Final Wave Follow-Up — 11 Entries Taken in Silence Before the Breakout

In the The Final Wave? When Structure Speaks Again, I shared the rhythm and structure behind what might become the final leg of this crypto cycle. Not forecast. Not emotion. But the echo of history, fractals that have repeated across every wave since 2020.

“While many waited for confirmation — I entered the rhythm before it spoke.”

Between June 23–26, while most waited for headlines and pump signals, I entered 11 swing trades some from july, each based on silent structure. This post isn't for hype. It's for traders watching these coins now, and wondering: What happens when you act before the breakout?

My 11 Silent Entries — June Executions

| Coin | Entry | SL | Price | R |

|---|---|---|---|---|

| BTC | $99,000 | $98,000 | $118,800 | +19R |

| ETH | $2,445 | $2,370 | $3,640 | +15.8R |

| XRP | $1.9792 | $1.7800 | $3.84 | +9.3R |

| HIVE | $0.1937 | $0.183 | $0.246 | +4.8R |

| SUI | $2.60 | $2.38 | $4.00 | +6.3R |

| LINK | $12.00 | $10.90 | $18.50 | +5.9R |

| BNB | $635 | $618 | $760 | +7.3R |

| SOL | $135 | $125 | $181 | +4.6R |

| LTC | $84.00 | $80.70 | $106 | +6.6R |

| DOGE | $0.159 | $0.147 | $0.249 | +7.5R |

| ADA | $0.598 | $0.556 | $0.857 | +6.1R |

Each of these might being archived in depth in a Codex series — with screenshots from my trading journal. All entered before media moved.

What You Can Learn From This

- Structure speaks before sentiment — every entry was mapped from june low

- TP ladders matter — many hit 1&2, 4 more to go, fib extensions give clear exit structure

- Timing > hope — reaction is easy, rhythm mapping is edge

- Risk anchors count — each trade had invalidation locked

These weren’t impulsive plays. They were composed swings — mapped in advance and logged in my personal trade journal. Charts, thoughts, plans — all written before price confirmed. Same I did at the April bottom. Same I wrote about last year in Reversal on the Horizon - Are Altcoins setting up for a rally? The calendar changed. The pattern didn’t.

Higher Timeframe Targets

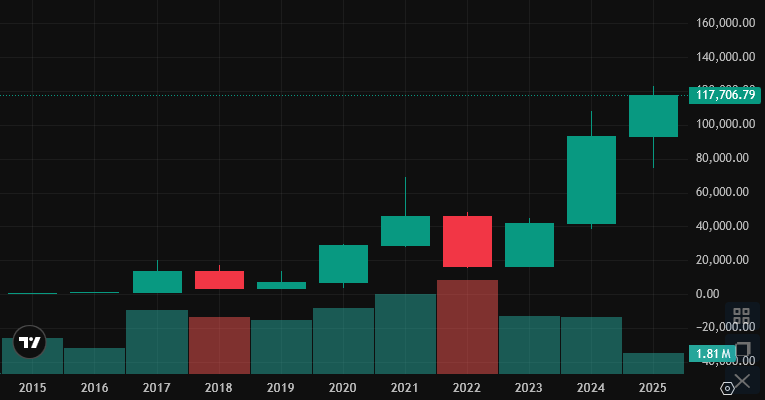

- BTC toward $130K–170K

- ETH projecting $6K–7.5K

- XRP, ADA, DOGE, LINK, SUI — all targeting legacy fib extensions.

Context-wise: I personally believe we’re currently in wave 3 of a new impulse that began from the 75K coil. If structure continues to echo, that would mean a corrective wave 4 could pull price back toward ~105K — before a final wave 5 reaches ~$170K to close the impulse. I see oct-dec we peak. If that happens, this impulse could mark the end of the cycle — not as certainty, but as rhythm. Structure doesn’t promise outcomes. It whispers possibility.

Verified Entries — Account Screenshot

Structure spoke before sentiment arrived. Entries placed June 23–26 and 2 july. Not posting everything, to much flex imo!

“June coil wasn’t luck. It was rhythm. Mapped before noise. Executed before hype. And now the echo plays out.”

Reflection: Is This Edge — Or Just Luck?

Every trade shared here was logged silently — before breakout. That includes setups shared in The Final Wave? When Structure Speaks Again — posted the day before BTC’s macro move and the rhythm that led to 1000%+ returns in real setups over the years.

I’m not saying I know everything. I’m saying I’ve seen something — a pattern memory, a rhythm echo, a structure that speaks before volume arrives.

I'm also considering writing a deeper Codex reflection post — one that explores how my edge formed: Not through theory, but through years of silent pattern recognition. Would you read something like that?

So instead of the TA I shared through the years — I’ll now publish Codex reflections. Not as a flex. But as a bigger gift: The system, the log, the memory, the rhythm. I get to reflect — and you get to see the patterns that led me there, so you can recognize your own before they form.

Is this luck? Or edge built over time? Drop a comment below and help me reflect. Because even I struggle to define it sometimes. But the log doesn’t lie — it either repeats, or it doesn’t.

Also: Where do you think BTC will peak this cycle? → $130K? $170K? Or higher?

Maybe it is. Maybe it isn’t. But I’m already inside the wave. Are you? 🚀

Please do follow if you want to keep up with my next post. Any upvotes or reblogs are hugely appreciated!

Latest post, check out :

The Final Wave? When Structure Speaks Again #BTC #HIVE

Christopher

Kristiansand, Norway

Source: Photos are chart-screenshots by me from Tradingview.com

follow for our street art contest and blogs about travel, art, photo, crypto & gaming

Thanks again for all the reflections on the “Final Wave” post — tagging you here since you shared thoughts or we’ve charted together over time: @zekepickleman @ph1102 @mypathtofire @nenio @tobetada

Just dropped a follow-up. This post leans more reflective — showing how structure spoke before price moved. I'm considering writing a deeper Codex series: more about how my edge is built, not just what entries made it. Do the reflections in this post resonate? → Does any of this land with you?

Let’s hope this wave takes us high 🚀

You got here some nice returns!

Hopefully we will see ATH in some of these coins.

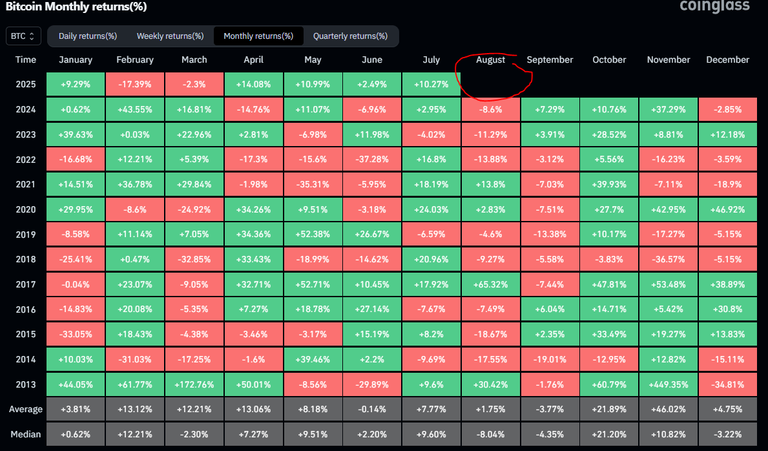

Thank you. I think XRP hasn’t hit a confirmed new ATH across all exchanges yet, but several coins are really close. August often brings corrections (see heatmap), so it might be wave 4 soon → setting us up for wave 5 into Oct–Dec. Structure still echoing... could be the final crescendo playing out 😮💨

Good job man. Do you think we will have just a whimper of an alt season or it could melt up a little like in previous cycles? I am thinking to just bag these low profits rather than hold out any longer with alts.

Thanks sir 🙏 Honestly... what else are we going to do for the next 6 months anyway? Structure’s already speaking — and it’s the same rhythm I saw last cycle. History repeats. It’s never different, no matter what emotions tell us.

XRP last cycle gave a strong rally → sideways 1 year → final wave. Same happened with SAND, MANA — and now, it echoes again. I was emotional at the bottom. I felt bearish. But charts don’t lie — emotions do.

If you look at my reply to nenio below, I believe we’re currently in wave 3. That means two more still to go — wave 4 correction, then wave 5 into crescendo Oct–Dec. Codex memory’s playing out in real time.

Too much work to make a post... sharing some thoughts here, feel free to come up with input is much appreciated @zekepickleman @ph1102 @mypathtofire @nenio @tobetada

2026: What is coming is distribution that is masked as bullish continuation (decending triangle) in retail fomo. Let's see if I'm right, I'm very sure about it just as I was at BTC at 16.9k long -> Start of Bullrun. I will look to short the lower highs in the end as an improvement of the last cycle I first shorted when descending triangles broke support, for a 50% fall that will come again. Imo its final wave, charts dont lie. Big rally up -> consolidation almost 1 year -> final wave. (just study previous cycle MANA SAND many more did the same move) What do you think, do this land with you? And I love hearing your thoughts about ETH, I see a fractal -> ETH is doing the BTC 2020 cycle?

It is so tough to tell at this point! I tend to miss the gains above ATH as I am more of a swing trader than a leverage player. I like to buy when everyone else is selling and vice versa. Much slower and boring compared to the leverage game!

I take such a basic view and like to watch the STOCH and MACD for oversold and overbought for the swings. If I were to wager a guess, (from the basic premise that crypto goes / then \ then / again) being over bought on the weekly chart more or less since May, I would say your shorts are the good play. This is in the medium term though and you are probably looking more short term in leverage plays. So it doesn't account for that.

Much more risk averse and pedestrian in my approach but I am taking a little profit now and carefully watching Eth as sentiment seems to be rising. No buying in for me til Oct or so if we get a macd cross down and a good bounce on the stoch at the bottom.

Who knows? Exciting times!

Nice. The end will be tough. I prefer swings aswell, not daytrading i like to ride the waves. Thanks for your comment. 😃