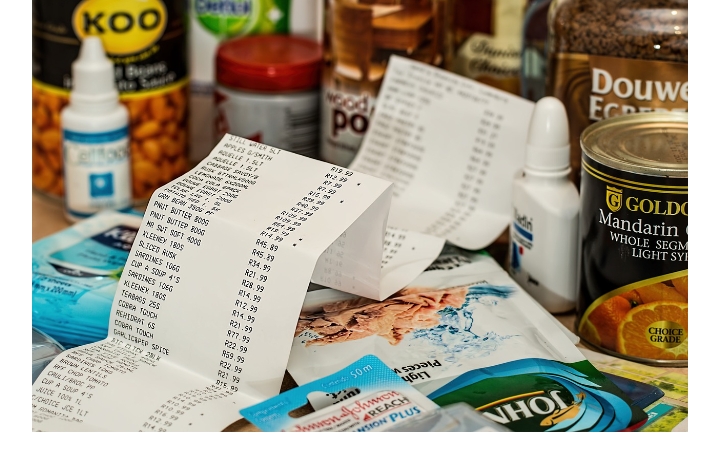

Cutting on expenses a vital way for survival

With global economies staggering, it has led to an increase in the cost of living in many places , and many would have to cut on their expenses so as to be able to strive through .

While managing your expenses is the best way to avoid debt, it can also be an uphill battle. That’s why it’s important to have a plan in place. That way, you can avoid accumulating debt by following a few simple rules. Below, you’ll find ways to cut down on your expenses, avoid financial pitfalls, and stay out of debt in the process.

To start with

MAKE A BUDGET: making a budget helps ,give you more control over your income , developing a realistic budget and sticking to it is a very vital way of cutting on expenses, and it also makes provision for saving against future occurrences.programs like spreadsheet and online softwares and apps can also prove helpful in developing a realistic budget , and also help you determine how much you make and how much spend.

REDUCE IMPULSE PURCHASE: buying by impulse is another way by which most people ignorantly spend more money than they should have spent or more than they have budgeted, a helpful tips might be this : if you see something you want to buy, instead of buying it right away, you could go home and mull it over, you probably won’t come back to that store to buy that . Before buying ask yourself,” do I really need this” and as you might be surprised to find out, chances are : you don't

source

source

ADOPT A DEBT MANAGEMENT STRATEGY:

If you have multiple balances that you need to pay off, you’ll need to develop a plan that is effective to manage your debt. Consider attending a personal financial management course to learn how to manage your debt.Some of the things you might be able to do to get to a point where you can manage your debt include:

Talking to your creditors to negotiate better rates

Consolidating your loans (loan consolidation)

Seeing if there are alternative financing solutions

Filing for bankruptcy

And most importantly, try as much as possible to avoid debt when possible ,

CONTROL YOUR MONTHLY EXPENSES AT HOME

Cutting down on monthly expenses can help save you a great deal of money, by themselves most bills may seem insignificant, but when you see the cumulative the amount can be enormous , you can cut down on unnecessary bills like

- Cable

- Excessive energy use

Also, take the time to check your credit card and bank accounts to see if you are paying any unexpected recurring bills.

IDENTIFY AND LOOK OUT FOR OTHER WAYS TO CUT ON EXPENSES

Identify little activities that can be substituted, that you spend unnecessarily on, things like; eating out may be more expensive than eating home made food, or like if you don’t go to the gym often it would be wise to cancel your membership to save more money.

DEVELOP ALTERNATIVES TO SPENDING MONEY

There might be cheaper alternative ways to do things, Like : instead of eating out which would be expensive ,you might consider going on a walk and then having a picnic, or you could

Rent books at the library instead of buying them. Try to take advantage of promotions going on in your city. For example, many cities have a day where museums are free or even half off.

Obtain Adequate Home and Auto Insurance

Be sure that you have adequate insurance on your home, its contents, and your automobiles. An individual can have major bills if they do not have adequate insurance. For example, if you were involved in a major car accident due to no fault of your own and do not have adequate insurance, you may be responsible for most of the cost of repairs and damages out of pocket.Monitoring your income can be very effective in making your budget work. Take a look at your bank statements regularly to identify where you are spending. You can also create a spreadsheet to categorize and track your expenses. This will show you what’s really costing you and allow you to start making adjustments to your expenses.source

With all these above points, we all can make progressive efforts towards limiting out expenses, and possibly help save more .

The #marchinleo is ongoing and this is a very nice opportunity to get your posts curated, so why not join.

Posted Using InLeo Alpha