The Banks Are Thriving

Last Friday, earnings season officially kicked off… and in a BIG way! The banks reported their results — and this year, we’re talking about one of the most impressive starts we've seen in recent years!

And no, that's not an exaggeration. The numbers speak for themselves. Profits are strong, resilience is remarkable, and the trajectory of the banks shows that the financial system isn’t just surviving — it’s thriving.

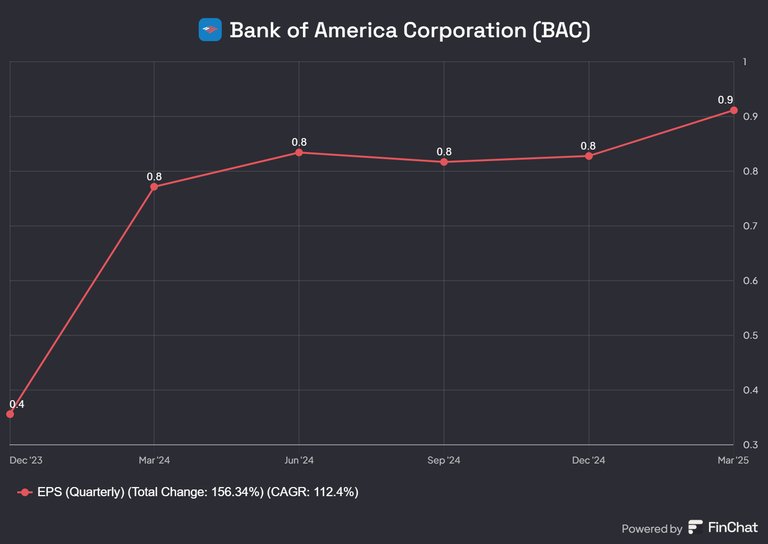

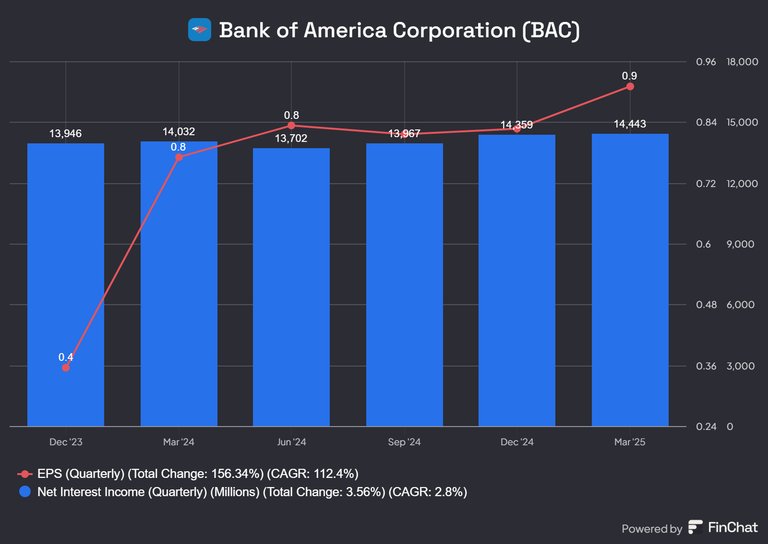

BANK OF AMERICA

So, we begin with Bank of America , which for Q1 announced earnings per share of $0.90, beating analysts’ expectations and marking an 18% increase compared to the same period last year.

Its revenues grew both from interest income and fees, while the Global Markets division posted its 12th consecutive quarter of year-over-year revenue growth.

On top of that, net interest income hit $14.6 billion, and non-interest income reached $12.9 billion — both above expectations. Meanwhile, loan loss provisions held steady at $1.48 billion, which reassured investors.

Overall, Bank of America shows that despite market pressures, it can deliver steady performance and adapt flexibly to any new reality.

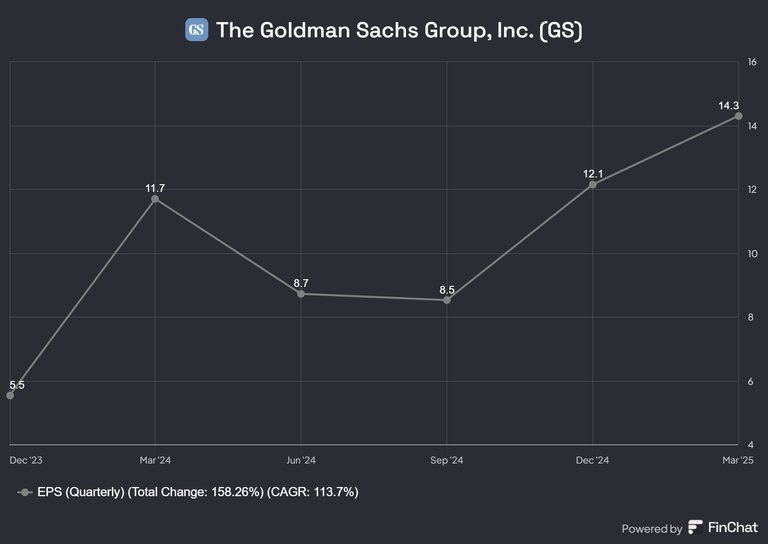

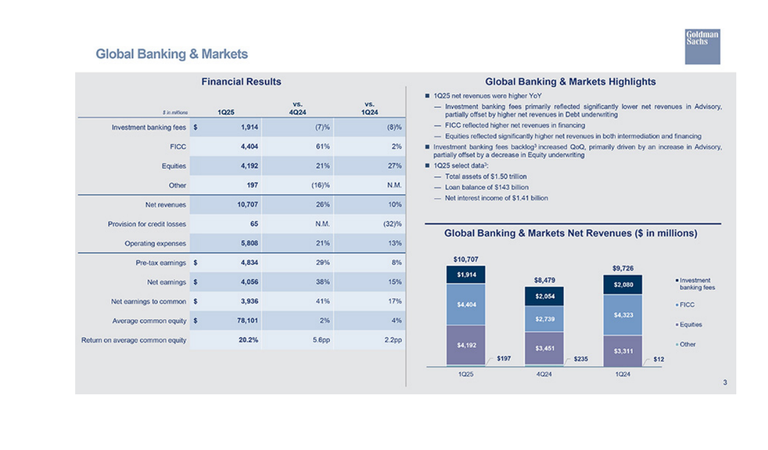

GOLDMAN SACHS

Next up is Goldman Sach , which reported an EPS of $14.3, far above Wall Street estimates. The main source of strength? FICC (fixed income, currencies & commodities) and equity trading, with revenues hitting $4.19 billion, up 27% year-over-year!

The bank’s total revenue for Q1 reached $46 billion, significantly exceeding market expectations.

A few key highlights from those numbers:

Markets revenue: $9.7B – a record-breaking performance, largely thanks to high activity in derivatives and commodities.

Investment banking fees: Up 12% year-over-year, boosted by demand for debt underwriting and M&A advisory services.

Assets under management: Up 15% YoY, reaching $4.1 trillion, driven by steady inflows and higher market valuations.

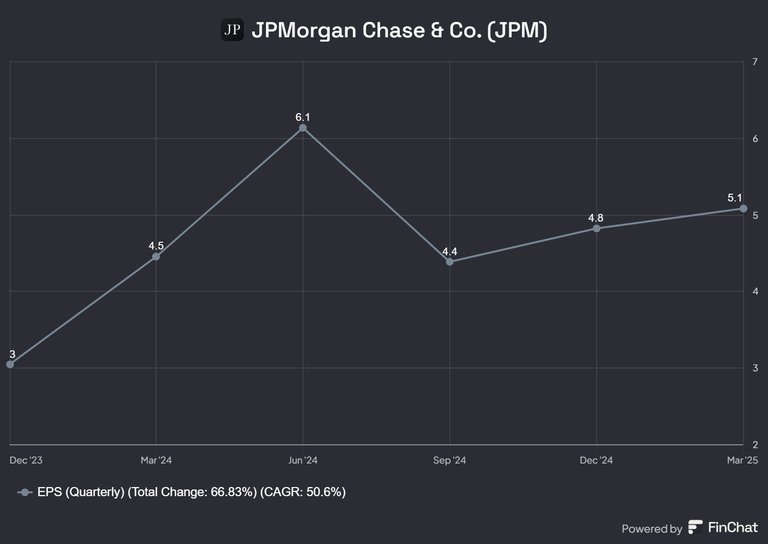

JPMORGAN CHASE

Jamie Dimon, CEO of JPMorgan , emphasized that the economy remains in a phase of heightened volatility due to geopolitical tensions, high interest rates, and uncertain fiscal policy. Nevertheless, he stressed that JPMorgan has built a “fortress” of capital strength and liquidity, ready to handle any scenario.

The bank’s diversification strategy — blending consumer banking, investment banking, wealth management, and trading — offers it unique stability, even during periods when others are under pressure.

JPMorgan is widely seen as the gold standard in the banking sector, and as the latest results show, that reputation is well-earned. In every crisis, it comes out stronger — and that’s exactly why it remains a core pillar of our investment strategy.

Posted Using INLEO

https://www.reddit.com/r/finance/comments/1k1hqte/the_banks_are_thriving/

The rewards earned on this comment will go directly to the people( @dkkfrodo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

High interest rates are good for banks: their margins will be higher. Low interest rates are also good for banks: they'll be able to borrow money for free.

Everything is better for banks 😂

I thought the crypto space was progressing in its replacement narrative. If TradFi remains this strong, what can Web3 people learn from this?

!PIZZA

!LOLZ

lolztoken.com

Not on my watch!

Credit: reddit

@steemychicken1, I sent you an $LOLZ on behalf of rzc24-nftbbg

(3/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

$PIZZA slices delivered:

@rzc24-nftbbg(3/10) tipped @steemychicken1

Moon is coming - April 19th, 2025