Brown's Bottom.... When not to sell yer Gold!

Between 1999 and 2002, the then-Chancellor of the Exchequer Gordon Brown approved the sale of approximately 395 tonnes of the United Kingdom's gold reserves, which represented about half of the nation's total. The sales were conducted in a series of 17 auctions, earning an average price of about $275 per ounce and netting about $3.5 billion total.

The stated reason given by the Treasury was to diversify the reserve assets of the UK from gold, which was viewed as a volatile and non-yielding asset, into other stable and interest-bearing foreign currency assets. Specifically, the proceeds were invested with:

- 40% in euro-denominated instruments,

- another 40% in US dollar instruments,

- and the remaining 20% in Japanese yen instruments.

Gold go down....

However, the mechanism and timing of these sales could hardly have been worse! For starters, prior announcement of the sales led to declining gold prices since the market expected supply injections, leading to to a decline in the gold price by about 10% during the first auction in July 1999.

And then up

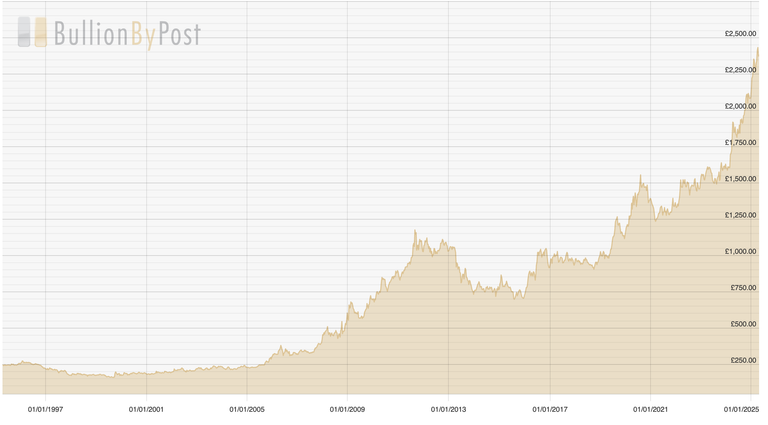

During the years following, gold experienced a gigantic surge. In 2011, the prices of gold had reached over $1,900 an ounce, and as of April 2025, prices are approximately $2,300 an ounce.

Had the UK retained its gold reserves, then the value of those reserves would have been astronomical. The 395 tonnes sold would be worth around $29.2 billion at current prices.

Brown's Bottom...

This series of sales has popularly come to be referred to as "Brown's Bottom," since the sales were made at a 20-year low in gold prices.

While investment from the foreign currency assets has generated returns, these have been overshadowed by the later price rally of gold.

Critics argue that this is one of the biggest financial misconceptions in British economic history. Others still contend that, in the economic climate of the late 1990s—when gold had been in a long bear market and other investments appeared more promising—the diversification action was justified.

Final thoughts...

In retrospect, while the rationale for diversifying the reserves of the UK might have rested on concerns over economic statistics of the time, the way and timing of the gold sales have been roundly criticized.

As large a price rise in gold has occurred in the subsequent decades, the decision has usually been portrayed as a lesson in the pitfalls of extreme market timing and the wisdom of measures to diversify assets.

Postscript...

Maybe now is not a good time to sell Hive....?!?

Posted Using INLEO

https://www.reddit.com/r/finance/comments/1jqtfeh/browns_bottom_when_not_to_sell_yer_gold/

https://www.reddit.com/r/MetalsOnReddit/comments/1jqulgs/browns_bottom_when_not_to_sell_yer_gold/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Thank you for the analysis. Personally, I'm not even planning to sell my hive now

It is good time to buy HIVE and stake it ;)

!PIZZA

$PIZZA slices delivered:

@danzocal(4/10) tipped @revisesociology

Moon is coming