Trump's Liberation Day Tariffs: Misguided, Mismatched, and Market-Disturbing

Created using Canva

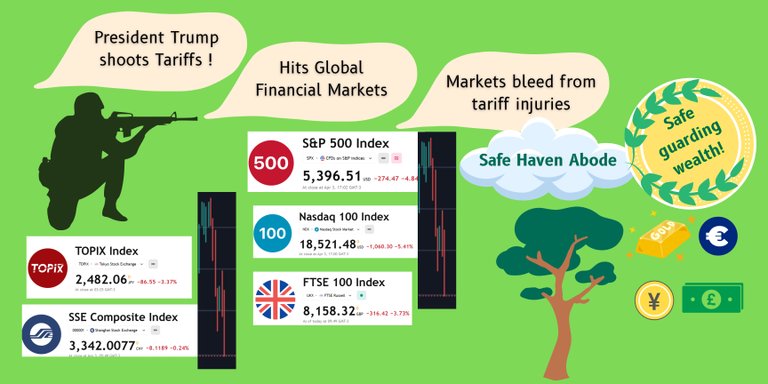

Trump’s Tariffs: Unfair Strategies Wreaking Havoc on Markets

The fallout from "Liberation Day" continues as global financial markets plummet in response to President Trump’s aggressive tariff announcements made on April 2nd.

In my previous article, I explored the routes through which investments are adapting to this economic climate characterized by bearish investor sentiment:

Alternate Safe Haven Assets That Shined Amid Tariff Turmoil and USD Decline.

It has now become evident that President Trump's "Liberation Day" tariffs are not reciprocal tariffs that uphold fairness in trade.

President Trump's Tariff Rates: A Case of Unfair Reciprocity

President Trump argues that his tariffs are reciprocal, asserting that other countries impose higher tariffs on products imported into the United States than the U.S. imposes on imports from them.

However, the new tariff rates announced on April 2nd are far from fair; they are not aimed at merely closing the gap between tariff rates imposed by the U.S. and those levied by its trading partners. These rates are disproportionately high, diverging sharply from what would be considered fair reciprocal rates.

For example, the U.S. has imposed a 27% tariff on Indian imports—a rate significantly higher than the fair reciprocal tariff of 14% that would be necessary to balance the tariffs levied by India (17%) and the U.S. (3%).

President Trump’s tariff on India exceeds fair levels by 13%, and this pattern of high tariffs continues for other countries as well.

For instance, Vietnam which gets a new Tariff levy rate of 44%, has actually never levied Tariff rates beyond 15% on US imported products.

Tariff Rates and the Quest to Reduce America's Trade Deficit

The April 2nd tariffs, which have created turmoil in global financial markets, are, in fact, inequitable. They do not serve to align U.S. tariffs with those of its trading partners.

President Trump aims to reduce the U.S. trade deficit with its partners, believing that these "Liberation Day" tariffs can help achieve that goal. The methodology used to determine these tariffs appears to emphasize the U.S. trade deficit rather than addressing reciprocal trade practices.

This illustrates that America's trade deficit isn't solely the result of unfair tariffs from trading partners; it arises because the U.S. imports more goods and services than it exports.

Hence, instead of imposing high tariffs to correct the trade deficit, President Trump should focus on enhancing the fundamentals to boost American exports. His entire "Liberation Day" tariff policy, which has led to significant market turmoil, is fundamentally flawed.

To Be Continued...

If you'd like to understand the impact of Trump's "Liberation Day" tariffs, read my earlier article here—

Alternate Safe Haven Assets That Shined Amid Tariff Turmoil and USD Decline.

Thank you.

Posted Using INLEO

https://www.reddit.com/r/economy/comments/1jtmj90/trumps_liberation_day_tariffs_misguided/

The rewards earned on this comment will go directly to the people( @x-rain ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.