Why is Crypto so hard?

I saw a crypto meme on Twitter today that was probably the funniest I have seen in a long time.

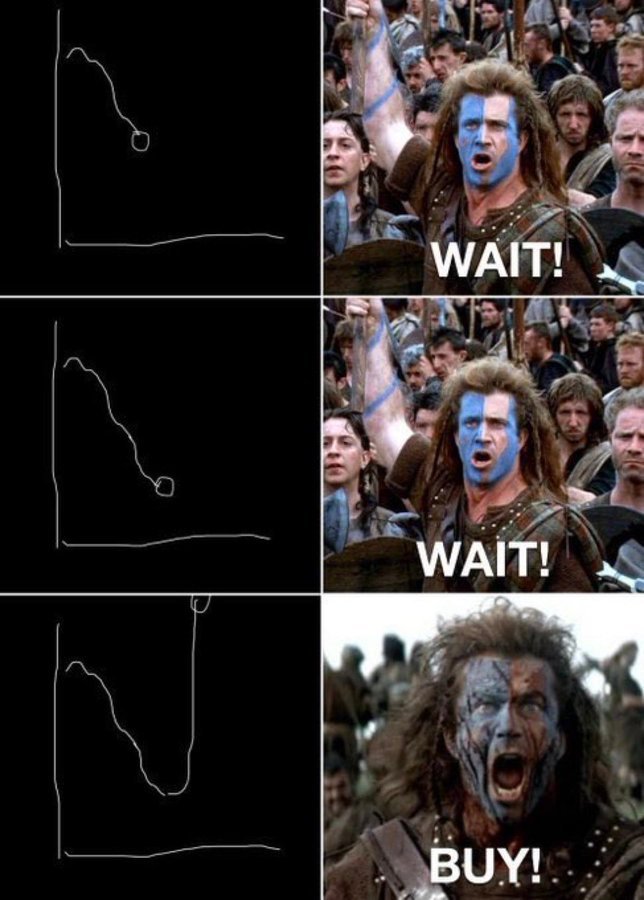

The meme is a simple summary of what happens every crypto cycle, but even though we know this all the time, we still fall into that character when the market begins to act up. I will post the meme below for you to see.

Apparently no one buys a dipping coin, or lets say 95% of people won't. Why? because they are afraid of losing.

I do not know what to say because this is already a crypto cliche, but I'll still do for the sake of emphasis.

People only buy what is pumping because they know they will make a profit; unfortunately, when they do start buying, they do not do so at a price that is high enough to be life-changing; this is why people need three to four cycles to become wise; however, this is not new, and it does not take a genius to understand.

What distinguishes you as a genius is your ability to put your convictions into action. While this appears to be a simple task, it is the most difficult thing to accomplish. The reason is because the market has so many unwarranted voices that can influence your crypto decisions.

I once read a documented story on Hive about someone selling all of their XRP because an alleged crypto guru who is also a YouTuber said XRP was going to zero, and then XRP exploded a few months later.

According to them, if they had kept the coin, the money could have changed their lives, but that YouTuber with alleged years of experience persuaded them to sell.

Now, voices like this allegedly self-proclaimed crypto guru are resurfacing, and do you know how they convince you?They pull up charts and give you some solid reasons, and as soon as you start listening, you will realize you are buying into their ideas.

Crypto Twitter is one of such places, it is full of crypto folks who are cursing the hell out of themselves. The arguments are unhealthy; people are throwing tantrums and putting their emotions on the line; some people are losing their minds, throwing their opinions around in insulting ways; and most of the time, all I can do is laugh inside.

Some people are clueless, while others have some knowledge, and still others refuse to let others rest by waving their predictions about what will happen to prices. It is absolute chaos out there, and people who are constantly switching between Twitter and YouTube or trusting YouTube bros are the ones who have their convictions rewired.

Do you know why? It is a game.

The game is the game, period.

I have been following Twitter for a while, and it is not because I am looking for crypto validations, for other vendors, although I have subconsciously learned some of the harshest realities of being in the game, it is always a good idea to double-check your conviction rather than allowing an engagement-seeking bloke to guilt-trip you.

Again, by December, I believe everyone will have learned one obvious lesson. Why December? Because this is when and where the road goes.

Now, I am going to discuss that meme.

Take a look at that chart. Notice how the "BUY" in the meme's final image began when the pump was already at some of its highest levels? That is because the meme simply mocks those who wait for a coin to significantly increase in value before entering; unfortunately, they are either buying near the ATH or buying when they will barely make a profit.

This is the same as panic selling. It is difficult to hold when the market is bleeding; this is the critical point at which things become too difficult, and this meme depicts the entire crypto cycle in a single image.

The period of FOMO is getting closer, and when it is fully upon us, you will see the rush to secure the next mad gain; this is exactly the playbook that makes crypto so difficult.

Interested in some more of my posts

Why Is the grind getting harder?

Monopoly Is the Death of Civilization

Survival: Choas and Scarcity

Crypto: Gut & meaningful Connections

What is the primary barrier to entry in Web3?

What Are Some Things You Should not Do During A Bull Market Year?

I think part of it is trying to squeeze out higher gains. Some of the most profitable companies, for example, do not have the long term results that Bitcoin has. Apple's net profit margin is about 24%. Microsoft's net profit margin is about 34%. Tesla's net profit margin is about 24%. Even a bank such as JP Morgan Chase only gets about a 24% net profit margin. Yet Bitcoin's long-term gains are even higher. All we have to do is buy and hold.

Over a 5 year period here is how they compare:

Obviously, over the short term there will be ups and downs. But you can see that long term returns can be life changing money. In spite of this, it's not enough for the gamers. Not only do they want higher returns, they want them NOW.

They don't value the gift that's in front of them because they want more and want it faster.

Even here on Hive, we see people selling their Hive and liquidating their HIVE to buy tokens that have a lot of hype but no long term gains. HBD, if we hold and reinvest interest, it would yield a 100% return over five years. HIVE itself is a gift because you can mine it with no investment other than time and talent. And your earnings compound as your HP increases.

They want life changing money without first changing their lives. And they don't realize that they already have life changing money if they can hold on to it. Instead, they move their capital around in an effort to beat the simple gains of BTC because 900% is not enough. Even those who somehow manage to hodl start looking for ways to generate yield from their Bitcoin.

In truth, crypto is not hard. We just make it difficult on ourselves.

I stopped watching technical analysis on YouTube for that reason. I realized that these guys are traders who are always looking for the next big thing for quick profit. They go through all kinds of effort when all they need to do is buy and wait.

I've a lot of people do this over the years: they liquidate their Hive assets to buy meme coins. Some of them make profit and won't use some of that profit to buy back the Hive that acted as their initial investment. It's completely saddening, but some of them also get burned and then they lose all their initial investment (which is the Hive they've 100 to 90% liquidated)

Indeed, Hive is a blessing, and the holding HBD mechanism when it's the bull run can literally help you build your HP, you can even take back some profit, put then into IRL investment and use some of these gains to but back Hive in the bear market. This playbook will guarantee you maximum and Higher HP in the long run. I thought I was the only one aware of this mechanism, but then I see Hive's compounding capabilities is often underated

You're right when you say people want it all in the short run. I've been here 7 years and I can attest to this.

Conviction when everyone is in panic and going against the market is something quite uncomfortable but it is really where real wealth is made, given the fact that your investments need to have long term fundamentals and utility of course.

You're right, but 90% of people will never hold onto their conviction even when they know that there's a huge that that they'll win big. I think most people will not take the slight odds, they're more comfortable with what everyone is holding, it's not like they've done their research, but they feel that since a lot of others are holding it, then that might be the signal they need.

The right thing might be the hardest things to do.

I think one just need to study the crypto cycle very well. If not, the quest for immediate gain can rather lead to unanticipated loss

Even though we study, we still make the same mistakes.

In the end you can never really trust people on Twitter on YouTube, they may be paid to push a token or against it. Unless you do your own research and hold to it rather than listening to FOMO or even worse chasing the market as it's shooting up. Nothing is ever easy in crypto anymore, the days of the easy buck seem to behind us. It's now the day of the smart crypto investor!

You know people easily trust YouTube or Twitter influencers because they feel these guys have successfully made money over the years, and thus, have more experience than them. I tour Twitter on a regular basis and I'm certain that many people are going to be the dummies of this bull market.

It's also very hard to decide when to sell and take profit, at least a small amount of the portfolio, or else you just hold forever and loose all the bull runs, and suffer through the bear market.

I think I suffered through the bear because I didn't have a solid plan and I rode everything to zero. However, I'm better at having plans now, so you're right. For people who made profit it's always difficult to decide when to take profit. Let's see how the next 3 to 4 months will turn out to be.

Sometimes I wonder if one can be knowledgeable enough regarding crypto to the point of not making wrong decisions. Crypto is so hard...out there , they hype over a coin, I buy with my hard earned money and never gain via the coin, they hype another one, I will bluntly overlook it, then within days or weeks, that one now do 25X, 7x, etc...this has been one painful experience I have been in with my crypto journey . Crypto is hard abeg..toiling with my emotions..lol

It's not really about knowledge, I think it's about being courageous enough when others are panicking. There are people who have all the knowledge in the world about crypto, yet things like fear and FUD comes in at this stags of the market. The human emotion is not easy to curtail because a lot of things are at stake. The market has been wild and my biggest motive is to wait and watch.

It's the common factor with most people. They don't want to sell when its high and they fear buying when its low. I think that is the psychology for stocks as well.

Hahaha I think not selling when it's high is mostly because of greed. There was this greedy fellow I know, he made profits in 2017 and didn't take profit because he wanted it to go higher

Happens every time lol. Sell on they way down and buy on the way up. I think the greed of wanting to make max profit within a relatively short of of time is what gets most users to be carried away by FOMO. Nowadays, scrolling through CT gives me a headache, and it's really interesting how fast the sentiment changes from bearish to bullish within the same set of users as if people's memories is that of a goldfish's attention span.

I know a Twitter influencer who has preached doom for over two months now. She felt altcoins are dead and there won't be an altcoin season. She said she wouldn't hold any other coin except BTC, guess what? She's back and ranting about how altcoin season will be big and this is simply because Eth went from 1400$ to 2400. These guys are just adult babies and hardly know anything

Lol, definitely. Most of it is just guess work and going with the trends instead of actually having conviction through informed research.

Crypto is hard because people are distracted by the rare meme coin trader that made millions and think this is standard. If they see something like hairybuttcoin pumping, many people think "This is my chance ! ". It's like the casino mentality. Some people go to Las Vegas with the hopes of making millions.

I have only three coins: HIVE, DASH and BTC. I haven't made millions, but I'll probably make more than what I started with.

I cannot agree more lol. Memecoins are a huge distraction, and I agree that the pumps that comes with it makes it feel like the regular standard. People get burned everyday, and I think it's because we sell the wrong mentality when it comes to crypto: the mentality that just one single meme in one single moment can bring untold wealth

In 2021 I had only Hive, BTC and Ethereum, I don't think anyone should have too much, especially if they don't know the fundamentals of that project.

Honestly, I have hung the boots for a while on crypto. Especially after the run of those telegram drop-pings. I logged off totally cos I felt I need to get my brain back into its natural shape not filled by consistent usage of Telegram to mine anything.

I believe my experience is largely because I really have no conc. knowledge of how it works except the basics and buying and selling that's all. I wonder how the professionals do it - maintaining their mental health and a radioactive markets. 😅😅 I give it to them.

Except you dedicated years of trial and error, as well as learning, you'll probably not understand anything. It's hard to understand how it works, and even if you do, the market is still a rollercoaster of emotions.

Even the people who seems to be knowledgeable are not so knowledgeable. When it comes to crypto decisions 80% of people will always be scared because it's never easy.