UBS Expands Blockchain Integration with Digital Gold Investments

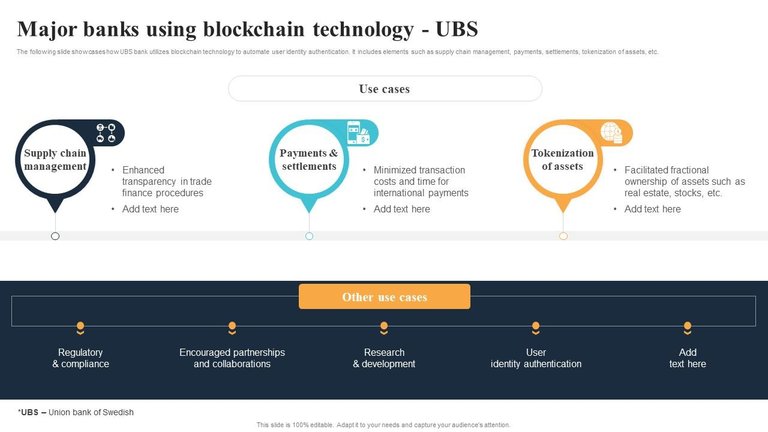

Switzerland’s largest bank, UBS, is making a significant leap in merging blockchain technology with traditional finance, specifically through digital gold investments aimed at retail investors. Managing over $5.7 trillion in assets, UBS has successfully completed a proof-of-concept for its fractional gold investment product, UBS Key4 Gold, utilizing the Ethereum Layer-2 network ZKsync Validium.

By leveraging ZKsync Validium, UBS enhances scalability, transaction privacy, and interoperability, reinforcing its commitment to blockchain-powered financial solutions.

UBS Adopts Zero-Knowledge Technology for Institutional Blockchain Innovation

The shift to ZKsync Validium represents a strategic move by UBS to modernize its digital gold investment infrastructure.

UBS Key4 Gold was initially built on UBS Gold Network, the bank’s proprietary permissioned blockchain that connects vaults, liquidity providers, and distributors. However, transitioning to ZKsync Validium offers multiple advantages:

- Enhanced Privacy: Zero-knowledge proofs (ZK-proofs) allow transactions to be validated without revealing sensitive data.

- Scalability Improvements: Higher throughput enables a faster and more cost-effective trading environment.

- Optimized Interoperability: The integration with Ethereum Layer-2 solutions makes UBS’s digital gold more accessible within the broader blockchain ecosystem.

UBS’s adoption of onchain finance aligns with broader industry trends toward tokenization and decentralized financial instruments.

ZKsync’s Role in Financial Transformation

ZKsync inventor Alex Gluchowski believes blockchain technology will be central to the future of finance. In a January 31 post on X (formerly Twitter), he stated:

“I firmly believe that the future of finance will take place onchain, and ZK technology will be the catalyst for growth.”

This perspective echoes UBS’s growing blockchain engagement. In November 2024, UBS launched a tokenized fund on Ethereum, marking an early step in integrating Ether (ETH) into traditional financial markets.

ZKsync’s roadmap for 2025 aims to process 10,000 transactions per second (TPS) while reducing fees to just $0.0001 per transaction. These advancements could make Ethereum-based Layer-2 solutions highly attractive to institutional investors, addressing key concerns such as high transaction costs and network congestion.

Privacy: A Key Concern for Institutional Blockchain Adoption

Despite the benefits of blockchain, privacy remains a major concern for institutions. Remi Gai, founder of Inco, highlighted this issue during the FHE Summit 2024, stating:

“Institutions struggle with blockchain’s transparency.”

He suggested that technologies like fully homomorphic encryption (FHE) could provide the confidentiality necessary for financial institutions, unlocking new liquidity in blockchain-based markets.

Confidential Computing: Unlocking Trillions in Tokenized Assets

Beyond ZK-proof-based privacy solutions, confidential computing is emerging as a powerful tool for institutional blockchain adoption.

By allowing financial institutions to process encrypted transactions without exposing sensitive data, confidential computing could unlock trillions of dollars in capital for the crypto sector.

A Global Financial Markets Association (GFMA) and Boston Consulting Group report estimates that the total market for tokenized illiquid assets will reach $16 trillion by 2030. Even conservative estimates from Citigroup suggest that $4 to $5 trillion in tokenized digital securities could be minted within the same timeframe.

Recognizing the potential of tokenization, major financial players are accelerating their blockchain initiatives. For example, Goldman Sachs plans to launch three new tokenization products in 2025, signaling growing institutional interest in digital asset markets.

UBS and the Future of Blockchain in Traditional Finance

UBS’s embrace of Ethereum-based solutions and privacy-enhancing blockchain technologies signals a broader paradigm shift in traditional finance. With institutional players increasingly leveraging Layer-2 scalability and tokenization, the future of finance appears to be moving onchain at an accelerating pace.

As UBS, Goldman Sachs, and other financial giants explore blockchain integration, digital assets could soon become a cornerstone of global financial infrastructure, bridging the gap between traditional banking and decentralized finance (DeFi).

Congratulations @mikezillo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: