U.S. Senate Advances GENIUS (Stablecoin) Act

KEY FACTS: On May 19, 2025, the U.S. Senate voted 66-32 to advance the GENIUS Act, a bipartisan bill introduced by Senator Bill Hagerty to establish the first federal regulatory framework for stablecoins, digital tokens pegged to assets like the U.S. dollar. The legislation, which requires stablecoin issuers to maintain 1:1 backing with high-quality assets and strengthens consumer protections and anti-money laundering measures, overcame earlier opposition from Senate Democrats concerned about President Trump’s cryptocurrency ventures, including his family’s USD1 stablecoin. Revised provisions addressing ethics, Big Tech restrictions, and enhanced safeguards persuaded 16 Democrats to support the bill, setting the stage for Senate floor debate and a potential vote by Memorial Day.

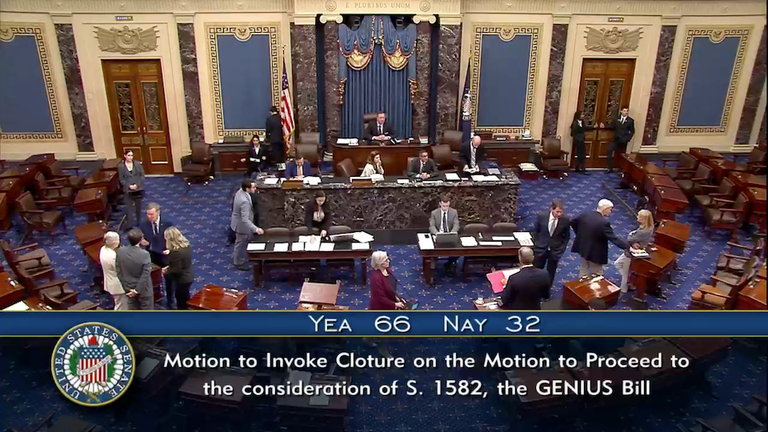

The US Senate voting 66-32 to advance debate on the GENIUS stablecoin bill. Source: US Senate

U.S. Senate Advances GENIUS (Stablecoin) Act

The U.S. Senate voted 66-32 on May 19, 2025, to advance the Guiding and Establishing National Innovation for U.S. Stablecoins Act, commonly called the GENIUS Act. The procedural vote, which invoked cloture to end debate and move the bill to the Senate floor for further discussion, marks a critical milestone for the legislation aimed at establishing the first federal regulatory framework for stablecoins—digital tokens pegged to fiat currencies like the U.S. dollar. This development comes after a tumultuous journey for the bill, which faced significant opposition from Senate Democrats earlier in the month over concerns tied to President Donald Trump’s extensive cryptocurrency ventures.

262 (66-32)

Agreed to

On Cloture on the Motion to Proceed: Motion to Invoke Cloture on the Motion to Proceed to S. 1582; A bill to provide for the regulation of payment stablecoins, and for other purposes.

S. 1582

May 19

Source

The GENIUS Act, introduced by Republican Senator Bill Hagerty of Tennessee on February 4, 2025, seeks to create a comprehensive regulatory structure for stablecoin issuers in the United States. Stablecoins, which are designed to maintain a stable value by being pegged to assets like the U.S. dollar, have grown into a $250 billion market, playing a pivotal role in cryptocurrency trading, cross-border payments, and remittances. The bill requires stablecoin issuers to maintain a 1:1 backing with high-quality assets, such as U.S. dollars or Treasury bills, and includes provisions to enhance consumer protections, strengthen anti-money laundering (AML) measures, and limit the involvement of non-financial tech giants in issuing stablecoins.

The Senate’s decision to advance the bill follows a failed attempt on May 8, when Senate Democrats, including prominent figures like Mark Warner, Ruben Gallego, and Kirsten Gillibrand, withdrew their support, citing concerns over inadequate AML provisions and potential conflicts of interest involving President Trump’s crypto-related businesses. The Trump family’s involvement in ventures such as World Liberty Financial, which issues a stablecoin called USD1, and other digital asset projects raised alarms among Democrats about the bill potentially enriching the president and his family. A May 19 memo from the Senate Banking Committee’s Democratic staff went as far as accusing the bill’s initial draft of enabling “Trump crypto corruption” by failing to bar elected officials from profiting from stablecoin ventures.

However, negotiations over the past two weeks led to significant revisions to the GENIUS Act, addressing many of the Democrats’ concerns. Key concessions included stronger consumer protection safeguards, enhanced AML provisions, and restrictions on tech companies like Apple, Meta, and Amazon issuing their stablecoins to prevent the misuse of financial data for targeting consumers. Additionally, the revised bill extends ethics standards to special government employees, including high-profile figures like Elon Musk and David Sacks, who have been linked to the Trump administration’s crypto agenda. These changes persuaded 16 Democrats, including Warner, Schiff, and Gallego, to flip their votes in favor of advancing the bill, securing the necessary 60-vote threshold to overcome a potential filibuster.

The GENIUS Act’s journey has been fraught with political and ideological challenges. On May 8, the bill fell short of the 60 votes needed for cloture, with a 48-49 vote that saw opposition from all Senate Democrats and two Republicans, Josh Hawley and Rand Paul. Hawley’s absence during the May 19 vote and the continued opposition from Senators Jerry Moran and Rand Paul underscored lingering concerns about the bill’s implications, particularly regarding Big Tech’s potential dominance in the stablecoin market and insufficient national security protections.

Democratic Senator Kirsten Gillibrand, who initially co-sponsored the bill but withdrew support earlier in May, emphasized the importance of the revisions in her decision to back the legislation. Speaking at an event hosted by Coinbase’s lobbying arm, Stand With Crypto, on May 14, Gillibrand highlighted the bill’s refined focus on consumer protections, bankruptcy rights, and ethics as key factors in her renewed support. According to her:

“When this language comes out, people will see really good refinement, a lot of progress, on things like consumer protection, and bankruptcy protection, and ethics...”

Republican Senator Cynthia Lummis, a staunch advocate for the bill, expressed optimism about its passage, targeting Memorial Day, May 26, 2025, as a feasible deadline. Lummis, speaking alongside Gillibrand at the Coinbase event, underscored the bill’s potential to bolster the U.S. dollar’s global dominance and keep financial innovation within the United States. “This is a fair target,” Lummis stated, emphasizing the urgency of passing the legislation before the Senate shifts focus to other priorities, such as the GOP’s tax and spending package.

Stablecoins have become a cornerstone of the cryptocurrency ecosystem, enabling seamless transactions without the volatility associated with assets like Bitcoin. They facilitate cross-border payments and remittances, offering a faster and often cheaper alternative to traditional banking systems. Industry leaders, including Coinbase CEO Brian Armstrong, have urged Congress to prioritize the GENIUS Act to attract billions, if not trillions, of dollars from traditional financial institutions into the crypto sector. Armstrong, speaking at a panel discussion with Senators Lummis and Gillibrand, emphasized the need to keep the bill focused on stablecoins rather than broader crypto regulations to ensure swift passage.

The bill’s supporters argue that it will strengthen the U.S. financial system by increasing demand for Treasury assets and ensuring that stablecoin innovation remains onshore. Senator Hagerty, the bill’s sponsor, described it as a “pro-growth” measure that would establish the first-ever regulatory framework for payment stablecoins, positioning the U.S. as a leader in digital finance.

With the cloture vote secured, the GENIUS Act now heads to the Senate floor for debate, where amendments could further shape its provisions. Passage in the Senate appears likely, as only a simple majority is required following the cloture vote. However, the bill’s fate in the House of Representatives remains uncertain, as a separate stablecoin regulation bill is currently under consideration. Reconciling the two versions could prove challenging, particularly given the tight legislative timeline before the August recess and the looming 2026 midterm elections.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

a covered a similar of this few days ago. I am happy for the development in the US bothering stablecoins. Having been ripped by crypto's volatility, I think Stablecoins is the future.

https://www.reddit.com/r/CryptoCurrency/comments/1krkuln/us_senate_advances_genius_stablecoin_act/

This post has been shared on Reddit by @rose98734 through the HivePosh initiative.