Stablecoins’ Rise: Reshaping Global Finance and the Role of HBD

Digital assets are here to stay. Many types of assets fall under this category. They include digital currency, digital art, social media accounts, data and databases, digital media, e-books and online publications, domain names, software—this includes mobile apps and games, digital photos, and intellectual property that exists in electronic forms. Source.

You can add “any form of content or media that exists in a digital format and has economic value.” That’s what a digital asset is. Stablecoins for sure fall under this category of asset, and according to the Ark Invest research team, stablecoins are one of the big ideas for 2025.

In this article, I just want to share three tables from Ark Invest that show that stablecoins indeed are a big idea this year and in years to come. The team allotted 13 pages in their research to present the current trends in stablecoins.

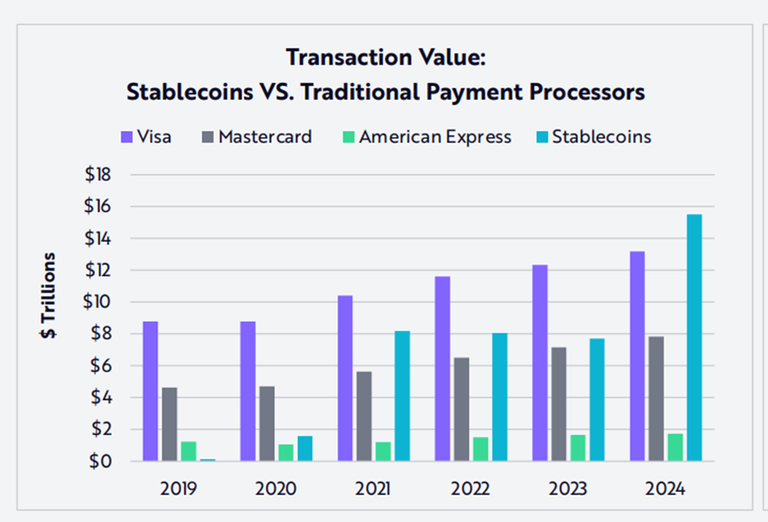

Table 1: Stablecoins Overtaking Giant Financial Institutions

Stablecoins have been described as one of the fastest-growing sectors in digital assets and had overtaken both Mastercard and Visa in transaction value in 2024. According to the report, stablecoin suffered a 70% drop in market capitalization during the previous bear market. Nevertheless, despite its decline, its growth remained unstoppable. Last year, “the annualized transaction value of stablecoins hit $15.6 trillion—roughly 119% and 200% that of Visa and Mastercard, respectively.”

As you can see in the above table, the transaction value of stablecoins in 2019 was insignificant, and Visa and Mastercard dominated the space. However, after five years, stablecoins overtook both financial giants, and its transaction value hit close to 16 trillion USD.

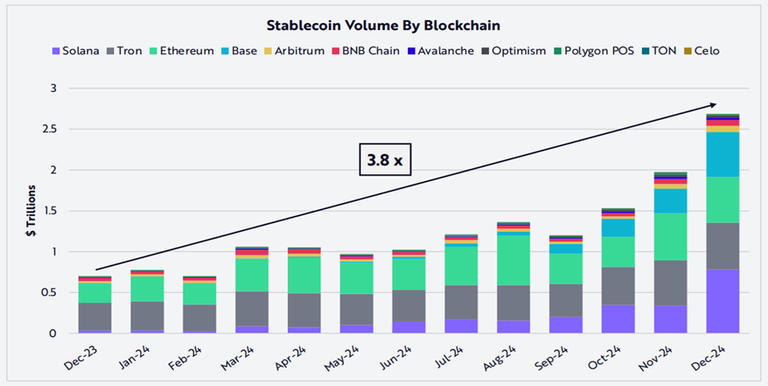

Table 2: Leading Blockchains that Contributed to Stablecoin Volume

In the next table, we see the leading blockchains that influence the steady growth of stablecoins.

It is interesting that in December 2023, when the monthly volume of stablecoins was less than 1 trillion USD, Tron was the first in the race, followed by Ethereum. Surprisingly, in just a matter of one year, Solana and Base surpassed both Tron and Ethereum in the stablecoin race. We were told that both the daily volume and the monthly volume of stablecoins in December 2024 reached 270 billion USD and 2.7 trillion USD, respectively. This tells us that the stablecoins sector is demonstrating remarkable growth.

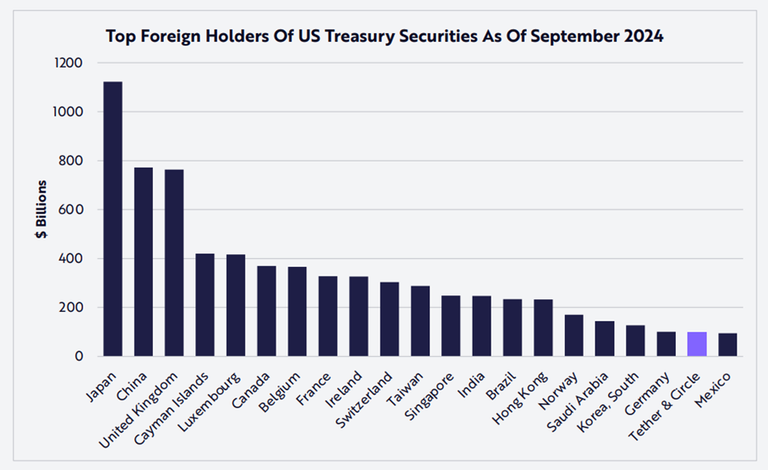

Table 3: Stablecoins and the Demand for USD

As I digest the Ark Invest research, there is one noteworthy insight that I think deserves emphasis. This insight has been repeatedly mentioned by @taskmaster4450 in his articles. However, this insight is contrary to the narrative of the economists from the Austrian school. I know this because I have been reading a lot of their stuff since 2009.

The insight has something to do with the strength of the US dollar. Ron Paul, the libertarian analyst, has been a vocal critic of the strength of the USD since the 1970s. He is not alone in this critical evaluation of the US dollar. It is the unanimous opinion of Austrian economists. According to them, the USD has been in critical condition for decades, and nothing can stop its demise. There are several reasons why such a collapse of the USD has been delayed, and two of those reasons have been under serious threats for decades now, which are the strength of the US economy and political stability. The military might of the US, though it remains intact, is also undergoing serious questioning from many critics. The advantages of the USD as the world reserve currency, many believe, are being challenged by the yuan (an idea to which I no longer subscribe). If there is one reason that remains strong is the fact that other nations’ economies and currencies are falling faster than the US economy and the USD. Source.

The above analysis could be valid during the pre-crypto era. Unfortunately, one reputable Austrian economist doesn’t believe that cryptocurrency is money, and that is why they don’t see the potential of stablecoins to reverse the de-dollarization of the world. And I think this is one of the findings of the Ark Invest research team.

The trend in stablecoins is moving against the combined efforts of China and Japan in selling US treasuries, the decision of Saudi Arabia to end the 45-year petrodollar agreement, and the attempts of BRICS nations to reduce “their reliance on US dollar payments by circumventing the SWIFT network.”

This trend is proven by the fact that in the last two years, stablecoins deposed both Bitcoin and Ethereum as bridges into the digital asset ecosystem. The USD-pegged stablecoins rule the on-chain transaction volumes, followed by gold-backed and Euro-backed stablecoins. The team suggests that the market for stablecoins will continue to expand in years to come, and that will include the Asian currency-backed stablecoins. I saw such a development last year here in the Philippines with the introduction of both PHPC (launched by Coins.ph, a leading cryptocurrency exchange in the Philippines on the Ronin network) and PHPX (a collaborative of Union Bank of the Philippines, Rizal Commercial Banking Corporation, Cantilan Bank, and Rural Bank of Guinobatan built on the Hedera network). Consequently, due to the growing influence of stablecoins, this will increase the demand for US Treasury securities.

Above is another fascinating table. As you can see, both Tether and Circle “ranked as the 20th largest holder of US Treasuries as of December 2024.” Though without basis, my wild guess is that in 5 years, Tether & Circle could overtake many of these nations and could rank from 20th to 4th place, overtaking the Cayman Islands. If they will overtake Japan like what stablecoins did to Mastercard and Visa, that would be unbelievable!

Furthermore, emerging markets are now moving into “stablecoins as a store of value, means of payment, and cross-border currency.” This trend could make stablecoins “one of the most effective ways to export US dollars.” In line with this trend, it was projected that by 2030, stablecoins could grow to 1.4 trillion USD, a 0.9% of global M2 supply from its current 203 billion USD or 0.17% of global M2 supply. With such growth, stablecoins have the potential to redefine cross-border transactions and the future of digital finance.

HBD’s Participation in the Rapid Growth of Stablecoins

Now, as a Hivian, my question is how can HBD participate in the ongoing growth of stablecoins? This question has been answered in so many articles published on Hive.

Merchant Adoption and Real-World Use Cases

We have seen how Hivians in Venezuela have been using HBD in businesses in Sucre.

@edmundochauran published this post last March 18, 2024, where he highlighted the ease and convenience of using HBD to buy food in Cumaná, Sucre, Venezuela. Just seven hours ago, @elamaria shared her positive experience of making a purchase using HBD and Distriator at Hatogrill, which I assume is also a business in the same place.

Moreover, the use of HBD is not confined just to Venezuela. This is also happening among Cubans. @manuphotos in his post shared an update on Hive P2P where he mentioned four services used to exchange for HBD. I am glad to see the Cuban pesos swapping for our stablecoin. This is in line with the Ark Invest findings about the growing interest of emerging markets in stablecoins. Similar moves like this will increase HBD’s exposure and utility.

Multi-Chain Expansion and Interoperability

As far as I know, when it comes to multi-chain expansion, the InLeo team is the model for this initiative. We witnessed how they onboarded Dash’s userbase on Hive and expect that the same thing will happen with Solana, Arbitrum, Chainlink, and others in days to come.

As for interoperability, this has become the buzzword on Hive in the past few days. @edicted shared five days ago about the potential of VSC interoperability on the Hive network. How I wish that @vsc_eco’s announcement on X that Hive will “become the ultimate hub for interoperability” (Source) will soon become a reality.

Additional Proposals and HBD's USP

Except for the above two, more ideas are suggested for HBD to gain traction in the crypto space. They include following major stable coins like USDT in forming liquidity pools, listing on centralized exchanges (CEXs), expanding utility in DeFi platforms and cross-border transactions, and exploring the potential of HBD to serve as collateral. These are some of the ideas proposed here on Hive by futurist thinkers like @taskmaster4450 and others.

Critics of HBD think that its biggest threat is internal. Until now, I was clueless about how such a threat would work out. Whether such an idea has a basis in reality or is just a product of a suspicious mind, as for me, after reading numerous articles here on Hive, one of the strongest features of HBD is its ability to resist regulatory scrutiny due to its algorithmic and decentralized characteristics. In contrast to major and centralized stablecoins, this is HBD’s unique selling proposition (USP).

In an era where trust in centralized authorities keeps eroding, HBD has the potential to carve out a niche in the stablecoin sector and can become a major player if the identified mechanisms above are implemented while maintaining its decentralized ethos.

Grace and peace!

Other Significant Articles About HBD:

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1imu7i4/stablecoins_rise_reshaping_global_finance_and_the/

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

I personally, I strongly feel we need more of HBD to be available for the Crypto space. We need more of stablecoins

Yes, we do.

Thanks for the shoutout!

Thank you too for your post.