Gemini Introduces Tokenized Stock Trading

The tokenization of real world assets (RWA) is underway.

On this front, Europe is leading the charge. Due to the established regulatory environment, companies are turning to the EU for this service. Thus far, the United States has not issued any structure on these assets, leaving companies to seek elsewhere.

Gemini is one of the leading crypto names. They are entering this realm in an effort to become an ever larger player. Their competition is going to come from the likes of Blackrock who is establishing itself through the development of infrastructure to take advantage when the US government clarifies things.

Nevertheless, trading of stocks has now started.

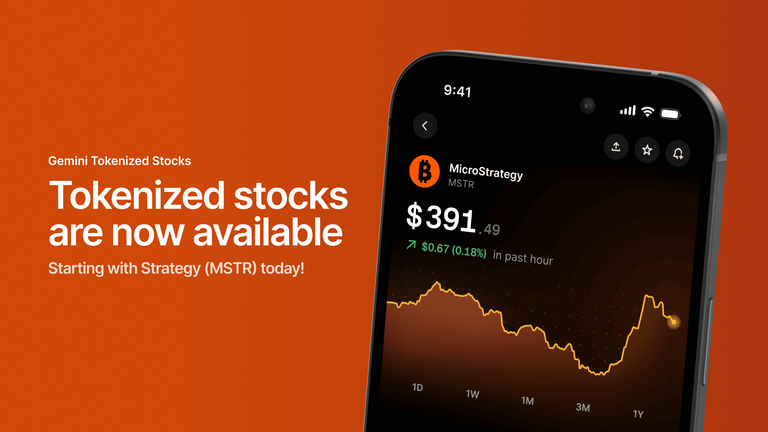

Gemini Introduces Tokenized Stock Trading

Blockchain trading of real world assets was a topic of conversation for a number of years. Advocates long saw the potential benefits that come from this transition. As the industry matured, i.e. infrastructure was put in place, the viability only increased.

Regulators are following suit. As mentioned, the EU is ahead of the curve on this one. That is why Gemini has its first listing in that area. This means those in countries such as the US are barred from trading in these products (at least on the retail end).

It should come as no surprise that the first stock traded is Michael Saylor's Microstrategy (MSTR).

Gemini customers in the European Union can now buy tokenized MicroStrategy (MSTR) on Gemini 1 and take it anywhere onchain. This means that anyone in the world with a smartphone and an internet connection can gain access to tokenized U.S. equities like MSTR on the blockchain. This is the future of finance and the future has arrived.

Trading began Friday, unleashing what is expected to be an onslaught of RWA that will find its way to blockchain. Gemini and other firms are already looking into the idea of bringing Bitcoin ETFs on chain.

Combining the best assets in the world with the 24/7/365 form factor of crypto is how we reimagine and rebuild the financial system. We are starting with MSTR and will be rolling out more tokenized stocks and ETFs in the coming days. Our goal is to export U.S. equities across the globe and connect the greatest companies on planet earth to the people of planet earth. This is great for America and great for the rest of the world. A true win-win.

This is likely to be the foundation of remaking the entire financial system.

Benefits of Tokenized Assets

There are a number of benefits to the tokenization of real world assets.

To start, we have 24 hour trading. The crypto markets never close. This is a change from the existing markets which have set trading hours. Even the futures market is closed for 2 days.

Another is the fact that fractionalized units are available. When it comes to buying something like Bitcoin, there is no need to talk about splits in an effort to reduce the per unit price, thus increasing affordability. Fraction units are available, meaning someone can buy a few dollars worth of Bitcoin even though the price is above $100K.

This is going to apply to stocks. People can now hold .01 MSTR in their wallets. As this spreads to other assets, we could see an increase in activity as smaller players (i.e. a larger section of the global population) gets involved.

We also see the potential for easier cross asset movement.

At the present moment, assets such as stocks and bonds are separate from crypto. Basically, if one is involved in crypto and prefers to move to those traditional assets, the process involves the selling of the crypto, moving the money to another platform, and them purchasing the asset.

With this, one can simply go from USDC to MSTR or whatever the pairings might be. Since the assets are all on the same platform, friction is removed.

Impact on US Dollar

One thing that gets overlooked is the expansion of the US dollar due to the tokenization of RWA.

For much of the global population, access to US dollar denominated assets is difficult. This means that when one's native currency is crashing, there is little that can be done.

Tokenizing assets such as stock, which opens them up to global trading, pushes the reach of the dollar into the hands of billions of people. Anyone with a smartphone and a wallet would be able to access these types of assets.

Of course, for the foreseeable future, this is going to be negated by the AML and KYC laws that governments are implementing. However, as these types of assets find their way to decentralized exchanges, people can buy whatever they desire as long as it is provided by the protocol.

This is going to help form a one-two punch along with the expansion of stablecoins. My forecast is that we will see stablecoins tied to most platforms, the majority which will be USD. Therefore, people engaging with social media platforms, as an example, will have the ability to use their stablecoins for a host of assets. Over time, the efficiency between the different platforms will improve.

It is a move that will provide even greater network effects for the US dollar. The amount of economic activity tried to this currency is going to skyrocket. Of course, as we stated, the USD is no longer just a currency.

MSTR is the first of what is going to be a flood of real world assets that are tokenized.

Posted Using INLEO

This was only a matter of time. is going to change the way we invest, especially for people who can't easily access traditional markets like me. I do wonder how hard the regulators will push back, but this shift is definitely underway

Amazing this can do wonders...

This is a good start and many stocks investors will start buying

This development will help make trading constantly with out closing the market. I love the new development

https://www.reddit.com/r/stocks/comments/1lnjvqu/gemini_introduces_tokenized_stock_trading/

This post has been shared on Reddit by @blkchn through the HivePosh initiative.