Disney posted solid Q3-2025 results. Turnaround is confirmed!

Hi HODLers, Hiveans and Lions,

Disney just published their Q3 Results (their fiscal year is Sept to end of August).

There were a LOT of moving pieces in this publication. Please find below some of the metrics and I'll add my 2 cents afterwards.

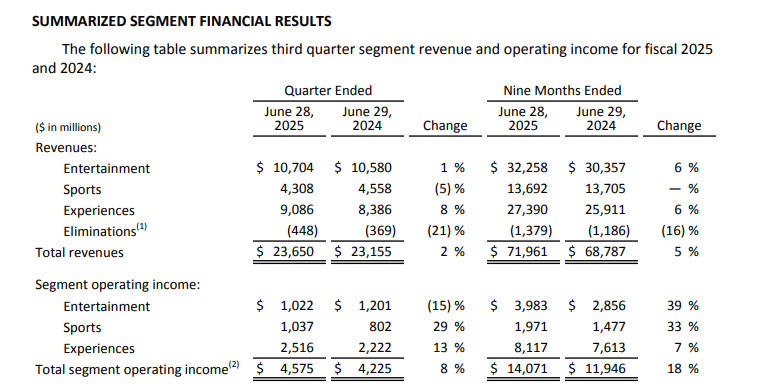

Revenues

- Entertainment $10.70B vs StreetAccount $10.81B

Linear Networks $2.27B vs SA $2.34B

Direct-to-Consumer $6.18B vs consensus: SA $6.32B

Content Sales/Licensing and Other $2.26B vs consensus: SA $2.13B

- Sports $4.31B vs consensus: $4.43B

- Experiences $9.09B vs consensus: $8.88B

Cash from operations $3.67B vs consensus: $4.00B

In summary:

- Parks and Cruise did extremely well and are expected to do well going forward

- Sports was under pressure as customers are cancelling their cable, etc.. but new deals were signed with the NFL and WWE for upcoming content to be distributed through the new ESPN Streaming Product which they will release end of August

- Streaming business added some new users but nothing exceptional, this could be seen as a little disappointing.

Overall, I felt as most professional financial analysts that this was a very solid Q3 and that the Disney turnaroudn which started 9/12 months ago is strongly continuing. I have confidence that Disney's share price is going to be substantially up over the next few months/years.

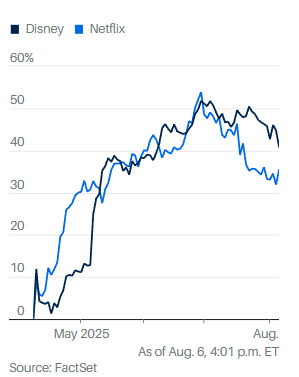

$DIS and $NFLX Performances since the tariff pause

Author's latest publications:

Posted Using INLEO

0

0

0.000

https://www.reddit.com/r/Economics/comments/1mjqznw/disney_posted_solid_q32025_results_turnaround_is/

This post has been shared on Reddit by @davideownzall through the HivePosh initiative.

Good News the mouse is back!

The mouse is back and it ain't woke anymore.

It's just looking to make more cheese!

🐭😅✊🏻

Disney still showing some solid returns. A good one indeed, let's hope they find a way to blend in with what AI has to offer or they may see lots of red candles in the coming future. Never an easy task to run and maintain a big company

AI and future copyright issues are a big thing to watch out.

Kudos for pointing it out, people usually dismiss this.

Take care and thank you for the comment!

Congratulations @vlemon! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Great post! Disney's Q3 was overall positive and once again demonstrates its ability to reinvent itself and capitalize on its strengths. You know I've never considered investing in Mickey Mouse, but I might change my mind. Thanks for showing us this company. !PIMP