How to file Income Tax Return yourself

A step by step guide as many friends asked for it - the last date has been extended to 15th September 2025.

I have been filling my Income Tax return myself from long time and I also help many people free of cost to fill their return, but slowly the number of request is increasing, so this time I thought, it's good to create this step by step guide and share with them and see, if it enables them to do it themselves. Getting it filed by a 3rd party provider is not very costly, at the minimum they charge around 500/- but I feel it's more important to understand and ensure what's getting filed in, to avoid any wrong doing, because later the tax department may come back asking more tax, if it's filled wrongly. So better to make it right by doing it yourself.

And who all need to file the Income Tax Return ? If you are liable to pay tax, having an income for more than 2.5 lakh, then it is mandatory to fill the return. If your income is less than that, then you can still file a zero return, people do that to show returns for three years while taking loans from Bank. And I also think, it's good to file a zero return, it does not cost you anything, but can help later.

One more important reason to file your Income Tax Return - if you have money in savings account and the bank deducts TDS, then you can claim refund - I am filling return for Mom for these refunds. There is a specific form that you need to give to the bank every year to not deduct TDS, else by default they will deduct, if interest amount exceeds ₹10,000. You can verify that information from your AIS (Annual Information Statement), which is available in the eFilling portal, after you log in.

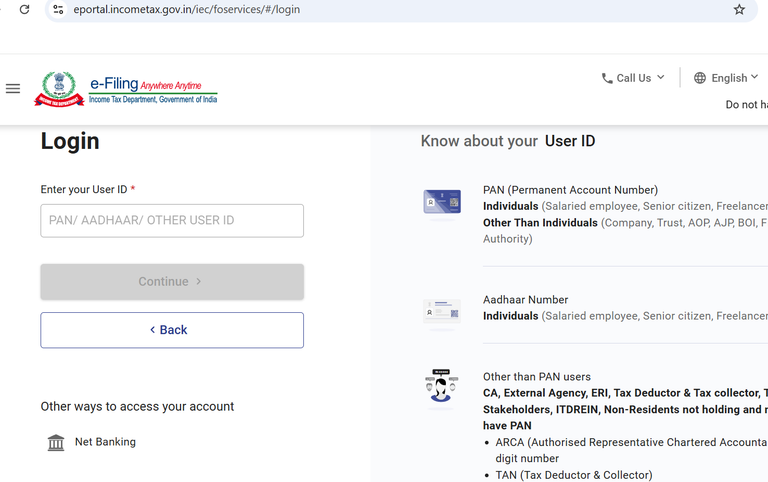

So the very first step is to have login credentials, the user id being your PAN ( Permanent Account Number). They have already linked the PAN to Aadhaar Number and your Aadhaar must be already linked to your mobile to validate at the end. So create the login credentials first, if you have not done already.

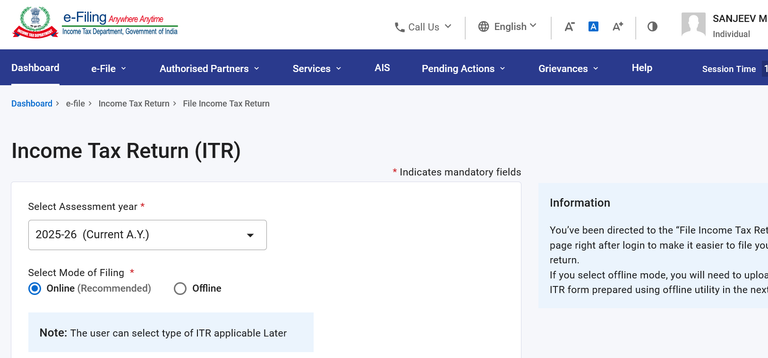

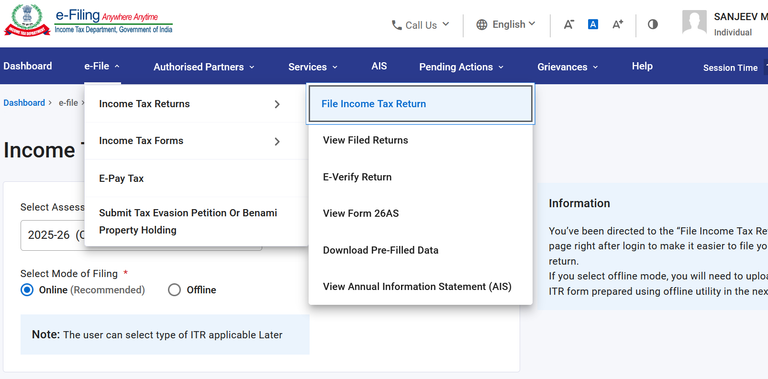

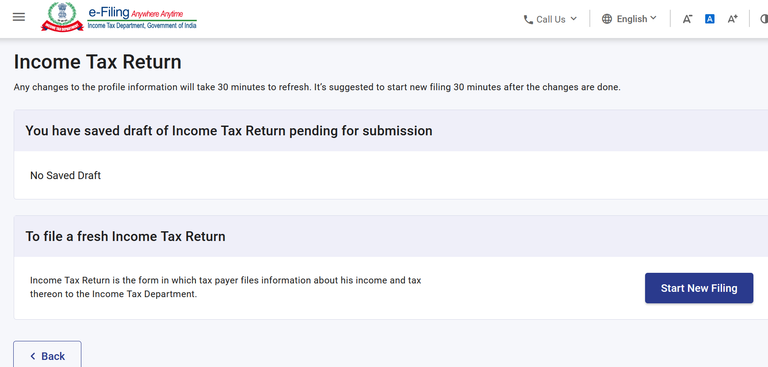

Once you are logged in, click on eFile > Income Tax Returns > File Income Tax Return and select the current Assessment year and select online Mode of Filling .

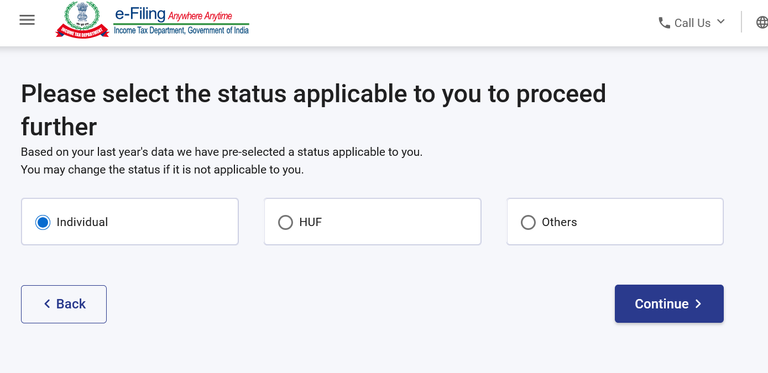

Start a new filling and select Individual and continue.

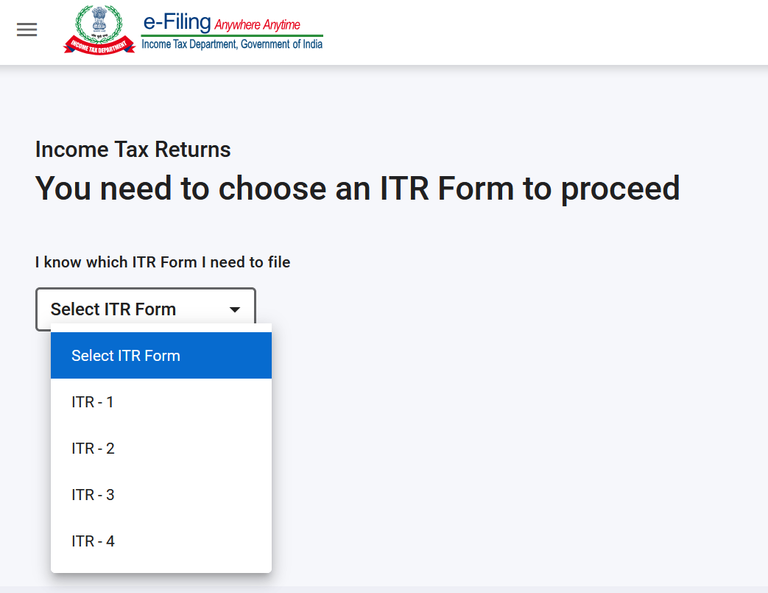

In the next page you have to select the ITR Form, which is important.

You can use ITR-1 if your income is up to 50 lakhs from salary and one house property. If it exceeds 50 lakh or you have multiple house properties, then you will have to use ITR-2. Also ITR2 has to be used, if you have Capital gains or foreign income/assets.

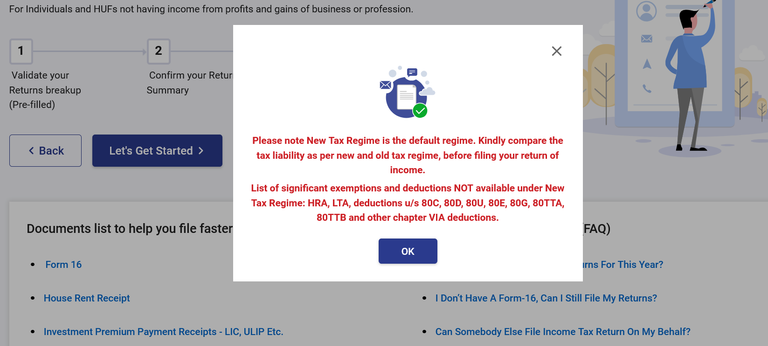

Before filling the return, have your Form 16 handy. And make sure to compare the Tax Regime, because the New Tax Regime is the default regime. If you don't have a Form-16, then you can still fill, if you have all your payslips, which makes it a bit difficult.

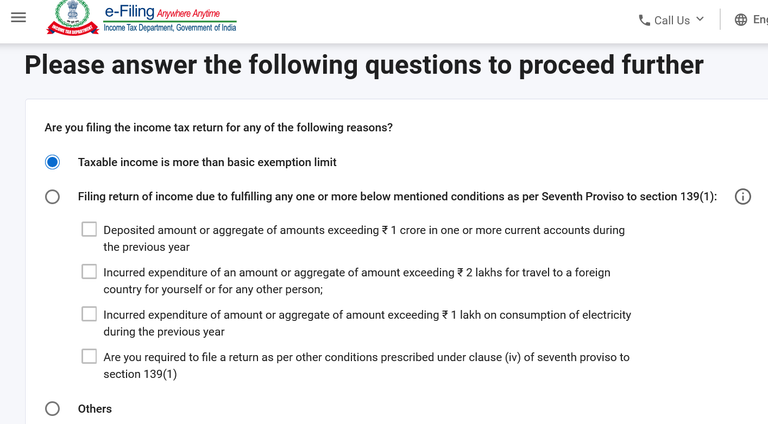

In the next page you will have to say your taxable income is more than the exemption limit, that is why you pay tax, right ? But for zero tax return, you should select Others.

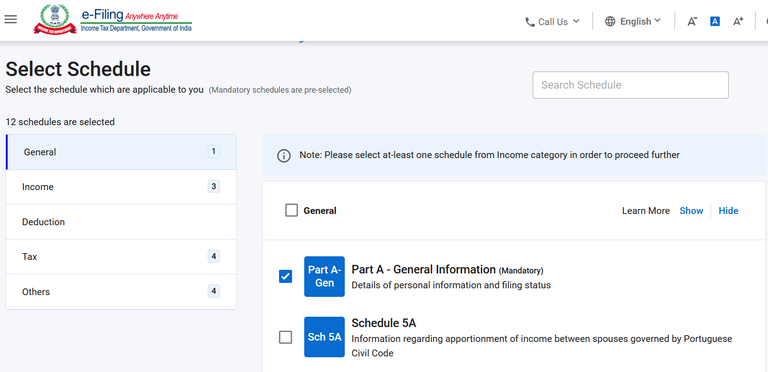

In the next page you have to confirm the schedules applicable to you, by default Mandatory schedules are pre-selected but you must confirm them, going through them one by one.

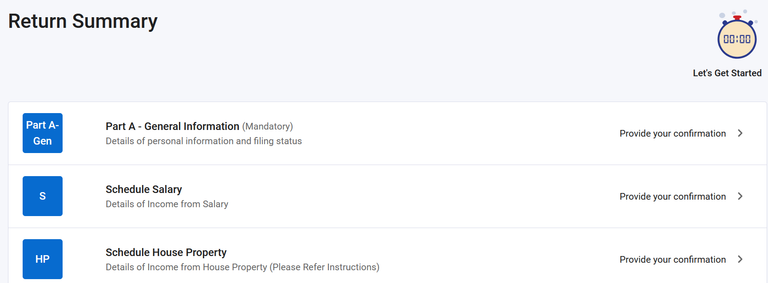

So go through each schedule and provide your confirmation.

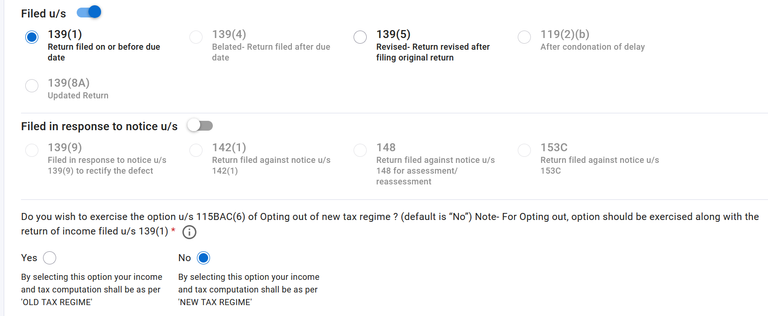

You can opt out of the new tax regime at this stage as well, and have your tax computation as per old tax regime, but you should do that only if your office erred, otherwise it's not worth.

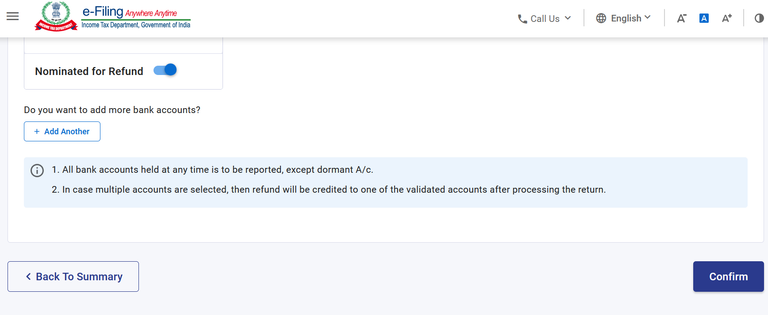

One important part of Part A - General Information is Bank Accounts and you should add all active bank accounts and choose one of them for Refund. If any account has been inactive, then remove them, I had to remove my Citi Bank account this time. If you add a new bank account, it takes 48 hours to reflect, so keep that in mind, and start early before deadline.

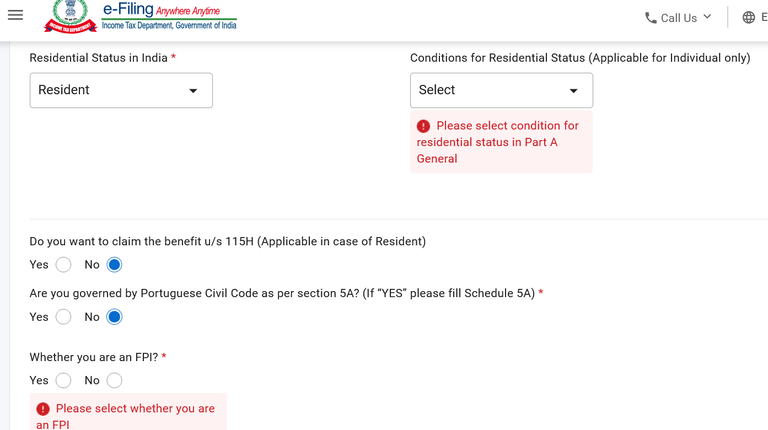

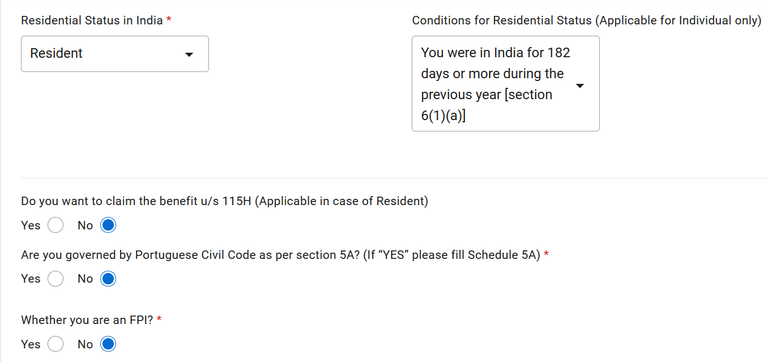

And don't expect the site to have everything selected right - I am not sure, why they can't fix these small things.

Select the option as shown above - ya, otherwise you can't move forward.

And then very important - make sure to go through each schedule and match the information with Form 16. This year, they are even allowing to proceed to verification, without you confirming all schedules, which is bad. So remember, it's your responsibility to take corrective measures, else you end up paying more tax.

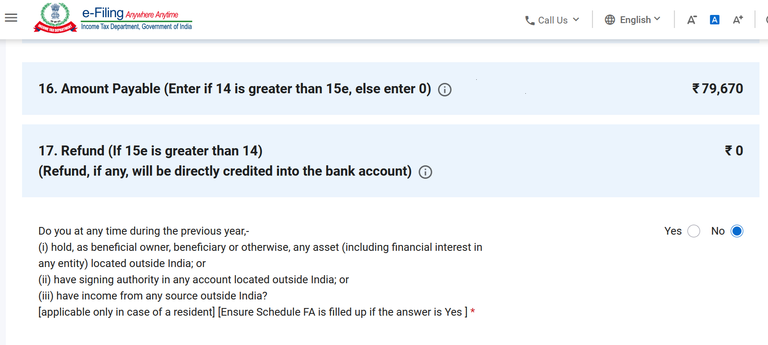

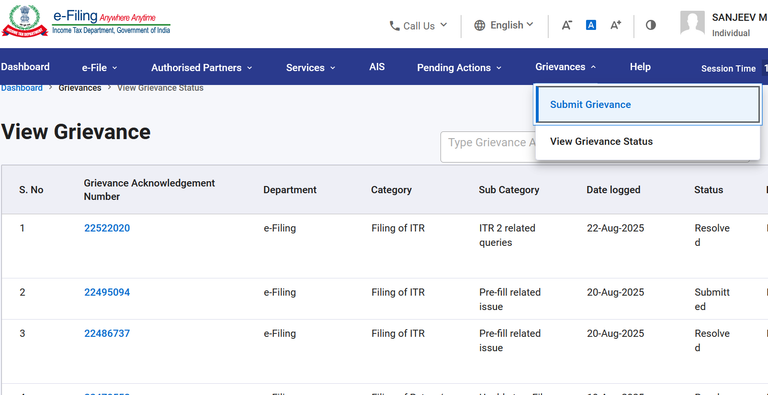

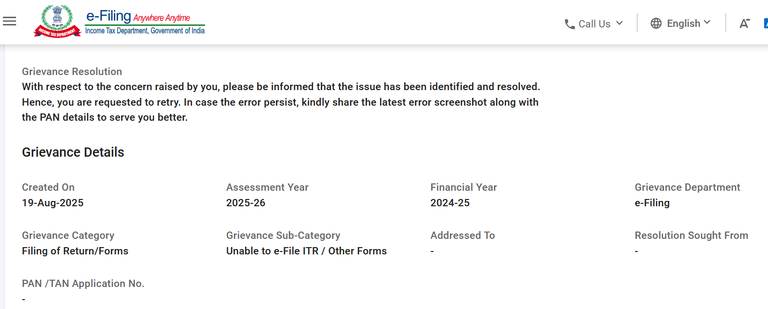

For me, they showed an outstanding payable amount, that was way beyond my thoughts - that's because of wrong calculation, which can be possible for several reasons, like your employee not providing right information, or even the Income Tax department not filling these prerequisites rightly. So don't get shocked, instead find out which item is not reported correctly. Some of the components you can edit and save, but for me, even though an amount showed up correctly, it was not being shown as eligible for deduction. So I had to call the Help desk after which they told me to send a mail to rectify that. The mail creates a grievance record, you can also create that directly Under Grievances as shown below :

Unfortunately the resolution is not rightly taken care, even though they update the ticket and resolved.

After five different tickets, they even stopped responding to my grievance and again I called their help desk, who provided a clue and advised to go and talk to the Public Relation Officer in the nearest Income Tax office. However, based on his clue, I did search the internet and found out the solution, interestingly many people have faced the same problem and they could have created a simple video or tutorial or even say that straight. Now let me get you to the problem :

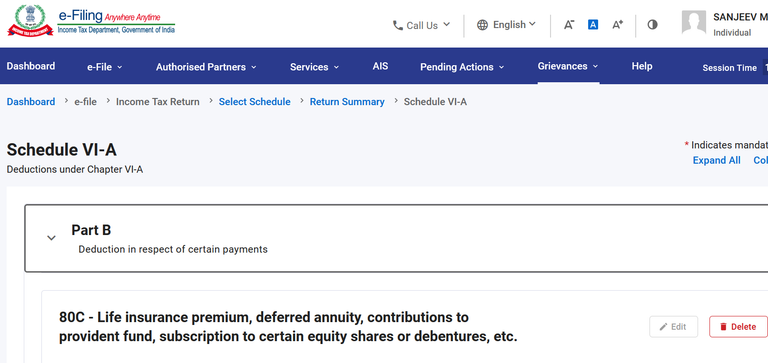

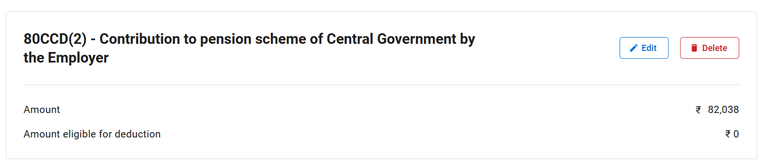

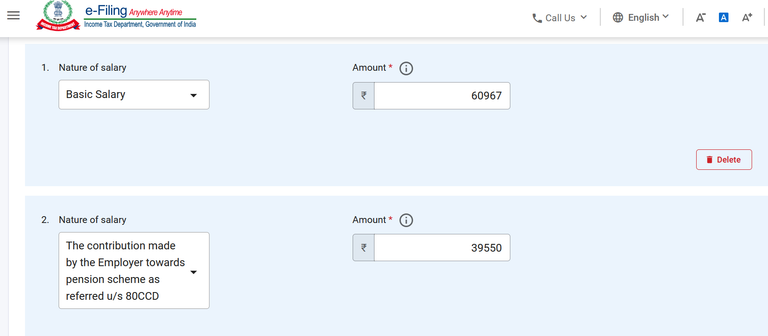

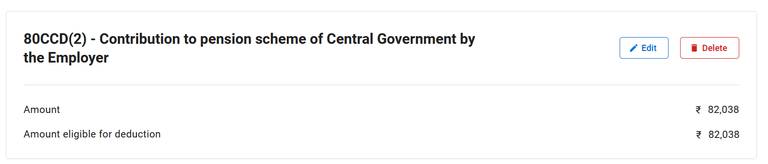

Under new tax regime Deduction in respect of contribution by Employer to pension scheme under section 80CCD (2) is non-taxable and even though they show the amount rightly in the section, the amount eligible for deduction is zero, which means, it's not considered. So how do you fix that ?

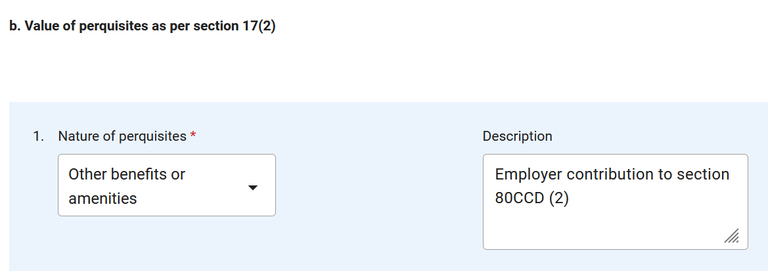

You have to edit your salary and add another salary break up (not a perquisites breakup) and provide the amount with the option as shown above. If your employer has shown that amount as Value of perquisites as per section 17(2) in your Form 16, then you also get that amount as perquisite under Salary. So either you have to delete that perquisite, or update the Basic Salary amount by deducting the amount of 80CCD (2) from the Basic Salary. I would prefer the later i.e. deduct the amount from Basic Salary.

While saving if it gives error for that Description field then put something as shown above.

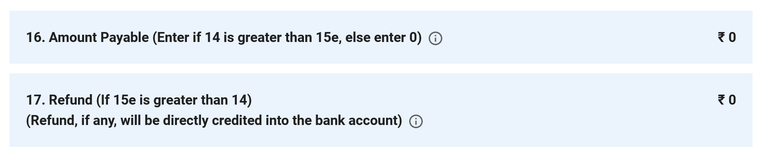

So now if you go to Schedule VI-A, you should see the same amount eligible for deduction and this changes the entire tax calculation. If your Employer has calculated it correctly and deducted the right tax amount, then you should see Zero tax payable under section Part B - TTI - Computation of tax liability on total income, but only if, you do not have any other income.

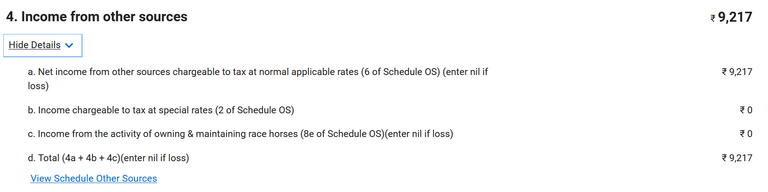

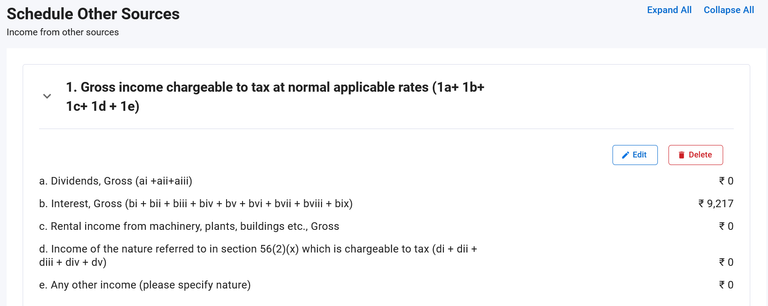

For me the interest from different Savings Account showed up as Income from other sources.

You can verify that amount from your Annual Information Statement (AIS), that has all the details, but still you will have to pay outstanding tax amount for that. They are very accurate in fetching the data so you have to consciously try to get as minimum interest as you can, by having only required minimum balance, I have managed to reduce it this year.

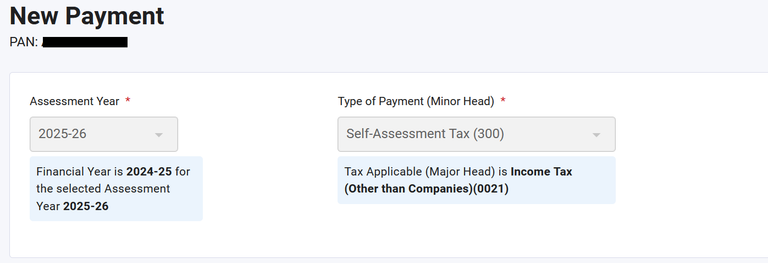

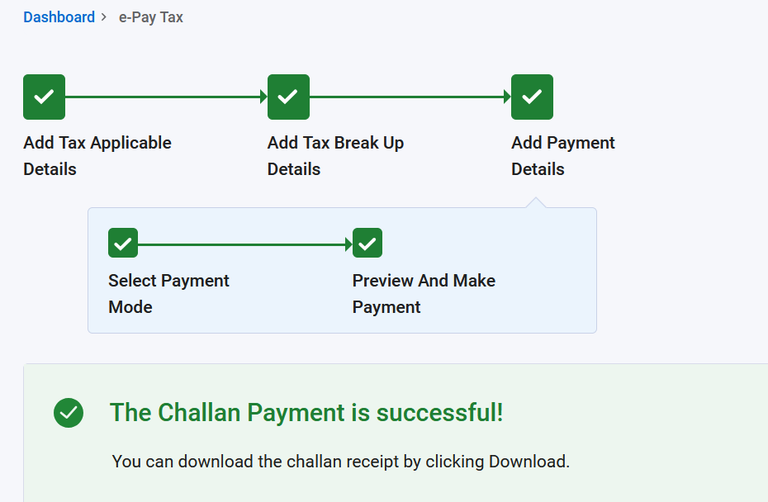

So proceed and pay the outstanding tax amount.

It will automatically fill in the details in the relevant schedule after the tax is paid successfully.

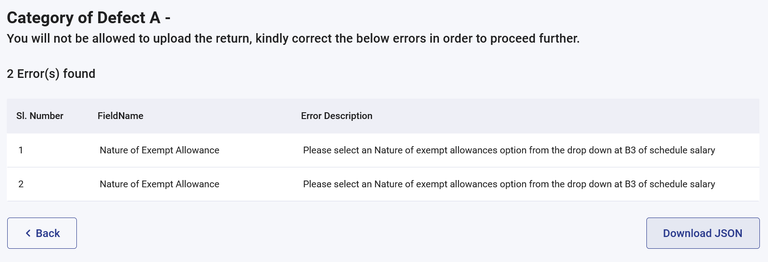

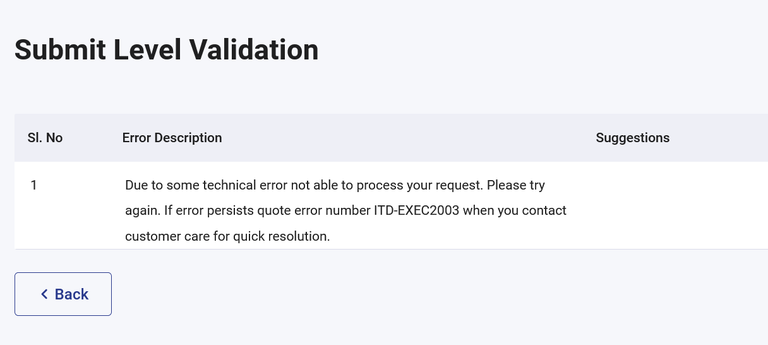

So finally, you should have Zero tax payable... and proceed for validation, but wait, you still can see some surprises. When I did that, they showed me this :

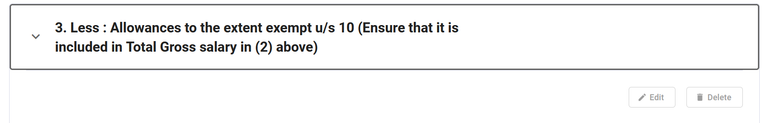

So after some brainstorming, I decided to delete all the elements under section 10 inside Schedule Salary, as they are anyway not applicable.

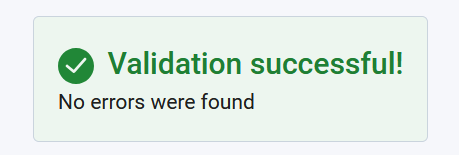

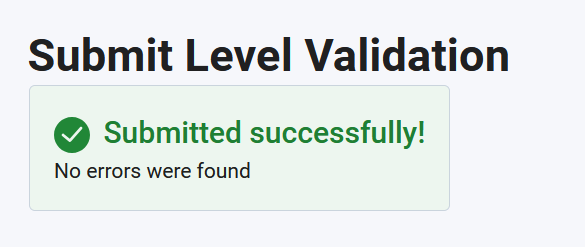

And then that was cool - it surpassed all validations..

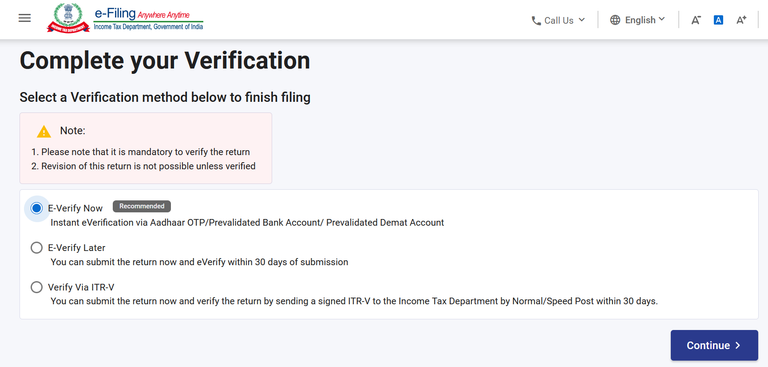

Now you should be able to move forward and finish the submission and verification, but the story does not end there.

Technical Error can still happen - so keep retrying and you should be able to finish it with few retries.

After couple of retries, I was able to submit.

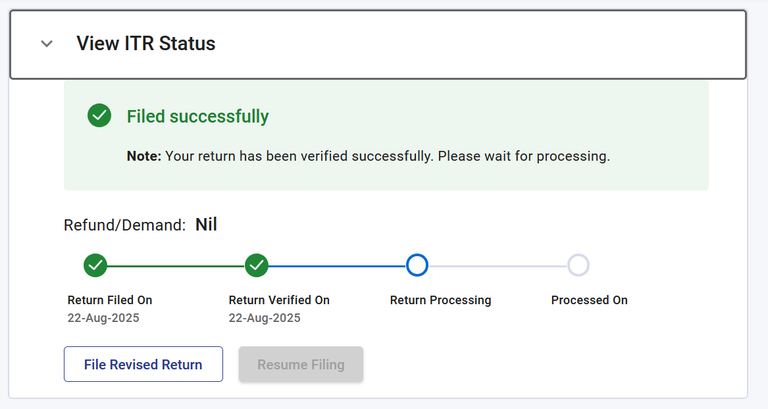

The tax department will notify you on your phone and mail id, upon the processing of your return.

You can always see the ITR Status from your Dashboard.

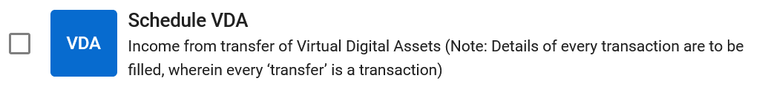

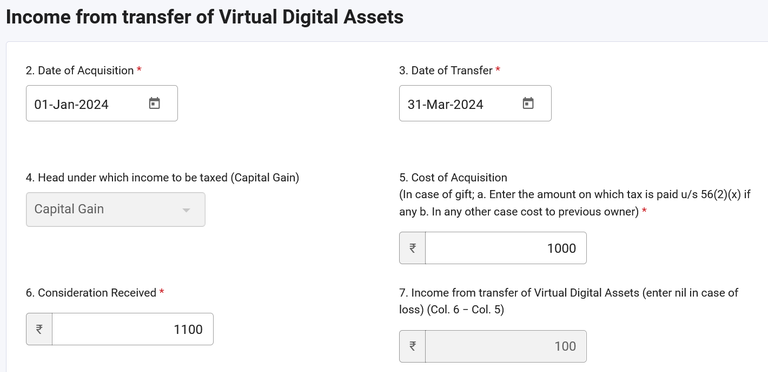

Before I wrap this post, I must tell you that, if you have any income from crypto or virtual digital assets, then you will have to include Schedule VDA and then fill the details as shown below. Here are some screenshots of my experiment.

! [DID THIS HELPED YOU ?] It has taken more than a week to write this blog and if this helped you to file your return yourself then donate some money for charity, that you would have paid to a tax consultant and help others to file their return.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

AI free content - do not lose your natural intelligence.

Don't have a hive account ? Then you are missing the fun on one of the most decentralized blockchains - created and run by community, free from any centralized entities. Create your account using my referral and you will have my support for good and genuine AI free content.

8 years is a very long time my friend! 8 years of creating and posting, 8 years of building relationships, meeting different people from different races, 8 years of challenges and experiences. But if I may ask; looking back from then till now, are you happy that you made the right choice of investment?

Well, right is always subjective, it's a choice and no one is forcing us - so yes, we should be happy with what we are doing. If there is a better way then do that.

You are right, thank you!

It really took you time to do this s a whole lot of work and you have done well assisting those who cannot do it 🙏

Oh wow this one is very detailed guide, thanks for breaking it all down in simple steps for all of us. Filing taxes ain't easy. I'm definitely going to share this with some people

This is very detailed, I am sure it will be very useful for those that really need it. Well done sir👍

Bookmarked!

Much appreciated. Always wanted a detailed guide like this.

Excellent friend, that you can file your Income Tax return yourself and at the same time help more people to do so.

Excellent, this step-by-step guide is well explained so that ordinary people can pay their own income tax in India.

https://x.com/lee19389/status/1959018555258831016

#hive #posh

Filing a good income tax return is the duty of a responsible citizen. It is proof of being a responsible citizen.

This part is the best friend, since you're not asking for anything for yourself but rather to help others who need it more. It's a great act on your part to collaborate with those who have less, even because I experienced it a year ago with those who are sick and need to buy medication and complete their studies.

In our country too, these have to be submitted every year and it is very important. People who do not submit these and are not filers have to pay a lot of tax for doing any work, seven percent, and those who are filers have to pay three percent. Therefore, all of us must submit them every year.

Many people are afraid and confused about filing income tax returns, but after reading your step-by-step explanation, the matter became much clearer. This blog will be beneficial for many.

I don't really know about the view of others, but sometimes I always feel taxes are a way of taking from citizens

nice step by step. 🙂😉👊

I will be filing for myself after many, many years. what fun! :P

Really helpful post! I like how you explained the process in simple steps and also shared your own experience. Filing taxes can feel confusing sometimes, but this guide makes it much clearer. The point about even filing a zero return is something many people don’t think about, so that was a good reminder.