Tesla China Sales Up In Spite Of Refresh

China is the largest car market in the world. This means that Tesla's numbers out of this region are crucial.

We see Tesla sales down across the world. Of course, the mainstream media, including financial channels, want us to believe it is all due to Elon Musk and his involvement in DOGE. Remember, these are the same people who said Tesla was done due to Elon's purchase along with involvement with Twitter.

Never do they mention that Tesla had the best selling vehicle in the world in 2024. The Model Y topped everyone else. This is a problem for early 2025 sales since the company shut down production in all its plants.

That means the best selling vehicle with from about 25K produced each week to zero. We saw a changeover that lasted a few weeks.

Tesla China Sales Up In Spite Of Refresh

The first month and a half of the quarter saw a major drop off in sales. Although Tesla doesn't release numbers, there are other sources that people track.

To start, some countries (not all) in Europe report on a monthly basis. This saw a poor January and February.

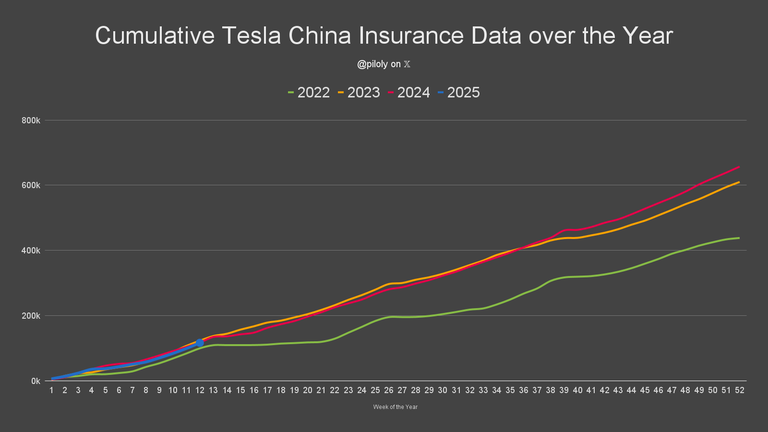

Second, we have China. Each week there are registrations based upon the insurance data. While not 100% accurate it is generally in the ballpark.

Since China is the largest market and the one that we have the most data, it is heavily followed. This does not mean the same results are seen across the world. However, it does tell us how Tesla is faring with one if its major production hubs.

For all the doom and gloom, this is what we have:

As we can see, there is a year-over-year increase. Naturally, it is below Q4 which is, in the automotive industry, the best quarter (this is worldwide). At the same time, the first quarter is often the worst.

The big news here is that, in spite of a major shut down due to the transition to a new (refreshed) model, sales are up as compared to last year.

We will see what the last week of the quarter brings.

Global Sales

It is unlikely that global sales for Tesla will fare as well. Some are surprised at how quickly production is rolling out. This is a major positive and will likely be reflected in Q2.

The major challenge was Tesla pushed its inventory levels for the Model Y way down before the shift in lines. It went from a 17-19 days of inventory to 12. Simply put, there were few cars to sell.

It was a calculated move. Do you suffer some hit to the sales numbers or focus upon cash flow? The company chose the latter. It can be catastrophic for a new model to roll out when a lot of inventory is on hand. That means serious discounting of the older cars, something that to offset them sitting. In other words, it is tough to turn them into cash.

Ultimately, the question is how quickly do the lines at the other factories ramp. China is a marvel when it comes to manufacturing. For Tesla, this is often the top plant.

For the quarter, China can come in at around the 130K mark with a decent final week.

This is important because we saw a total of 369,783 deliveries in Q1 last year. With 130K (or so) in China this year, it leaves us looking at just under 240K for the rest of the world.

The answer will come on April 2 when the company announces the deliveries for the quarter.

Posted Using INLEO

The media always finds a way to spin things. Tesla shutting down production for a refresh obviously affects sales, but they won’t mention that. The selective reporting is too obvious lol

https://www.reddit.com/r/Economics/comments/1jjz8xi/tesla_china_sales_up_in_spite_of_refresh/

https://www.reddit.com/r/Republican/comments/1jk6a7h/tesla_china_sales_up_in_spite_of_refresh/

The rewards earned on this comment will go directly to the people( @loading, @x-rain ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

I have always tell people that it is juts a matter of time, the Tesla market will recover and I guess it is happening right now