Hive Power lending service: a win-win business

I've had this idea for a long time. Some may see it as an abomination or a redundancy, but in my head it makes sense. That's why I'm releasing it to the world to see if it catches on. It's simple, perhaps even boring, although for some it will surely be sacrilegious. It's a Hive Power rental or lending service, one that makes the lender a profit and is free for the borrower.

Before going any further, let's first look at the reasons why someone would want more Hive Power (I like to call it Voting Power, it's more intuitive):

- To grow faster: More voting power means more attention from the users you reward with your curation and more resources to post, comment, and interact, which ultimately increases your chances of having more followers and greater exposure for your content.

- Higher earnings from curation: With more voting power, your earnings from curation also grow; it's directly proportional.

So far, the possibilities of increasing Hive Power are through author earnings (what you collect from your published posts) and by Power Up (by staking Hive) directly. The first option can take a long time, the second costs you money.

Whichever way you do it, you have a problem once you increase your voting power: a lack of liquidity. To fully access that money, you have to wait thirteen weeks after Power Down (withdrawing Hive from staking). This means you could miss out on investment opportunities or be unable to cover expenses in the event of an emergency. Also, now that some are beginning to view the KE ratio (Hive Staked vs Hive Power earned) as a measure, you can be "punished" for your Power Down.

So, how can anyone can increase the voting power quickly, without it costing anything and without losing liquidity?

This is where the system I devised comes in (which I'm making available to anyone who wants to implement it on their own or join).

Let's say:

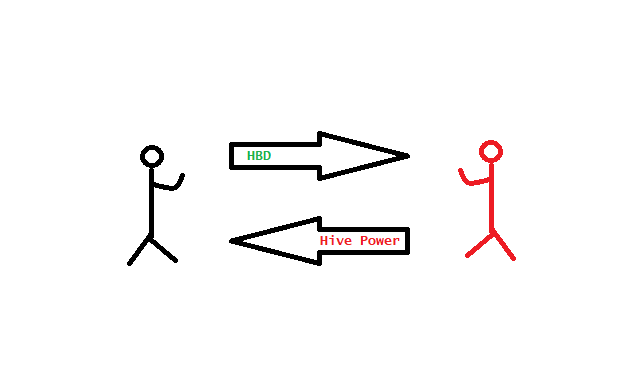

- User A needs Hive Power (HP) and sends the equivalent in HBD to User B.

- User B delegates the Hive Power indefinitely to User A until the latter requests cancellation.

- User B, to make a profit, puts the HBD in Savings and earns interest based on the APR.

- User A proceeds to enjoy their new voting power.

In this system, the person requesting the voting power has the ability to liquidate it within a minimum of 5 days (the same time it takes for a delegation to return to the owner) receive the HBD back and whitout spend a penny in the process. In other words, you have complete control over your funds and can move between Hive Power and liquid HBD with relative ease and speed. You don't have to worry about volatility or losing money on currency exchanges. In fact, volatility is your friend, as in my system the delegated amount isn't recalculated based on the Hive price. That is, the contract is fixed at the exchange price, for example:

- With a Hive price of 0.27 HBD, User A sends 13.5 HBD to obtain 50 HP in delegation. The Hive price then increases to 0.34 HBD, so the value of their 50 HP obtained through delegation increases to 17 HBD. However, the initial 13.5 HBD continues to cover the service, so their delegation does not decrease, nor does they need to send additional HBD unless they want an additional delegation, which would be calculated based on the current price.

- If the price drops, the delegated amount would not be affected either, but in this scenario, User A has the option to cancel the current delegation and initiate a new request based on the new prices.

Lenders have the opportunity to earn high interest in a stable and liquid currency by depositing the equivalent HBD in Savings, thus maintaining the capital security and the economic sustainability of the transaction. You can also continue to earn profits on your delegated voting power. Remember that HP has an approximate APR of 3%, so you can lend that extra money to other users or use it as your own. For example:

- User B sent a 1000 HP delegation. After 30 days, due to the Hive Power APR, this delegation increased to 1002.5 HP. User B updates the delegation to remain at the agreed-upon 1000 HP and recovers those 2.5 HP for personal use or new delegations.

I'm sure some of you are thinking that from the lender's perspective, it doesn't make sense because they can earn through curation or by delegating to other curation projects. However, obtaining an APR greater than 8% through curation is a very complicated task, and curation projects that deliver more than that percentage do so because they do so in Layer 2 tokens.

With this system, the lending user would receive a 15% APR in a stable and liquid currency, in addition to an extra 3% in HP.

Now, to support this idea, I'm launching the service from CANJE(I don't rule out the idea of creating a specific account for this).

For now, only 200 HP will be available for rent; sorry, I'm not a whale 😅. However, we also open the opportunity to others who want to rent their HP. How would it work?

Let's say you want to be part of the system and put your Hive Power to work in this. You would be on a list waiting for a user to request a loan. @canje would receive the HBD and place them in Savings, and you would make the corresponding delegation. Every month, CANJE would send you the interest generated less the management fee. In other words, you would earn an annual APR of 12% on the HBD value established at the time of the Hive Power loan.

If the user wanted to cancel the transaction, we would notify you so you could withdraw the delegation. If you are the one who unilaterally withdraws the delegation, if CANJE cannot cover that HP, the HBD will be returned to the user who requested the loan.

The advantage is that on the blockchain, everything is transparent, and it's easy to verify who transferred and who didn't.

The hardest part of this, I think, will be finding those users willing to rent HP, leaving the HBD as insurance. In the end, the interest generated by those HBDs in Savings is what pays the rent.

Now, imagine this scenario: one of these large whales or curation projects using this system rents 10 or 20% of its HP. It would be quite possible for them to cover their expenses with that alone without having to use Power Down to pay their curators or workers.

Of course, this system works as long as the HBD interest in Savings remains above or equal to the average interest earned per curation. That is, as long as it's above 8% APR.

The only catch is that this entire process would be largely manual. If there's a developer who wants to be part of it and/or contribute to making it as automated as possible, please get in touch. Likewise, if you liked the idea and want to implement your own, you're also welcome to do so.

Posted Using INLEO

Apúntame. Me gusta.

!BBH

Hello!

It's an interesting idea, no doubt. I'll think about it when I get a little older to appreciate it.

Good luck!

🙌

!BBH

¡Gracias por tu apoyo!

¡Es un honor para mí!

¡Abrazotes!

It's an interesting idea. I would like to join when I got more HP. For now, I'm willing to use the service but I don't have enough HBD right now.

Everyone is welcome in Both sides. Minimum of lend is 1 Hive Power, if you have the equivalent in HBD you can.

!BBH

I have some HBD but I'm saving it for other purpose. I'll join when I got more. Thank you.

🙌

Me cuadra!

🙌

!BBH

Interesting idea, but doesn't https://hive-engine.com/lease do moreless the same? You can request a loan of HP and pay with i.e. SWAP.HIVE - which doesn't really fall far from liquid hive/hbd.

I think the advantage of this method is that you can use it without the need to use another platform and the possibility to earn interests in the HBD received for the one who delegates.

Already @okarun answer it, but I will say more, this lease don't cost anything to the person that take the HP loan, they receive their full amount of HBD when they decide to end the lease.

The lender earn Through the interest receive from Savings APR.

One get "free" HP the other earn HBD with and unbeatable APR without doing Power Down.

!BBH

It's definitely a win-win situation.

Yeah, I can see that. It's not "cheap" from borrowers' point of view, compared to hive-engine leases, where IIRC you can hunt for HP leases around 9-13%. But it adds easy entry point and some token-price-fluctuation safety for sure. From lenders' point of view, it's super lazy, it's nice that unused HP can be turned into rewards going directly into HBD savings. Of course if lender wants to build up HBD savings. Otherwise, up to 30d waiting time for "claim" then 3d to transfer. Still better than powerdown time if one would try getting own rewards as HP (OTOH, one could just switch to HBD rewards I guess..). Nice, clear, idea! HE leases have their share of users, so I guess this one would have some as well

Ooh, I get it now. I see what you mean, and what could be its selling catchphrase.

However, it's not like the "lease don't cost anything to the person that take the HP loan. It costs them exactly the HBDs APR. They lock the HBD in the lease, instead of locking them in savings and getting the savings reward for themselves, so no free lunch for anybody.

However, it would be certainly easier to use than getting rewards in tokens and then having to convert, and also it's "more stable", as you get direct cost/reward guarantee (borrower knows they lose APR from those HBD they locked in the lease, while lender knows the exact HBD value of the rewards with no side token price fluctuations).. on the other hand, the lender still can't liquidate that savings-HBD for 15 days on average (savings reward paid every 30d, so avg wait time ~15d)

Great, thanks for explaining!

So, I understand correctly you are proposing a reciprocal delegation system that involves the two main coins of the Blockchain. I think it's a very interesting idea!

Basically, yes.

To implement the idea I think there is a need to create a new feature in the Blockchain, otherwise it would be to risky for the one lending the HBD. Also, it must consider compensate posible differences in the income % of curation and savings. But I think it's an interesting idea! Keep going!

At this moment need a trusth third party so I use @canje a long going business of remittance to Cuba with HIVE, HBD or LEO.

The difference between curation and Savings for the one to take the loan is cover with the chance to make liquid that HP fast. But I taking in account that most of people don't have HBD in Savings, most just swap HBD for Hive and do power up or directly spend it.

This is a niche idea, see it like another choice for people that want HP but desire the chance to make it liquid without have to wait 13 weeks.

I hear you, but keep in mind there is already ways to make liquid hive by delegating HP. I'm not saying the idea is not useful, cuz I think it is, I'm just pointing out some possible issues to deal with in the implementation.

Good strategy.

You can start with your Hive community if there is a demand. Or build one and try this.

That is the goal, already the service is avaible for those who want use it.