Close the door or Hodor?

I looked into my portfolio the other day and was surprised that a stock that I had left for dead in there was up. Quite a bit. 600% in the last 30 days. Which is great, as I wasn't down 80% anymore, but up 60% - more or less. My brokerage account calculates weirdly, so I'm not sure what my actual buy-in was. I think it was 3,30€, my notes say 2,25€, and the brokerage says 1,62€. Doesn't really matter.

Anyway, the stock is Opendoor. Apparently there's quite the hype going on, with Retail-Investors creating an anti-short bubble. Additionally, the fund manager that called the Carvana-Recovery said that OPEN is going to 80$/share (it was 50ct a month ago).

After setting my stop-loss to 2,25€, I went and had a look at their latest earnings statement. As I have very little money in this one and held it more as a reminder to investigate before buying, I didn't follow it anymore.

Revenue is still going down. Bummer, after doing that since 2021. BUT it's "only" -4% YoY and 4% up QoQ! Wow! Is there a turnaround? Not really, in the last 4 years, Q4 was always the weakest in the year, so a QoQ is not a good indicator.

Net loss is going down - that is indeed great and highly necessary, as they have quite a bit of debt and the dilution of 1,2% per quarter in average can only get you so far. They have around 560 Mio. $ in Cash, and with an operational cashflow of negative 279 Mio. and GAAP net income of negative 85 Mio., that is not enough - they're probably diluting the hell out of the shareholders as I write this, though it's after hours.

But what if they turn profitable?

Let's look closer at the guidance:

As you can see above, there's a difference between GAAP and Adj. Net Loss of 22 Mio. $ in Q1/2025. Which is quite a bit, around 25% polishing.

If the Revenue comes in like they think, it's still either flat or a little below the Q2/2024. Nothing to write home about.

Now, contribution profit - what an interesting thing. It's basically what's left when only considering the buying and selling of the house, with the maintenance cost in between. No company cost. Grok gave me this:

So, it's a great little metric to track that part of the business - but it excludes a big chunk of the cost, as we can see when comparing the Contribution Profit to the GAAP Net Loss.

I personally care more about cash flow - and I don't see them anywhere near profitability on that metric, yet.

I don't see the $80

I ran some calculations. Yes, I love my excel for that. I really don't see $80, nor anything near it, for the next years.

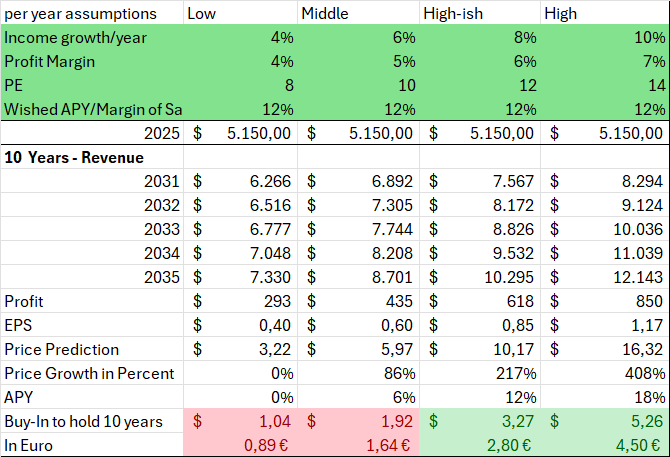

5 year Calculation with assumptions that I see as reasonable, if the company does not go bankrupt, which I still see as very possible, even after diluting a lot at the current share prices.

10 year calculation - I put in a little higher numbers here, though I don't expect them.

10% Revenue Growth is possible, especially if mortgage rates go lower again and some buying pressure comes into the real estate market. But a profit margin of 7% still seems high.

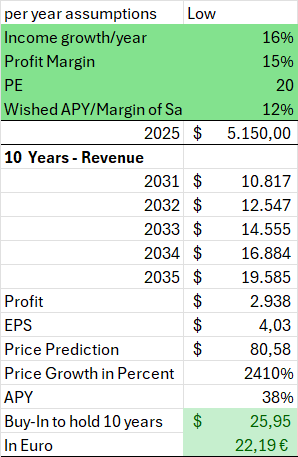

Just for fun, here's one of many possible calculations that lead to a share price of $80 - in the next 10 years.

Conclusion

I don't bet against the current sentiment - that stock might keep flying. I'll keep upping my Stop-Loss orders and see how much I can squeeze out of this one. But I don't see a rational projection to make holding this stock any longer worth the risk.

I still learned my lesson, even if I got incredibly lucky on this one.

As always - this is not financial advice of any kind. You can make your own decision as a free thinker! If you find flaws and mistakes, please let me know, I still have much to learn and would love to do so.

Posts with titles like this make me want to somehow get a publicly listed company called RUG. They will of course, be in the rug business.

Having worked in corpo-town for many years, so many of these numbers that make it up to the top are already so curated (internally) that what gets presented to market is probably 7-12% (pulling numbers out of my arse) error of margin - because each of the errors in reporting from team to team, department to department and different measures, that are constantly changing, are never truly normalised.

I like that you look at the fundamentals of the stock. So many people plot meme lines and astrology for stocks, when all that really matters is - does the business cut a profit? Do they do it in a sustainable matter? Is there a continued demand for their product service?

Not, OH, THE BOLLINGER BAND IS IN RETROGRADE WITH THE TEACUP.

I hate technical analysis

I love crunching numbers... I always get sucked in pretty quickly. And I do love my excel sheets, too, for everything 😅

Very interesting what you say about the numbers in corporations, I was not aware of that. Especially the GAAP-Numbers should be audited and monitored, at least that's what's promised in the stock market. But I'm not long enough in there to know, either - came in during the hype of 2021.

And by the way, the Bollinger Band is in prograde, which had the teacup switch chirality from trans to cis, which will eventually lead to a lowering of mortgage rates.

Anyway, I don't think that Opendoor is a good buy, nor could be called an investment. It's a gamble at the moment. Unprofitable, unsustainable, and cyclical.

Panic Buy!

Regarding numbers, and the auditing - sure, the auditing does get done for corpo accounts internally, and externally - but things like customer satisfaction, margins, sales projection, and those "ephemera" of business often get lost in translation as they make their way up the chain.

It isn't an actuarial accounting of those "business costs" that circulate throughout the year, eg: we paid 10 staff $50k per year, took this many calls, therefore our cost per call is $x (stick that in your Excel and bake it).

It isn't an accurate measure, because then you end up with, well, different calls took different lengths of time, different customers had different needs, some customers called back multiple times, and suddenly, your "cost per customer" is very different from cost per call, and you'd expect that expense to grow in a linear manner in relation to the the rest of the business.

Unless of course, you were really serious about business improvement (which was one of the main areas I worked in) - where you would take into account (or at least try) every possible variable, but... my management, at least was limited by what their management, and what the business wanted in terms of level of detail, so I always felt I could have offered more detail, more granularity, more efficiency, hence the 7-12% I pulled out of my posterior in the prior comment.

I'm so glad that I stuck to being a small business, though having many chances to expand. Reading that, it seems so unsatisfying to me to having to put numbers on everything, especially customers. I enjoy the direct connection that I have with most of mine, and even if I got a bit side-tracked last year, it was that connection that is bringing things back. It's not efficient at all to stop and talk to them on the streets, or to take calls that are merely about bread, but more about whatever else.

That connection builds community, and the community has had my back for more times than I can count, and big time.

Though, doing it for someone else, analyzing the data just for the sake of analyzing it... yeah, I could see myself doing that for a while, as a fun project. But not as a business path.

So many places my wife and friends have worked with aren't even aware of their inefficiencies. Inefficiencies, that if fixed, wouldn't make their product or service worse, but perhaps better!

Data is fun, but knowing how to take the data and convert it to actionable insights is where the true value lies. e.g, for a bakery (and I know nothing about baking) - bake the stuff that requires a low temperature early, while the oven is warming up, that way, I guess less energy is wasted.

In Australia, at least, where we have time of use tarrifs for power, bake the stuff that requires the most power in the middle of the day, when the sun is shining. And, as the oven cools and energy becomes more expensive, again, bake some more stuff that doesn't need as high a temp.

But having said that, on a small scale operation, it would be savings of probably cents per day, but over a year, that's extra money in the pocket, increased profit margin, less impact on the planet, and more less carbon dioxide for the evil trees to inhale...

I like rambling. See why people don't like me going into too much detail? :P

And, because those trees didn't get as much carbon dioxide, they won't grow into the transmission lines, bringing them down in the next strong storm, and then interrupting everyone's power.

I'm a stickler for those efficiencies! You'd enjoy the bakery in that regard... I was always very focused on getting the most out of resources and money, leading to a very profitable business - a lot more profitable than Opendoors :-D I should calculate a projection on the bakery and see where it will be in 10 years...

And yes, a lot of things are cents. For example, we need a certain gas pressure to operate the ovens. Meaning, when they're "empty", they're not really empty. So we use the little that is left in the kitchen, for the cooking and roasting - a 15kg gas tank is $2,75 here, so it's really not a lot of saving.

Also, I always reprimand everyone for leaving a light on or even some machine connected that has a light on it. It's more about attention to detail than saving money, it's an attitude that I need them to maintain. If they don't, the details un-attended become bigger and bigger over time.

But sir, the light isn't on, I put duct-tape (food grade) over it!

That's some very cheap gas, I think a 9KG bottle (the type most people use on a bbq) is like $25 here!

It is, it's highly subsidized by the government. Last time they wanted to touch the subsidies on gas and gasoline, there was a 3 week nationwide strike (because of other good reasons, too, but the gasoline was what moved the masses). The second time, there was a 3 day strike in the Sierra, the Andes region. Then they finally starting cutting it down step by step, at least the gasoline. 2019 was the first strike, and we've been in states of emergency ever since 🤣

Oh Come on!

Publish a quality chart!

Use tradingview!

PS. You stopped out yet?

Yes, got stopped out the next day at €2,50 🙃 Bookmarked trading view for future posts 😋

Stopping retail people out is the game professionals play.

Probably, I don't mind, though. Glad I got rid of this one without a loss. Wouldn't risk it to go into -80% territory again :-D