation exemplified the cautious, step-by-step approach that would ultimately undermine the Central Powers' overall campaign momentum.

On the Eastern Front, the Russian armies achieved astonishing successes. General Aleksei Brusilov announced that his forces had captured nearly 20,000 Austro-Hungarian soldiers, including hundreds of officers, within just days. The Russian offensive resulted in significant territorial gains, with the Austro-Hungarians' southern defense line collapsing due to exhausted reserves and chaotic withdrawals.

The retreat was disorderly; the Austro-Hungarian commander Karl von Pflanzer-Baltin ordered a full retreat from the Prut River defenses. Thousands of prisoners were taken in the process, with Russian forces closing in on critical logistics and supply routes. The Russian armies advanced rapidly, creating a broad salient that nearly encircled enemy positions, capturing large numbers of prisoners and vital terrain.

In the north, Russian General Alexei Evert held back the Germans, but his forces were also facing supply shortages. Russian commanders delayed planned attacks due to bad weather, missing opportunities to capitalize further on their momentum. Despite setbacks, the Russian push threatened to unwind the Habsburg Empire further.

The Limitations and Opportunities: Could the Russian Counteroffensive Have Changed the War?

Many military analysts reflect that had the Russian Evert’s forces continued their offensive without delay, the Austro-Hungarian Empire might have been compelled to seek peace or collapse entirely. The week could have marked a decisive turning point, yet logistical issues and strategic hesitations prevented full exploitation of the opportunity.

Simultaneously, the Germans and Austro-Hungarians faced their own crises. The resurgent Russian threat on the Eastern Front, coupled with ongoing attacks elsewhere, stretched their divided forces thin. The Germans' long-held advantage in Western front reserves was diminishing, while their supply lines in the east strained under the Russian advances.

In Italy, the Austrian offensive spearheaded by Conrad was nearing its end. The Italian forces continued to push northward, capturing territory and regaining ground previously lost. By June 16, Conrad withdrew a division from the Trentino sector, marking the closure of that offensive. The Italians' persistent advances provided a counterbalance to the static trench warfare in France and Belgium.

The Battle of Ypres and Other Western Front Battles

In the same period, fighting at Ypres concluded as Canadian troops reclaimed much of the territory lost to German advances. These engagements, while less decisive than Verdun or the massive Eastern Front successes, demonstrated the stalemate characterizing much of Western Europe’s trenches still held firm.

Turmoil in the Middle East and Africa

The Arab Revolt continued to escalate. British naval forces bombed Ottoman strongholds at Jeddah, leading to the fall of the city by June 16. Meanwhile, the battles in Africa saw the Allies pushing the Germans out of German East Africa, with forces from Rhodesia and Belgium making significant advances into German-held territory. Notably, the Germans withdrew from Tanganyika on June 13, marking a strategic retreat.

Reflection on the Broader Picture and "What If" Scenarios

This week underscores how many "what if" scenarios could have shifted the course of the war. What if the Germans had pressed their advantage at Verdun? What if Evert’s armies had exploited their momentum more aggressively? Or if the Austro-Hungarian and German commands had coordinated better? The possibilities remain intriguing, as history might have turned on a variety of small decisions and missed opportunities.

What this period teaches us is the fragility and complexity of wartime decision-making. Small delays, poor communication, and lack of coordination can have outsized consequences. Whether it’s the Russian advances, the stalemate at Verdun, or the shifting fronts in Africa and the Middle East, the First World War’s battles reflect the deadly interplay of strategy, logistics, and human resilience.

If you’re interested in these “what if” scenarios or in deepening your understanding of wartime decisions, many analyses and documentaries explore these pivotal moments. The week of June 1916 remains a testament to the extraordinary stakes of war — where each decision could lead to victory or catastrophe.

For further insights into figures like Falkenhayn and their plans for Verdun, or to explore the full scope of this transformative week, stay connected through historical channels and dedicated war documentaries. The past continues to inform our understanding of the present, revealing how moments of hesitation and boldness can alter history forever.

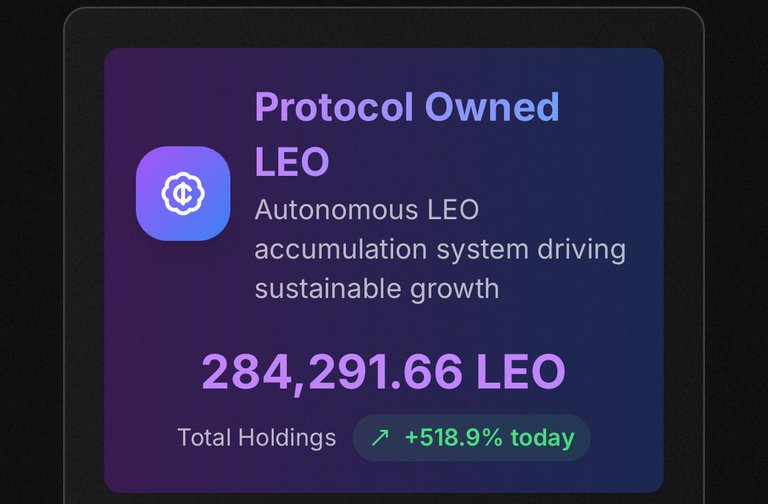

Yeah, the amount you transferred is small. There is a bridging fee, and a certain amount of LEO is also likely burned. You need to increase the quantity you want to transfer.

When I did mine, I did a rough calculation and added a few hundred LEO so that even after the fees, I would still have a certain amount of LEO I wanted to have for sLEO.

Rough estimation, if you transfer 200 LEO, about 8-12 LEO will be subtracted. You can try with that.

In 2007, Apple introduced the iPhone with simplicity in mind—no complex manuals or buttons, just a seamless swipe. The crypto space has yet to experience a similar transformative moment. That changes now.

📲 Enter AdEx AURA, the digital assistant for your wallet. It's intuitive, requiring no manual input. It analyzes your onchain activities and provides actionable insights:

For quite some time, many, including myself, were convinced by the overpopulation narrative. In truth, a significant decline in population threatens the existence of entire ethnic groups and cultures if corrective measures aren't taken. The rich culture of Japan, for instance, deserves preservation and continuation.

An In-Depth Look at the Numerical Magnitude of World War I

World War I was an unprecedented global conflict characterized by its immense scale and destructive power. While discussions often focus on human losses—soldiers killed, wounded, or displaced refugees—today's reflection ventures into a different realm: the numbers behind the war’s material and logistical infrastructure. These figures, often overlooked, reveal the staggering scale of industrialization, logistics, and resource mobilization that fueled such a devastating war.

Indy Neidell, host of the War Channel, begins by emphasizing that the technological innovations during WWI possessed unprecedented destructive capabilities, with the growth of firepower being particularly notable. Early war artillery was rudimentary, but continuous developments in design, range-finding technology, counter-battery tactics, and strategic deployment exponentially increased their lethality.

For example, in 1915, French artillery shells numbered over 8 million along a 50-kilometer (about 30 miles) front in the Champagne and Aisne sectors. Two years later, during the Second Battle of Artois, similar shelling over a roughly 40-kilometer (about 25 miles) line saw nearly 19 million shells fired within just two months.

The Battle of Verdun epitomizes the intense use of artillery. The German military aimed to crush the French forces through relentless bombardment, bolstering their stockpiles to sustain such operations. During just six days, 1,200 artillery pieces fired two million shells; within the subsequent 12 days, another two million shells were unleashed.

The scale of logistics to support this artillery barrage was immense. Daily, over 30 train loads of munitions arrived at the front. The Battle of Verdun, beginning on February 21, 1916, saw about 1 million shells fired during the initial lengthy artillery assault alone—highlighting the logistical horrors behind the scenes.

In the overall campaign, French and German artillery together used over 65 million shells. The casualties were equally staggering—more than 700,000 casualties, with approximately 75% caused by artillery or shell fragments.

Logistics and Supply Chains: The Hidden Backbone

The war’s destructive power was not solely ammunition. Millions of soldiers, along with their support personnel, required continuous supplies of food, water, and equipment. For instance, the Western Front spanned roughly 1,000 kilometers (around 600 miles), requiring an extensive network of fortifications, transportation, and logistics.

A detailed example is the Canadian Corps on the Western Front, tasked with defending a 6-kilometer stretch. This unit comprised nearly 98,000 soldiers and an additional 17,000 support personnel, effectively creating a mobile city behind the front lines. Supplying this force involved managing vast quantities of ammunition, food, water, and transportation infrastructure across multiple kilometers of roads, railways, and tunnels.

The Corps built and maintained approximately 50 kilometers (around 30 miles) of roads—mainly wooden plank roads susceptible to damage from constant shelling. They also constructed a 12-kilometer (7.5-mile) underground railway network connected to 13 subterranean stations, all carved into the chalk bedrock, serving both troop movements and medical evacuations.

Water supply was similarly monumental, with 21 pumping stations and over 70 kilometers of pipelines delivering up to 600,000 gallons of water daily—enough to sustain thousands of horses and soldiers. Communications were preserved through extensive networks of telephone lines, totaling around 1,800 kilometers (over 1,100 miles) within tunnels and trenches.

The logistics extended to supporting industries. A mobile sawmill system delivered 30,000 meters (around 10,000 feet) of lumber weekly to repairs and construction along the front. Additionally, narrow-gauge railways moved ammunition and wounded soldiers, showcasing the war’s infrastructural complexity.

Post-Battle Reorganization

When the German forces retreated after the Battle of Arras, all related logistics and infrastructure had to be dismantled and reestablished further along the new front—a process that was both time-consuming and labor-intensive but crucial for ongoing combat operations.

The war's logistical complexity extended into everyday sustenance. German Army records from 1915 reveal staggering figures: a division of 35,000 soldiers consumed approximately 1 million pounds of meat monthly, alongside hundreds of thousands of pounds of bread, canned meat, jam, and coffee. Horses required over 7 million pounds of oats and hundreds of thousands of pounds of hay.

On a broader scale, to feed the entire German army, weekly needs rose to approximately 60 million pounds of bread, over 130 million pounds of potatoes, and 17 million pounds of meat. These figures underscore not just the war’s scale but also its environmental and industrial demands.

While these numbers may seem abstract, the host reminds us that they are deeply intertwined with the tragic reality of death and suffering. The billions of shells, millions of pounds of food, and immense logistical efforts all underpin the mass casualties and upheaval experienced during WWI. The larger these figures become, the more evident it is that the slaughter was massive.

Conclusion

This exploration of wartime numbers offers a perspective beyond human casualties, illustrating the vast industrial, logistical, and infrastructural efforts that sustained and fueled one of history’s most devastating conflicts. From explosive shells to complex underground transport systems, the sheer magnitude of resource mobilization underscores just how gruelling and destructive WWI was.

Special thanks go to Ryan Garan for inspiring and contributing much of the research for this overview. If readers are interested in further explorations of WWI—such as ranking the most foolish acts of the war—they are encouraged to follow the provided links and stay tuned for more content.

Remember, the colossal figures behind WWI’s logistics reflect not only the scale of industrial warfare but also the enormous cost in lives and humanity.

The Evolution of Cavalry in Modern Warfare: A Look Back at the Role of Cavalry in World War I

Throughout history, cavalry has symbolized pride, agility, and martial prowess. Mounted on majestic horses, wielding swords and military blades, and charging into battle with roaring bravado, the cavalry epitomized the fighting spirit of traditional warfare. Yet, as technology advanced and warfare tactics evolved, the future of cavalry, especially in the context of World War I, came into question. This article explores the changing nature of cavalry during one of the most transformative conflicts in military history.

Before delving into the brutal realities of World War I, it’s important to recognize the romantic allure of the cavalry. Soldiers dressed in their finest uniforms—white gloves, feathered helmets, and carrying gleaming swords—embodied a martial nobility that had persisted for centuries. Military theorists like Friedrich von Bernhardi believed that fighting with cavalry was quintessential to warfare, often imagining battles where horsemen clashed in direct sword-to-sword combat.

In the mid-19th century, conflicts such as the Crimean War and the Franco-Prussian War revealed the vulnerabilities of traditional cavalry. Firepower from artillery, machine guns, and rifles made the once-dominant mounted units increasingly vulnerable. Russian War Minister Alexei Kuropatkin acknowledged that while cavalry no longer posed the kind of threat it once did, its role as scout and protector of the army’s flank remained vital in modern battle formations.

However, this pragmatic view met resistance from aristocratic and traditional military elites who believed cavalry should continue to lead charges, embodying honor and martial glory rather than serve as mere reconnaissance. The enduring symbolic significance of the cavalry persisted, with many expecting that military courage and swordsmanship would still determine the outcome on the battlefield.

The initial weeks of World War I saw some of the final traditional cavalry charges in history. On August 12, 1914, during the Battle of Haelen, German cavalry units mounted daring assaults against Belgian forces near a small town called Haelen. Riding through cornfields and engaging in close-quarters combat with swords, these charges seemed to echo the martial ideals of old, yet reality was brutal.

The German cavalry lost nearly a third of their horses—848 out of approximately 1,250—yet suffered only around 500 casualties. Despite their bravery, the advent of modern technology, including machine guns and barbed wire, rendered such charges almost suicidal, revealing their increasing obsolescence.

The Decline of Cavalry in the Face of Modern Weaponry

The realities of mechanized warfare soon transformed the battlefield. For the British Empire, cavalry units specialized in reconnaissance, shock tactics, and exploiting breakthroughs. However, the cost of maintaining large cavalry forces—high expenses for horse care, transportation difficulties, and rapid wear of metal horseshoes on paved roads—became an increasing burden.

German and Austro-Hungarian cavalry often served as reserve units, filling gaps in trenches or being held back until the appropriate moment. Their training in shooting and combat was limited compared to infantry or artillery, and machine guns quickly suppressed any morale-boosting charges.

On the Eastern Front, where the vast open spaces persisted, cavalry still found opportunities to play roles in escorting, scouting, and rapid flanking maneuvers. The Cossacks of Russia, with their famed horsemanship, managed some successful raids despite the intense machine gun fire.

Notable Cavalry Engagements and the End of an Era

While many battles marked the decline of traditional cavalry tactics, some noteworthy engagements persisted. The Battle of Moreuil Wood in March 1918, involving Canadian cavalry, illustrated both the resilience and the limitations of mounted units. During this engagement, Canadian cavalry charged against German formations, effectively halting their advance and showcasing that cavalry still had a role to play—though it was increasingly diminished.

The final significant mounted assault in WWI occurred during this period, reflecting a last gasp of the cavalry's martial tradition.

The American Contribution and the Transition to Modern Weapons

The United States, by entering the war in 1917, equipped its cavalry units with rifles and automatics, including the M1911 pistol. Interestingly, American cavalry officers like George S. Patton played a crucial role in modernizing mounted combat and eventual mechanized warfare. Patton, a trained swordsman, went on to develop tactics that would influence future armored warfare.

By the war’s end, most military officers had abandoned the notion of combat with swords and horses. The traditional cavalry—a symbol of honor and martial tradition—gave way to mechanized units, tanks, and airplanes, fundamentally transforming warfare.

The Evolution of Cavalryman’s Sword

The military sword, particularly the cavalry saber, evolved over centuries from a curved, slashing weapon to a straighter, mostly piercing tool by 1908. The design reflected the changing tactics: from emphasizing slashing cuts in the 1796 model to thrusting stab motions favored later.

Officers often carried ornate dress swords for formal occasions, marked by intricate decoration and family insignias, serving as symbols of status. However, combat use of swords was largely phased out during WWI, replaced by firearms and machine guns.

The End of Swordsmanship and Cavalry on the Battlefield

The brutal logic of modern warfare—far-reaching machine guns, barbed wire, rapid-fire artillery—made traditional close-quarters combat and mounted charge strategies obsolete. Cavalry units, once the spearhead of martial advance, found themselves relegated to reserve or secondary roles.

This technological shift signified the death knell for the horse-mounted soldier on the battlefield. Despite occasional rumors of cavalry resurgence in specific terrains or situations, the dominant trend was toward mechanized units—tanks, armored cars, and airplanes—ushering in a new era of warfare.

The history of cavalry in World War I exemplifies a fascinating transition from centuries-old martial traditions to modern combat reality. While the romantic ideals persisted in imagery and ancient customs, technological progress rendered mounted combat increasingly impractical. The war’s brutal lessons—highlighted by the massed use of machine guns and barbed wire—cemented the decline of the noble cavalry charge, symbolizing a broader shift toward mechanized, distant, and lethal warfare.

For those interested in exploring further, numerous artifacts and equipment from the era remain available for study—some up for auction—offering tangible links to this pivotal chapter in military history. As warfare continues to evolve, the legacy of the cavalry endures as a testament to tradition confronting the relentless march of innovation.

This article was inspired by the detailed insights shared in a documentary narrated by Indy Neidell, highlighting the complex and fascinating evolution of cavalry during World War I.

Both my email and texting apps have become great at using AI to auto-summarize all the spam, fraud, and phishing attacks that they can't filter out anymore.

The Hundredth Week of World War I: A Turning Point in the Great War

As the first full year of World War I drew to a close, the conflict continued to escalate, with major battles and strategic maneuvers shaping the course of history. In this special centennial episode, Indy Neidell reflects on the significant events of late June 1916, marking the hundredth week of the war.

The Battle for Verdun: A Deadly Stalemate and Chemical Warfare

One of the most infamous battles of the war, Verdun, saw its intensity escalate as German forces launched a renewed attack. On June 22, 1916, they commenced a brutal assault using poison gas shells—specifically phosgene, dubbed the Green Cross. This new, lethal form of chemical warfare caused horrific casualties among soldiers and horses alike, killing everything from foliage to insects.

The Germans managed to inflict heavy losses, with an attack near the town of Fleury resulting in the death of approximately 30,000 German troops and the near destruction of a French division. Despite their aggressive tactics, the Germans made a strategic mistake: they halted their gas shell bombardments just before the attack, giving French defenders a chance to regroup.

The Germans also succeeded in capturing Thiaumont Fort, bringing them close to taking the second-last fortress protecting Verdun, Souville. However, their failure to secure Verdun entirely was a costly misjudgment. The intense trench systems, reinforced with concrete and barbed wire, made the battlefield a formidable obstacle. French troops, under the command of Generals like Nivelle, worked arduously to repair damaged defenses, with the battle exemplifying the brutal trench warfare of WWI.

The Brusilov Offensive: Russia's Push on the Eastern Front

On the Eastern Front, Russian forces under General Alexei Brusilov launched a major offensive in Galicia. This attack represented one of the most significant breakthroughs in nearly two years, with Russian armies advancing towards key strategic points such as Lemberg and Brest-Litovsk. The northern Russian units threatened to encircle the Austro-Hungarian forces, potentially invading Hungary, while southern units successfully dispatched Austro-Hungarian troops in Bukovina.

The offensive had enormous implications: if other Russian generals, like Evert and Kurapatkin, could contain German forces and delay reinforcements, the entire Austro-Hungarian empire could be at risk of collapse. There was also a possibility that persuading Romania to join the war could bolster Russian southern forces, further destabilizing the Central Powers.

Russian withdrawal was slow and methodical; by week's end, they had captured much of Bukovina, but their attack was limited by insufficient forces and artillery. Despite these gains, the Russian army could not fully capitalize due to internal constraints and the ongoing German reinforcement efforts.

While the Germans pressed their offensive at Verdun, they paused their attack in early July to regroup. The deployment of chemical weapons, although terrifying, did not achieve the decisive breakthrough they sought. The Germans learned that their initial gas attacks had limited impact without adequate support, and they often had to revert to conventional artillery after chemical shells failed to produce the desired effects.

Meanwhile, the French defense remained resilient, bolstered by generals like Nivelle preparing their troops for future counteroffensives. The battle demonstrated the limitations of new weapons combined with trench warfare's entrenched defenses.

The Battle of the Somme: A British Attempt to Relieve Verdun

In a strategic move to ease pressure on Verdun and break the German lines, British Commander Douglas Haig prepared for the Battle of the Somme, launched on June 29, 1916. The plan was meticulous yet ambitious: massive artillery bombardments, reinforced by air reconnaissance by the Royal Flying Corps (RFC), aimed to destroy German trenches and defenses.

Haig’s objectives were clear: train and equip troops, gather extensive shells and weapons, and support the French at Verdun. The British anticipated a two-phase attack: first to break the initial German trench system, then to exploit any breakthroughs with reserves. Despite careful planning, the logistics were unprecedented—millions of shells, hundreds of miles of roads and railways, and extensive trench networks had to be prepared.

The artillery barrage was formidable, with over a thousand guns aimed every twenty meters along the front. The RFC contributed significantly by aerial reconnaissance, providing vital intelligence and disrupting German supply lines and troop movements. The air war saw the rise of notable aces: Royal Flying Corps pilots like Hugh Trenchard, and the notable German ace Oswald Boelcke, who was temporarily recalled to Russia for safety reasons. Tragically, Boelcke was killed in combat this week, underscoring the dangerous skies.

Leaders and Heroes: A War of Ancestral Fame and Sacrifice

The war's heroics extended beyond the battlefield. The funeral of German ace Oswald Boelcke was attended by high-ranking officials, including the German Crown Prince and twenty generals—highlighting the respect accorded to aerial pioneers. Duchess of Kent (Hugh Trenchard’s), and other leaders recognized the importance of air supremacy in the prolonged engagement.

In Germany, other significant figures fell this week, including Helmut von Manteuffel and Rudolf Berthold, noted for their combat achievements. Meanwhile, the Battle of Verdun and the Somme exemplified the tragic loss and the high human cost of technological and tactical innovations.

Beyond the battlefield, the war's toll was felt globally. In the Antarctic, explorer Sir Ernest Shackleton reached South Georgia after two years stranded, reflecting the war’s distant ripple effects. When asked about the end of the conflict, Shackleton replied somberly: "The war isn’t over. Millions have been killed. Europe is mad. The world is mad."

In this hundredth week, the war seemed to teeter on a knife’s edge—victory and defeat hanging in balance. The conflict had already claimed countless lives and changed the face of warfare forever.

As we mark the centennial of this tumultuous period, it’s clear that the battles and strategies initiated in June 1916 had lasting consequences. From the deadly gas attacks at Verdun to the relentless artillery of the Somme, the war was defined by innovation, sacrifice, and tragedy.

Thank you for following this detailed reflection on the hundredth week of WWI. Your support makes it all possible. For more updates, consider supporting us on Patreon, and share these stories with friends and teachers. Don’t forget to subscribe—see you next week.

This ad was produced for around $100 in tokens using Claude/ChatGPT/Veo3 and required 20 hours of labor. It garnered over 1.2 million impressions in under 48 hours, and our followers increased from 2.8k to 7k during this time. AI-enhanced storytelling proves to be a potent resource for enterprises.

Yeah, many do work over the weekends but for most people, Saturdays and Sundays are off, so I guess that's why Friday is so important and needed to be celebrated. Can't go to work when hungover 🙂

Gratitude goes out to partners like Microsoft, NVIDIA, Oracle, Google, and CoreWeave for making this a reality! A huge number of GPUs are putting in extra hours.

The Controversial Legacy of Douglas Haig: The "Butcher of the Somme" and the "Master of Victory"

Douglas Haig remains one of the most polarizing figures in British military history. Known by critics as the "Butcher of the Somme" and vilified for the devastating casualties inflicted during World War I, he is simultaneously remembered as a "good soldier" and a "victory architect." His name often evokes intense debate, rivaling even the most legendary generals of the Great War.

Born on June 19, 1861, in Edinburgh, Scotland, Douglas Haig was the son of a prosperous whisky merchant. Growing up during the Victorian era, a time marked by rapid technological advancement and imperial ambitions, Haig's formative years were shaped by a society that celebrated military prowess and social hierarchy. Educated at Sandhurst, Britain’s prestigious officer training school, he joined the 7th Hussars in 1885, a regiment known for its aristocratic traditions and leadership among the cavalry troops.

Haig's first deployment took him to India in 1886, where he encountered a vastly different world—marked by alcohol abuse, disease, and the scandal of British-run brothels. Despite the temptations and hardships, Haig was noted for his strict adherence to gentlemanly conduct and discipline. Later, in 1898, he served in Sudan during the effort to quell the Mahdist uprising, a campaign that tested the resilience of British colonial forces.

His experience in Sudan was intertwined with notable figures such as Herbert Kitchener and Winston Churchill—men who, like Haig, would shape British military and political futures. His role in these campaigns highlighted his steadfastness and traditionalist approach amid challenging desert warfare.

After Sudan, Haig served under General John French during the Second Boer War. Unlike French, who was often plagued by debt and a more flamboyant personality, Haig was reserved, introspective, and conservative. His relationship with French was complex—Haig played a key role in assisting him to clear debts, and in turn, French elevated Haig’s reputation during the war.

By 1904, Haig had become one of Britain’s youngest major generals in the Indian cavalry, reflecting his rapid ascent. His thoughts on modern warfare began to evolve, particularly concerning the tactics suited for 20th-century combat. He believed in maintaining traditional cavalry charges with swords and lances, a stance that would later prove problematic during trench warfare.

Haig’s influence extended beyond battlefield command; he became a pivotal figure at the War Office, working with War Secretary Richard Haldane. Together, they sought to modernize the British Army, creating a more professional and organized force. A major reform was the development of the Territorial Force in 1908, designed to serve as a reserve of 900,000 men, though it was later scaled down to 300,000 by Haldane. Haig also prioritized the training of the British Expeditionary Force (BEF) and envisioned a highly mobile, aggressive army ready for swift advances.

As Europe plunged into war in 1914, Haig commanded the British First Army. His early assessment proved prescient: he believed the conflict would last for months or even years. Haig advocated for large-scale, decisive battles, drawing inspiration from Napoleonic methods—focused on breakthrough and pursuit rather than attrition or passive defense.

During the initial battles in Belgium, notably at Mons and subsequent engagements, British soldiers demonstrated remarkable combat effectiveness. However, cautious hesitation, particularly regarding the deployment of reserves, became apparent. At the Battle of Le Cateau and later during the First Battle of Ypres, his indecisiveness sometimes hampered British efforts to consolidate gains or execute large maneuvers.

The defining moment of Haig’s legacy is undoubtedly the Battle of the Somme in 1916. His plan centered on a massive offensive designed to break through German defenses, with the hope of ending the stalemate on the Western Front. The initial assault saw hundreds of thousands of British soldiers advance into a hail of German machine-gun fire. Despite some territorial gains, the casualties were staggering—more than 57,000 British troops lost on the first day alone, a record for bloodshed in a single day.

Haig’s strategy of concentrating massed forces for an all-out breakthrough proved tragically flawed. Although some territorial gains were achieved, the expected breakthrough faltered, and the battle devolved into a prolonged, bloody stalemate. Critics accused Haig of reckless tactics and excessive casualties, dubbing him “the Butcher of the Somme,” while supporters argued that the offensive eventually wore down German resistance and prepared the way for future advances.

Throughout 1916 and into 1917, Haig continued to believe in the value of massed attritional warfare. His tactics often involved costly assaults on entrenched positions, with limited success. His refusal to adapt to the realities of trench warfare and reliance on traditional offensive strategies drew widespread criticism.

In battles like the Battle of Arras and the Battle of Passchendaele, the same pattern of high casualties and limited gains repeated. His emphasis remained on inflicting maximum damage to the German army, convinced that persistent pressure would eventually lead to German surrender. However, his hesitance to utilize reserves effectively and his focus on attrition revealed significant weaknesses—most notably his “hesitation” at critical moments, such as during the Battle of Loos and later during the Battle of the Somme.

In 1917, the innovative use of tanks at Cambrai showed Haig and the allies that breakthroughs were possible. Yet, Haig hesitated to fully exploit these advances, wary of overstretching and risking counterattack. As the war dragged on, the human cost mounted, and public opinion grew increasingly critical of the leadership.

Despite criticism, Haig remained unwavering in his conviction that victory required sustained, grinding effort. His prediction that the Germans would surrender if the war persisted into 1917 proved overly optimistic, as the conflict continued into 1918 with devastating losses on all sides.

When the war ended in 1918, Haig’s reputation was in tatters among the public and military critics alike. To many, he epitomized the horrors and failures of trench warfare, symbolizing misjudgment, excessive casualties, and stubborn adherence to outdated tactics. Nonetheless, some viewed him as a resilient leader who wore immense responsibility and endured unparalleled hardship.

In the postwar years, Haig dedicated himself to helping veterans, establishing the Haig Fund and the Haig Homes and Hospices to aid wounded soldiers. He passed away on January 29, 1928, leaving behind a legacy entangled with controversy—both as a war hero and as a symbol of strategic failure.

Douglas Haig’s life story is a testament to the complexities of leadership amidst the chaos of modern warfare. His military career, marked by both traditional values and controversial tactics, continues to inspire debate among historians and the public. Whether viewed as a hero or a villain, his impact on the course of World War I and the collective memory of Britain remains profound.

For further exploration, consider watching channels like Cody’s Alternate History Hub, which discusses the potential different outcomes of battles like the Somme. Share your thoughts below, and don’t forget to subscribe for more historical insights.

Yeah, definitely. It seems that people need this kinda shared online experience for some reason. Especially during summer times. Previously we had the Hawk Tuah girl, RayGun from the olympics, now the cheating Coldplay concert couple, Ibiza final boss and Sydney ad...

Peanuts compared with the rest of the market... Still, something to be acknowledging I would never thought possible 5 years ago.

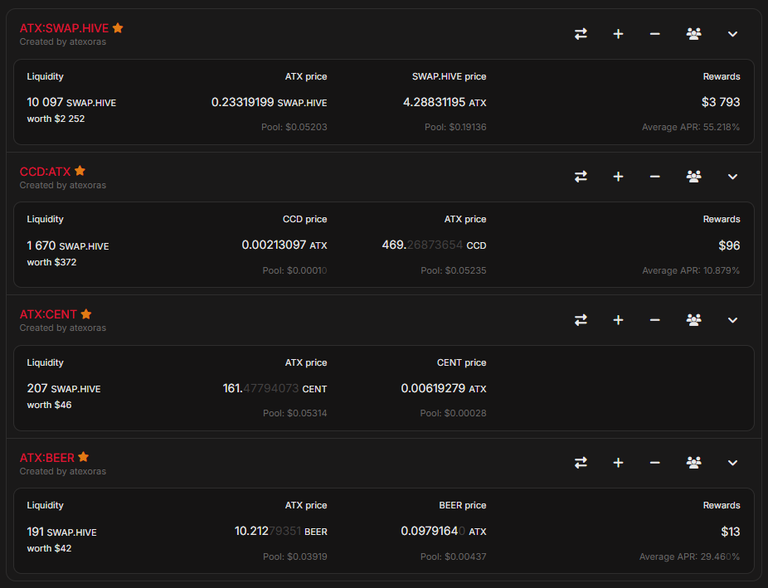

Less than 20 days for the big moment of ~5x in terms of distribution. Into the ATX:SWAP.HIVE pool only. But other pools will have long term applications too.

yeah! I understand! But for example the cent:leo pool provided great APY for over a year already. Now with the upcoming price pressure I am a bit more carefull due the larger impairment risks! But definitly great to see the pool value increase

In-Depth Analysis of the New "Battlefield 1" Trailer: Historical Insights and Game Design

Last week, a new trailer for the upcoming game Battlefield 1 was released, which immediately sparked widespread interest among history enthusiasts and gamers alike. Given the previous trailer’s intriguing showcase of experimental equipment and rare wartime technology, many viewers are eager to understand the historical context behind these visuals. In this article, we will dissect the trailer's content, compare it with actual World War I history, and explore how the game might incorporate these real-world elements into its design.

The Opening Scene: A Damaged British Mark IV Tank Surrounded by German Forces

The trailer begins with a striking image of what appears to be a malfunctioning British Mark IV tank, seemingly abandoned and under siege. The setting looks like the battlefield's edge, with German soldiers dressed in diverse gear surrounding the vehicle. The soldiers are equipped with a mix of uniforms and weapons, such as Mauser C96 or Luger 08 pistols, both iconic firearms that enjoyed prolonged production after World War I.

Why Didn't the Germans Destroy the Tank Immediately?

Despite the tank's apparent malfunction, the Germans opted for capturing and studying enemy equipment. Since 1916, the Germans had captured and utilized several Allied tanks and even used captured British tanks in combat, as resources and manufacturing capacities were limited. The A7V, Germany's sole design of tank with only 20 units produced, is prominently featured in the trailer as well, revealing the limited but strategic German tank efforts.

Inside the Tank

The interior of the tank appears surprisingly spacious, suggesting a possible focus on crew experience or design variation. Notably, the Mark IV required eight crew members to operate effectively, while the German A7V demanded a larger team of eighteen for vital roles like weapon operation, observation, and engine control.

Furthermore, the presence of a dove being released outside the tank hints at the use of carrier pigeons in WWI communication—an often overlooked but crucial wartime tactic. Historical records show that pigeons played vital roles in battlefield communication, even receiving medals for their service.

The Assault: Air and Ground Combined Operations

The trailer's rapid cuts feature dogfights and coordinated attacks involving aircraft and tanks. It zooms in on Sopwith Camel biplanes, prevalent on the Western Front starting in 1917, engaged in dogfights and attacks on Zeppelins. The speed of the aircraft is highlighted, with some reaching 182 km/h—an impressive speed for WWI aircraft, though perhaps depicted slightly exaggerated for cinematic effect.

The footage suggests an evolving battlefield where tanks and aircraft operate together, a precursor to later combined arms tactics. This reflects the gradual technological progress in WWI, leading up to the development of more advanced weapons seen in WWII. Although WWI was characterized predominantly by trench warfare, innovations such as tanks and aircraft slowly transformed combat strategies.

A noteworthy element is the depiction of a Zeppelin dirigible flying dangerously low over the battlefield. Historically, German Zeppelins were used primarily for strategic bombing or reconnaissance, flying at high altitudes to avoid enemy fire. Now, the trailer shows the Zeppelin flying so low it appears vulnerable, which contradicts historical flying practices. Zeppelins in WWI avoided low-altitude flight due to the threat of anti-aircraft fire; thus, this artistic choice may aim to dramatize the chaos of battlefield scenes rather than adhere strictly to history.

The Zeppelin’s destruction, with debris and fireball effects, aligns more closely with actual incidents where damage was inflicted from below, either via antiaircraft guns or sabotage. Interestingly, the crew members aboard such ships likely lacked parachutes, making escape options limited, adding dramatic tension.

Personal Equipment and Weaponry: A Glimpse into WWI’s Arsenal

The trailer showcases a variety of weapons, many of which have historical counterparts. For example:

Mauser C96: The pistol held in close-up is a famous WWI sidearm, also serving as the basis for Han Solo’s gun in Star Wars.

Sturmgewehr MP 18: The first mass-produced submachine gun, introduced in 1918 for German stormtroopers, is depicted alongside soldiers wielding it with a bayonet attachment. It was revolutionary in infantry tactics, emphasizing automatic fire over single shots.

Observation and Anti-aircraft Equipment: Use of early semi-automatic rifles like the Mondragon, employed by observation units, and the adoption of trench and urban combat tactics, reflect the diversity and evolution of WWI weaponry.

The trailer features iconic WWI vehicles such as the Rolls-Royce armored car, used in the Middle East campaign and early mobile warfare. The presence of a Harley Davidson motorcycle with a sidecar armed with a machine gun also underscores the importance of mobility — used for rapid troop and wounded transport.

Historical Accuracy

The depiction of the motorcycle and armored car aligns well with historical records. Such vehicles played critical roles in reconnaissance and rapid assault during the war’s later stages.

One stark theme in the trailer is the battlefield's mud and damp conditions, reminiscent of the Battle of Passchendaele (Third Battle of Ypres). The mud was so deep that soldiers drowned or became immobilized, a grim reality of WWI trench warfare.

The impacts of winter, including freezing temperatures and mountain warfare in the Alps or Caucasus, are also hinted at, depicting war in diverse terrains — from the arid Middle Eastern deserts to the snow-covered eastern front.

Reconnaissance and Strategic Bombing: Zeppelins and Early Bombers

The trailer shows aerial bombers such as the Gotha IV, tasked with strategic bombing missions over enemy territories. These aircraft often flew low over enemy lines, a risky tactic reflected in the trailer's low-altitude flying, which is a departure from traditional high-altitude reconnaissance.

The presence of obstacle balloons and anti-aircraft guns demonstrates the multifaceted defenses against these aerial threats. Additionally, WWI introduced the concept of anti-aircraft artillery, which was still evolving during the conflict.

The Endgame: The Decisive Battle and Explosive End

The final scenes depict a Zeppelin caught alight and crashing—a historically plausible event given the vulnerability of these dirigibles as the war progressed. The explosion effects and the crew member's quick draw of a rare Mauser pistol provide cinematic drama, although real Zeppelin catastrophes often involved intense fires and destruction.

Notably, the shot of a British Indian soldier wielding a melee weapon adds cultural and tactical diversity, acknowledging the contributions of colonial soldiers in WWI.

Conclusion: A Fast-Paced, Historically Inspired War Game

Overall, the trailer indicates a game that emphasizes fast-paced, intense battles set during the final years of WWI, integrating real historical weapons, vehicles, and tactics with dramatic flair. The developers appear to aim for fidelity to history, while also enhancing gameplay with larger-than-life scenarios—like dramatic Zeppelin destructions and dynamic combined arms combat.

The emphasis on experimental equipment, such as early automatic rifles and innovative vehicles, suggests players will experience a cinematic yet authentic portrayal of WWI's technological evolution. For history buffs, the trailer offers a rich tapestry of war technology and tactics, while gamers are promised an exhilarating experience rooted in one of the most transformative conflicts in modern history.

Final Note: Call for Feedback and Continual Learning

If any viewers notice inaccuracies or additional details missing from this analysis, they are encouraged to comment and share their knowledge. The authors value community insights, especially regarding lesser-known equipment and historical nuances.

Stay tuned to The Great War channel for weekly updates and detailed explorations of WWI history, tactics, and strategic developments. Subscribe and join us as we uncover the complexities of this pivotal conflict—both on the battlefield and in the historical record.

Well shit @luchyl, this post is older than 7 Days days. Look for some other shit. (We will not send this error message for 24 hours).Learn all about this shit in the toilet paper! 💩

Working on bringing delegation into The BBH Project. It will be to this account in support of the curation trail. This will be rewards for delegating. More info to follow in the coming days ;) #bbh

Kingston fire is 2,175 hectares, "had some growth" on Thursday.

Officials are building a fire guard on southern flank of fire.

Holyrood fire is still 22 hectares.

Martin Lake fire is 230 hectares.

Heat warning in effect for northern Avalon Peninsula and northeastern region of Newfoundland.

Special air quality statement still in effect for portion of the northern Avalon Peninsula.

Evacuation orders still in place for Kingston, Perry's Cove, Western Bay and Small Point-Adam's Cove-Blackhead-Broad Cove, sections of Holyrood and Conception Bay South.

Evacuation orders still in place for cabin area off of Route 360, Bay d'Espoir Highway, extended to Rushy Pond.

Evacuation orders expanded Thursday to Ochre Pit Cove and Salmon Cove.

Oh, I had no idea.

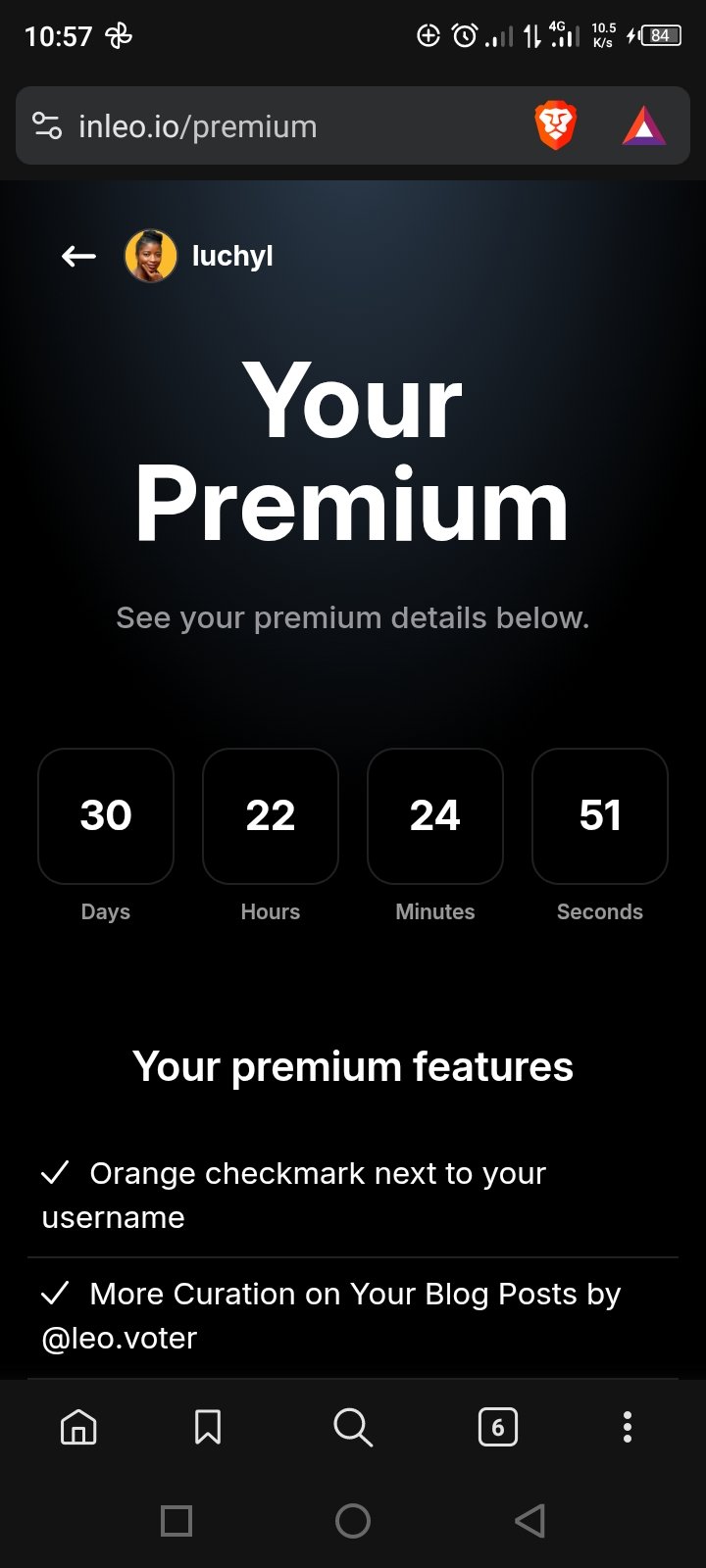

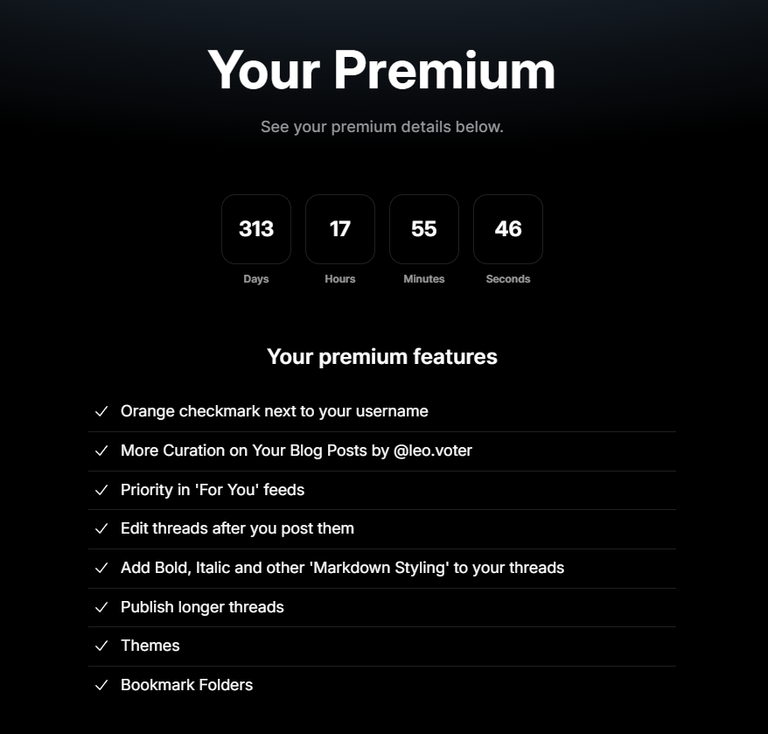

Haven't really paid attention to how many had the premium subscription tbh, just noticed the number on the premium page earlier today 😆

!BBH

Recent research reveals intriguing discoveries about the universe's initial molecule, hinting that the current understanding of the early cosmos might require some revisions.

The worst part is the same kind of people try their best to stop us from buying assets and investing in #crypto etc. while claiming to be "helping" us!

SPS price action over the past week was yet another challenging week, declining from $0.00696 to close at $0.007232. This is against the backdrop of the concerning longer-term downtrend.

While Bitcoin and Ethereum continue to benefit from regulatory and institutional adoption, gaming tokens like SPS remain dependent on ecosystem-specific developments.

They insisted that the excessive money printing was essential to "save the financial system." However, after the failures of Mt Gox and FTX, Bitcoin rebounded more robustly, without any government intervention.

This is not the only #crypto sale I will be using to facilitate today's $LEO purchase. While I sell others, I will give you a moment to front run me.

#leo has been trading flat after the 5X price increase. I don't mind giving other a chance to get some cheap $LEO into their hands. I will give you 15 minutes since the moment of publishing.

Apple CEO Tim Cook Faces Criticism Over Gesture to President Trump

The Controversial Gift Presentation

Apple’s CEO, Tim Cook, has recently come under scrutiny after his act of presenting a gift to President Donald Trump drew widespread criticism. The gift—a finely crafted glass disc mounted on a 24-karat gold base—was engraved with the president's name. This gesture was reportedly part of Apple's strategic efforts to influence trade policies, specifically to avoid tariffs that could impact the company's operations and pricing.

Critics argue that such a high-profile gift is more than just a courteous gesture; it's perceived as an attempt to curry favor with the President. In the highly polarized political climate, any corporate interaction involving politicians and symbolic gestures can evoke controversy, and Apple's decision to present this particular gift has not escaped public and media backlash.

Apple's Innovation and Marketing Prowess

The transcript humorously highlights Apple’s reputation for relentless innovation, tracing the evolution of the iPhone with playful mentions of its size alterations. It emphasizes Apple's continuous drive to push technological boundaries, which in this context, is humorously contrasted with the exaggerated introduction of a fictitious product—the "Apple Eye Kiss."

The "Apple Eye Kiss" is satirically portrayed as “the most technologically advanced way to kiss the president’s ass,” illustrating a tongue-in-cheek commentary on how corporate gestures can sometimes be perceived as sycophantic. The humorous promotion claims that employing the latest A18 Bionic chip, this fictional device delivers "unprecedented puckering pressure," adding a layer of satire to the broader discussion of corporate politics and diplomacy.

The transcript reflects a satirical tone, mockingly advertising the "Apple Eye Kiss" with exaggerated enthusiasm—"We appreciate it very much, Tim," and remarks that it “makes me feel very good,” accompanied by quirky music. This parody underscores the perception that corporate actions, especially in political contexts, can sometimes appear as manipulative or insincere.

While the presentation of a gift by a CEO to a political leader might be standard procedure in diplomatic and business circles, the humorous exaggeration suggests skepticism about the sincerity or implications of such gestures, especially given the political tensions surrounding tariffs, trade negotiations, and corporate influence.

In summary, the controversy surrounding Tim Cook’s gift to President Trump highlights the delicate intersection of corporate diplomacy, politics, and public perception. Apple’s strategic moves, whether genuine or symbolic, are magnified in the media and public eye, often sparking debate about the motives behind such gestures.

The satirical elements in the transcript serve to critique how corporate entities sometimes navigate political landscapes with calculated diplomacy, which can be viewed with suspicion or humor. As the discussion continues, both Apple and other corporations remains under scrutiny for how they balance innovation, influence, and public image in an increasingly polarized environment.

I overslept in the afternoon. I think it's because I needed sleep badly and the weather condition was very good to sleep. I slept more than 3 hours. It's not a little time.

Cryptocurrency Market Outlook: Insights from Adam Crypto

The cryptocurrency space is constantly evolving, and with volatile markets and unpredictable cycles, investors seek expert opinions to navigate the turbulent waters. In a recent in-depth interview, renowned trader and analyst Adam Crypto shared his perspectives on the current state of the crypto market, strategic positions, and future expectations for Bitcoin and altcoins, providing valuable insights for both retail traders and institutional players.

Adam Crypto emphasizes the importance of simplicity in trading strategies. "I don't overcomplicate things," he states. His approach revolves around securing "easy wins" and maintaining straightforward long-term positions. By focusing on long-term traders—those who hold Bitcoin for multiple years—Adam believes that they are part of the "smart money." He highlights that this long-term cohort consistently outperforms short-term traders, underlining the significance of patience and discipline.

Reflecting on the recent market movements, Adam notes that the current bull market may be nearing its end. He predicts that the last phase of the bull run tends to be the most explosive, often delivering the greatest gains before a downturn. Looking back, he recalls initiating long trades during market bottoms in 2019 and 2022, which he has held for years, capitalizing on significant market rallies.

His analysis of Bitcoin's daily chart reveals that the cryptocurrency broke out of a bull flag pattern in early July, propelling prices upward. The breakout, coupled with the break above key technical indicators—such as the EMA ribbon—serves as a bullish signal. Historically, Bitcoin surpassing the EMA ribbon on higher timeframes has led to substantial price surges, suggesting that a continued upward move could be on the horizon.

Adam Crypto projects a conservative but optimistic outlook for Bitcoin's price. He targets a potential rise to $118,000, a level where he has already taken profits, and envisions an even higher ultimate target of $149,000 based on his technical analysis of bull flag patterns. He explains that these targets are derived from precise market measurements and pattern breakdowns. He advises traders to monitor these levels carefully, especially as the market approaches the anticipated end of its current cycle.

Regarding market cycles, Adam refutes claims that the traditional four-year Bitcoin cycle is dead. Instead, he points out that history consistently shows Bitcoin reaching new all-time highs approximately every four years—once in December 2013, then December 2017, and again in late 2021. He believes that the cycle is still intact and that the current market behavior aligns with historical patterns, making a late-2023 or early-2024 peak plausible.

While Adam predicts short-term bullishness, he cautions that the cycle's climax might arrive sooner than many expect. His primary concern is that the end of this bull phase could come as early as the end of Q4 2023, or in early 2024. He stresses that the last leg of a bull market typically produces the most dramatic gains but also warns against complacency. Essentially, traders should be prepared to take profits as the cycle matures.

A standout point in Adam's analysis pertains to on-chain data—specifically, the ratio between long-term and short-term Bitcoin holders. He explains this ratio as an indicator of market conviction and strength of "smart money." A rising ratio indicates more long-term holders, who generally are more profitable and patient, while a declining ratio suggests growing short-term trading and profit-taking.

He highlights that during parabolic upward moves, short-term holders tend to flock in, often leading to market tops, whereas during downturns, long-term holders accumulate. Currently, the ratio suggests the market may be approaching its final phase of the current cycle, making it an important metric for timing exits.

As for altcoin season, Adam Crypto is cautious. He notes that in previous cycles, altcoin rallies became less potent each time due to the enormous proliferation of projects and limited retail purchasing power. "You can't just throw your money blindly into altcoins expecting another 2017 or 2021 rally," he warns.

Instead, he recommends focusing on larger projects with strong fundamentals and volume, especially those aligned with the U.S. narrative—such as Ethereum, XRP, Solana, and BNB. He emphasizes that for trading large amounts, projects should be listed on Binance to ensure sufficient liquidity and ease of scaling in and out of positions.

He believes the window for a meaningful altcoin rally is narrow, with some opportunities last November, but warns that the market's capacity to back further gains is limited. Therefore, selective, research-driven investments in high-quality coins are preferable over chasing numerous small projects.

Managing Risk and Profit-Taking Strategies

Adam advocates a disciplined approach to profit-taking, referencing his own experience of realizing profits at key levels, such as $104,000 and $118,000 for Bitcoin. He maintains that locking in gains as targets are reached is essential, especially given the potential for the market to turn bearish abruptly.

He advises traders to be conservative with lofty expectations, highlighting that targets like $180,000 or $149,000 should be viewed as probable, not guaranteed. His core message centers around protecting accumulated gains by actively managing exits as the market shows signs of fatigue.

Final Thoughts: A Cautiously Optimistic Outlook

In closing, Adam Crypto shares his personal outlook: while he's bullish on Bitcoin and select altcoins, he anticipates the current rally's peak is near. He believes the most lucrative part of the cycle might be underway, but encourages traders not to count on a prolonged rally stretching for years.

His core message is to stay disciplined, be selective with altcoin investments, monitor on-chain indicators, and prepare to take profits as the market matures. His insights serve as a reminder that while the crypto market holds immense potential, prudent risk management remains crucial as the cycle nears its climax.

Stay tuned to Adam Crypto’s channels for ongoing trade analysis and market updates, and remember: in crypto, patience and strategic exits often outperform reckless speculation.

Totally get what you're saying about unfair distribution. It's not just about having resources, but who gets access to them and why. That imbalance is a huge part of the problem

This is one of my birthday gifts, and I am loving everything about it. Oh, the sound and its smartness and the noise cancellation is 100%. 😍

The thing is that I needed a new set of earbuds because my previous one got bad, but I had no idea I would be receiving a new one as a birthday gift. The giver would have noticed it and ordered this perfect one for me. It came as a surprise.

Receiving gifts from family and friends shows how much they cherish you.

Many individuals don't experience investment failure due to selecting poor stocks. The real issue is their inability to rein in spending that could be used to generate returns.

The market isn't the main adversary; it's the tendency for impulsive purchases.

You can't connect your Hive account to Leodex, you can only bridge Leo to your leodex wallet after you must have connect your wallet. There's a bridge they are using but I haven't tried it myself. I guess you should make a thread about it for those who knows to guide you.

Feliz viernes comunidad, que sea un gran día para todos, que cada una de sus actividades se cumplan y de esa manera poder comenzar un fin de semana de la mejor manera, buena aptitud y siempre estar dispuestos a seguir creciendo.

From one to another, feeling the absence of someone doesn't necessitate their return to your life. Missing them is simply a step in the process of moving forward.

Rain falls softly, yet nourishes all it touches. Strength can be gentle and quiet. It doesn’t seek praise or recognition. It simply gives life and keeps moving.

The initial version of an innovative project for a company has been successfully created using a particular solution. It’s impressive how it simplifies the process from start to finish!

Agreed. For several generations, academia has been shaped by the notion that concepts commonly thought to be ancient were actually modern inventions linked to specific media technologies of the time. This formula has been overused and turned into a gimmick. While some have moved beyond this outdated thinking to critique it, others remain entrenched in this mindset for life.

it is kind of selfexplanatory. Xou log in with your Metamask and can swap different tokens. Make sure to add the networks you want to use to metamask. Like arbitrum etc

Trillions in corporate investments are flooding back into the US and it's not just a headline.

🟡 Apple plans to invest $600B in the US over 4 years

🟡 New facilities in Texas and Michigan, plus 20,000 new jobs

🟡 Stargate AI project brings $500B and 200,000 jobs

🟡 Nvidia and TSMC add $200B and $100B in AI infra buildout

The capital cycle is shifting. From offshore cost-cutting to domestic dominance.

Next up: who controls the rails of AI.

GPT-5 stands as the most intelligent model developed so far, but the primary focus has been on practical use and widespread accessibility and affordability.

I use inleo every day on mobile. Keychain has a built in browser that works nicely. You can also log in using leoauth from any browser on your phone. Just need your posting key.

Because I don't listen to 40 hours of Bitcoin podcasts per week, I:

🪙Haven't earned fiat in 10 years

🪙Haven't had a bank account in 9 years

🪙Have 100% of my money in self-custody

🪙Can pay 100% of my expenses without KYC

🪙Earn most of my income from an uncensorable blockchain (my side hustle is self-employment with many different paying customers, all in crypto)

🪙Use sovereign privacy tech at every level: no phone number, de-Googled phone, e2e encrypted messaging, VPN paid in private crypto, Linux, Brave browser, email aliases

You too, anon, can live a truly sovereign life if you quit Bitcoin podcasts. I can show the way.

When you've accumulated experience, don't hesitate to share it with new people. Generate enthusiasm, but also education!

This has a ripple effect, because the person you've taught something will use it to help someone else in need. So it's not a waste of time; always be willing to share what you know 🙌 .

Every time I teach someone something new, I end up learning something myself too. Those ripples can reach further than we ever expect, so keep sharing what you know and inspiring others along the way.

Yes, you can always learn when you teach something. You reinforce what you know, and if you have doubts about what you're trying to convey, you'll seek out more.

Bitcoin doesn’t shout, it just keeps producing blocks. Markets rise and fall, but the chain stays steady. True value is built quietly over time. Patience is the strongest investment strategy.

Citigroup: 185 years

AT&T: 114 years

UPS: 98 years

Disney: 91 years

Exxon Mobil: 73 years

Samsung: 63 years

IBM: 60 years

Comcast: 48 years

Sony: 47 years

Intel: 42 years

GM: 40 years

Apple: 33 years

Toyota: 32 years

Microsoft: 30 years

Walmart: 28 years

Tesla: 18 years

Amazon: 17 years

Facebook: 14 years

Google: 14 years

1/3🧵. #Threadstorm

It is good to invest on stocks that gives high return in future. Investing in future industry probably helps us in resolving the issue. I have done some analysis and interested in 'Silicon chip'

#outreach #investment #stocks #semiconductor

2/3🧵. Manyatimes, stock market moves in phases and waves of different industry. Earlier it was petroleum, then IT, followed by energy and now the future would be of semiconductor. It is important component for the innovation and technology.

Understanding Crypto Market Crashes: Causes, Catalysts, and How to Prepare

In the volatile world of cryptocurrency, market crashes are an inevitable part of the landscape. A recent comprehensive analysis by Guy delves into why these crashes happen, the main catalysts behind them, and how investors can interpret and navigate these turbulent times. This longform overview consolidates and expands upon the key insights shared in the video, offering a clearer picture of the factors that trigger a crypto market decline and how to respond effectively.

A central theme in understanding crypto crashes is leverage—using borrowed money to amplify trading positions. Crypto traders often employ leverage, such as 5x or more, which can multiply gains but also devastatingly magnify losses. For instance, a 20% drop in the price of a crypto with 5x leverage will lead to liquidation, meaning the trader's position is automatically sold to prevent further losses.

This widespread use of leverage creates a fragile system where a sharp price decline can trigger a cascade of long liquidations, resulting in millions or even billions of dollars worth of assets being automatically sold off in a short period. These massive liquidations often cause rapid price drops, sometimes falling below key support levels — such as $4,000 or $100,000 — which in turn lead to more liquidations and panic selling.

Most short-term price movements in crypto are driven or exacerbated by these liquidations, creating a cycle of sharp dips and quick recoveries known as V-shaped rebounds. Interestingly, these recoveries are often triggered by short squeezes—where traders betting against the market are forced to buy back assets as prices rise, fueling rapid price rebounds.

Monitoring Liquidations: Platforms like Coin Glass provide real-time data on liquidation events. Watching these indicators can help investors assess whether current declines are temporary or part of a larger trend.

The Catalysts Behind Market Crashes

Market crashes are usually caused by a combination of macroeconomic and crypto-specific factors, often working together.

These are external, large-scale economic developments that affect liquidity and investor sentiment broadly—for example, wartime escalations, inflation reports, or changes in monetary policy. When macro conditions turn bearish—like when central banks signal higher interest rates or when geopolitical tensions rise—liquidity dries up, and risk assets, including crypto, decline.

For example, if tensions in Ukraine or conflicts in the Middle East escalate, or if economic data suggest a slowdown, crypto markets tend to fall because investors become risk-averse. These broad macro triggers are often reflected in stock markets as well; if stocks drop, it's often due to macroeconomic concerns rather than crypto-specific issues.

These are factors unique to the crypto ecosystem that can trigger short- or long-term declines. They are categorized into temporary and permanent catalysts.

Temporary Catalysts: Short-lived developments, such as a Bitcoin futures listing or a regulatory warning, which influence prices temporarily but do not alter the fundamental value of the project. For instance, Bitcoin’s listing on CME futures caused a cyclical peak in 2017 but didn't fundamentally change Bitcoin.

Permanent Catalysts: Long-term, fundamental shifts that change the trajectory of a project. For example, the introduction of Bitcoin spot ETFs in the U.S. changed the investment landscape permanently. Conversely, issues like insider token sales or project failures—like the collapse of the Pudgy Penguins NFT team—can cause lasting damage.

Monitoring Cryptocatalysts: Keeping an eye on news, regulatory changes, technological advancements, and project developments is crucial. Channels like Coin Bureau provide analysis to help understand whether a catalyst is temporary or permanent.

Changes in government spending, inflation, and interest rates are pivotal. Rising inflation often leads to aggressive rate hikes, which can depress risk assets. Conversely, policies promoting liquidity—such as quantitative easing—tend to boost crypto prices.

In the U.S., public data like the government deficit or Federal Reserve’s rate decisions provide insight into liquidity conditions. When government deficits increase, they often signal more money entering the economy, which can be bullish for crypto.

Risks such as conflicts in Ukraine, Iran tensions, or China-Taiwan relations can significantly impact crypto markets by increasing uncertainty. Notably, an escalation between China and Taiwan—especially given Taiwan’s vital role in global microchip manufacturing—could have global repercussions.

Major tech stocks reliant on chips from Taiwan would plummet in such scenarios, dragging down crypto due to their close correlation with technology and macroeconomic health. Such geopolitical tensions tend to create a risk-off environment, leading to prolonged bear markets if they persist.

Recognizing and Interpreting Cryptokatalysts

Cryptocatalysts can be temporary or permanent, each with different implications.

Temporary Bullish Catalysts: Tend to mark local peaks, such as exchanges listing new futures contracts or ETFs. Their effect is usually short-lived, and prices often revert after the hype subsides.

Permanent Bullish Catalysts: Projects like Bitcoin earning spot ETF approval fundamentally change the landscape and support long-term growth.

Temporary Bearish Catalysts: Include events like team scandals, hacks, or project-specific issues that often mark local lows but may resolve over time if the project remains fundamentally sound.

Permanent Bearish Catalysts: Insider token sales, project shutdowns, or critical security breaches. For example, the closure of significant banking rails like Signature’s Signet or Silvergate’s SEN during the 2023 banking crisis severely impacted liquidity for institutional crypto trading.

Caution on Overreacting: Traders often overreact to temporary bear catalysts, mistaking short-term setbacks for permanent damage. Always assess whether the core fundamentals of a project remain intact before panicking.

Staying informed involves continuous monitoring of project developments, macroeconomic news, and regulatory changes. Given the fast-paced nature, many traders rely on news channels, analytics platforms, and social media to stay updated.

Decision Framework:

If a bearish crypto catalyst is temporary and macro conditions are bullish, expect a quick recovery.

If macro conditions are bearish, even positive project news may not lead to immediate gains.

Given the complex interplay between macroeconomics, geopolitics, and crypto-specific factors, navigating market crashes requires vigilance and a nuanced understanding of each catalyst. Recognize the signs of liquidity crunches—like high liquidation volumes—and interpret news critically.

Most importantly, maintain a long-term perspective and avoid panic selling based on headlines or short-term price drops. Market recoveries often follow sharp corrections, especially when fundamentals remain strong and macro conditions improve.

If you want more detailed insights on how crypto markets operate, including the mechanics behind price movements, you can explore additional resources like specialized videos or analysis channels. Remember, staying informed and prepared is your best strategy amid the inherent volatility of crypto trading.

Stay vigilant, keep learning, and invest responsibly.

The Biggest Wealth Migration in Modern History: An in-depth look at the global exodus of millionaires

This year marks an unprecedented chapter in global economic shifts, as a record-breaking 142,000 millionaires are estimated to have fled their countries, heralding what is arguably the largest wealth migration in modern history. But beyond the staggering numbers lies a complex story about geopolitical power, economic strategy, and the evolving landscape of global wealth distribution. Who are the winners and losers in this migration, and what implications does this have for already-wealthy nations versus those vying to attract capital?

Historically, Western countries like the United Kingdom, the US, and various European nations have been the primary magnets for global wealth. However, recent trends show a dramatic shift. For the first time, the UK is losing millionaires at a faster rate than any country, surpassing even China in the exodus of ultra-rich individuals. This shift is catalyzed by aggressive tax policies, political uncertainty post-Brexit, and social unrest, which are prompting the wealthy to seek refuge elsewhere.

In contrast, countries in the Gulf Cooperation Council (GCC), notably the United Arab Emirates (UAE), are experiencing a boom. The UAE, with its zero income tax, strategic visa programs, and pro-business environment, is set to attract an estimated 63 billion dollars in private wealth in 2025 alone. Notably, the UAE's robust golden visa programs—offering long-term residence permits through investment—serve as a blueprint for other nations aiming to attract high-net-worth individuals (HNWIs).

Europe’s internal dynamics reveal a competing landscape. While Western and northern European countries like Germany, France, and Spain are witnessing significant losses of millionaires, Mediterranean nations such as Italy, Portugal, and Greece are emerging as attractive new destinations. Italy, in particular, is gaining over 3,600 millionaires thanks to its special tax regimes and flexible visa options.

While tax considerations are often cited, the true motivations for wealth migration extend beyond mere fiscal benefits. The ultra-rich seek security, stability, and an enhanced quality of life—including access to premier education, healthcare, and climate—preferably in jurisdictions that allow them to "shop" globally for services and lifestyles.

Tax policies on accumulated wealth, estate, and capital gains are a significant driver. Countries like Monaco, the UAE, and Malta offer low-tax or no-tax environments, making them hotspots for asset protection and tax efficiency. The industry supporting these migrations—shaped by a $20 billion annual market—specializes in issuing Golden Visas, facilitating second passports, and advising wealthy clients on how to leverage legal frameworks to optimize their wealth structures.

The mass departure of the rich carries profound implications. For countries like the UK, with an expected loss of $92 billion in funds and around 16,500 millionaires expected to leave in 2025, the consequences include dwindling investment, economic stagnation, and a weakening of national prestige. These withdrawals are often presented as indicators of a country's instability or poor policy choices, serving as powerful signals to international investors.

Moreover, the exodus isn't solely about losing wealth—it's also about brain drain and capital flight, which can stifle innovation and growth. For instance, the continuing loss of high-net-worth individuals in Germany, France, and China reflects concerns over political uncertainty, regulatory unpredictability, and increasingly burdensome tax regimes.

Some analysts and organizations, like the Tax Justice Network, argue that these high-profile migrations are overstated. They suggest that the 142,000 expected migrants (approximately 0.2% of the 60 million global millionaires) do not represent a catastrophic shift but are indicative of a small, though significant, segment of the concentrated wealth. These figures are sometimes based on social media activity or visa applications rather than concrete fiscal residency changes, raising questions about their accuracy.

Nonetheless, the political and economic impacts remain tangible. Wealthy individuals are leveraging their mobility as a form of power—using the threat of migration as a bargaining chip to influence domestic policies. Governments face a dilemma: impose higher taxes and risk losing capital, or offer concessions to keep the wealthy engaged and invested.

The European internal competition

Within Europe, there's intense competition for these rich migrants. Traditional financial hubs like London and Paris, once top destinations, are experiencing population declines of high-net-worth individuals, primarily due to policy changes like the withdrawal of the nondom tax status in the UK, and increased wealth taxes in France and Spain.

Conversely, Italy, Portugal, and Greece are actively promoting attractive tax regimes and investment opportunities, such as Italy's "flat tax" of €100,000 on foreign income** and flexible visa options—making these nations increasingly appealing. Portugal and Greece, with their growing real estate markets and visa incentive programs, are rapidly becoming new sanctuaries for the wealthy.