SPS Market Analysis Aug 29 – Sep 4 2025 | Splinterlands #471

The regulatory environment continues evolving in crypto, and the SEC unveiled its Spring 2025 Unified Agenda, signalling a shift toward clearer policies rather than enforcement. Chair Paul Atkins emphasized establishing clear rules of the road for crypto. The SEC and CFTC released joint guidance clarifying that registered exchanges can facilitate spot crypto commodity products. As mentioned before, this bull run is all about clearer regulatory policies and institutional adoption. The institutions continue to dominate headlines with American Bitcoin, co-founded by Eric Trump and Donald Trump Jr., debuted on NASDAQ under ticker ABTC, closing 16.5% higher after spiking 110% intraday. Galaxy Digital pioneered tokenized public shares on Solana, marking the first SEC-registered equity tokenization on a major blockchain. US Bank resumed crypto custody services for institutional investment managers after a two year pause. Crypto-adjacent narrative, Polymarket, has seen a boost with Donald Trump Jr. joining as an adviser and Polymarket getting approval to re-launch in the US.

On the crypto markets front, Bitcoin struggled through the week, dropping to the $108k-$109k range before recovering above $112k, facing back-to-back weekly losses and down over 7% for the seven-day period. Ethereum fell to around $4.3k before recovering to $4.4k but maintained a 15% monthly gain, outperforming Bitcoin. With September upon us, and historically the worst month for most crypto, it will be an interesting period to see how much gas is left in the tank for the 2025 crypto bull run.

SPS Weekly Performance Overview

SPS delivered a textbook lesson the past week on why dead cat bounces are dangerous to trade. After breaking down from the $0.00089 highs, price spent the week bouncing between $0.000825 and $0.00087 in what can only be described as weak, unconvincing price action. Market cap decreased from $4.31M to $4.12M, reflecting the price weakness.

Market Analysis - Trends

The market structure remains bearish after breaking the $0.00085 key support level. The sequence of lower highs and lower lows is textbook downtrend behavior. The bounce to $0.00087 created a lower high, while the $0.000825 low established a clear lower low from previous cycle bottoms. Until this sequence breaks with a decisive move above $0.00088, the technical bias remains negative.

Survival Mode's announced pause adds another layer of uncertainty to an already weak technical picture. The timing could not be worse from a SPS price action perspective. Pausing Survival Mode while SPS trades in a downtrend does not help with the negative technical structure.

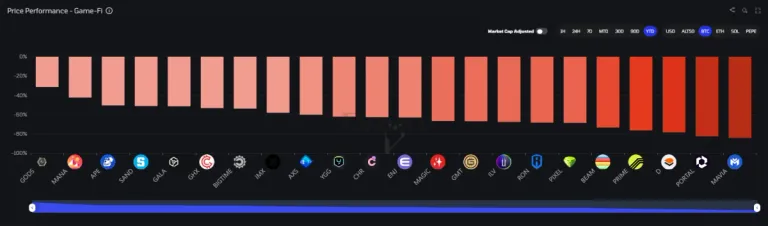

In the past 9 months of doing weekly TA blog posts on SPS, splinterlands news and developments is absolute key to driving the SPS price, as there has been a deviation from the correlation of Bitcoin and Ethereum price movements to SPS and GameFi in general. When you look at the price performance of GameFi, it paints a very dire picture. Other narratives in the crypto space have caught up and surpassed GameFi.

Market Analysis - Volumes & Liquidity

Daily volumes paint a picture of disinterest and low conviction throughout the week. Starting at $52k on August 29th, volume contracted sharply to just $31k by September 4th, which is nearly a 40% decline that coincided with the price weakness. The volume profile during the attempted bounce was particularly telling. When price tried to recover from the $0.000825 low, volume remained stagnant around $37k-$46k range. For a token already dealing with technical breakdown, poor liquidity creates additional downside vulnerability.

Market Analysis - Support & Resistance

The technical levels have shifted after last week's support break. The former $0.00085 support zone now acts as primary resistance, creating a ceiling that any recovery attempt must overcome. This represents the broken support-turned-resistance level that classic technical analysis dictates becomes the new ceiling. The key invalidation levels are clearly defined: bulls need a decisive daily close above $0.00087 to suggest the breakdown was false. Bears get confirmation on any break below $0.000825, which would likely target the next support zone around $0.00079-$0.00080.

Concluding Thoughts

This week, SPS demonstrated textbook weakness through failed bounces and shrinking volume. The path forward requires honest assessment: SPS is showing classic signs of a negative downward trend, which is frustrating as the previous we saw it bounced and smash through multi-month lows. It is difficult to ascertain whether the Survival Mode pause would have such a fundamental impact on the price, but as I have seen in writing these posts, SPS seems disconnected from the wider crypto world, as bullish Bitcoin and Ethereum price action have little to no effect on it. So, we can only assume that and not much movement on the new mini set has caused a breakdown in the SPS price over the past week.

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to play splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO

Thanks. Definitely worth sharing!

Delegate Tokens and HP to Fallen Angels to earn weekly rewards!

Delegate | Join to the guild

Thanks for sharing! - @mango-juice