Credit Default Swap are mooning! Indicating trouble ahead...

Hi HODLers, Hiveans and Lions.

Japan Stock Market just opened and it is a continuation of last week's bloodbath. The NIKKEI opened down more than 6% as I am writing this article.

One thing that investors and personalities I followed have been talking about are Credit Default Swap also known as CDS.

CDS Definition

A credit default swap (CDS) is a contract between two parties in which one party purchases protection from another party against losses from the default of a borrower for a defined period of time.

A CDS is written on the debt of a third party, called the reference entity, whose relevant debt is called the reference obligation, typically a senior unsecured bond.

In every day words, you get paid if the underlying company or asset defaults on their debt.

Following the recent consumer confidence numbers and slowdown of the economy, the CD have started raising. The current market shock of the crazy 'Trump Tariffs' have increased volatility across the board but also the probability of a recession.

Kalshi's prediction markets are pricing a recession at around 58% today!

Recession means more businesses in trouble and more going bankrupt, therefore CDS has shot higher.

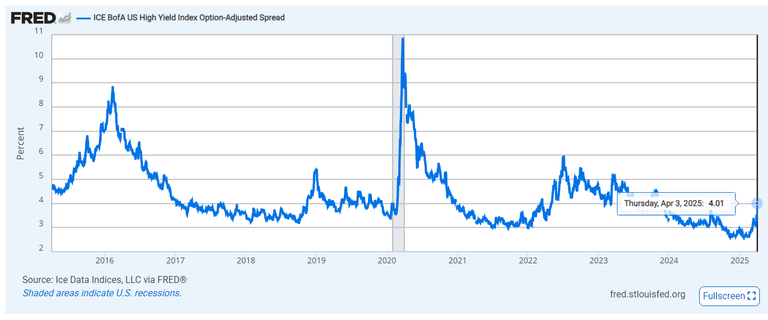

10 Years Credit Default Swap

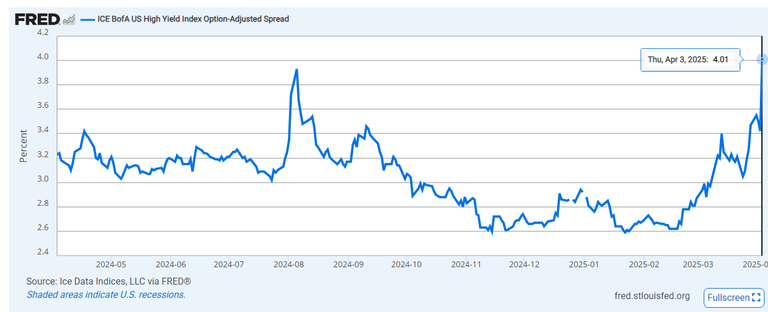

1 Year Credit Default Swap

Let's see what happens next but this has a strong deja vu feel of 2008 and 2020!

Stay safe out there,

"So it begins..." The Trade War which could trigger the next recession!

Lululemon is the bellwether of the US Economy! And it published a bad Q4...

Posted Using INLEO

https://www.reddit.com/r/Economics/comments/1k4l2lv/credit_default_swaps_up_sharply/

The rewards earned on this comment will go directly to the people sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.