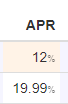

gtg witness update, upcoming changes in HBD APR

Of course @hbdstabilizer is set to 100% beneficiary for this post.

In April 2022 I published a witness update, announcing 20% APR for HBD

I’m always very careful and rather conservative when it comes to such decisions, but given current conditions this seems to be a good time to go this way.

HBD is heavily underappreciated, and I don’t mean its monetary value, which by definition should be kind of pegged to USD, but its utility.

1.5s on average to transfer funds fromalicetobob.

Neither of them pays any fees.

There’s an internal, fee-less, decentralized market HBD <-> HIVE

Two-way conversions between the two.

And of course: the time-locked saving balance.

I was about to do that many times already, but now I think it’s finally time to end this “promo”.

I will start lowering down the hbd_interest_rate to 10% gradually. My first thought was to set an end date for this process, but I can’t predict what will happen in the coming weeks or months, and if I would have to adjust my plan.

Of course, my action on its own doesn’t affect platform wide APR for HBD, because it’s a median value taken from top witnesses.

HBD is awesome and will stay awesome, (even at 0% APR!) because of the above perks.

In the long run (and it was a long run already) it shouldn’t overshadow what matters most: Hive Power.

And by the way, the next Hive Power Up Day is coming, are you ready? Have you ever participated in it?

See also:

Nice sunflower-ish logo reveal!

Thanks for the update, ocd-witness has been signaling 15% for quite a while now and is interested to lower it to 12% gradually as well to match with curation and HP APR. Depending on the times and other factors, maybe even a bit lower later.

I intentionally re-used one that had its premiere when I introduced 20% APR.

And yes, similar plan and rationale here.

This one from acidyo seems like a good proposition to me. I specify that I am not a witness but a simple user

I can't say I'm super knowledgeable about these things, so I don't know if 20% is better or worse, but I'm always in favor of Hive Power. I've been attending Power Up events regularly for a year now, I'm even organizing one for the Turkish people, so I'm ready for the next Power Up day, I'm even planning to break 10k HP.

That's great thing to hear, good luck with that! :-)

While this move isn't affecting HP holders directly, it's giving back the priority to those who work for making Hive better (by using their Hive Power for governance voting and reward allocation).

Actually that's what I wanted to say. There might be a change that will push people back to HP because if it's 12%, the APR of HP and HBD will be almost equalized. Thanks for your nice wish 🤝

Yup. 20% is too high, for many reasons. Good plan.

This makes sense and honestly I couldn't even understand why it's been at 20% for as long as it has been. It undervalues hive itself since you only make a 7%-11% APR while do working (aka curation) the negative of that however is the risk that hive changes in price and does so rather rapidly.

Now HBD does a pretty good job at holding it's value at $1 but there's legit no work to be done to get that 20% APR.

I'm honestly all for slow reduction down of APR on HBD to something more around the 5% - 7% level.

The reason for that is HBD requires pretty much zero work so 5%-7% a little lower APR with lower risk seems reasonable compared to a riskier HIVE APR that puts out around 7% - 11% (I get this percent from general powered up APR and maxing out your curation on average)

And let's not forget sacrificing the security of the chain itself, for profit. HP does a lot more than offer a return. 5-7% seems legit.

It's been at 20% to draw some attention... Can we tell that it was a success? Well, to some extent - maybe.

And yes, you are absolutely right when it comes to reasoning.

We will see how the markets react on that. Well, I'm not even sure if at that small scale we would be able to tell much looking at the data.

Will HBD saving holders move their assets to HP? Or stay even at 0-5% APR range? Or move away?

Time will tell.

well I am moving my HBD to HP

but also only cuz Ive planned that anyway, before I recognized the upcoming HBD change

already wanted more HP the last time it dumped ^^

(also my personal situation may force me to pay out again to survive and that is easier with Hive than HBD too, still at the moment, sadly)

I think HBD and the 20% is a great combination which only lacks one:

better BTC/HBD pairs/ exchange interface/ bridges/ liquidity

and maybe some marketing towards Bitcoiners wanting to swing trade BTC/USD but without direct USD (KYC, BANK)

building it right, many ecosystems can profit from each other

they by having some decentralized stable coin option for realizing trades

and we some additional liquidity for building the platform while they wait for their BTC to fall ^^

etc

I think many will leave - and that's bad!

20% for nothing?

you mean for the "nothing" of putting your MONEY into this platform into SAVINGS

factually bringing money flow into this ecosystem

it should also attract investors

who do not directly be involved with Hive Power/ curatin/ government/ the platform

just provide some liquidity and get some reward for it (you also do not let others use ur money/ liquidity for free, do you?)

Please explain how a bunch of HBD locked up in savings brings money into hive and provides value and earns 20% of which most likely is constantly cashed out. Thus a sink with a drain that doesn't bring value or produce revenue for the Hive token. If it where up to me there would be no DHF and no HBD it would just be hive.

so they just imagined the HBD into their savings?

have not bought them? with BTC->Hive->HBD ?

so where exactly is your questions how that brings money into hive (the ecosystem) and provides value [literally bringing in money/ value] (liquidity to build the platform further) ?

even if constantly cashed out, that sink and drain would only be a little part of the inflow

to profit

and also very dumb

because of compounding..

yeah, I am also sceptical about DHF and especially the ninja mined stake in it..

and who controls it..

still - I like HBD and still see its potential very unused

the 20% APR pretty much countered our modern fiat inflation and was a VERY unique and special thing

(show me something else that is as constantly stable as HBD in our current world)

the platform and community should use the HBD situation to onboard Bitcoin swing traders

and normal savings people..

great competition with a decentralized stable coin and the APR to exchanged and banks.. but needs better ramps, bridges, pairs.. attention..

Good point I wasn't thinking about the inflow from other assets into HBD. However that means all that value is being locked up into HBD where it doesn't really benefit the system. In fact I almost see it as a new risk if someone had a wealthy amount of HBD that could take that 20% APR and keep buying up hive at a very lower price and have a massive value of powered up hive to vote witnesses. Would it not present a passive risk factor over time?

Also I'm sure little to no fees that would contribute back into the value of Hive where captured in those transactions. Being that it's a feeless blockchain hive was converted to HBD with zero fee or profit to the value of hive. Perhaps a conversion fee is in order and being that we are paying out 20% APR then paying a 0.25% fee or lower shouldn't be an issue at all and would provide value to the hive token if done correctly.

It always comes down however to the root issue. You can talk about all of this stuff but when it comes down to it hive is looked at as an exit flow of money. You interact and do things on hive to get paid and cash out is the mindset of many and it makes sense the way it's structured and promoted as an article marketing site you get paid to post content on. But there's NOTHING to bring that value or sustain that exit flow of money which is why hive always falls back down in value. Fix that mindset or address that constant exit of value and you fix the issue of hive always being worth so little.

yeah, it is a big complex structure

we need to work more out and involve game-theory

self-reinforcing circles

(but not circle jerks^^)

I've also often addressed the value out -> Hive value down and people voting out-cashers issue..

while it's been quite hard for myself to reach/ earn my stake..

and also only having cashed out once (I already have been dolphin once) when I became homeless and still had big cramps additional to my permanent pain

about the attack vector/ risk you mentioned, I am unsure..

I think the ecosystem is big enough already to level out/ self-regulate

and we also want outsiders to gain influence

(or is Hive already rigged? and those in power just try to keep it?)

government can and will change

(not always the programmers are the best managers..)

You pay a 5% fee to convert HIVE to HBD. (If you are not buying it from the market.)

HBD doesn't contribute much to Hive's inflation it is only around 2-3% while other sources create an 8% inflation for Hive.

The biggest issue I am seeing is that a ton of hive is getting powered down and those powered down hive is leaving the platform. (They are not getting powered down to get into HBD. At least most of it isn't.)

Last 3 months seen at least -1m stake every month. (Source: Arcange's HIVE Financial Stats)

And one important metric would be who is selling HBD and HIVE. Is it people who are putting HBD into savings, or people who are getting paid in HBD through proposals and writing content.

It is important to determine where this money outflow in the platform is coming from.

It comes from accounts voting rewards to accounts that dump.

This is the only source of hive that isn't first bought.

With all due respect, APY is not about work or effort, it's about risk. Investing is always about risk vs. return.

HBD is not risk-free, by any means.

HIVE is not risk-free either, of course.

HIVE has huge upside potential. HBD only has its APY.

If HIVE crashes, so does HBD. If HIVE moons, HBD stays around $1.

Imho, a 20% HBD APY seems about right, given its dependence on HIVE, but a longer lock-up period at that rate seems reasonable.

I’m talking about a CD-like time vault, though. Not power-down vaults.

With that said, variable HBD APY for variable lock-up periods is the way to go, imho. 20% at 365 days, maybe 5% at 3 days, with a few set points in between.

These should all remain witness parameters, though.

Maybe 6 parameters: 12 mo, 9 mo, 6 mo, 3 mo, 1 mo, 3 d.

Or maybe 2 parameters, 12 mo and 3 d, with hard coded interpolation for the in between durations.

If I have 200 HBD and I put 100 each into both time vaults (20% and 5%}, after 365 days, I have 122.14 in one and 105.13 in the other (assuming daily compounding).

The difference being I have to wait at most 3 days to get my 100 HBD back (plus interest) from the short term vault. In the long term vault, I have to wait up to 365 days (which decreases as my anniversary date approaches).

Either way, we should allow removal of principle with the only penalty being accrued interest since last rollover, imho.

This is all very similar to what @taskmaster4450 has been saying for months, I do believe.

Would you say HBD has less risk than HIVE and thus should have a lower APR?

The 'risk' of HBD and HIVE are inextricably intertwined and, from that perspective, quite similar. Meaning, if HIVE crashes to zero, so does HBD, and vice versa. The haircut rule does cause the direct link to be severed at some point. But massive declines in value in either will create FUD for the other and will likely cause mass exodus from both.

Talking about 'HIVE APR' doesn't make any sense to me. I am not going to invest in a volatile, speculative asset (of any sort) simply because it provides 12% APY to all shareholders. The fact that it provides 12% APY is meaningless. It would be same as if AMZN declared that on the first of every month they are going to split their stock 100/99. So, if you are holding 100 shares on August 31, you end up with 101 shares on September 1. So what? It's a meaningless and irrelevant change. Amazon is not suddenly more valuable because there is 1% more of its stock issued every month, evenly dispersed to all existing shareholders.

Of course, if my AMZN stock is static (not subject to the split) while everyone else's is receiving the split, then I am losing out. Sort of like receiving dividend checks but burning them instead of cashing them. That would be akin to having HIVE and either not powering it up or powering it up but not curating.

When investing in HIVE, the downside risk and upside reward-potential are both in the underlying asset (HIVE). When investing in HBD, the downside risk is also in HIVE (and, to a lesser extent, in the mechanism holding the peg) but the upside reward-potential is solely in the APY.

The question underlying all this discussion is, how is the HBD APY being 'paid for'? Many seem to fear that HIVE has to lose value in order to maintain the APY and the peg. In a static system, this would be the case. However, if the APY brings outside investment into the Hive ecosystem, then the price of HIVE rises in reflection of that, meaning the APY is 'paid for' by the overall growth in the ecosystem, and will quite likely more than pay for itself, depending on the amount of investment growth being stimulated.

Tinkering to often with the APR parameter is a bad thing. We need some type of mechanics that will be set in the code and give everyone more predictability. The lock-up periods is a step in that direction. We can explore more.

20% was a nice boost for the loyal platform supporters

maybe should still be high up there to still use the chance to attract some more outside interest, especially with the upcoming market volatility

but then lowered to 7-14% according to rising outside interest

(to not "overheat" the system by too many taking the chance to profit from 20%)

Thing is that loyal platform supporters usually focus on their HP, so some of them might felt disappointed.

As mentioned earlier, HBD is great on it's own, and if our little "promo" drew attention of outsiders, then good, our platform has tons of amazing features. Now it's time to look at it closer.

I have a little in HBD savings, just because I thought I should, but I am a bit disappointed like you noted. How long do you think it will be until other witnesses follow suit? Should I convert the HBD to HP now? :)

Hard to guess, but even at 10%, 5%, or 0%, there are compelling reasons to keep your HBD. Of course, it's up to you.

Since you're voting for me as a witness, the more HP you have, the stronger my vote becomes. So, I might be a tad biased on that matter. ;-)

:D :D

I vote you as witness, because of your smile.

^^

well, if you guys say it is time.. then it is what it is.. ^^

Guess when you say gradually you really mean it. :D

Ha! So it draws attention :-) Good. But it was only to let people know ASAP that it's actually moving without moving it much just yet. Speed would depend on the feedback I'm getting here.

lols. next month.... 19.98%

I wish we had done that on the way up. We went from under 10% up to 20% like a rocket to the moon!

I have been working on getting 6K HBD in the savings because of the 20% APR. I even powered down all of my 10k HP to get as much HBD in the savings as possible!

But I am down for the HBD APR to be lowered to 10-12% and at that stage, I would move all of my HBD back into HP or some tokens :D

Haha you were one of the people I was thinking of reading this post :D You did power down! All good though, different methodologies! Just go back to Hive Power now :D

Haha Great! :D Making waves on the InterHive :P

I did! And if I can convert it back now and these prices, I am in profit :P

Working on that, slowly xD

I agree completely!

It is true that the 20% rate is great for HBD Savers, but at what cost. I'm not sure if it causes people to put less into HP or not. I have seen data and charts in some posts here, so I'll have to find them again and see what the data says.

I have seen something going on in Venezuela regarding using HBD at stores there. I think @hivesucre is at the center of this trend. I wonder what their thoughts are on the 20% interest rate. Does that benefit them or not. Would a lower rate slow adoption of HBD as a payment currency in their stores or not.

Also, I wonder about work on ideas from @taskmaster4450 in regard to implementing other locking/staking/saving of HBD such that longer pays better. There was a suggestion of a Hive Bond that might pay a higher interest rate for a longer amount of time lock, similar to bank CD rate tiers. Any insight @gtg as to if that could be a reality "soon"?

One other thought. In gaming,

you play the game and level up which unlocks better rewards. It might be cool to have several levels of HBD interest depending on how much you have in HP. Holding under 10K HP pays one interest rate on your HBD, holding 10K to 30K HP pays more, etc. That incentivizes holding HP. Play the HIVE "game" of posting/commenting/voting/buying and level up your HP to unlock higher levels of HBD interest rewards.

While those ideas are interesting I would rather want to keep things simple. Hive is already complex enough. Maybe with smart contracts dapps could do all such fancy stuff on a 2nd layer with their own economic models.

Thanks for your reply! There is lots of potential in 2nd layer experiments. Now we have hive-engine which offers some choices such as how many tokens to mint and unstaking parameters, but more would be needed to better gamify rewards. We'll see what hive-engine and other 2nd layer developers will offer in the future.

Interesting suggestion!

Booo 😡

If it works, don't touch it!

That's the thing that we don't actually know if it works. Yes, we survived that long and we could brag about it already, and even keep bragging when it's smaller, because we are (are we?) lowering it not because it is something we couldn't handle, it's just shift in priorities.

And when it comes to potential, sure, IMHO Hive is heavily undervalued, but apparently markets DGAF about MHO ;-)

(Not a financial advice, obviously)

I've gained a little from HBD savings, but HP is my focus and I think curation should be encouraged as it spreads the benefits. I have a full set of HPUD badges and will try to keep that up.

We do need various options for people to invest though.

Wow, congratulations! :-)

I am also setting my witness to vote for a lower interest, was voting for 18% now I am at 16%

But we knew that when raising HBD interest to 20% that it would make it very attractive. It was alright when HIVE was not going down, but with the current market conditions I am afraid new investors may not see that Hive is about HIVE.

I don't think the change will impact HIVE at all, but it may signal that HIVE is still at the very least as important as HBD.

If I were to put a big chunk of money on Hive on a bear market like this I don't think I would even consider HIVE with an interest of 20% on HBD, I'd go all in on HBD, and the thought of that bothers me.

Really glad to have this being lowered! I know a lot of people enjoyed the 20% but I think it's about time to get it down to a reasonable level. I think 10% is likely a good middle ground, it incentivizes people to do more for Hive Power where that earns 12% for curation+inflation at the moment. We are setting up various markets for HBD but those have been a little slow to roll out.

At the end of the day, I think a slow taper off away from 20% is good. I just wonder what those gigantic accounts with hundreds of thousands of HBD are going to do. Dump Hive? Hard to say.

I think adjustments are necessary in order to make this sustainable. Everywhere you look, investments would hover around 5% apr for safe to moderately risky investments. And 10% apr are already considered highly volatile and risky.

Congratulations @gtg! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 232000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

It WAS underappreciated, but going to 20%, IMO, was going into other extremeness and the result was that it was OVERappreciated... Let's meet in the middle, it's not too late...

Thanks for making this change!

Honestly, HBD APR has been in the ''too good to be true'' category for a while. And as @elmerlin said the other day in a discord room (ocdb I guess) it's not about ''being able to pay that 20% APR in a sustainable way (because for now, it is!), it's more about balancing incentives''

And I can't agree more on that.

Hive Power holders should be the #1st class citizens on the Hive chain, and 12% for HBD savings feels more than reasonable (at least to avoid eclipsing the APR of HP).

On the other hand, I believe that as a community we should be careful about changing the economic rules of our chain. Money is skittish and does not like unforeseen changes. Be careful there is imperative not to change the numbers too often.

I have been thinking about a hypothetical way to adjust the % interest on savings that might be interesting, but that is a topic for another day.

I also agree with the points of @deathwing to make HP more appealing, I also believe that reducing a bit posting rewards for an increase in HP APR would be a good measure.

Of course, I own a lot of HIVE, so my opinion is hugely biased. I'll change the params of my witness to signal 12% APR on savings.

Have a good day @gtg !

I get it, but I think we could run this 20% experiment a bit longer. the main reason for having it this high is to attract investors and so far that is starting to work. When someone wants to buy HBD, they have to essentially buy Hive first which puts buying pressure on the markets (the selling pressure from selling Hive on the internal market does not really move the price on the external market, and even better when they convert it). When they sell it, it again puts buying pressure on Hive (again, on the internal market that isn't too much, but we could perhaps say it 0s itself out from the beforegoing selling pressure). We have also seen that 20% is not unsustainable. But I agree that we should make HP the place where value should go long term.

I don't know what would be the right APR, and probably nobody does, we all play the guessing game here, as for the most thing in life :)

But I don't think constantly tinkering parameters is a good thing, and the overall uncertainty that we have with this parameter. Can we try and propose some type of rules and mechanics that will give predictability to the HBD APR and how it is determined, and have this set in code?

At the end the HBD APR is secondary when it comes to the health of HBD and HIVE, the haircut rule is the ultimate protection and the ruler of the system.

Like a proposal that never expires and is updated every month or two and has the following options:

If the up wins, increase the apr to 0.5-1%, If the Keep wins, just let it untouched, and if the Down wins reduce the apr -0.5-1%.

And some mechanism so that you can 'keep' your vote without having to renew it after each reset. But that after a year it expires and you have to vote again manually (in case of lost keys, death, etc).

This way the APR would be predictable within a timeframe of 6-12 months more or less, and it would be ideal to increase it as we 'feel' the peak of the bull market approaches to incentivize the people to sell before the inevitable crash and reduce it as we bottom out to incentivize people to move to HP.

As I see it, we have two options with a dynamic APR:

A semidinamic apr sounds good, as long as it doesn't make the code less secure, of course.

Anyway, let's see how the HBD debate ends

All for debate ... on another note, some might argue that going in the opposite directions with the HBD APR, from the second point I described above in the semidinamic case is actually better .... example, high debt = high HBD APR, not the opposite, this to stimulate more funds into the ecosystem ... its a whole game theory and monetary policy that we are talking about :)

If we have time-specific lock-up vaults, then no investor will ever complain about changing APYs, because it's not changing for their already-committed investments.

When I lock up money in a CD, I don’t care if the bank cuts interest rates on new CDs, at least not until mine matures.

That's the way HBD APY should operate.

Personally, I think this sort of decision needs to stay in the hands of witnesses, where it is public and transparent.

The witnesses answer directly to the community, via stake-weighted voting.

This is exactly as it should be, imho.

If @gtg lowers the APY and enough stakeholders unvote him as witness, he will reconsider.

Also, keeping important parameters at the witness level allows extremely quick responses to attacks and other potential problems.

I think this is a great move and brings the focus back onto Hive Power where it should be. My 1k power up is in my wallet and ready to go!

Maybe think about limiting the number of whales that can like any one blog post how about limiting the amount each blog post can make your post is way overrewarded

Agreed, way over rewarded!

You've read that part about beneficiary being routed to @hbdstabilizer, and you understand how it works, right?

If you disagree on rewards you are free to downvote it.

However, please note that 100% beneficiary is set to @hbdstabilizer which means in contributes to a very useful community driven initiative and it eventually ends up in DHF, so author rewards are not going to me but in fact are working for the platform.

How about 5% APR for HBD much safer

We don't want people just to join Hive for free money, do we?

lol

I'm willing to reduce it as well because, from the outside perspective, it sounds like a scam. It's too good to be true and people think it's not sustainable (which I believe is true in the very long run but it's fine for now). What I would like to avoid is to drastically change it without any prior notice for "investors". This will make us silly. I know, decentralization and stuff but after all we should be considered a mature and stable environment to onboard masses, both users and developers.

The world needs a lot more HBD. If anything, I’d like to see the APR increased.

APR was increased so the world had a chance to notice it. Now we need to try other approaches to reach that goal. Currently there's a usability barrier because of very limited ways to on ramp / off ramp with HBD.

I guess I’m not concerned that the world hasn’t noticed. I’m thinking of the long-term need for much more HBD. Also not concerned about the dearth of on- and off-ramps for HBD. Our internal DEX, that I like. But I would like to see more ramps for HIVE.

You have my support on this I hope other top witnesses follow suit!

I even find it offensive that you try to put the label 'Promo' on the situation, it turns out that it was not a benefit, it was never a pro-platform decision; why wasn't it announced in the Post as a temporary promotion? I'm not saying you should watch your words, but this kind of situation is why small print exists in contracts, where does it say that this is temporary?

I understand that it can be reversible and that you are fine with it at this time reducing it to 10% and 'even 0%', but don't try to sell this as the end of a promotion. Please Respect us.

Another issue and it does not go directly to you @gtg forgive me for using your Post to address all those Witnesses, who say over and over again that this is a platform of freedoms, where the community is listened to, they fill their mouths saying that as a benefit before other centralized platforms, and here they are, telling us how they think we should consume their platform and giving us not an order but an 'Innocent' suggestion.

I'm sorry if my choice of words caused any confusion or offense. It's possible that's because of some language differences. The term 'Promo' was not meant to downplay the benefits of the

hbd_interest_rate.The nature of the

hbd_interest_rateis inherently variable. As with many blockchain parameters, it can change based on various factors. I've previously clearly pointed out the "strings attached" aspect, and the importance of individual research, which was boldly marked.The page I linked to, clearly indicates that the interest rate is a "current" value. If you navigate to "Learn more about HBD interest here", it mentions:

Please note that my post reflects my and only my perspective on the HBD APR. Other witnesses might have different views, and currently it seems that the rate remains at 20% even though I've already started to gradually reduce it.

As for the other issue, it's OK to use my post, let me just share my point of view: witnesses on the Hive serve the community. Our primary role is to represent the will of our voters and ensure the smooth operation of the platform. Witnesses are servants, not the rulers.

Contrary to some misconceptions, we don't have the power to dictate or control how individuals consume or interact with the Hive platform. Any suggestions or opinions expressed are just that - suggestions, meant to facilitate discussion or share a perspective.

Amazing idea, hdb don't need 20% apr for a safe (long term) growth

I'd get behind 0% interest on hbd. Wouldn't want this whole platform going belly up like luna. Hive should be the investment not hbd in my opinion. However I get what's going on here. hbd used as investment vehicle could yield us potential investors and that's a good thing. Implosion of hive is not likely at current debt levels. Thanks for the update and for lowering the rate. I like the way you run this chain, that's why I vote for you. Keep it going.

Bring HBD back to 30% or above, I'm trying to survive here

That would be irresponsible to say the least.

My life has changed a lot over the past year, and I no longer have much time to curate and post, although, I've been attempting to stay engaged.

I recently decided to power down half my stake which is being wasted by my inactivity and to put it into HBD.

Reading this I will not be purchasing HBD for a bit and will have to decide what to do with my powerdown now.

It seems the largest stakeholders aren't interested in promotion or growth to individual users which I understand, however I also don't see any attempts to lure, gain or market to developers, app creators, and they are often dismissive to the devs we do have.

Without HBD as a back up and with everything being so stagnant, I guess I will have to take some time to consider whether I should leave my stake in Hive at all.

Loved the ride, love the community, love the potential, but I don't understand the direction of the project.

HBD isn't going anywhere. Above is just my PoV and stated intent. The overall rate is still at 20% since it's the median from top witnesses.

Oh, Hive as a platform is far from stagnant.

Just saying. Do what's best for you :-)

Sir, we are in a bear market ... Hive is no exception to the rule... we cannot fight the trend that has taken the whole market down 80 percent ... not until the halving of Bitcoin ... as a crypto investor, I happen to know that Hive's nearest competitor for stablecoin interest is already up to 16 percent, so if we want Hive to be competitive in the bull, tinkering with the interest is not the way to go. Twenty beats sixteen and definitely zero every day in an investor's mind, and so we will have better heeled members of the investor class who know little about the story of Hive looking sideways about "what kind of team do they have, giving up competitive advantage IN LESS THAN A YEAR BEFORE THE BULL?"

In my view, we aren't sacrificing any competitive edge. I'm just adjusting a parameter to reflect the current situation more accurately. The pace of change matters a lot here. I'd rather make gradual adjustments now than be forced into rapid changes later. It's easier to bump up the rate when needed, but lowering it quickly isn't a great idea.

OK ... I can appreciate how tough it would be to get all the way into say, October next year or later and suddenly have to bring things down because we meet the limits. Please also consider how even since I wrote to you, Hive is being noticed as it is by early leaders of investment groups ... one of the strengths mentioned by this master of pursuing hidden gems of crypto is the passive income:

His analysis is unsparing, and he recognizes that he needs to hear about the community more before making a final analysis ... but he says, one of Hive's strengths in its (too small) user base is that passive income. Where he is from, inflation is hitting hard but HBD is well ahead ... roll back to 10 percent, and we lose that. Wirex and its access to well-known stablecoins will eat that lunch, split it with their partners Visa and Mastercard, and roll on.

As someone who is not just a Hiver but a crypto investor, albeit on a much smaller than James in the video: please understand that if 20 percent interest HBD was a promo, it was timed WRONG. Nothing in the world was going to make people stay in the market or come to Hive in April 2022 in masses with the market on its way to a 80-99 percent crash. In like manner: August 2023 is still too early to see if the "promo" has made a difference. We are still in the bear. Hive is still down 90ish percent, and so are a lot of other projects, so few who are coming back have come yet. What we do have is incomparable, perfectly democratic access to putting Hive to work and not having it taken off chain. Now, Hive has a lot of users who have survived three years of a pandemic and all kinds of disasters by earning and selling their Hive -- and that's not going to be changed in bulk, because we don't have control of geopolitics in place where money and resources have been taken out for CENTURIES from the people. But for those doing a little better, they have the option of putting their HP to work in various ways (we could do better in letting those ways be known) and letting their HBD get inflation-beating interest around the world. Investors already see this two-pronged approach. That's quite a story to take and present in the next bull, and there is a global audience that will be presenting it everywhere in the world.

LOL, one of the most active blockchains and that guy can't see the usage.

And he also think that J.S. is behind it. And that he'll use one of his projects such as bittrex to market it.

I don't even have words to describe how dumb that all that is.

We have had articles THROUGH HERE LAST WEEK that have estimated Hive's active daily users as low as ELEVEN THOUSAND per month ... that's the basis of Leofinance wanting 26 million HBD to get a mere 10,000 more users in here and DOUBLING THE USER BASE. Remember those articles last week?

Now, granted, the man even admits that he doesn't have all the facts... anyone who hasn't looked at Hive for a while well might be confused if they knew about Steem in the past. But bear in mind: he is talking to people who will copy his EVERY MOVE, and his reach is bigger than ours because as he says, HIVE DOESN'T HAVE A GOOD MARKETING PLAN. Now, you are welcome to go correct him in the comments, but that's the knowledge base from an investor with reach on the outside looking. Don't overlook the technical analysis hard facts.

Hive has a user base too small to compete with web 2 -- TRUE. Facebook has around 2 BILLION USERS. This is true.

Hive needs a marketing plan, quick, fast, and in a hurry -- TRUE, or somebody better tell Leofinance we're not giving them 26M HBD.

This investor -- one of the few to discover Hive with an active investor group -- sees Hive's passive interest as a bright spot.

He's got quite few community facts wrong, but he asked for help because he knows that -- but don't miss what he is suggesting as an TECHNICAL INVESTOR with people who follow his moves. We can get him straight on the community facts, but AGAIN: if the point of 20 percent interest was to get an investor's attention, IT WORKED. Remember: we need outside people to come IN. Not all of them have the inside facts ... but that is the nature of being on the outside looking in, remember? No one is buying Hive and moving its price or staking HP on its biography because few know either of those things... but ITS INTEREST is being presented as the bright spot!

That number is way off. They're asking for just shy of a quarter million, but not all at once. Stakeholders can cut their funding with the push of a button at any time.

I'm looking at their proposal again ... if their proposal is asking for a quarter million dollars, then how is it fully funded at 25,658,195.800 HP? Now, I did get the HBD and HP figure transposed ... but Hive is worth a bit over 28 cents ... so that's not $250,000 in value, but instead still closer to $7.1M for that proposal. What am I still missing?

I have no problem correcting my error, and I'm not even quibbling about the price -- I am frankly relieved to be wrong, given that we are talking about adding about 9-10K users. My point still stands: WE KNOW we need a marketing plan, and we know our user base needs to get bigger ... so we're just going to be mad because someone who does not know Hive's entire biography (in the 11,000 or so people that are around here, few know all of that) sees exactly the same thing and can see how we can do better and wants to know what he is missing? Like James on YouTube, I'm willing to get a better understanding and make corrections, and I appreciate you reaching out to me. I hope we on Hive can reach out in the same spirit and not miss the opportunity to connect with even someone who has made an imperfect discovery of the community!

The HP represents all the stake backing the proposal. I voted for it. I have roughly 85k HP. If I removed my vote, subtract 85000 from that 25,658,195.800 HP.

The return proposal sits at just over 21 million HP. I also vote for that. (I remember seeing a call to action asking people to vote for the return proposal in order to make it harder for LEO, but I had been voting for the return proposal since before summer.)

Since 25 million is more than 21 million, the proposal has been "approved."

There are no costs involved with those numbers. The actual proposal is asking for 495 HBD daily for 487 days. So if it's underperforming, it's possible some votes will be removed, pushing it under the return proposal and therefore they lose funding. That could happen on day 10, day 58, day 87, day 267, any day, with no warning. (But that's the life they signed up for.)

Of course I point it out to educate. Not to ridicule. These facts are spot on.

I'm not too concerned about that James guy. Not sure if he'd be interested. I look at that body of work and feel like he just picked Hive randomly. Probably already forgot about us. I noticed Crim reached out so maybe I'm wrong, which is fine.

I see a lot of creators like James. Similar approach. So many of them. I stopped paying attention to that kind of stuff years ago. Believe it or not, I'm not really into crypto.

OK: I have corrected my main post and removed the inaccurate figure, and I appreciate the explanation ... that was way more complex than I ever imagined.

I think my concern is, can we afford to be forgettable if Hive needs adoption? James is a technical momentum long-term swing trader type ... it may be that he is likely to forget, but he also asked for more information. If we don't care, then surely no one else will. Hive, to us, is not every other crypto, but it will be classed as such. We are the only people on this earth who can change that. I see James as good practice if nothing else.

I'll put it this way. I do care. Some things I can help people with. Other things, not so much. I'm not the right individual to be around that James situation. Perhaps you are, so please continue. You see potential there, grab it. I see potential in people seeing potential. So I encourage you to continue. There's nothing wrong with finding a path and deciding to see where it leads. I've been on one myself, advocating for something I see huge potential in, for several years. One thing. People agree it makes a lot of sense. Yet it has not come to fruition. Even when I TRY to give up. I can't.

I appreciate you caring enough to help me understand, and I can appreciate not everyone being able to put up with everybody because indeed, momentum traders can be annoying.

Hive is in fruition in one way ... the number of testimonies I read of how Hive has changed their lives as individuals and in their families, and communities is ever growing, even in the bear. This connects with me because I am a storyteller at heart. It appears there is a groundswell; the challenge is that Hive's price is not high enough, still in the bear, for those stories to yet be from all across the globe. But even in the United States, I have a story: I am a better storyteller, and author, and richer in a thousand ways, for Hive. Now, we see people outside are lagging on Hive's biography, and how long-time Hivers like me are still not clear on how it all works ... but the stories I read weekly and almost daily some weeks give me hope.