US-Finanzministerium crasht Kryptomarkt.../ US Treasury Department crashes crypto market...

Im Interview bei Fox Business sagte US-Finanzminister Scott Bessent, dass die Regierung keine Bitcoin-Käufe für die nationale Reserve plant.

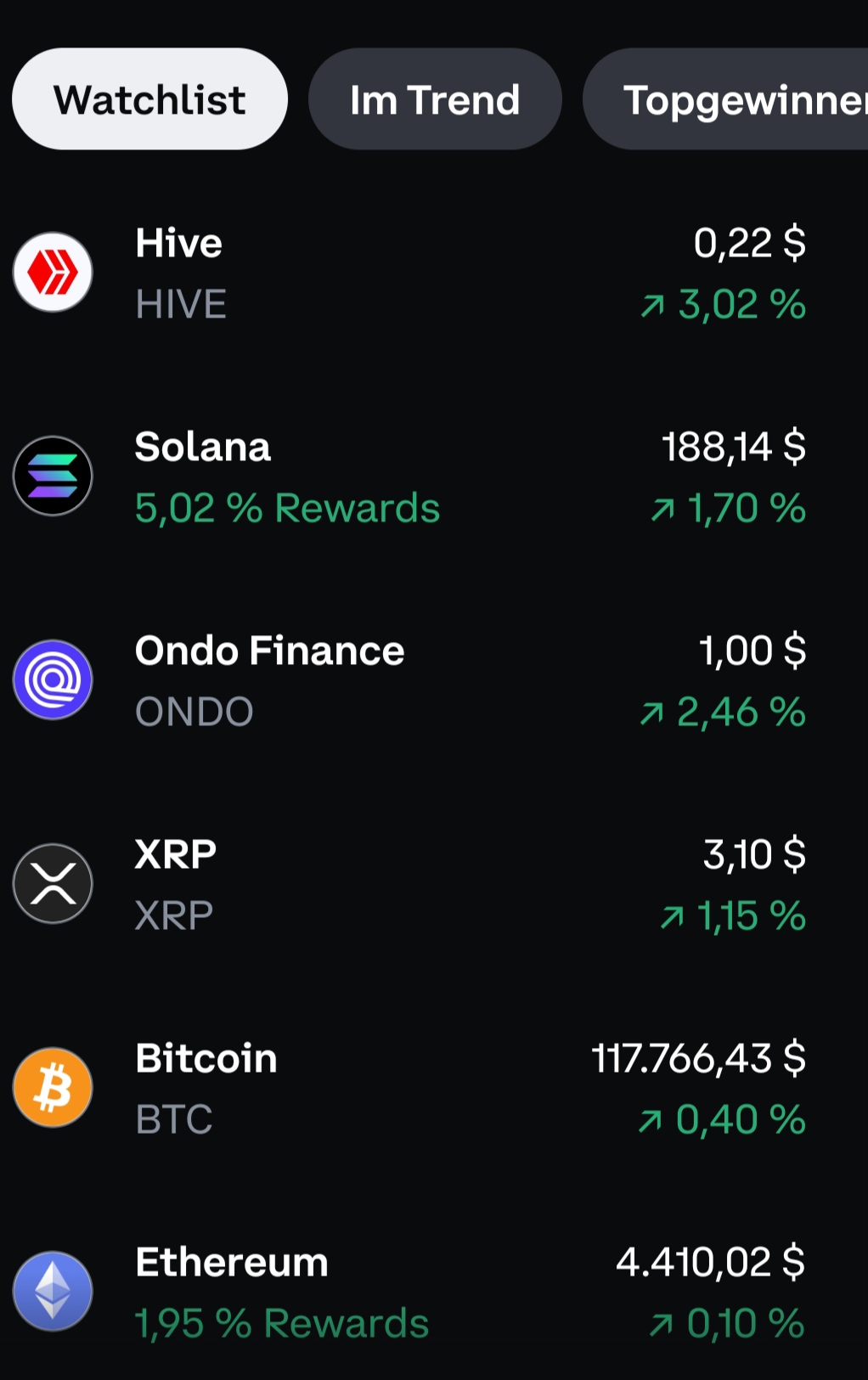

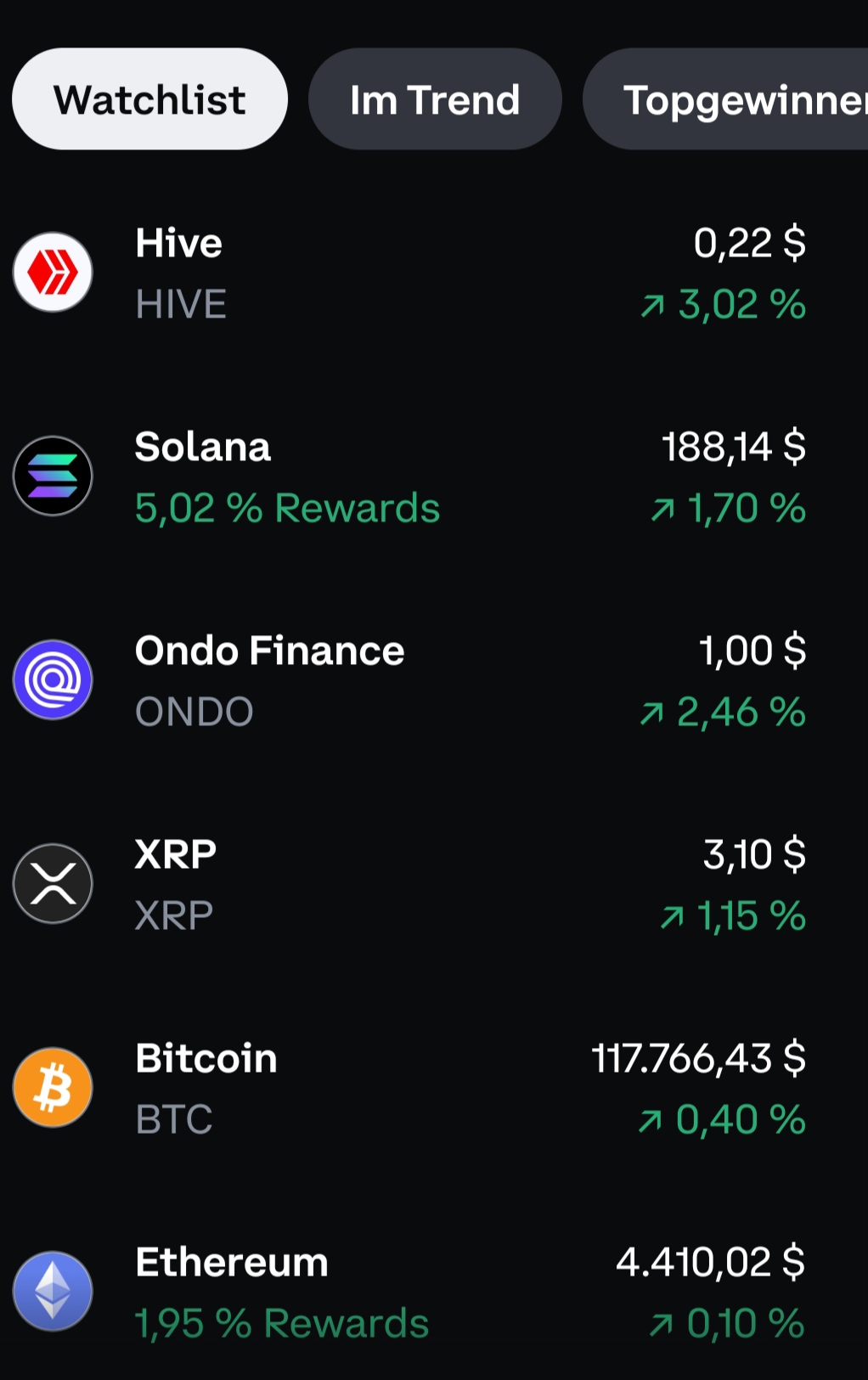

Bitcoin fiel daraufhin unter die psychologische Unterstützung von 120.000 US-Dollar. Am Morgen erreichte die Krypto-Leitwährung noch ein neues Allzeithoch.

“Wir haben begonnen, ins 21. Jahrhundert zu kommen und eine Bitcoin-Reserve aufgebaut. Wir werden sie nicht kaufen, aber wir werden beschlagnahmte Vermögenswerte verwenden und sie weiter aufbauen”, erklärte Bessent.

Er bestätigte auch, dass die USA nicht vorhaben, ihre Bitcoin-Bestände zu verkaufen. Ihm zufolge sei die Reserve zu den aktuellen Preisen rund 15-20 Milliarden US-Dollar wert.

Auf die Frage, ob die USA ihre 261,5 Millionen Unzen Gold neu bewerten würden, deren offizieller Wert bei einem 1973 festgesetzten Preis von 42,22 US-Dollar pro Unze rund 11 Milliarden US-Dollar beträgt, die aber zu Marktpreisen heute rund 750 Milliarden US-Dollar wert sind, äußerte Bessent Zweifel. Sie würden jedoch ebenfalls als Wertaufbewahrungsmittel behalten werden.

Obwohl Trumps Dekret zur strategischen Bitcoin-Reserve auch Käufe erlaubt, wird es die wohl vorerst nicht geben.

Auf der Bitcoin-Konferenz in Las Vegas machte David Sacks, der KI- und Krypto-Zar der USA, überdies deutlich, dass es Bessent und Lutnick von der Idee der Bitcoin-Akkumulation zu überzeugen gilt:

Wenn wir also Howard Lutnick, den Handelsminister, oder Scott Bessent, den Finanzminister, davon überzeugen können, Bitcoin zu kaufen, und sie eine Lösung finden, wie wir das finanzieren können – ohne eine neue Steuer oder eine Erhöhung der Schulden, vielleicht indem wir das Geld aus einem anderen Programm nehmen, das es nicht nutzt – dann könnten wir möglicherweise mehr Bitcoin erwerben.

David Sacks

Dies ist erstaunlich, da sowohl Bessent als auch Lutnick eine Menge Finanzmarktexpertise mitbringen und sich als Bitcoin-Befürworter positioniert haben. Der Finanzminister hielt laut seiner letzten finanziellen Auskunft privat sogar zwischen 250.001 und 500.000 US-Dollar im Bitcoin-Spot-ETF von BlackRock.

Hines ließ außerdem bereits im Juni dieses Jahres verlautbaren, dass es bald neue Informationen zu den Akkumulationsplänen der USA geben wird und dass diese die Bitcoin-Community erfreuen werden.

Wir wollen so viele Bitcoin wie möglich haben. […] Es gibt unzählige Wege, wie wir das tun können. […] Wir wollen etwas tun, was am effektivsten für die Vereinigten Staaten sein wird. Also wenn wir bereit sind, dies zu verkünden – und ich bin sicher, dass wir das in Kürze tun werden – denke ich, dass die Community sehr erfreut sein wird.

Wenige Stunden nachdem Scott Bessent in einem Interview mit FOX Business überraschenderweise betont hatte, dass die USA keine Bitcoin kaufen werden, meldete sich der US-Finanzminister wieder zum Thema der Bitcoin-Reserve zu Wort.

In einem Post auf der Plattform 𝕏 schrieb Bessent, dass das Finanzministerium entschlossen sei, budgetneutrale Wege zu erkunden, um weitere Bitcoin zu akkumulieren – mit dem Ziel, die USA zur „Bitcoin-Supermacht der Welt“ zu machen.

Grundsätzlich gilt: Die budgetneutrale Akquirierung von Bitcoin kann auch ohne Käufe vonstattengehen – beispielsweise durch staatliche Mining-Aktivitäten.

Ich zitierte aus folgenden Artikeln...

https://www.blocktrainer.de/blog/us-finanzminister-bestaetigt-die-usa-werden-keine-bitcoin-kaufen

Mein persönliches Fazit:

Persönlich bin ich beruhigt, dass die USA nicht aktiv Bitcoin kaufen werden. Das die USA ins Bitcoin Mining-Ökosystem einsteigen halte ich for ehere unwahrscheinlich da auch hier Steuergelder aufgewendet werden müssen um Mining-Anlagen aufzubauen.

Bedenklich halte ich eher, dass jetzt Donald Trump und der Finanzminister Scott Bessent mit ihren Aussagen die Märkte massiv beeinflussen!

English

In an interview with Fox Business, US Treasury Secretary Scott Bessent said that the government does not plan to purchase Bitcoin for the national reserve.

Bitcoin subsequently fell below the psychological support of $120,000. The reserve cryptocurrency reached a new all-time high that morning.

"We have begun to enter the 21st century and have built a Bitcoin reserve. We will not buy it, but we will use confiscated assets and continue to build it," Bessent explained.

He also confirmed that the US does not plan to sell its Bitcoin holdings. According to him, the reserve is worth around $15-20 billion at current prices.

When asked whether the US would revalue its 261.5 million ounces of gold, which officially amounts to around $11 billion at a price set in 1973 of $42.22 per ounce, but is worth around $750 billion today at market prices, Bessent expressed doubts. However, they would also be retained as a store of value.

Although Trump's Strategic Bitcoin Reserve decree also allows for purchases, they are unlikely to be made for the time being.

At the Bitcoin conference in Las Vegas, David Sacks, the US AI and crypto czar, also made it clear that Bessent and Lutnick need to be convinced of the idea of Bitcoin accumulation:

So if we can convince Howard Lutnick, the Secretary of Commerce, or Scott Bessent, the Secretary of the Treasury, to buy Bitcoin, and they can figure out how to finance it—without a new tax or an increase in debt, perhaps by taking the money from another program that isn't using it—then we could potentially acquire more Bitcoin.

David Sacks

This is surprising, given that both Bessent and Lutnick have a wealth of financial market expertise and have positioned themselves as Bitcoin advocates. According to his latest financial disclosure, the Treasury Secretary even privately held between $250,001 and $500,000 in BlackRock's Bitcoin spot ETF.

Hines also announced in June of this year that new information on the US accumulation plans would be available soon, and that this would delight the Bitcoin community.

"We want to have as many Bitcoins as possible. […] There are countless ways we can do that. […] We want to do something that will be most effective for the United States. So when we're ready to announce that—and I'm sure we will be shortly—I think the community will be very pleased."

A few hours after Scott Bessent surprisingly emphasized in an interview with FOX Business that the US will not buy Bitcoin, the US Treasury Secretary spoke out again on the topic of Bitcoin reserves.

In a post on the platform 𝕏, Bessent wrote that the Treasury Department is determined to explore budget-neutral ways to accumulate more Bitcoin – with the goal of making the US the "world's Bitcoin superpower."

In principle, budget-neutral Bitcoin acquisition can also take place without purchases – for example, through government mining activities.

I quoted from the following articles...

https://www.blocktrainer.de/blog/us-finanzminister-bestaetigt-die-usa-werden-keine-bitcoin-kaufen

My personal conclusion:

Personally, I'm reassured that the US won't actively buy Bitcoin. I consider it rather unlikely that the US will enter the Bitcoin mining ecosystem, as taxpayer money has to be spent to build mining facilities.

I'm more concerned that Donald Trump and Treasury Secretary Scott Bessent are now massively influencing the markets with their statements!

Posted Using INLEO

War jedenfalls ein ordentlicher Dämpfer. Und dann noch die stark gestiegenen Erzeugerpreise. 📉

Es ergeben sich wieder Chancen

Immer.

Wenn das nicht wieder ein Schachzug von Trump war damit seine Leute günstiger BTC kaufen können.

Insiderhandel ist für ihn doch Tagesordnung.

Mit einem Satz kann man Millionen machen. !LOL

Ganz ehrlich...

Der selbe Gedanke ist mir auch sofort gekommen.

Aber wir sind ja nur Hobby Verschwörungstheoretiker... 😉

Bin mir zu 99,999999999% sicher das es keine Theorie ist !LOL

Ich erinnere nur an das Video "der hier hat xxx Millionen gemacht"

lolztoken.com

They just don't want to.

Credit: reddit

@der-prophet, I sent you an $LOLZ on behalf of mein-senf-dazu

(2/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

lolztoken.com

Nobody nose.

Credit: mimismartypants

@der-prophet, I sent you an $LOLZ on behalf of mein-senf-dazu

(1/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

https://www.reddit.com/r/Kryptostrassenwetten/comments/1ms5saw/usfinanzministerium_crasht_kryptomarkt/

This post has been shared on Reddit by @wissenskrieger through the HivePosh initiative.

I don't think that's a massive surprise, as actively buying BTC would probably not sit well with most of the population at this stage. Once the Fed starts cutting rates and BTC goes to 220k, that might change a little.

https://x.com/lee19389/status/1956829890155872642

#hive #posh

I would not describe that as a crash, in the long view ... Bitcoin is bouncing around under its ATH and consolidating as it tends to do, and everyone in the U.S. crypto markets who pays attention already knew that the U.S. was not going to buy any more Bitcoin; they were going to use what they have and can confiscate. That last part is the news to be paid attention to. It's also not new that presidents who come in on the ignorance of the people are generally demagogues ... this particular crew knows that supposedly freedom-minded crypto users elected them on a platform Clemens von Metternich would be proud of (I have read Project 2025; how to prop up a dying empire for another century by stripping rights from the people and forcing them through both church and state means is there), and so they are there to be manipulated, having already sold crypto's soul for the gains they hope to get.

That's exactly why financial education is so important😉

That and some history too ... get all the horror, without the panic!

That is true. President Trump's statements can affect the markets positively or negatively depending on his words, due to how powerful his position is.

Personally, I don't like the fact that governments can acquire cryptocurrencies, especially Bitcoin and some altcoins, but it's one of the disadvantages we have when we don't have the financial means. The main idea for me is to level the playing field a bit and increase our chances of achieving a better life.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Cryptocurrency mining is very expensive, especially in countries like the United States. However, what is important is the market manipulation they can do if they decide to buy or create their own altcoin.

!WINE

Interesting update! Even though the US isn’t buying Bitcoin for reserves right now, it’s good to see they’re still thinking about ways to build a strong position in it. The drop in price might worry some people, but the long-term idea of becoming a Bitcoin superpower sounds pretty big.

One very important thing, in my opinion, is to monitor the impact of such statements by political and financial leaders on the market more carefully. Every investor should understand that market volatility is not only caused by economic reasons, but can also be caused by political reasons.

Interesting update. Even though the US won’t buy Bitcoin directly for its reserves right now, it’s clear they see its importance in the future. The price drop below $120k shows how sensitive the market is to such news, but the idea of exploring budget-neutral ways to build Bitcoin holdings sounds like a smart long-term move. This could really shape the US role in crypto.