USDC is an Important Part of LEO Tokenomics | Road to $30

Saving and investing is extremely important. In practical life, we have expenses that we have to take care of. If the savings and investments are not in fiat, we have to sell the cryptocurrencies or any other asset that we have invested into. When this is happening in a bear market, the selling happens even around the market bottom. It is certainly not a fun experience to have the right expectations and investments and still become unable to survive long enough without "needing the money" to exit profitably.

Price is Supply vs Demand

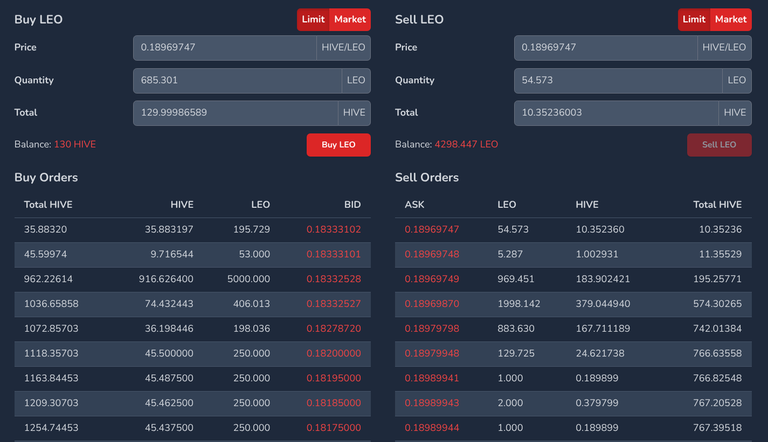

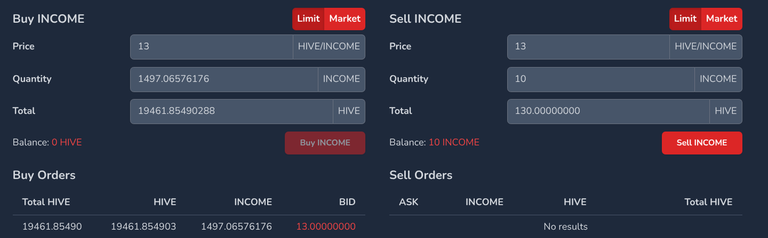

Above is the orderbook on HIVE-Engine when I bought 130 $HIVE worth $LEO today. I gained the HIVE from INCOME Token shutting down. I loved being part of the project and I certainly wasn't happy to see it go. @ecoinstant is the best community builder on HIVE I have seen. He is continuously working on other projects. I'm sure the energy spent on INCOME can now go into other amazing work. Since there was a large buy wall generously setup, exiting at a profit was very easy.

Imagine the orderbooks were arranged differently in these scenarios. The same order would have created vastly different price movements. In the case of XYK pricing model commonly used in Liquidity Pools, the price changes are more predictable. If the selling pressure and buying pressure are the same, the price move sideways. If you cut down on selling and increase the buying, you are going see the prices go up. To make the matters even better, LEO is deflationary!

HODL $LEO to Get Tokens To Sell

HIVE had this type of system created almost a decade ago. The liquid earnings for the users are given in HBD which is a decentralized stablecoin that is pegged to USD. When authors cash out their liquid Rewards, it does not create any selling pressure on $HIVE. Those who stake used to get earn liquid LEO and the same LEO Token was distributed as part of @leo.voter delegation rewards.

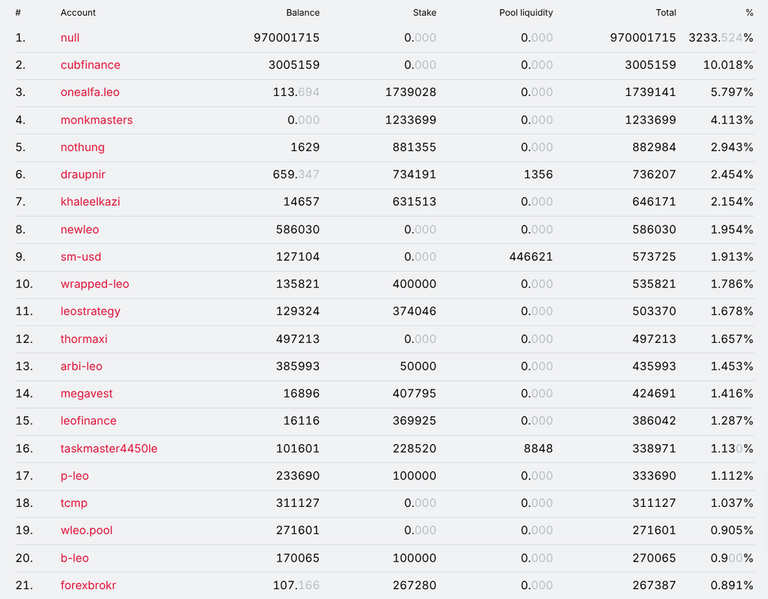

A large number of top $LEO holders are long term believers, part of the team or part of the Protocol controlled funds (including wrapped versions of LEO). Many of us are experienced traders and have seen enough things to make us want to take some profits. The more profits we take, harder it is on the price of LEO. Having a constant stream of stablecoin income fixes this. I originally thought USDC was not as good of an idea compared to $RUNE $LEO $CACAO Rewards.

After thinking things through, I have come to realize that paying sLEO (staked LEO) holders on Arbitrum in USDC is one of the best decisions made regarding LEO Tokenimics. The value of this decision will become more apparent during the bear market IMO.

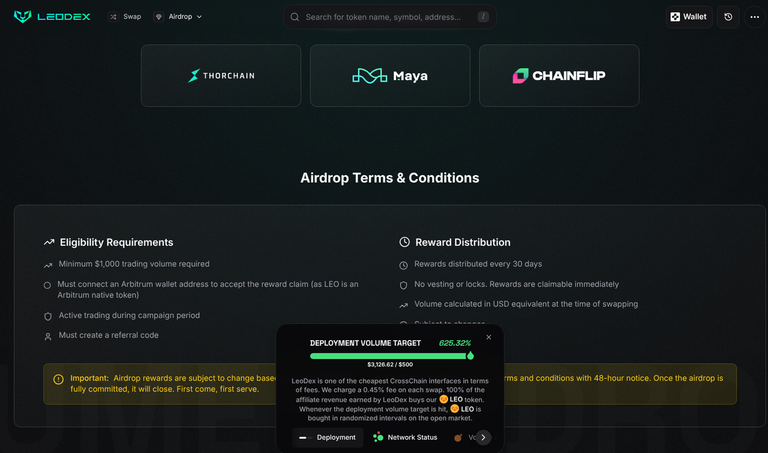

Airdrop Has Strict Conditions

The requirements make sure that the Airdrop receivers are very likely to bring value to LeoDEX. There is no point allocating 2.5 million out of a 30 million supply to group of Airdrop hunters who will only sell the Token. The promotion received from this 2.5 million LEO allocation should make up for the added selling pressure. See how there is $3,126.62 waiting to purchase $LEO. These continuous purchases at random intervals will continue for 63 days more days.

After that, the rewards given to sLEO holders will be in USDC. These sLEO holders include the Protocol Owned Liquidity. These USDC will then be used to buy more LEO and stake as sLEO to continue the flywheel. What other sLEO holders do with their USDC is none of our concern. The only way they could affect the price of $LEO is by buying it increasing the price. Imagine what the dynamics would have been if sLEO was rewarded in more LEO.

Ranking 7th on xScanner

LeoDEX occasionally makes it to Top 10 and often this is thanks to a transaction through @mayaprotocol that involve a cryptocurrency like ZEC where LeoDEX was the first UI to support the asset when it was added. First mover advantage is extremely powerful. Most of the world's population have not used a DEX. LeoDEX can have the first mover advantage on those users with LeoDEX playing a significant role.

A Small Suggestion

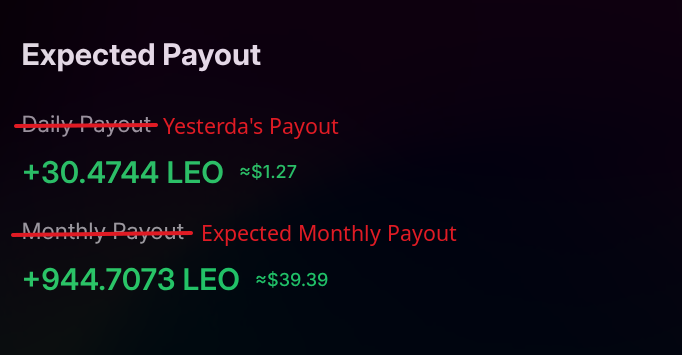

The old payout calculations on Dashboard does not seem to work accurately for me. The new system powered by buybacks through curation revenue is working great under the hood. We need to polish the front end to provide a more accurate picture of what the numbers are for the users who delegate to @leo.voter. I highly recommend becoming a delegator as a way of Dollar Cost Averaging (DCA) into $LEO at a zero risk. The only thing you could possibly loose is the Curation Rewards from your HIVE Power.

LEO Price Has Barely Done Anything

A 94.1% ROI (not counting curation income) is very impressive. WE have seen even steeper climbs (and falls) during the past year alone. The current prices are not very high either. If $LEO was $30 today (a valuation inspired by @onealfa), we will be the 131st biggest cryptocurrency on @coingecko. Funnily enough Radium (a prominent Solana DEX) occupies that position at the moment. We can 600X Token price by working together to bring in more revenue. As a final parting, I will leave my investment thesis. It is very simple to the point your typical middle schooler should be able to understand. All we have to do is continue to build this vision.

LEO: A Simple Investment Thesis Backed by Real Revenue

Posted Using INLEO

Congratulations @vimukthi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 72000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPGOod breakdown of everything going on with Leo and LeoDex

Could link that leaderboard you are using to track LeoDex ranking?

This one only tracks @mayaprotocol and THORChain revenue: https://xscanner.org/interfaces

This is for Chainflip: https://scan.chainflip.io/brokers/cFLvH2ZA3J5dsDdrDuV1Eyh9Jk6yasijtKQagGhMDKoKBU3pc

Thanks man

I'm happy to help those who want to learn more about LEO. We have an amazing project with an amazing community.

Great post and great topic. This article clearly demonstrates the importance of building sustainable ecosystems. I've lost sight of this project because I find the user interface cumbersome, but your post made me want to take a look at the project and revisit the InLeo and LeoDEx front end. !BEER

View or trade

BEER.Hey @vimukthi, here is a little bit of

BEERfrom @stefano.massari for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.View or trade

BEER.Hey @vimukthi, here is a little bit of

BEERfrom @stefano.massari for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.