CPI And Oil On A 5 Month High

THE ECONOMY REMAINS STRONG, BUT INFLATION LOOMS

Data shows the economy is holding strong, with unemployment decreasing and job creation exceeding expectations. This is undoubtedly a positive sign, but it comes with challenges, including the risk of inflation rearing its head again.

THE LABOR MARKET

Let’s start with the basics. In December, 256,000 new jobs were created—blowing past the 157,000 forecast and significantly higher than November’s 212,000.

At the same time, the unemployment rate dropped to 4.1% from 4.2%, which was also a pleasant surprise, as most experts expected it to remain unchanged.

A significant rebound was seen in the retail sector, linked to the holiday season surge, but other sectors also reported increased hiring needs in recent months.

So, what does this mean? Well, it’s a clear sign of economic resilience despite pressures from inflation and rising interest rates. People have jobs, which means they have money to spend—boosting consumption and supporting growth.

INFLATION

However, there’s another side to this coin. Low unemployment is great socially—it means more people have money in their pockets—but it’s also an enemy of inflation.

As I said, when people have money to spend, it drives up demand, which in turn puts upward pressure on prices.

In other words, this could lead to inflation or make reducing it even harder. And let’s be honest—after everything we’ve been through to get inflation under control, no one wants to see it make a comeback.

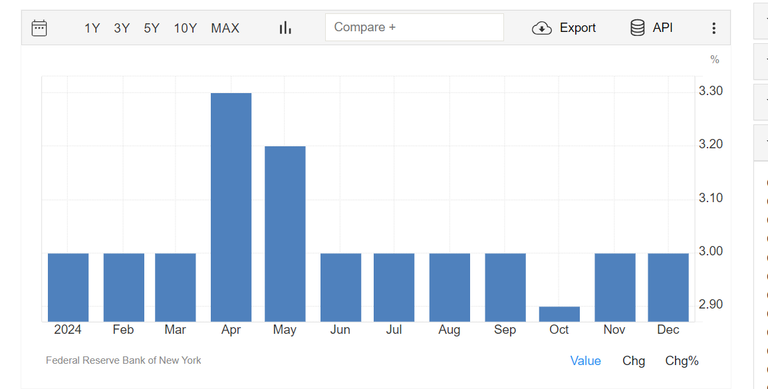

CPI expectations

THE FED

So, does this mean the FED will need to adjust its strategy? Sort of!

The data I just showed gives the FED room to “ease off the gas” on rate cuts. That’s because acting too quickly could reignite inflation.

As I have mentioned, the FED is keen to avoid an inflation rebound while also assessing the impact of fiscal policies introduced by the new administration. This means higher interest rates are likely to stay for longer than some might have hoped.

The economy’s strength is good news, but it comes with the constant balancing act of keeping inflation in check. The FED has a tightrope to walk, and their next moves will be critical for maintaining stability. Of course the policies that Donald Trump wants to enact are by nature inflationary and what I am expecting is an all out war between the Trump administration and the Fed.

OIL

Last Friday, the United States announced a new round of sanctions directly targeting Russia's energy sector. These sanctions impact Russian oil producers and over 500 tankers that transported a total of 530 million barrels of Russian oil in 2022. Of these exports, 61% went to China, with most of the remainder heading to India.

So, what’s the goal of these sanctions? The primary objective is to cut Russia’s revenue from oil. However, they come with a downside, as they raise concerns about global supply shortages.

How big are the shortages? According to Warren Patterson, Head of Commodities Strategy at ING, they could reach 700,000 barrels per day.

As expected, these concerns have driven oil prices to a five-month high.

Posted Using INLEO

Hey @steemychicken1, this is a really interesting take on the current economic situation. It's great to hear that unemployment is down and job growth is strong – that's definitely a positive sign! But I completely agree that inflation is a major concern.

It's a tricky balancing act for the Fed. On one hand, they want to keep the economy growing, but on the other, they need to keep inflation under control. I'm curious to see how they navigate this, especially with the new administration's potential policies that could add fuel to the inflation fire.

And then there's the oil situation. These new sanctions on Russia could definitely impact global supply, which is a worry. It's a complex issue with no easy answers. Thanks for sharing this insightful analysis!

I strongly believe that the new administration would do anything to reach the oil price to 100$ per barrel

Hopefully.

Well not in my country though as the rate of unemployment is still very high then if you manage to find a job it will be enslavement, giving all your time and energy for penny, its just crazy i haveing a talent and handwork does pay off in times this hard

The data is about the US economy because that is the economy that affects the crypto and the markets.

Ohh well my observation is ever since trump got in the US economy has been improving just like you said however i just hope with the inflation of crypto it wont affect the market value and prizes of things