Are we going through a Market Bubble?

The world economy is on strong rise since Post Pandemic. However, inflation rate is also a stable rate around the world if not alarming. The US dollar grew exponentially strong in the past couple of years as the global debt rise.

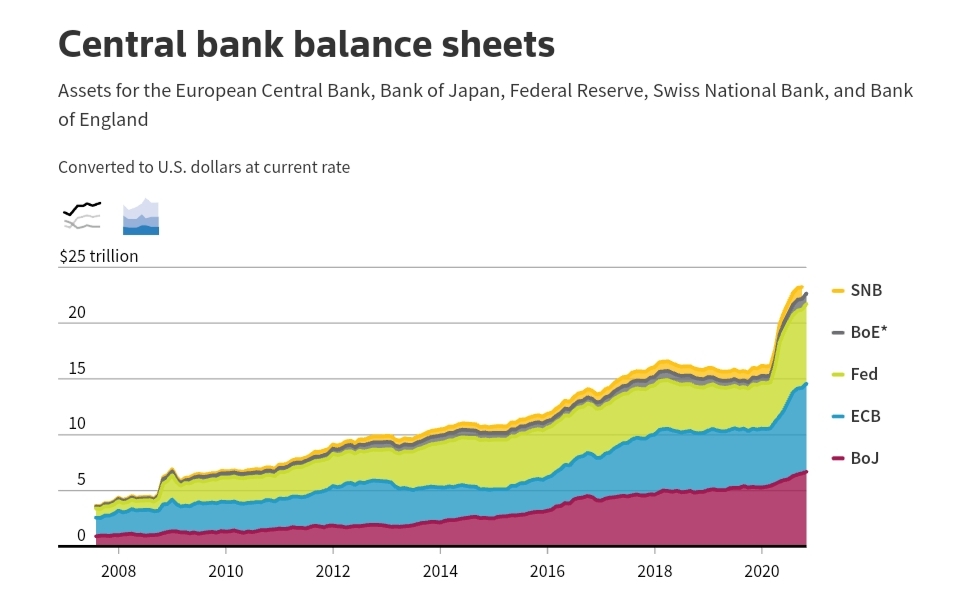

As wee can see above ,the balance sheet of Central Banks, there is high spike after 2020 owing to world economy preventive measures after the slow down of economy. The governments increased the money flow by printing more money. The above continuous increasing trend of the holdings of Central Banks is a indicator for investors that no matter how the Global scenario changes. Whether it is Pandemic or War, things always comes back to normalcy and when this happens, the government needs more money in their holdings to control the inflation. The Macroeconomics not only shapes the Global economy but also choices of investors in the long term. We can predict as per the past records that the World economy is going to see a stable growth in atleast two decades to come if not more. This scenario is not only the case in Fiat Currency.

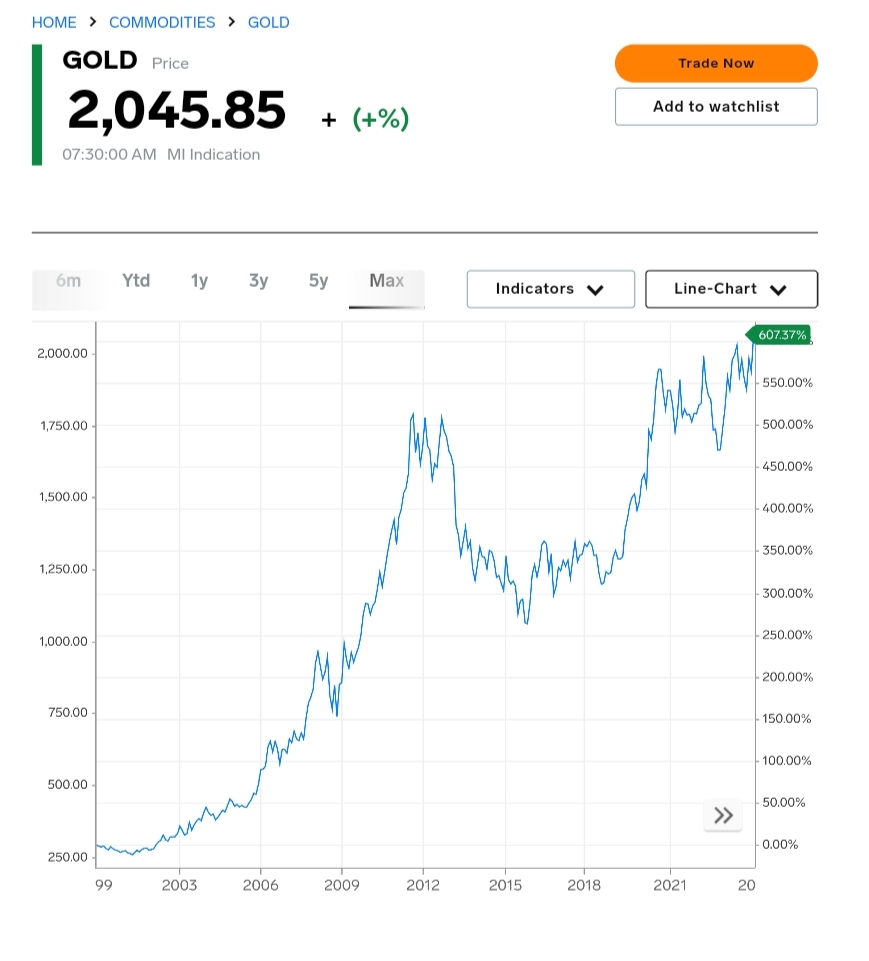

The Gold prices have also touched their all time high after a sharp dip in 2020 due to covid. The market scenario during covid somewhere strengthened the governments holding in Gold and seeing it's past records, it is uncertain if there gonna be major slowdown in Central Banks Gold Holdings.

If we see around the Stock Markets, we see all time high growth 📈 in most of the index. But there might be some correction given the rising global debt and high money flow in the world economy. I have been investing in Indian Stock Markets from last two years and since than the index has been rising continuously.

At this high Indices of Stock Markets and High Gold Prices, choosing the one can be confusing. But there are many who always prefer physical assets owing to unpredictability of money market. So, What do think about current Market scenario?

Posted Using InLeo Alpha