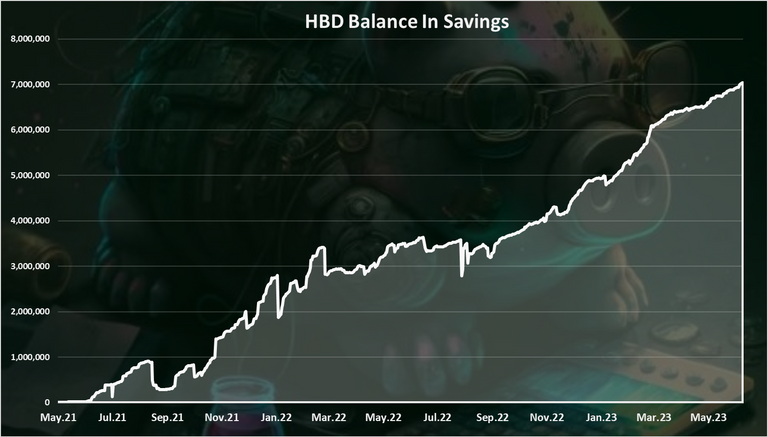

HBD In Savings Reaches 7M HBD While The Overall HBD Supply Drops And Liquid HBD Supply Shrinks

The amount of HBD in savings keeps on growing even though the overall HBD supply contracts.

The chart looks like this.

Even though a bit slower, the amount of HBD supply in savings keeps on growing.

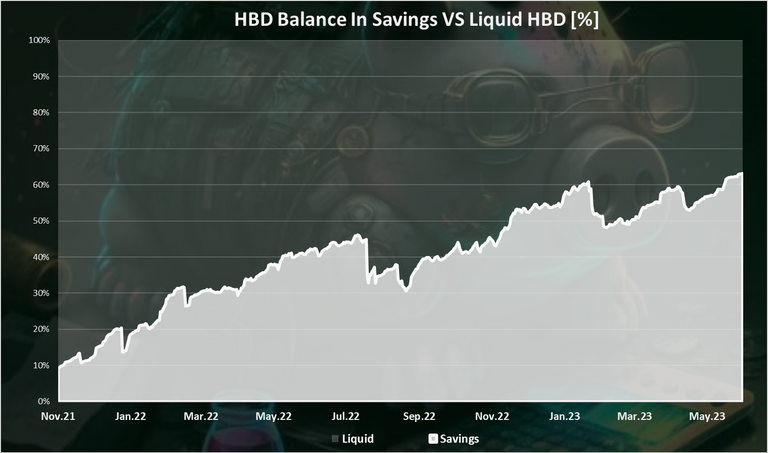

When plotter against the liquid HBD in terms of share we get this:

We are now at all time high with 63% share.

0

0

0.000

Makes sense to grow HBD during this bearish season, will be interesting to see HBD savings reaction during the bull season.

I really think it's time to start thinking about gradually reducing the interest rate. I don't think we should wait until we are approaching unsustainability, but be willing to adjust now rather than be afraid of spooking the markets when we finally have a more urgent need to reduce interest rates.

This is really up to debate.

I really don't know what would be the right approach here, but I'm not in favor of changing things all the time. We need some stability and predictability.

Is the APR sustainable or not, comes down to the price of HIVE. If the HIVE price increases the debt should not be an issue. Its similar to the countries debt in the real world. If you manage to pull out economic growth, then the debt will be negligible. We are now approaching a HBD supply crunch and I would leave it out to play out for at least a year. The HBD in savings cant grow by a lot without pushing the HIVE price.

Ultimately the haircut rule is what regulate HBD and the overall tokenomics, more than the APR for HBD in savings.

I disagree with the stability argument. The haircut rule doesn't apply automatically to savings APR so a change would be expected to be made when we reach that point. Never changing the APR before that point trains speculators to expect that it will never be changed, and then they can be spooked or panic when it does inevitably, eventually have to change.

Investors can be comfortable with changing APR as long as those changes aren't drastic. It is quite normal in other debt markets for interest rates to change from time to time, and crypto investors are even more comfortable with volatility than the broader financial space.

The part of me that favors continued high interest rate is that the cost of dilution is mostly being borne by a) inactive whales from Steem era + b) speculators on Upbit holding large amounts of liquid Hive and HBD without earning any interest. More involved Hive users can benefit from a high HBD interest rate at their expense.

This opens up a potentially tricky debate. Do witnesses have a (moral and/or legal) fiduciary responsibility to all Hive holders? How much space do they have (morally and/or legally) to decide the rates at which investors/speculators get diluted. Do we as stakeholders have such a fiduciary responsibility to other holders of Hive when we vote for the witnesses who make these decisions?

Are you trying to cheat the system? Making promises and then changing the rules - are you Joseph Robinette Biden?

HBD interest rate was never a promise, it was always only a policy. The interpretation of the policy as a promise is the error we need to avoid.

If you believe that it was a promise, can you cite where witnesses claimed the HBD interest rate would never be changed again?

I have a suggestion: let's change the bet every day or every hour depending on the situation) - who wants to play this game? Do you need long term investors? Do you need 1 billion HBD? or do you want to dig in the children's sandbox, close your hands from all the troubles and say I'm good?

We do not need 1 billion HBD. Having a billion HBD now would just make us insolvent. We do not have the base of an economy to maintain such debt.

Also, a frequently updating APR can still be valid returns. What is important for HBD is price stability moreso than APR stability. I would continue to hold HBD in savings with variable APR.

We do not need capital investment to the point of paying more for it than it benefits us.

Agree.

Make more use.

HBD can't make Hive insolvent. It's mathematically impossible.

Agree on the interest rate not being a promise. I don't know where anyone gets that from.

We would not be able to pay off our debts. Yes, by the rules written into the protocol holders of HBD who convert would get what the rules determine they get, but it wouldn't be a dollar worth of Hive.

The 'debt' is not a dollar, it's conditional. The 'rules written into the protocol' as you call it, are in fact the rules.

Let me use my tool here :)

The debt is almost flat in the last months hovering around 6.5%, even with the price drop of Hive. The speculative HBD from Upbit has been going down, and the HBD there dropped from around 3M to 1.7M now, causing all the HBD supply to go down. It has been balanced out.

https://www.hbdstats.com/

In the long run (5+ years), if we don't see HIVE price appreciation, then HBD APR might be an issue. Say we double the amount of HBD in savings, only from interest, and the HIVE price remains same or lower. Then we will have a scenario with 14M HBD in savings, 13% debt if the HIVE price is the same, or higher if its lower.

According to your tool, HBD Supply Excluding The DHF: has decreased by about $700,000 in a month, and HBD In The DHF: has increased - where does this far-fetched problem come from and who is trying to make noise out of thin air?

Photo from May 15th.

Sufficiently low enough demand for Hive while simultaneous high demand for HBD savings can result in a net decline in demand for Hive (even accounting for the Hive burned by Hive to HBD conversions), and reaching the debt limit ahead of such an expected timeframe. I'm not saying this is a likely scenario, but it's very much possible.

My concern though is not about that happening, but that through our pursuit of "stability" for HBD interest, we train the market to expect that HBD interest is not supposed to change. There are commenters in this thread who already appear to believe that HBD interest rate is a promise not a policy, as if it were hard coded and required a hard fork to change.

HBD is only supposed to be stable in price. APR and consequently APR stability is just a means to an end in 1) bringing in capital, 2) developing the network effect and 3) helping to maintain HBD price stability. We should not spend more than we need to in the aim of achieving those things, and we do not need to add APR and investment stability as an end in and of itself.

I am not concerned that it is urgent, but in the long run, if we train the market to believe that APR stability is part of the promise of HBD, that will have been a mistake.

Not that the largest holders of HBD are much more active. Most have very little HP if any at all - and who would blame them - I am certainly not ear marking more Hive/HP purchases whilst the return for non-productive holding of HBD > HP.

"If you pay someone to like you, no one actually likes you"

Mercenary liquidity is extractive and will leave the moment somewhere else pays them more to like them. Taking the 'energy' of productive members of the community with them.

Arguably, what we lack is more productivity. Authentic users who contribute and are active in creating the environment we would all like to be in.

Ideally, we don't want people who only use the platform if we're paying them to. Problem is, we're paying them to park their money and then any semblance of usage is gone.

Gold words!

If everything works - don't go in, so as not to break / one more golden words!

As background, I've been voting for a lower rate for a long time, maybe a year.

However, I don't think the argument is compelling. We should see what happens when demand for savings outstrips the liquid supply forcing more and more HIVE to be bought for conversion.

I wonder if that high interest rate of HBD is beneficial for the system in long term

There is only one way to find out :)

And what that way is ......!

To let the system move this way for long? 🤔🤣

Yes

🤣

It doesn't really find out. As with many things the counterfactual is unobservable.

For example, if high interest rate is maintained and Hive does well, would it have done as well or better even with a low interest rate?

Yes, true that. Other things influence as well, and we cant mesure the exact impact. And as we are seing now probably the overall crypto market has the biggest impact, and that is totaly non corelated with the local hive tokenomics.

We need to increase it to 25%

Lol some are already freaking out with the 20%, you don't want some to piss in their pants by increasing it to 25% 🤣

😁 It's better to let us all piss than to degenerate!

Lol if we carry on like this we will be giving Taskmaster something to write about.

I think he even writes in his sleep ;)

🤔

You think they just double down every moth or is that actually bought HBD?

If people were just holding HBD in savings and collecting interest, we would have seen it rise from 5 million to 5.43 million between January and May. Instead we saw it rise from 5 million to 7 million. That implies that people are intentionally buying or earning HBD to put it away in savings.

Interesting. We'll hit the haircut sooner or later, that will be a bullish event.

Its good analysis. I think its beneficial to have more in savings for 20% apr !

This is cool

A lot of people are going for HBD these days