UK gilt yields soar - for the first time this century the UK is paying more to borrow than the US

Normally British and American bond yields track each other. For good reason, as they are both service dominated economies with big housing and financial sectors.

But yields are starting to diverge and UK yields are higher than US yields for the first time this century. Here is the graph, the UK 30 year yield is in blue, the US 30 year yield is in red:

What is causing this divergence? Some people point to the Labour govt's failure to reform disability benefits as the culprit. Markets are worried that excess government spending means the national debt will balloon.

Others (including former Prime Minister Liz Truss) blame the Bank of England. The BoE has lost control of inflation again, their argument goes, and the markets are demanding higher yields to compensate for the value of their money being eroded.

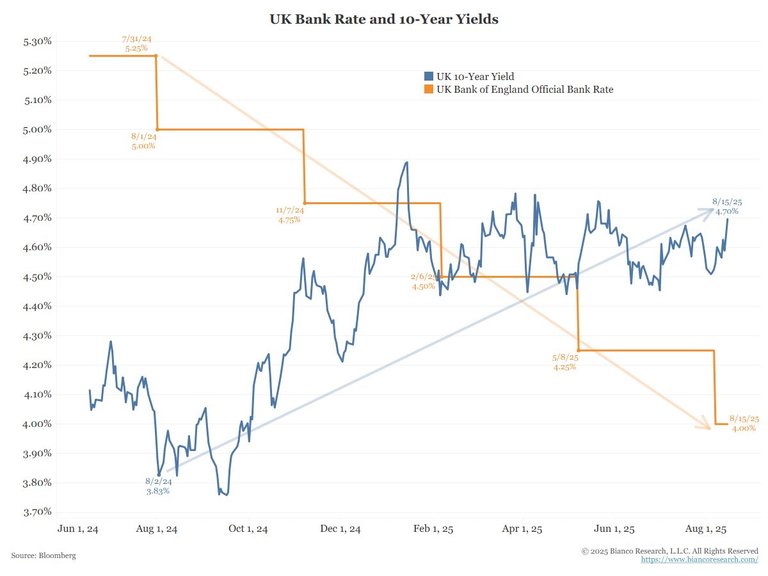

There is a germ of truth to this argument, as illustrated by the following graph of the 10 year yield plotted against the Bank of England base rate:

In the last year the Bank of England has cut base rates by 125 basis points, and the 10 year yield has moved in the opposite direction, increasing by 87 basis points. The bond markets are screaming "You are making a mistake" at the BoE.

The UK economy continues to grow as the fundamentals are still sturdy. But there is no doubt the govt is spending and borrowing too much, while at the same time the rate of inflation is steadily edging up.

If the Treasury has lost control of fiscal policy while at the same time the Bank of England has lost control of monetary policy, the economy is likely to get derailed.

Someone is going to lose their job over it. Given that Andrew Bailey is a wily political operator (he mistook inflation as "transitory" and raised interest rates too late, but no blame accrued to him, Liz Truss took it all), it's likely that Rachel Reeves will be the fall girl.

https://www.reddit.com/r/unitedkingdom/comments/1mvapfd/uk_gilt_yields_soar_for_the_first_time_this/

This post has been shared on Reddit by @rose98734 through the HivePosh initiative.

Congratulations @candy49! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 12000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP