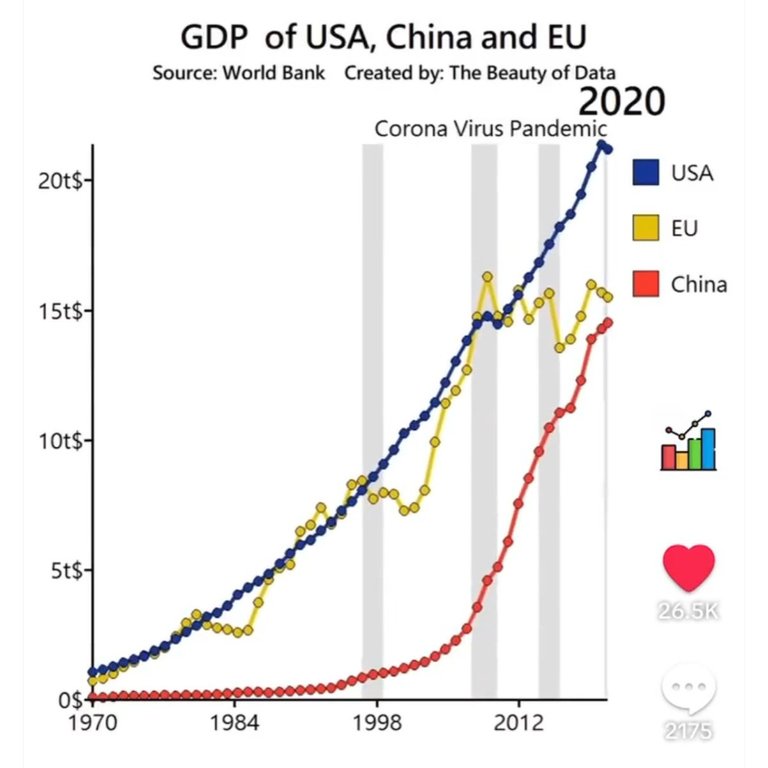

GDP US, EU and China: Why did GDP skyrocket since Corona?

Warum ist das BIP der USA seit Corona explodiert?

Wenn man sich die Entwicklung des BIP der USA betrachtet, hat man das Gefühl, dass jede Krise kurzfristig für einen Einbruch der Wirtschaftsleistung sorgt, aber es danach wie durch ein Wunder steil bergauf geht, während Europa eher stagniert.

Der Grund dafür ist die permanente Geldmengenausweitung (Inflation) und die US-Dollar-Hegemonie als Weltwährung, die es den USA erlaubt, den Dollar auf Kosten anderer Länder zu inflationieren und damit deren Rohstoffe und Produkte billig aufzukaufen, was dort ebenfalls für ein reales Wirtschaftswachstum sorgt (China).

Das heißt wird in einer Krise die Geldmenge inflationiert, um zum Beispiel Corona-Subventionen zu zahlen, steigt das nominale BIP in Folge, obwohl die Wirtschaft in Wirklichkeit still steht und der Wohlstand real sogar schrumpft.

Die Darstellung ist daher verzehrt und auch die offizielle BIP-Statistik ist mit Vorsicht zu genießen, da der Staat gerne die Inflation unterschätzt, um besser dazustehen.

Was sagt ihr zum BIP-Wachstum der USA und zur Stagnation in der EU? Denkt ihr, dass China die USA überholen wird?

GDP US, EU and China

https://twitter.com/WallStreetSilv/status/1686477414849781760

English

Why has US GDP exploded since Corona?

If you look at the development of the GDP of the U.S., you get the feeling that every crisis causes a short-term slump in economic output, but afterwards it miraculously goes steeply uphill, while Europe tends to stagnate.

The reason for this is the permanent expansion of the money supply (inflation) and the hegemony of the U.S. dollar as the world currency, which allows the U.S. to inflate the dollar at the expense of other countries and thus buy up their raw materials and products cheaply, which also ensures real economic growth there (China).

That is, if the money supply is inflated in a crisis, for example to pay Corona subsidies, nominal GDP rises as a result, although in reality the economy is at a standstill and wealth is actually shrinking in real terms.

The presentation is therefore skewed and the official GDP statistics should also be taken with a grain of salt, as the government likes to underestimate inflation in order to look better.

What do you think about the GDP growth of the US and the stagnation in the EU? Do you think China will overtake the US?

Live your Secrets and Hive Prosper 🍯

xx Viki @vikisecrets

Inflation no longer includes things like food prices in the US... Things are much worse than the graphs will indicate. Wealth is shrinking but statisticians know how to make a recession look like a boom!

Haha, yeah recession looks like a boom with inflated GDP data 😂

!BBH

@vikisecrets! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @thehockeyfan-at. (1/1)

each currency is only virtual. Value is in material things. therefore money is not important. He who has a monopoly on violence has power.

The GDP is not a good indicator to know the economic health of a country.

I don't think anything will replace the dollar for at least a decade. There is just trust in a system and the US dollar is still there. I do think that there are alternatives happening and the Bank of Japan can definitely hurt the US dollar with what they are doing. The government officials are out of control currently.

Even at Hive we trust the Dollar.

I believe this is not only happening in the United States but every part of the world. In my country too, the rate of inflation has gone high. Things are way too expensive than before and a lot of people can no longer afford what they used to...

Everything looks so much rosier with faked data. Chairman Mao's Great Leap Forward looked good on paper but was in reality many steps backward as tens of millions starved to death as a result.

I have a slightly different point of view. There are considerably less strict business laws in America than here in Europe. American children are more enterprising than European ones. (In America, a child can work for money in the neighbor's garden or deliver newspapers. This does not exist in Europe.) How many Europeans and how many Americans are among the 100 richest people in the world? I'm afraid America deserves its faster growth. Although some monetary and fiscal manipulations may be there. Are they not in Europe?

Good point, I think it is certainly a combination of that, US being more economically open, different mindset, I think in the EU the inflation went more into real estate prices and other assets and less into the GDP.

Im Prinzip handelt es sich bei beiden Ländern um Staatswirtschaft. China ist natürlich schon viel weiter, aber die USA holen auf. Leider sagt das GDP nichts darüber aus, wie es der Mittelschicht geht. In den USA und auch in der EU schrumpft sie, in China ist sie vielleicht noch ein bisschen im Wachstum, allerdings in einem sehr engen Korridor der staatlichen Vorgaben.

In den nächsten Jahren wird sich die Krise des Geldsystems entladen, und dann steht die Alternative zwischen Rückkehr zu einer stabilen Währung oder völligem Sozialismus zur Entscheidung an.

China is going to over take the US in the coming future. The US has a debt of over 31 trillion. $ is gonna crash.

!LOL

!SLOTH

!BEER

Learn more about the SLOTHBUZZ Token at Sloth.Buzz and consider sharing your post there or using the #slothbuzz next time

(1/1)

lolztoken.com

and accidentially won the Tour de France.

Credit: blumela

@vikisecrets, I sent you an $LOLZ on behalf of dotwin1981

(8/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

Inflation is simply an unavoidable tax put up by governments to control their budget, and the power of a fiat currency is all about how many lies you can make other people and countries believe ...