$HIVE & $BTC Technical Analysis - 06.07.2025

Sunday is for technical analysis of $HIVE and $BTC, so let's see what we're dealing with this week.

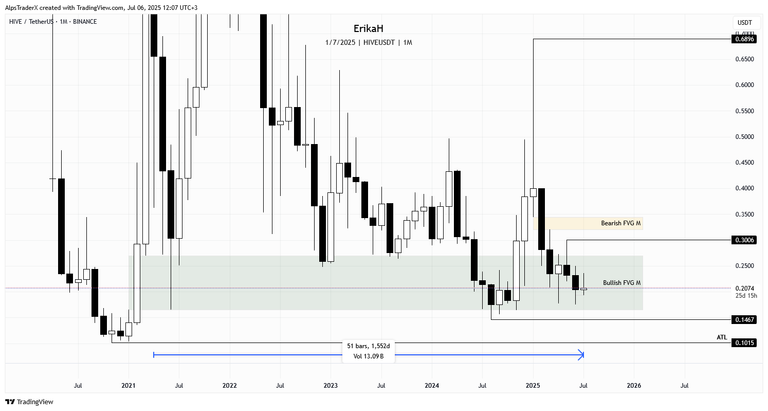

This is the first month of July, we don't even have a full week passed, so on the monthly time frame, there's not much to say. Price is still inside the bullish gap, the current candle almost has no body, which means indecision, but again, the candle is not closed yet. You can check my previous posts, to see what to expect on the monthly time frame.

The weekly chart looks a bit more clear, even though there are still 14 hours to go till the candle close. Last week we had a nice bullish candle, this week we have a doji candle so far, which means indecision. Obviously doji are not the best in case you want clear direction, but at least it's not a bearish candle.

In case of weakness, I'm looking the current swing low at $0.1757 to be swept. If we see more weakness, then I'm looking at the next possible levels: $0.01639, $0.1568, $0.1467 and ultimately at all time low (ATL) at $0.1015. Should we see momentum next week, the next liquidity level to the upside is $0.25, $0.2844 and $0.3006 a very important level.

The daily chart looks good in my eyes, not that it matters :P This week price almost rebalanced the bearish gap marked with yellow on my chart, but there was not enough buying pressure, to keep price at that level, or for price to invert the bearish gap and go higher.

At the time of writing, price is inside the bullish gap, which has almost been rebalanced and holding price so far. It's the weekend, not much is happening today. In case price can close above the gap and hold, which means $0.2114, $0.2355 is next, after which the levels I mentioned above. In case this gap marked with green fails to protect price, the next swing low is at $0.1930 and $0.1757.

On a more granular scale, on the h4 time frame chart, price is at a level of key importance. It is slightly above the bullish gap, the 0.75 level and the OB as well. The bullish gap has not been retested, so I prefer to see price dipping into the gap and bounce off, close above the gap, the 0.75 level and the OB as well, then continue to the upside. This may (or may not) happen tomorrow. Let's see. We have equal highs at $0.2115, which usually works as a magnet for price. Levels to watch on the upside above $0.2115 are $0.2179 and $0.2355.

In case of weakness, if the gap can't hold price, the current swing low would be my target, at $0.1930, then $0.1863 and ultimately $0.1757.

I'm not a support/resistance trader, but if I were to draw S/R, this is support for me. Has served as resistance since the 25th of June, price broke above it on the 25th of July and retesting it right now. This level has to hold, there's too much confluence here.

$BTC is also at a crucial level on the daily time frame. This week a bullish order block (OB) was confirmed and a swing high, but price failed to sweep the equal highs at $110,700.

At the time of writing, price is inside the bullish gap, that was fully rebalanced on Friday, below mid-range and below the order block as well. A nice bounce here would mean bullish continuation, a sweep of $110,485, $110,700, ATH at $111,968 and ultimately a new all time high.

Lose this level and we're going to be back to $105,058 or worse, to $98,125.

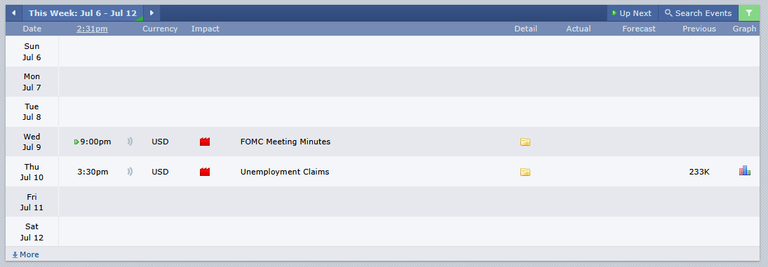

Next week's economic calendar is pretty empty. We have FOMC Meeting Minutes on Wednesday, and Unemployment Claims on Thursday. I'm really curious to see what's going to happen in the market, without any major economic news.

Remember, technical analysis is not about forecasting price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

Come trade with me on Bybit.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

Nice TA on HIVE/BTC! Bullish gap holding strong so far. Keep the updates coming! 🐎📈

I have to disappoint you. The TA is on HIVE/USDT and BTC/USDT. I don't see a point in doing HIVE/BTC.

There's an analysis like this every Sunday, so stay tuned.

Impressive and detailed analysis as always! Keeping an eye on those key levels—thanks for the clarity. 📊🔥

Please as always.

Thankyou for such Detailed Analysis...

You're welcome.

I could really use a 30 cent hive right about now... some apps are even running at a loss, unsustainably...

$0.3 is going to happen, but not overnight. Or a sudden expansion during Asia, a candle with a long upper shadow, if Koreans are buying again, but to keep price at that level, you need serious buying pressure.

it hasn't been a too bad week, more like a recoverying week for now, i cross my fingers to see hive at 0.25 again by august, then holidays shouldn't move much and maybe september enthusiasm will bloom on crypto

After I published my post, price went higher a little and closed as a bullish candle, so it's better than a doji.

I don't think summer holidays count in this game, but time will tell.