All Models Are Wrong; Some Are Useful

I have had both great successes and great failures in cryptosphere. At one time, I was at a point where I could retire, yet I ended up messing it all up due to too many risky maneuvers. I have grown with the experience and I have taken those lessons to into my mind. I do think I am a much better trader now. Yet I trade far less than I used to. Day trading takes far too much time that I could be using for other things (some related to finance and others completely unrelated).

My financial activities are more focused on the long term results. I do the occasional day trade when I see a good opportunity. I only use a tiny part of my portfolio for that. This is more of a restriction brought by my staking of assets. When I make trades for the long term, I care for both fundamentals and technical indicators. My 8 years of trading experience has shown me that short term trading is more about Technical Analysis than fundamentals. Hype and FUD can easily distort the markets. What is difficult is keeping up with the illusion and maintaining it without strong fundamentals.

30 Indicators in One Place

Relying on a single indicator is a bad idea. It is possible to get few wins and profits based on a single indicator. Then comes a time when the indicator flash the exact opposite of what is going to happen and the trade ends up in a disaster. Having several indicators with few of them being completely unrelated can help to mitigate this issue. Having a large number of useful indicators at one place can greatly help the decision making process.

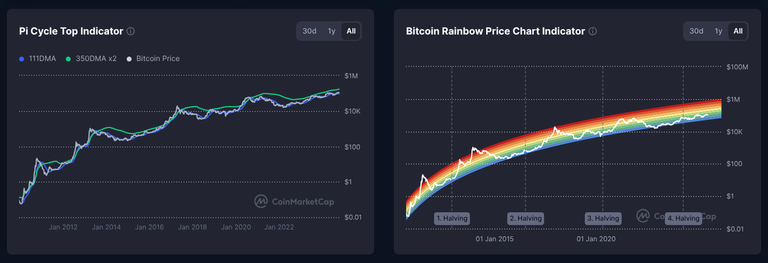

Crypto Market Cycle Indicators is a very good place to start. CoinMarketCap is owned by Binance and it has the most amount of visitors coming to check prices out of any similar website. CoinMarketCap knows what is popular and it knows what typical cryptocurrency investor is looking at. When they compile a list of 30 indicators, there is going to be even more eyes on these already popular indicators.

We Close to The Market Bottom

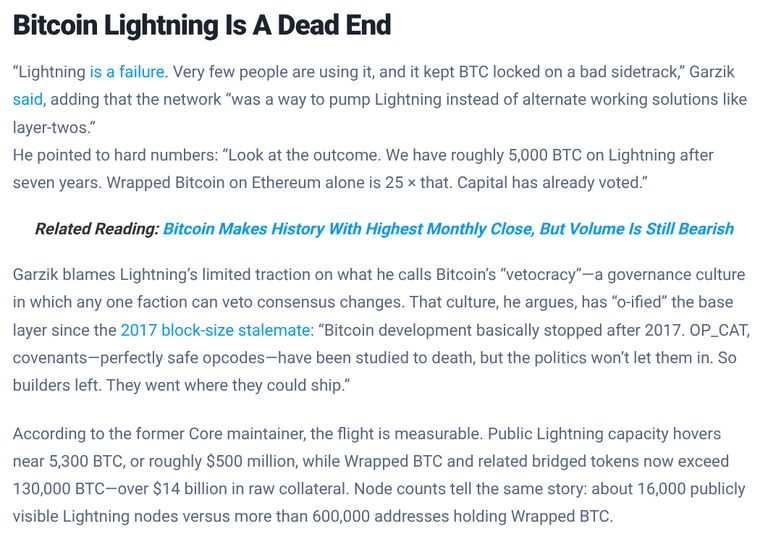

The above indicators are focused on $BTC and we have seen time and time again that Altcoins reach their market top much later. BTC is running high based on government + institutional adoption. BTC has been technologically stagnant for a long time. If anyone needs to get things done, they will have to look towards smart contracts.

Above are some quotes Jeff Garzik had to say about BTC. He first committed code to Bitcoin Core in the middle of 2010. He has a great deal of expertise regarding how BTC work. He is focused on Layer 2 projects on BTC. We have already seen Runes and Ordinals create massive levels of hype, financial activity, and skyrocketing Token prices only to have things crash down. Existing smart contract platforms purpose built for the task with already massive developer activity can solve the problems businesses have with much less effort.

EVM has the most amount of development because of its first mover advantage. I have a great deal of hope for Wasm smart contracts as they do not require much blockchain or cryptocurrency specific knowledge. Wasm has a strong and mature developer ecosystem spanning some of the biggest Web Apps in existence. Made with WebAssembly has a long list of projects made with Wasm. Take a look at Koinos which is one of the best designed projects in cryptosphere created by the people that coded most of what has become HIVE.

Refer to The Indicators

The indicators are yet to reach the reference values. Many of them far away and we are mostly looking at indicators around BTC. As per this model we have not reached anything interesting or risky in terms of price. One indicator could easily be wrong. 30 of them being wrong at the same time is extremely unlikely.

The Self Fulfilling Prophecy

There is going to be millions of traders looking at these indicators. Some will trade based on these indicators and other will trade based on the assumptions that millions of other traders will be relying on these indicators. Once half of the indicators are signaling market top, it would be advisable to start unstaking and get ready to take profits. Getting yourself retired first is a better goal than making yourself rich. I know I could manage to retire on $200 per month by being frugal. After that I can take more risks without worrying about paying the bills.

One Final Chart

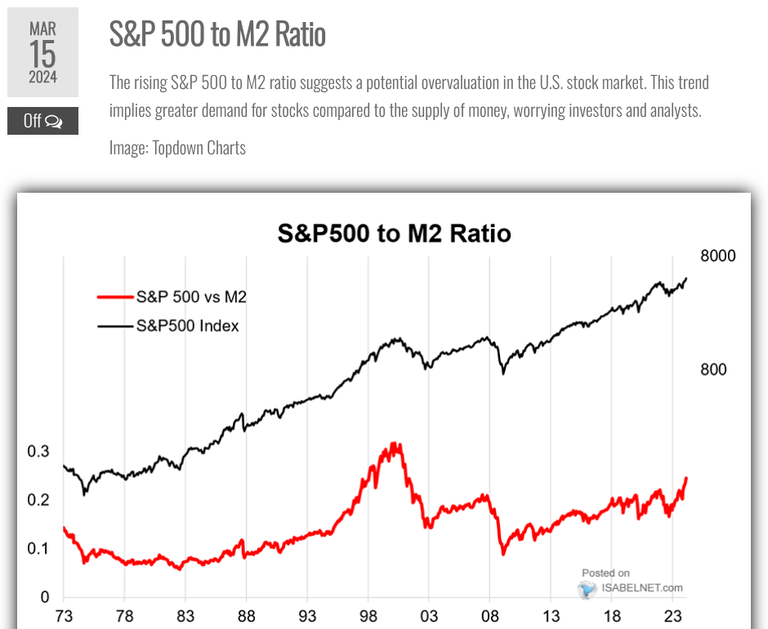

Although we wee S&P 500 keep going up in value, when you factor in the growth in money supply, we are yet to reach the peak of Dotcom Bubble. We had so much growth in M2 during COVID-19. Federal Reserve of USA increased M2 by 40%. It should not be a surprise that BTC reached a new All Time High so early. It was merely seeing the effects of inflation.

Best of Luck Trading!

Posted Using INLEO

I use a multi indicator thing as well to tell where we are at in the market.

https://colintalkscrypto.com/cbbi/

Everything pretty much points to having that extra surge for BTC. I'm personally only banking on 120K but like you said with all the massive amounts of printing we can see the repercussions of that still hit the markets before the bubble bursts.

I like your thinking about the minimum it would cost you to survive each month currently. Our scammy monetary system gets us chasing to higher numbers as inflation erodes at real value. I don't compromise on health and nutrition. I always try to eat good food, get plenty of sleep, lift heavy, and control my time as much as possible.

All the things beyond that are extra for me.

I don't compromise that much on health and nutrition. I should upgrade my bed, chair etc. and get some supplements when necessary with bull market earnings. Due to the extreme levels of inflation we have seen, I expect BTC to at least cross $150,000 and reach $300,000 in a best case scenario where traditional finance pump their own bags to dump on retail FOMO.

Thank you for sharing your multi indicator. I checked out some of them individually. They are great!

Please, your Trading experience is it with Futures or Spot? 👀

I trade spot because I don't have to worry about liquidations.

Cool. I've only been trying Futures, it's been so brutal 🤣🤣. I think I have to force the patience for spot from now on or something.

It takes time refine your trades, build discipline and learn more about the tools and indicators. Best of Luck!

Thank you! And thanks for this information about the 30 indicators, I've checked it out and I'd give it more attention with time 🤝

VSC smart contracts are built with Wasm! Maybe that's a good sign for the adoption of VSC.

I didn't know about the indicators from CMC. Useful!

I learned about Wasm because of Koinos. Having a technology that is widely used all over the web on high performance web apps can be a super power. Koinos had infrastructure in place to allow developers to code in TypeScript or C and have them converted to Wasm. In fact Wasm is a compilation target for programming languages languages. VSC could theoretically support smart contracts in any language as per my understanding.

Any language that supports Wasm, from my understanding. At least, in the beginning.

This was a brilliant and thought provoking read, @vimukthi! 📊🧠 The phrase “all models are wrong, but some are useful” truly captures the essence of navigating complex systems like crypto and economics. I appreciate how you broke it down with clarity it’s a great reminder that while no model is perfect they can still guide us in meaningful ways if we understand their limitations.

Nice