AskLeo - Where Are We on The WallStreet Cheat Sheet?

We bore witness to a remarkable milestone in the realm of cryptocurrency today: Bitcoin surged to a new all-time high (ATH) at $69,255.77. The frenzy on Twitter speculated that the peak might have reached $80,000, but Coingecko confirms the ATH at $69,255.77, marking today, March 8, 2024, as a historic day for Bitcoin.

For the very first time in history, Bitcoin has shattered records before the anticipated halving event. This monumental achievement owes its success to the unprecedented demand for BTC, evident in the activity of spot ETFs. Reports suggest these entities are gobbling up an astonishing $500 million worth of BTC each day.

Yet, amidst the celebration of this significant feat, a recurrent pattern emerges: Coinbase's peculiar behavior whenever Bitcoin achieves a new ATH. It's almost as if they intentionally disrupt the surge to prevent an astronomical price spike amid the overwhelming demand. One can't help but wonder about their strategy once the halving occurs, ushering in a new era of supply dynamics.

But let's pivot for a moment...

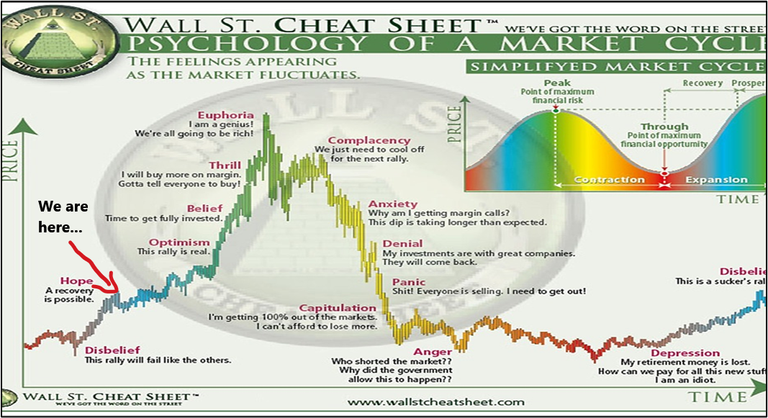

It's been quite some time since I delved into an #askleo topic, especially one as poignant as today's subject—the Wall Street Cheat Sheet, an emblematic representation of market cycles. The world of cryptocurrency mirrors these cycles, and today, we revisit this chart to decipher our current position within the narrative.

Recalling my previous analysis, I opined that we were entrenched in the disbelief phase of the cycle. Now, without a shadow of a doubt, I can assert that we've transcended that phase and are currently basking in a renewed sense of hope, after approximately three years of uncertainty.

The recent ATH for Bitcoin and the ongoing influx of investments through ETFs have infused the crypto community with optimism. This optimism manifests itself in the resurgence of meme coins and other altcoins, reflecting a buoyant sentiment among market participants.

We've successfully navigated through the wall of worry until this new ATH for Bitcoin, heralding our entry into the winner's curse phase. Here, optimism reigns supreme, and everyone fancies themselves a market expert—a familiar cycle we've witnessed time and time again.

Unfortunately, history also tells us that many will succumb to their greed and hypocrisy, riding the wave of success only to be engulfed by the inevitable crash. Nevertheless, the prevailing narrative surrounding Bitcoin paints a picture of it evolving into a financial standard, with the expectation of perpetual price appreciation, akin to gold post-ETF approval.

We find ourselves in the era of exponential growth, where Bitcoin's ascent is poised to outstrip gold's eight-year journey within a matter of months, perhaps even a year. Personally, I believe we currently inhabit the hope phase of the Wall Street cheat sheet, with the prospect of reaching its culmination by the end of this year or the next.

However, we mustn't forget that the ETF purchases fueling this frenzy are not infinite. As demand stabilizes, the bubble will inevitably deflate once again. The telltale sign of this impending crash will be the onset of euphoria, with even the most unexpected individuals boasting about their crypto portfolios.

When that time comes, it's imperative to exit all markets. But until then, let's savor the journey and remember to secure profits along the way. Predicting the peak is no easy feat... So, where do you believe we currently stand on this cheat sheet?

Thanks for your attention,

Adrian

The content of this blog post is incredibly insightful and engaging! It's truly exciting to witness Bitcoin reaching new all-time highs and the optimism and hope radiating through the crypto community. The analysis of market cycles and comparisons to the Wall Street Cheat Sheet provide a valuable perspective on where we might currently be in this narrative. The enthusiasm and caution intertwined in your writing reflect a balanced outlook on the crypto market's potential and risks. Your attention to detail and thoughtful analysis make for a captivating read that reminds us to appreciate the journey and stay mindful of market dynamics. Keep up the great work, Adrian! Your dedication to understanding and sharing the complexities of the cryptocurrency world is inspiring.

I don’t see many signs of engagement on this post but I appreciate your words of encouragement.

I'm glad you found the blog post inspiring and exciting! Remember, engagement can sometimes come in ways that aren't immediately visible, and your encouragement is making a difference. Keep sharing positivity and it will surely resonate with others. Your kind words matter!

Thanks, much appreciated

I'm so glad you found the post inspiring and exciting! Your enthusiasm is truly appreciated. Keep soaking up that positive energy and inspiration!

BTC to the Moon! 🚀

To the moon and back.

I notice these same "peculiar behaviors" whenever HIVE spikes too. I'll notice varied "subliminal" manipulation tactics on the front ends of hive platforms. For instance after HIVE's price spikes I always notice more node outages, more missing image issues, and little nuanced things like that. Only the superficial things that are usually having to do with what parts of the systems are centralized with people still control.

As for coinbase, they've always been rotten, shady, price manipulators, but they aren't the whole market so I wouldn't worry about their shallow reach on the bitcoin price. Crypto is still the Wild West, and anything can happen especially when large stakes are involved and such frictionless transactions.

I still think it's too early to be looking at Wall Street Cheat Sheets, maybe we'll revisit in December. For sure BTC is going to dump hard like it always after the peak of all this ETF irrational exuberance wears off, but as they say "This Time is different!" lol

The problem with Coinbase is that every sport ETF company is buying bitcoin from Coinbase.

I agree with you, this time won’t definitely be different. The cycle is probably shrinking and the top may occur sooner than many believe but we are not yet in a super cycle. Just my opinion.

See today, HIVE pumped today, for me images broken! Very strange.

I think we're in Belief, going into Thrill mode next!

You might be right some of the altcoins might be there already

was wondering about this one, i was not sure did it happen in some of the last few cycles

It’s the first time it happened

What if Bitcoin hit $100k before the end of this month 😜

Anything is possible.