LBI earnings and holding REPORT | Year 03 | Week 27

Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

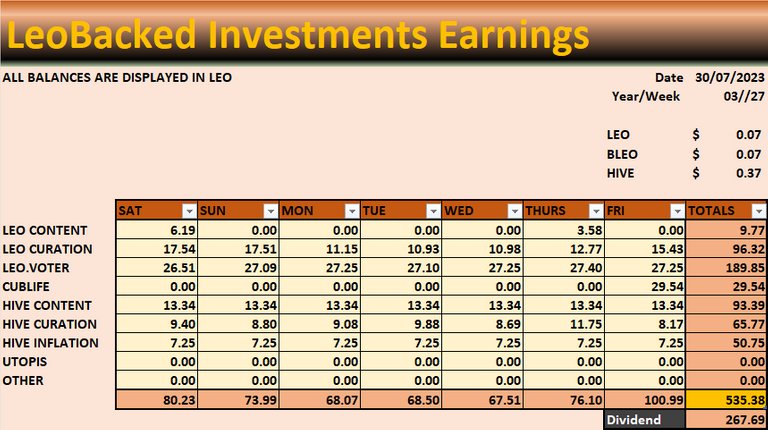

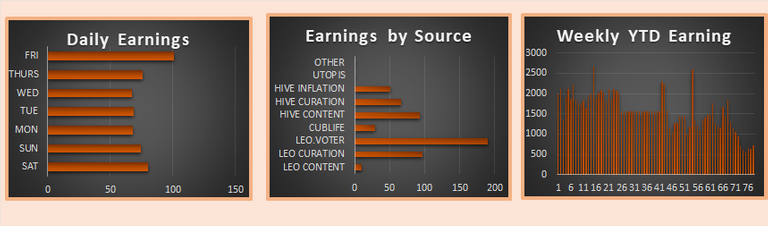

Earning this week are around what they have been. Nothing special at the minute. LEO.VOTER is for the first time the highest earner for the week which is surprising and i'd guess a 1 off. HIVE content is normally our best earner but we only get out 2-3 posts per week. Its been challenging to find something to replace the income we used to get from LEO curation, something will popup sometime.

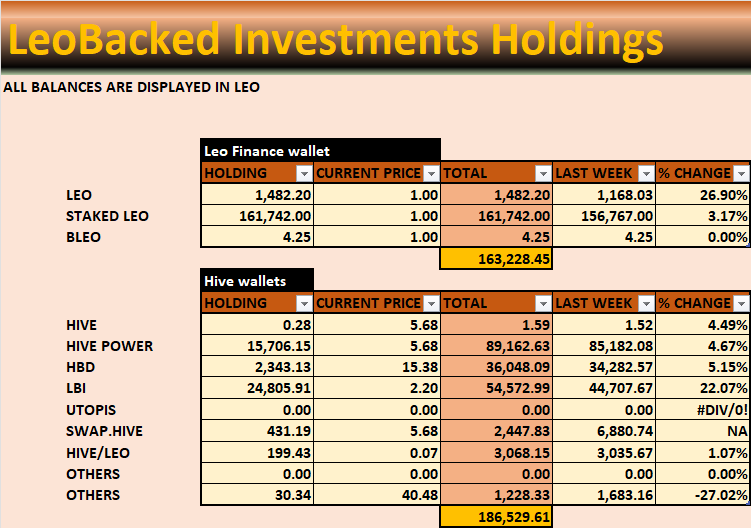

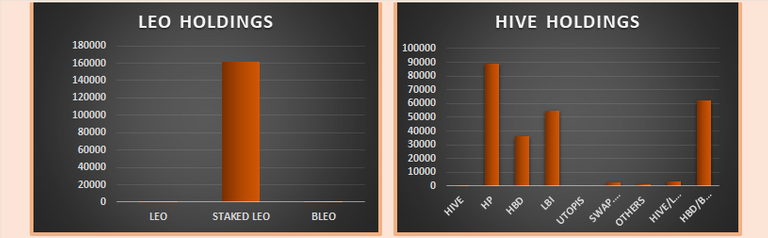

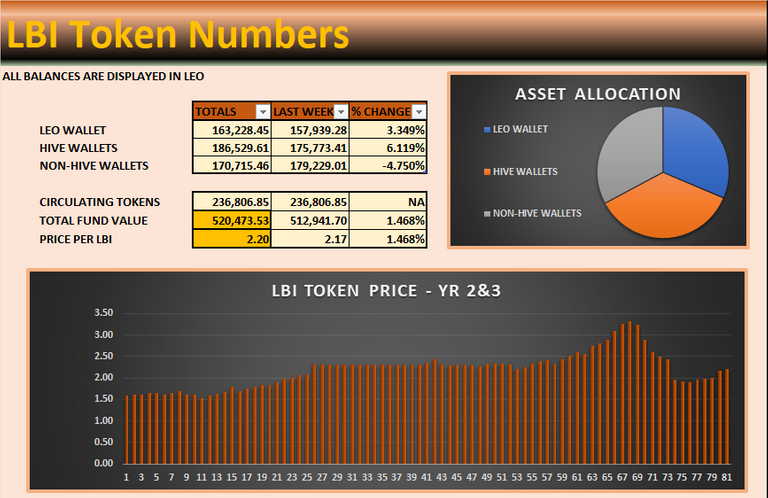

I stopped the LEO powerdown and staked 30k that was sitting in the wallet. In total to date, we have used around 40k LEO to buy back LBI tokens. Things are slowing down and i think most that are looking to sell back have so the reminder of buy backs will come from NON-HIVE assets.

For our HIVE wallet, we collected our HBD interest this week which was 43 HBD and added a few HP from content and curation. You can see we are holding 24,800 LBI and when the token buy back wallet is exhausted, we'll burn all these token to null.

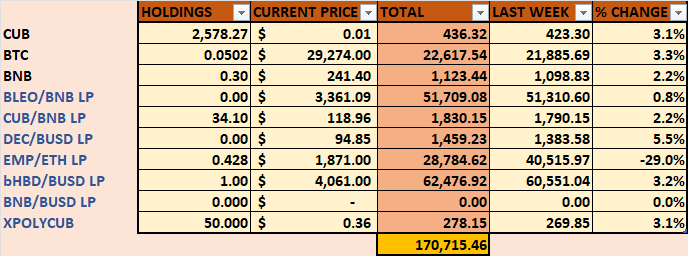

I have sold off our EMP holdings and converted them to ETH. I plan to use this ETH for LBI token buybacks. Harvests from CUB were converted to BTC and we now have 5% of 1 BTC which is a nice milestone to pass. Markets have been sideways mostly so no big chances this week.

The LBI tokens has a small increase in value this week. Everything has been sideways, LEO, HIVE and the rest. You can see from the chart above marked assets allocation, our fund is pretty evenly split between LEO, HIVE and non-HIVE wallets. We will see a small decline in non-HIVE as we convert ETH into HIVE to buy LBI tokens back but it'll not be massive.

To date, we've bought back almost 25k LBI tokens. I plan to continue to provide a buyback wall until run out of liquid funds is demand for a buyback wall declines. The latest wall has been in place for 4 days so im thinking most people that are looking to sell have sold already and locked in a 2x profit assuming they convert the swap-hive to LEO.

Going forward, we need to find some sort of income source. Content is the best and easiest way to promote and earn at the same time but we dont have a content team anymore with nobody looking to fill the space. Earning from staked LEO is limited and it does not provide a great ROI currently. LEO.voter seems to be the best way for us but it is slow to build. We have the option of converting HBD into HP which would give a 45-50% boast but I think we'll get HIVE for cheaper in 6-14 months' time.

We continue on the path we our already on and hope when crypto winter is over, we have built up something that can bring us back to glory days.

thanks for checking out this weeks report, have a great weekend.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

👍

Yes

Gz on the 0.05 BTC Landmark, that alone one day can set us off for life 😁

Curious about why you think in a 12 month timeframe Hive can be (more!) cheaper than this days...?

Just based on the last cycle. HIVE bottomed during NOV 2020 and FEB 2021. If the cycle lasts around 4 years and things somewhat repeat, HIVE and lots of other small ALT tokens will properly bottom out late 2024.

BTC > HIVE ratio topped off at over 320k HIVE to 1 BTC around the same time in late 2020. 1 year later in late 2021 HIVE had mooned to over $3 and you could swap 20k HIVE for 1 BTC. Even if you converted out at 200k HIVE to 1 BTC and converted back in at 50k, you would 4x your BTC or double your BTC and keep 100k HIVE :). The cycles being so short offers so many opportunities that can yield massively with little to no risk if planned and executed properly.

I understand that it's hard to believe HIVE will drop and be lower in 1 year from now, it does not really make sense to me either but the game is the game. I follow the path of previous cycles and hope they repeat and sometimes have to act against my own judgement like a robot. I never really wanted to start converting cryptos into HBD in 2022 because our CUB harvests declined alot, but im happy I did it now and that HBD would buy back 3-4x the same amount of crypto today.

You'll think back to this comment sometime in 2024 when HIVE is looking completely dead at 18-19 cents and be like,

On the positive, if it ever drops that far, it's highly likely it would at least 10x from that point over the following 12-18 months in 2025

Wow, that was a great answer, thanks a lot!