Concentrated Liquidity Pools: Sonic Vs. Sui (148%-480% APR)

Greetings, frens!

Recently, I have been playing around with concentrated liquidity pools on Sonic and Sui networks. In this post, I will do a little comparison between the Shadow Exchange(on Sonic) & Bluefin(on Sui), analysing APRs, reward tokens and strategies.

What Is a 'Concentrated Liquidity Pool'?

Unlike a normal LP, whose range can expand into infinity, a concentrated liquidity pool is something where you get to choose the active range the token pair must trade within. The narrower the chosen range, the higher the APR will be.

If (and when) you fall off the range, it's not the end of the world. Your 50/50 position is now just 100% on either side. You can always wait for the market to shift, fall back into the range, and start earning rewards again while the position is balancing toward 50/50 again.

Shadow Exchange

First, let's have a look at what the Shadow Exchange on Sonic has to offer.

In both examples, Shadow & Bluefin, I'm using the USDC/native token pair, which in this case is Sonic chains' $S token.

In the picture above, you can see the different range types, which give you different tolerance & APR estimates. The range here I'm most comfortable using is the Wide range that allows the $S price to move within a +/-15% range. The APR for this option is 480%, but as mentioned, it's an estimate as it fluctuates a lot while depending on how much trade is made between USDC & S.

For the last 16 days, I've been providing liquidity into this pool, sometimes adding liquidity, and sometimes falling out of the range. As you can see in the pic above, I'm currently out of range as the $S token has been pumping like other altcoins. Therefore, my S/USDC position has now been turned 100% into $USDC.

Like I mentioned before, this isn't the end of the world, as you can just leave your position to be and it'll start buying $S once within the range, and you'll start earning rewards again.

However, there are other solid plays as well...

Strategies

One thing I could do here is to remove my liquidity (all USDC) and wait and hope for the $S price to pull back and buy back once it's lower(orange circle), hold it and once it's back up (blue circle), open the positions again. In this case, my position would be more valuable than it would be if I'd just let it fall while in LP.

The problem with this strategy is that the more I need to wait, the more I'm losing rewards when staying out of the position. So once you've done this a bit, you get the picture of how rewarding this could be, and after some calculations, decide which strategy best suits you.

Rewards

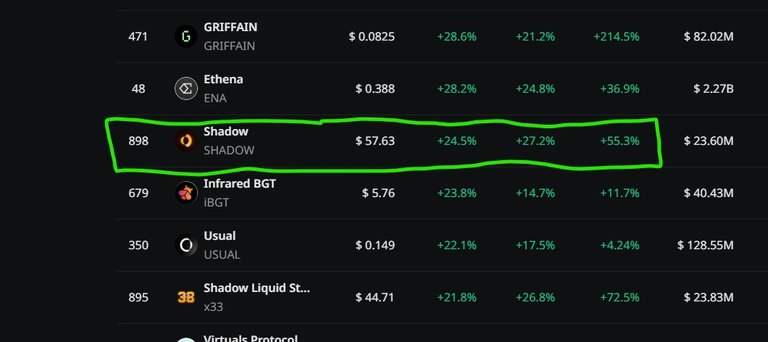

Shadow Exchange's S/USDC pools' rewards are paid in $SHADOW token, which has been doing very well during this current pump.

However, there's a catch...

The rewards we are earning are actually paid in xSHADOW, a staked version of the token. This means that if you want to exit xSHADOW and convert it to SHADOW and sell it, you need to start a vesting period that'll last for 6 months, which is an eternity in crypto space.

The platform, of course, offers an instant exit to SHADOW but with a 50% penalty. The question here is, do we have faith in SHADOW in the long run?

If not, we basically cut that 480% APR in half, making it a bit more realistic.

Bluefin

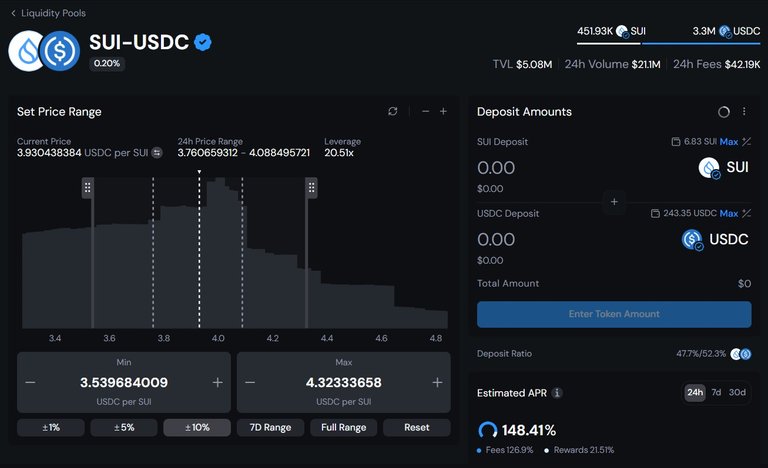

The SUI network has gained a lot of positive attention lately, and indeed, it's a good one with many defi opportunities. One of those being Bluefin and its concentrated liquidity pools.

Similarly to Shadow, here you can also choose different range types or set your own custom range. Bluefin's APRs aren't as big as the ones on Shadow, but still very good, and the best part is that we earn fees in $USDC & $SUI. Claimable and tradable right away.

Rewards

Besides SUI & USDC fee earnings, Bluefin pools are often incentivised with additional rewards. When providing liquidity into the SUI/USDC pool, we also earn $stSUI, a staked version of SUI, and $BLUE, the native token of the platform.

In my honest opinion, after playing around with both Shadow & Bluefin, the earned rewards are pretty much the same after a couple of weeks. Despite Shadow having a higher APR, after -50% penalty, the earned amount is close to Bluefin, which doesn't pay in vested tokens.

Strategies

Just like with the $S token, I'm currently out of range with $SUI as well and have exited my position, now waiting for a dip of some sort to re-enter.

However, another pool worth mentioning, especially in the current uptrend, is the SUI/wBTC one. It has a pretty similar APR compared to SUI/USDC, but obviously, the most interesting thing is that both assets are volatile ones, making it a great choice for uptrends.

For two days, I was earning nicely with this, but then BTC rallied, and eventually SUI followed and outperformed Bitcoin, and I found myself out of range.

So, at that point, I was all in BTC, whose price was close to 100k, so I exited my position and sold to USDC, again, waiting for a pullback. In hindsight, the obvious strategy here would have been to exit the position, swap half of the wBTC to SUI and re-enter the pool. This way the whole position would have appreciated in value while earning rewards.

Conclusion

All in all, it's hard to pick a winner here, even though I like the fact that Bluefin pays rewards in SUI & USDC instead of paying in native dex token. I've been doing this for so long that I don't trust Dex tokens in the long run, especially if we're caught in a bear market.

Still, as they say, never put your eggs in one basket.

Both SUI & Sonic are promising chains and I wouldn't be surprised if either one would surge big time at some point so I guess it's good have some exposure on both of them.

Besides Bluefin & Shadow, both chains offer a lot of other defi stuff, so this has been just the tip of the iceberg. Bluefin doesn't seem to have an ongoing airdrop program, but Sonic does have a massive one upcoming, and by using Shadow, you start earning points for that.

Use referral code 6WS5UP at Sonic Labs to get started!

Bonus tip: if you are in multiple pool positions, add a rectangle or lines of your range in TradingView like I've done so it's easier to monitor all of them in the same place.

That's all for today! Keep following 👇 for more defi, trading & airdrops content on these socials:

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 Holozing - is an upcoming play-2-earn game on Hive - get in before the launch!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

Posted Using INLEO

The auto-rebalancer SUI:USDC pool on Bluefin is good, it goes from about 80% APR in low volume to over 300% APR in high volume ( about 150% APR atm), the really useful part is that it auto rebalances when price moves close to the range edge, so you don't end up with a "deadpool" and mounting IL if you miss it at the range edge.

My first foray was into a manual pool and it dropped out of range, I'm still waiting weeks later for it to come back into avoid crystallising the IL, it's getting close with this recent SUI pump, but the auto-rebalancer has been working non-stop. I'll close my manual pool when I'm close to mid range and just put it all in the auto-balancer.

I have my SUI deposited on Suilend and have borrowed 25% of it in USDC to play the Bluefin pool, I'm nett positive on my borrow too, so thats an added bonus.

I take my BlueFin rewards ( Blue token) and swap them to Walrus to deposit on SuiLend for 53% yield atm. Nice way to build little bag of a new token too

Thanks for the comment! Seems like you're well into SUI defi 🙂. I totally forgotten about the whole lend/borrow looping, used to do that on Mode some time ago.

The auto-balancer seems interesting... just taking a look at it and can see the option but how do I know wheter I'm in auto or manual pool? Do I need to toggle to auto-balancer instead of default? A bit confused cos they look identical.

Damn, that WAL yield is good! Need to check that out. I was taking part in WAL airdrop but wasn't eligible.

To select the auto-balancer, go to the pools page and to the right of the SUI:USDC pool when you hover over it you will see a blue "+" icon , that is the manual pool. To the right of that is a blue "auto" button, if you hit that you are entering the auto-balancer pool.

There are a few auto-balancers, there is a selection ribbon just above the pool list where you can select to view just those. The SUI:USDC looks the best imo

Aah... got it, of course! Thank you very much!

Definitely gonna go auto next time 💪