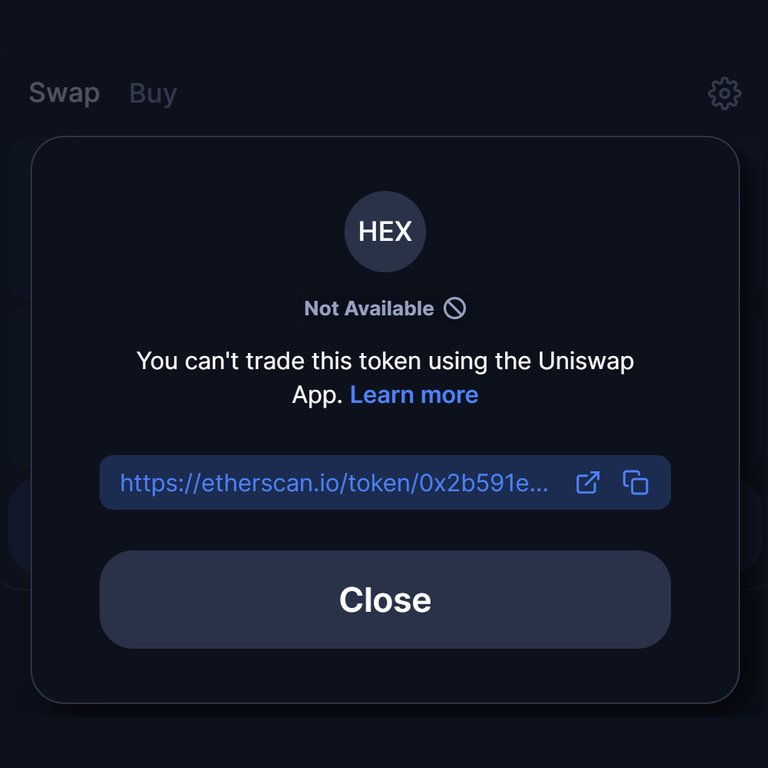

Uniswap is not decentralized, this is a no-go, they pulled HEX because Richard Heart was sued by the SEC without court order or judgement, is DeFi a scam?

Man kann von Richard Heart halten was man will, aber der Fall zeigt auf, dass Uniswap nicht dezentralisiert ist.

Das Swappen von HEX wurde entfernt, weil die SEC Richard Heart wegen Wertpapier-Betrug geklagt hat.

Bei einem echten dezentralisierten Protokoll müsste so eine Klage (nicht Urteil) keinen Einfluss auf die Trading-Paare haben.

HEX hat als einer der ersten auf Ethereum einen Time-Locked, extern geprüften Smart Contract implementiert, der es HEX-Besitzern erlaubte, HEX für eine bestimmte Zeit gegen Zinsen zu staken. Das war zur damaligen Zeit innovativ und hat viele Nachahmer gefunden.

HEX wurde ursprünglich an Bitcoin-Stakeholder ausgeschüttet (Claimdrop) und es gab auch die Möglichkeit ETH in einen Pool gegen HEX einzuzahlen, der direkt an Richard Heart ging.

Ein ähnliches Konzept gab es auch bei Pulsechain. Man musste ETH "opfern" (an eine Pool überweisen), um dann später beim Launch einen Anteil an den PLS-Tokens zu erhalten. Das haben viele gemacht, noch lange bevor die Pulsechain gelauncht wurde.

Richard Heart wird vorgeworfen einen nicht lizensierten Wertpapierhandel zu betreiben und mit dem eingezahlten ETH-Kapital zum Beispiel den Kurs manipuliert und für persönliche Zwecke verwendet zu haben.

Die Vorwürfe sind sicher nicht ganz unbegründet, aber ich würde es eher eine Art transparenten Scam nennen, der sich kaum von den meisten anderen DeFi-Projekten unterscheidet.

Eigentlich wussten HEX-Investoren immer recht gut Bescheid, wie HEX funktioniert und was einen erwartet. Und der teure Lebensstil von Richard Heart war ja auch offensichtlich.

Die Frage ist, ob es dann überhaupt ein Betrug in einem nicht regulierten Markt ist und ob HEX wirklich ein Wertpapier ist.

Jedenfalls sieht man den Einfluss der SEC auf Uniswap und dass das De in DeFi der eigentliche Scam ist.

Was sagt ihr dazu, dass Uniswap ohne Urteil und richterlichen Beschluss das Handeln von HEX entfernt hat?

Uniswap removed HEX

https://twitter.com/sunnydecree/status/1686638300113588224

https://twitter.com/hopperlife/status/1686905999058403330

https://twitter.com/yourfriendSOMMI/status/1687272755782430720

https://twitter.com/HEX_Buzz/status/1687223121269444608

https://twitter.com/vikisecretscom/status/1686778792197472262

SEC Charges Hex Founder Richard Heart With $1 Billion Unregistered Securities Offering

https://decrypt.co/150677/sec-charges-hex-founder-richard-heart-1b-unregistered-securities-offering

English

Regardless what you think about Richard Heart, this shows that Uniswap is not decentralized.

The swapping of HEX was removed because the SEC sued Richard Heart for securities fraud.

In a true decentralized protocol, such a lawsuit (not verdict) would not have to affect trading pairs.

HEX was one of the first on Ethereum to implement a time-locked, externally audited smart contract that allowed HEX holders to stake HEX for a set amount of time in exchange for interest. This was innovative at the time and has found many imitators.

HEX was originally distributed to Bitcoin stakeholders (claimdrop) and there was also the option to deposit ETH into a pool against HEX that went directly to Richard Heart.

There was a similar concept with Pulsechain. You had to "sacrifice" ETH (transfer it to a pool) to then get a share of the PLS tokens later at launch. Many did this long before Pulsechain was launched.

Richard Heart is accused of conducting unlicensed securities trading and using the deposited ETH capital to manipulate the price, for example, and use it for personal gains.

The accusations are certainly not completely unfounded, but I would rather call it a kind of transparent scam, hardly different from most other DeFi projects.

Actually, HEX investors always knew quite well how HEX worked and what to expect. And Richard Heart's expensive lifestyle was, after all, also obvious.

The question then is whether it is even a scam in an unregulated market and whether HEX is really a security or not.

Anyway, you can see the SEC's influence on Uniswap and that the De in DeFi is the real scam here.

What do you guys think about Uniswap removing HEX's trading without a judgment or court order?

Live your Secrets and Hive Prosper 🍯

xx Viki @vikisecrets

Ich weiß gar nicht, was von beidem ich schlimmer finde. 😅

😂

Unless the protocol is anonymous, decentralization is impossible. States will find you and force you to do their bidding.

SEC is always wanting to do something...lol

I wonder why it is like that...

I think this is another bad news

This is worrying and more necessary a real decentralization.

hmmm.. im not really familiar with HEX. maybe uniswap doesnt want to be involve with the issue of HEX?

OMG- krass das man das so einfach delisten kann/ tut.

!BBH

@vikisecrets! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @thehockeyfan-at. (1/1)

what is not expressly prohibited is not fraud. Even if it is unethical etc

!DHEDGE

This post has been selected for upvote from our token accounts by @valggav! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.bee

- @dhedge.pob

@valggav has 0 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends and gain access to upvote rounds on your posts from @dhedge. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.

I think Hex is a scam but I don't agree with Uniswap's decision. It's definitely not decentralized but it's just one exchange taking down HEX right? There is still plenty of other exchanges on ETH for them to use it right?

According to coingecko Uniswap was the only "decentralized" exchange offering HEX, but there are other CEXes of course where you can trade HEX as usual.

Stumbled on this post because someone sent me the link. Sharing my 2 cents about the Uniswap thing.

What you wrote above is only related to the Uniswap frontend. They have "hidden" the pool on their website and I think they have the rights to do so if they believe this is in the best interest of the platform. We have to do the same on PeakD if we receive an official DMCA request for a post as there are legal implications if we don't take action.

The good news is that the underlying protocol is where you have decentralization and if you are skilled enough to cast the transaction manually the swap still happens as the system and the nodes will process the transaction as always. More details here:

https://twitter.com/ercwl/status/1686532835232915456

thx for pointing out the important distinction between front-ends and backend, but still they disabled HEX trading without court order, I think Uniswap lacks alternative front-ends also.