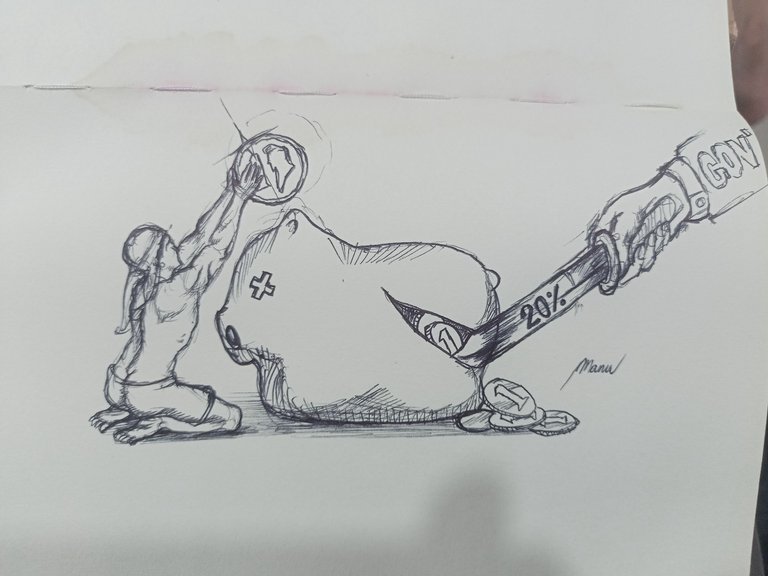

Bitter yield

I labored coins with quiet pride,

Let dreams in banks and hopes reside,

But now the hand that vowed to guard

Has taxed my trust and cut it hard.

A twenty toll on honest gain—

No crime, no trade in greedy vein—

Just savings scraped from days austere,

Now punished for the sake of fear.

You bleed the meek while giants feast,

And call it fair, this greedy beast.

What’s left for us but bitter rain,

And futures taxed for others’ gain?

Editorial on the Imposition of the 20% Tax on Bank Savings in the Philippines

The recent move by the Philippine government to impose a uniform 20% tax on interest earned from bank savings has sparked frustration and concern among ordinary citizens. For many hardworking Filipinos, saving money in the bank is a basic form of financial security—a slow and steady means to prepare for emergencies, education, or retirement. But with this new tax policy, even the modest interest earned from these savings is now subject to reduction.

This decision raises troubling questions: Why penalize those who choose to save honestly and responsibly? Why does the burden fall once again on the middle class and low-income earners who rely on banks as their safest option for managing small funds? Instead of encouraging financial discipline, this tax risks discouraging people from saving altogether.

While the government justifies this policy under the Comprehensive Tax Reform Program, the impact feels lopsided. Large corporations and wealthy individuals often find ways to shield their assets or invest in tax-free instruments. Meanwhile, the common Filipino, who deposits a few thousand pesos monthly, finds their already small interest earnings slashed further.

If the government truly aims for equitable taxation, it must consider progressive strategies that protect and empower the masses—not measures that strip them quietly through policies masked as reform.