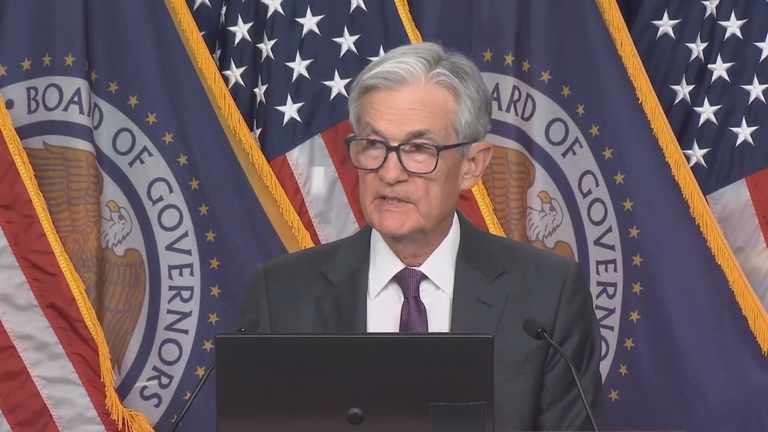

Fed Chair Powell: Bank Regulations Regarding Crypto Will Loosen

Do you remember the old E.F Hutton ads?

This was a Wall Street brokerage house that gained a lot of attention with the "when E.F. Hutton talks, people listen" campaign.

Here is one of their commercials.

I bring this up because the Fed Chair tends to be the same way. He has the ears and when he (she) speaks, markets listen.

Often we see the Fed Chair trying to foreshadow policy, in hopes markets will do the heavy lifting. It is an effective strategy since many front run the Fed.

Today's articles is not about markets. Instead, we are focused upon the words Powell spoke regarding cryptocurrency.

Fed Chair Powell: Bank Regulations Regarding Crypto Will Loosen

The pro-crypto sentiment is certainly sweeping the United States. We are seeing many institutions related to financial and banking regulation opening up to the prospects of a much broader industry.

Powell is no exception to this trend.

For years, he was adamant that the Federal Reserve would not issue a CBDC. With regards to crypto, that was as far as he went. This year is a different story.

His stance now is that a loosening on the banks with crypto is likely in the future.

"We took a pretty conservative, other bank regulators took an even more conservative perspective on the guidance and rules we imposed on banks," Powell said. "I think there will be some loosening of that."

"We'll try to do it in a way that preserves safety and soundness, but that permits and fosters appropriate innovation, but does so in a way that again doesn't put consumers at risk in ways they don't understand or make banks less safe and sound," he added.

Not surprisingly, one of the topics Powell touched upon in his speech as stablecoins. This is the mecca for regulatory focus within the United States. We are looking at the probable passage of legislation this Summer. That means the banks will be open to getting involved.

"Stablecoins are a digital product that could actually have fairly wide appeal and should contain consumer protections of the typical sorts and transparency, and that's what the Senate and the House are working on," he said.

My guess this is the first tier where the banks make their entry.

Stablecoin Issuers

It makes sense for the banks to start their own stablecoins. We are looking at free money for them.

They rake in deposits on a daily basis. These liabilities are either lent out or used to purchase government approved securiities.

We see the outline through stablecoin issuers such as Circle. Stablecoins are "bought" from the company, swapping 1 USD for a stablecoin. The dollars are then used to purchase T-bills, earning the issuer a return.

Banks will love this idea. The banking system has the means to further their returns by having their networks operate using stablecoins. They can offer expanded payment systems which reach outside their platforms, swapping with the coins of other issuers. The collective of this is going to swallow up US T-bills, providing a payout to all issuers.

My view is that the stablecoin market will exceed the total number of USD banknotes that are outstanding. Presently that is roughly $2.3 trillion.

When we consider the might of banks, along with Big Tech, a stablecoin with 1 trillion tokens issued will not be outlandish. A company like Meta could certainly achieve this.

We also could see some banks replicate what Blackrock did with the BUIDL fund. This will be more at the institution level but it is effectively creating a tokenized money market fund. Investments are used to purchase T-bills, the same as with most asset backed stablecoins. This time, however, a portion of the interest is paid to the investors.

BUIDL now has a market cap of $2.5 billion.

The banks are not going to pass on this opportunity. It looks like the regulators and legislation will let them in.

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This is great news for the cryptoverse.

https://www.reddit.com/r/Economics/comments/1k280ao/fed_chair_powell_bank_regulations_regarding/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Easting up the economy will soon happen but how does he want to tackle the inflation that he is also creating with the new tarrif, the dramas in the world are now in series

Ah, the E.F. Hutton effect! It's fascinating how the Fed Chair's words now hold similar weight, especially when it comes to crypto. Powell's shift on bank regulations for crypto is a game-changer. Imagine banks diving into stablecoins—it's like opening a treasure chest for them. Your insights on the potential market size and the role of Big Tech are spot on. It's a brave new world where "when Powell talks, markets listen"! 🌐💰

Such a fascinating coin! How did you find all these rare details about it?"

He gave a speech. A lot of this stuff you can find the bills that are put forth by various governments and read what they are looking to pass.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 84500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI am just thinking, how will this benefit an algo stablecoin like HBD?

!PIZZA

!LOLZ

lolztoken.com

They'd crack each other up.

Credit: gillianpearce

@taskmaster4450, I sent you an $LOLZ on behalf of rzc24-nftbbg

(4/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

It does. Algos and synthetics will not be legalized in the sense banks can interact with them. It will only be asset backed.

Can we say, then, that it is an advantage on the part of HBD that it cannot be legalized?

$PIZZA slices delivered:

@rzc24-nftbbg(4/10) tipped @taskmaster4450

Moon is coming - April 19th, 2025

Attention Housing and Real Estate and Cryptocurrency Scam Victims! If you’ve fallen victim to a any of these scam and lost your hard-earned money, you’re not alone. I was once a vitim until i come across (STORMBYTE HACKERS RETRIEVER) They help me recover my funds and guide me through this challenging situation.

Don’t let scammers take advantage of you any longer! Contact (STORMBYTE HACKERS RETRIEVER) today for support and to explore your recovery options. Together, we can fight back and reclaim what’s rightfully yours!

📞 +1 (562) 572-9348)

✉️ Stormbytehackersretriever@ protonmail.com

Posted by Waivio guest: @waivio_james-walsh