Ark Invest: Bitcoin To $2.4 Million By 2030

Sometimes it is just fun to dream.

While I tend not to get caught up on price predictions, occasionally it is best to just let loose.

Ark Invest tends to focus upon this stuff a lot more than I do. It is known for some of its predictions, many which were outlandish at the time. The track record isn't perfect but it does take a more sensible approach in the age of technology.

The firm is making headlines with its increase in the bull case for Bitcoin. Here is what was put forth in their 2025 report, released at the beginning of the year:

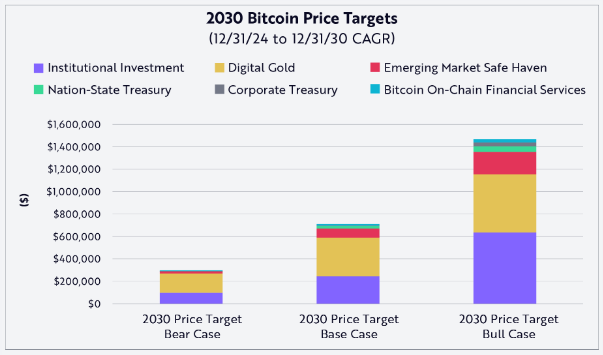

Source

As we can see, the target for the bull case was $1.5 million. Considering we are around $95K, that is a huge jump in 5 years.

The analysis did not stop there. According to a recent update, it now raised the bull case to $2.4 million.

If this pans out, it would be a 25x from current levels.

Ark Invest: Bitcoin To $2.4 Million By 2030

Sentiment is definitely changing around cryptocurrency. Since the election of President Trump, the view out of the United States did a 180.

Since taking office, the campaign rhetoric was followed by action. Key positions, such as SEC chair, are now filled with pro-crypto people. Trump sign an Executive Order establishing crypto as part of the US Strategic reserve.

Most importantly, there are bills working their way through Congress which would establish regulation in the leading economy. The belief is that many institutions were sidelined due to the lack of clarity.

Here is a key point that Ark Invest focused upon. It believes this is going to be a major driver for Bitcoin.

Large financial institutions will be the biggest driver of Bitcoin’s future price growth, as per the report of ARK. In the best-case scenario, estimates the firm, Bitcoin can grab 6.5% of the $200 trillion non-gold global financial market. This institutional adoption is the backbone of ARK’s positive vision.

One only has to look at the success of Blackrock's Spot ETF on Bitcoin. It went live about 16 months ago. It now has a NAV of almost $48 billion.

Treating Bitcoin as a new asset, Wall Street firms will build on top of it. With regulatory clarity, we are likely to see a wave of financial products the perform different services to the investors. Bitcoin will be the foundation, creating a large financial "economy" on top.

According to the firm, there are two other drivers of their bull case.

The second key driver in ARK’s price thesis is the increasing acceptance of Bitcoin as “digital gold.” The company expects Bitcoin to potentially claim up to 60% of gold’s $18 trillion market cap by 2030.

This is certainly a narrative which is picking up steam. Over the last 18 months, much of the conversation regarding Bitcoin shifted in this direction.

ARK’s estimates that the price appreciation being driven by Bitcoin as a “safe haven” in emerging economies may represent up to nearly 14% of the cost growth in its bull case projection.

The combination of these three variables could, according to the estimates, provide an explosive situation for Bitcoin.

The Bear Case Gets Upgraded

It is easy to get caught up with pie-in-the-sky projections. Many feel $2.4 million per Bitcoin is foolish. Perhaps it is.

Ark Invest does provide a bear case to. The chart above shows the difference in its original report to start the year.

For those who tend to prefer more conservative forecasts, this one also received a bump.

Although the $2.4 million bull case has been making headlines, ARK’s more modest estimates still indicate significant growth. The company increased its “bear case” from $300,000 to $500,000 and its “base case” from $710,000

to $1.2 million.

On the low side, we would still see tremendous growth.

These targets would mean Bitcoin would need to increase at compound annual rates of 32% to 53% over to 2030. Such prolonged growth rates would be rare for an asset that has already reached trillion-dollar market capitalization.

Source

Would anyone complain about a 32% CAGR over the next 5 years? Of course, 53% would be better.

The Impact On The Rest Of Crypto

What does this mean for coins such as Ethereum?

The past does not equal the future. We cannot claim, with full certainty, what happened in the past will repeat itself going forward.

That said, history shows that when Bitcoin has massive long term gains, the rest of crypto, on the whole, follows. It is not necessarily a 1;1 correlation but there can be upside growth.

Markets are mostly driven by sentiment. A Bitcoin bull makes everyone feel better about cryptocurrency.

I wrote a fair bit about the economic singularity. This is not going to happen by 2030. However, it is likely we see early impacts from automation due to AI and robotics.

When this occurs, the entire economic paradigm changes. Crypto is going to capture the value created. It is something that gets lost using metrics such as GDP. Of course, market pricing is not an ideal reflection of what is taking place.

How much of an impact could this have by 2030? We could see tokenized AI agents generated returns for investors. These could be forming a baseline of economic productivity that is tied directly to crypto.

I am not sure how much Ark Invest looks at the potential transformation of the economy from this perspective. Kathie Wood, the CIO, is trained in traditional economics, something that still tends to bleed into her analysis.

That doesn't mean the firm's analysis on Bitcoin (or anything else) is negated. My point is that we could see such a massive economic transformation that we are not quite sure what lens things are viewed.

Bitcoin could certainly reached the levels forecast. This might be a driver for the rest of crypto prices or the value capture aspect of tokenization due to AI and automation might take over.

Either way, it would all lead to higher levels.

Posted Using INLEO

CERTIFIED BITCOIN RECOVERY EXPERT THE HACK ANGELS RECOVERY

I’m Sophia Emma from the United State, and I can't thank The Hack Angel enough for helping me recover my Bitcoin worth $357,000 from a fake investment platform. After being scammed, I felt lost and frustrated, but their dedicated team worked tirelessly to track down my funds. Their expertise and support made all the difference, and I’m now back on track. I highly recommend Hack Angel to anyone facing similar challenges!"

([email protected])

Website at (www.thehackangels.com)

WhatsApp +1(520)200-2320)

Posted by Waivio guest: @waivio_sophia-emma

"Really amazing and motivating post! You explained Ark Invest's vision in a simple and inspiring way. Keep sharing such valuable content!"

Wow, this is really exciting to think about. I love how Ark Invest isn’t just throwing out crazy numbers. They actually back it up with real reasons like institutional adoption and Bitcoin being seen as digital gold. Even the bear case sounds amazing if it plays out. It’s fascinating to imagine how much crypto could grow if Bitcoin really hits those levels by 2030, especially with AI and automation changing everything, too.

It could even be more depending on how fast the adoption moves. And even if the adoption isn't restricted only the America, I'm talking globally.

https://www.reddit.com/r/Economics/comments/1k8owt8/ark_invest_bitcoin_to_24_million_by_2030/

The rewards earned on this comment will go directly to the people( @dkkfrodo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.