A great way to diversify your digital assets for this 2024 (Crypto portfolio building tool)

Greetings and a happy new year to all my dear readers of hive and this beautiful community of INLEO, 2024 is already here, and with the arrival of this new year it is important to set new goals to meet, that's why today I want to show you an article where you will learn how to have graphical statistics of the profits or losses of your investments, because I am using it and it is a very useful tool, and although it is very popular not many give the proper use and do not know all the functions of this tool.

Make yourself comfortable and today I will show you how to make a cryptocurrency portfolio and how you can see the metrics of your investments.

Image created in Bing AI - Edited in Photshop CC

Table of contents for this article:

♦️ Why diversify?

♦️ How to diversify?

♦️ Where can I see graphically the returns of my investments in real time?

♦️ Recommendations for 2024

Image created in Bing AI - Edited in Canva

Why diversify?

In order to explain to you how to create a portfolio it is important to highlight that, first we have to understand very well the factor of diversification, so talk a little bit about it.

Diversification is an investment strategy that involves the distribution of investments among several cryptocurrencies to reduce risk, that is the most logical and simple way to explain it for those who are starting in this investing in cryptocurrencies.

By investing in a variety of cryptocurrencies, we are protecting our portfolio against the volatility of a single currency, because it is important to understand that the crypto market is very speculative and changing at all times, imagine this: You invest in $SOL (SOLANA) with the current value it has, and for some reason in 2 or 3 months the SOL lowers its value, that will mean that your previous investment is in the red and is affected by the fall in the price of the SOL.

That happens when you do not have a good diversification, because your profits would be only if SOLANA increases its value, you will only earn money when this currency has a revaluation so you are closing yourself to only one opportunity, when you can opt for different currencies and thus have more opportunities, of course this requires a previous investigation of the market.

In the opposite case, we put the example that you have a portfolio with three different cryptos, and that is your way to diversify after having researched the market before, in that portfolio you have the coins:

$SOL

$BTC

$HBAR

The SOL low its value (hypothetical case), but the BTC and HBAR increased its value, so you lost the value of your investment with SOL, but you are recovering it with the increase in value of BTC and HBAR token, I hope you understand the point.

Image created in Bing AI - Edited in Canva

How to diversify?

There are several ways to diversify our cryptocurrency portfolio, and as I indicated above all this depends on a good market research to be able to apply diversification and invest in only in projects which you see some kind of possible increase or that this project is offering some significant improvements in the crypto field, something that differentiates it from the rest to be able to have a higher value, this and much more is what you have to take into account.

Diversification by cryptocurrency type: we can invest in different types of cryptocurrencies, such as Bitcoin, Ethereum, Ripple, Cardano etc. Each of these currencies has its own characteristics and uses, which can help to balance our portfolio, and to this example you can add some more crypto that lately are giving much to talk about.

Diversification by sector: Some cryptocurrencies are linked to specific sectors, such as technology, finance or energy. By investing in cryptocurrencies of different sectors, we can protect our portfolio against the fluctuations of a single sector, and this I mention is very important, but it is a much broader topic to explain that the truth would be interesting for a future publication, just remember that cryptos or any focus on improving a specific sector, whether it is play2earn, NFTs or others.

Diversification by market size: We can also diversify our portfolio by investing in cryptocurrencies with different market sizes. This can include a mix of established and large-cap cryptocurrencies, as well as smaller and emerging cryptocurrencies with a lower market capitalization, and it is no secret that some of these projects with a low market capitalization have given good results, but I repeat again, it is all a matter of prior research before investing in the potential cryptos that will constitute our portfolio.

Image created in Bing AI - Edited in Canva

Where can I see in graphical form the profits that my investments have had in real time?

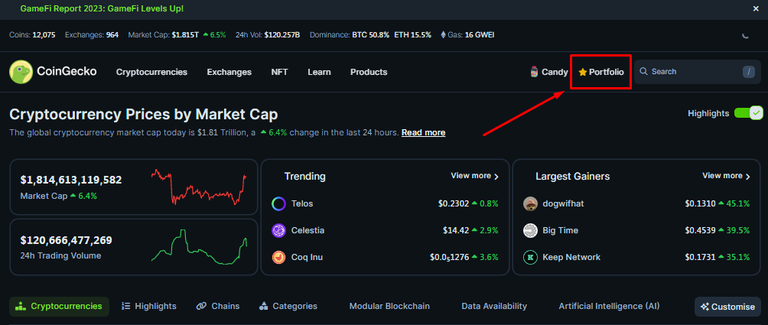

Now we have come to the point with which we started this article, which was to show you where you can make a graph of your investments to have them at hand and always see the performance you are having in real time, and of course it is the page or tool Coingecko.

Coingecko is presented as a tool to see the graph or value of cryptocurrencies, as well as see in which exchanges it is listed to trade with it, or also see a total history of its value, you can also see the market capitalization and many more things, so if you do not really use it I do not know what you are waiting to use it.

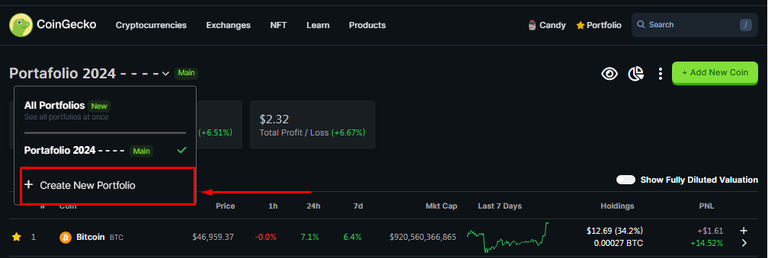

The interesting thing about this, is that when you create an account with your email and a password they will give you access to many useful tools, and among it is the crypto portfolio creation tool, where you can add the crypto that you have and thus have a graphical idea of the performance that your investment is having.

In addition, it also has its APP version, so you can download it to be aware of the value of your cryptos at all times, with notifications and much more.

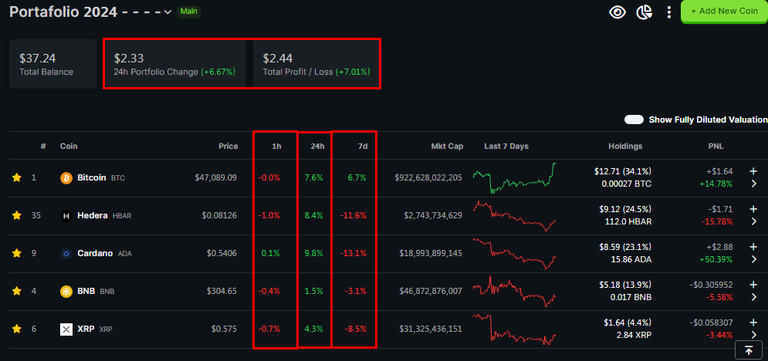

In the image I have shared above, you can see how my crypto portfolio looks like so far in this new year 2024, and you can see that it is composed of:

BTC: The main crypto in all of this, which will be for long term holding and selling just to take profits and then buying when the value drops again.

BNB: I use this one a lot, as I have some investments and projects that I follow in the Binance Smart Chain network, and having BNB in my possession is crucial for all transactions, plus it has had a good behavior as it is the native Binance currency.

XRP: Many are against this coin, but I am loyal and plan to acquire some more XRP this year as the months go by.

ADA: Another one of my favorites, although many others are not fond of it, I feel they are doing things right, just very calmly, and sometimes calm is important in the crypto world.

HBAR: This is the native currency of the HEDERA network, and lately has had a great impact and use in this network, with many transactions and a very low fee, it also promises many things that if they come to fruition can be an interesting network to explore.

This is my way of diversification, but you can make your own after researching very well.

Image created in Bing AI - Edited in Canva

Recommendations for 2024

For this 2024, I would recommend a balanced diversification between large cap cryptocurrencies such as Bitcoin and Ethereum, and emerging cryptocurrencies with high growth potential, and among those can include MEMECOINS, but you know that not all of them have a good result XD. It would also be wise to consider cryptocurrencies linked to growing sectors, such as blockchain technology and decentralized finance and NFTs that every day take more space in the crypto arena.

Although diversification does not guarantee profits or fully protect against losses, but it can be an effective strategy to manage risk and return potential in the volatile market, so it is important to keep this in mind for this year 2024, I will be talking more about my progress, or about my losses because nothing that can happen is predicted 100%, if so everyone's investments would be profits and no one would ever lose, but knowledge and good management makes the difference and you have to remember that very well.

Thank you all very much for reaching the end of my publication, and I hope you really enjoyed reading it, you can leave a comment and contribute some extra ideas that you think are important for the topic raised.

It is important to note that I am not an expert, and I only speak from my personal point of view, so you can also leave your suggestions to also improve my diversification method, and something interesting, would be to leave your opinion about my crypto portfolio. Do you think I have made a good choice for this year?

Follow me on Twitter.

English is not my native language, so I have used Hive Translator.

Posted Using InLeo Alpha