Uniswap Achieves Historic $3 Trillion Cumulative Trading Volume Milestone

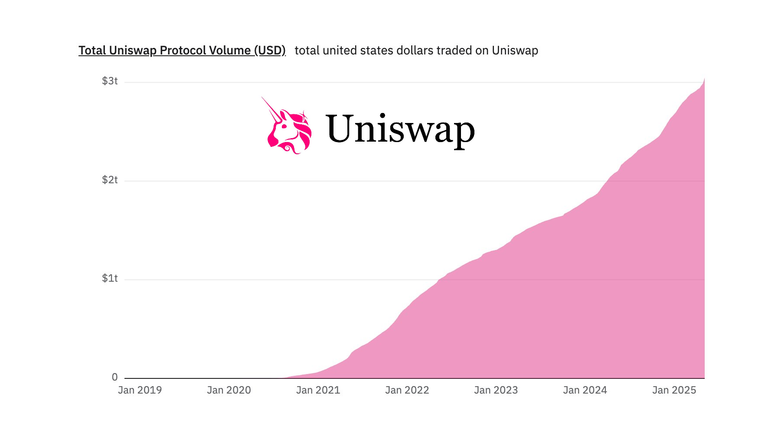

KEY FACTS: Uniswap decentralized exchange (DEX) has achieved a historic milestone by surpassing $3 trillion in all-time trading volume, becoming the first DEX to reach this figure. Launched in 2018 on Ethereum, Uniswap has grown rapidly, doubling its volume from $1 trillion in May 2022 to $2 trillion in 24 months, and now adding another trillion in under a year, with a current daily trading volume of approximately $3.3 billion and a 23% market share among DEXs. The platform’s success is driven by its support for multiple blockchains, the recent launch of Uniswap v4 on 12 networks, and innovations like Unichain, its Ethereum layer-2 scaling solution.

Source: CEO, Uniswap Labs - Haydenz Adams/ X

Uniswap Achieves Historic $3 Trillion Cumulative Trading Volume Milestone

Uniswap, the leading decentralized exchange (DEX), has become the first platform of its kind to surpass $3 trillion in all-time trading volume. This milestone, announced on May 12, 2025, shows Uniswap’s role in reshaping the financial sector and cementing its position as the market leader in the rapidly evolving world of decentralized finance (DeFi). The announcement, shared by Uniswap founder Hayden Adams via a post on X, highlights the platform’s remarkable growth and its enduring appeal among traders and liquidity providers worldwide.

Uniswap is the first DEX to $3T volume 🦄

Bet its the first to 10

Grateful to everyone who swapped along the way as we decentralize the global finance system 🌐

Source

Uniswap’s journey to $3 trillion in cumulative trading volume is a proof of the growing adoption of decentralized exchanges, which allow users to trade cryptocurrencies directly through smart contracts without intermediaries. Launched in November 2018 on the Ethereum blockchain, Uniswap has consistently pushed the boundaries of what is possible in DeFi, offering a permissionless and transparent platform for token swaps. The platform’s ability to process such an immense volume of trades, equivalent to the gross domestic product of major global economies, signals the mainstream traction DeFi has gained in recent years.

Hayden Adams celebrated the achievement with a screenshot of a Dune Analytics dashboard tracking the milestone, stating, “Bet it’s the first to 10,” hinting at Uniswap’s ambition to reach $10 trillion in volume in the future. The platform’s current daily trading volume stands at approximately $3.3 billion, according to Dune Analytics, with DeFiLlama reporting a slightly lower figure of $3 billion over the past 24 hours. These numbers shows Uniswap’s dominance, as it commands a 23% market share of daily DEX volumes, outpacing its closest competitor, PancakeSwap, which holds a 21% share with $2.7 billion in daily volume.

Uniswap’s rise to $3 trillion in trading volume has been marked by several key milestones. The platform reached $1 trillion in cumulative volume in May 2022, a feat that took 42 months from its launch. Doubling that figure to $2 trillion took just 24 months, and now, less than a year later, Uniswap has added another trillion to its tally. This accelerated growth reflects the platform’s scalability as well as the increasing demand for decentralized trading solutions in a market that has faced heightened competition from both DEXs and centralized exchanges (CEXs).

Unlike centralized platforms like Binance or Coinbase, Uniswap operates through smart contracts, enabling users to retain control of their assets via non-custodial wallets like MetaMask. This trustless model has resonated with traders seeking transparency and autonomy, particularly as DeFi continues to gain traction. Uniswap’s total value locked (TVL) currently stands at just under $5 billion, according to DeFiLlama. While this figure is roughly half of its 2021 peak, it remains a significant indicator of the platform’s liquidity and user confidence.

Uniswap’s market leadership extends beyond Ethereum, its native blockchain. The platform now supports trading across multiple chains, including layer-2 scaling solutions like Arbitrum, Optimism, and Polygon, as well as other networks like BNB Chain and Avalanche. The recent launch of Uniswap v4 on January 31, 2025, further expanded its reach, deploying the upgraded protocol across 12 blockchain networks, including Ethereum and Avalanche. Uniswap v4 introduces innovative features like “hooks,” customizable plugins that allow developers to create tailored logic for trading pairs, enhancing flexibility and user experience.

Despite its monumental success, Uniswap faces challenges, including competition from other DEXs like Raydium, which briefly surpassed it in 30-day trading volume in 2024 due to the memecoin trading boom on Solana. However, Uniswap’s robust infrastructure and continuous innovation have helped it maintain its edge. The platform’s recent launch of Unichain, its Ethereum layer-2 scaling chain, promises faster and cheaper transactions while improving interoperability across blockchain networks. Unichain’s DEX volume has already ranked third-highest in the industry over the past 30 days, according to Nansen data.

Another significant development is Uniswap’s adoption of Ethereum Improvement Proposal (EIP-7702), led by Ethereum co-founder Vitalik Buterin, implemented with the Pectra upgrade on May 7, 2025. EIP-7702 enhances Ethereum accounts to withstand potential quantum computing threats and allows externally owned accounts to temporarily function as smart contracts during transactions. On May 12, Adams announced that Uniswap is rolling out its own EIP-7702-compatible wallet and supporting other 7702 wallets, aiming to enable “one-click swapping” for all users. This move aligns with Uniswap’s goal of simplifying the user experience and making DeFi more accessible to a broader audience.

While Uniswap’s trading volume and technological advancements have soared, its native governance token, UNI, has not mirrored this success. As of May 12, 2025, UNI is trading at just over $7, down 3.4% on the day and more than 84% below its all-time high of $45, reached in May 2021, according to CoinGecko. This disconnect between the platform’s performance and its token price has been a point of discussion among investors and analysts. Despite Uniswap’s ability to attract significant liquidity and trading activity, UNI’s value has remained suppressed, reflecting broader market dynamics and the challenges of tying token prices to protocol success in DeFi.

Uniswap’s $3 trillion milestone is not just a win for the platform but a defining moment for the DeFi ecosystem. The platform’s ability to process such vast trading volumes with a relatively small user base, approximately 3.9 million cumulative addresses as of 2022, suggests significant room for growth as DeFi continues to mature.

Uniswap’s focus on innovation, scalability, and user experience positions it to maintain its leadership in the DEX space. The introduction of Unichain, the expansion of v4, and the adoption of cutting-edge technologies like EIP-7702 demonstrate Uniswap’s commitment to staying at the forefront of DeFi. As Adams boldly predicted, the platform’s sights are now set on $10 trillion in volume—a goal that, given Uniswap’s track record, seems increasingly within reach.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

By adding #bilpcoin or #bpc to original posts, you can earn BPC tokens

https://peakd.com/hive-140084/@bpcvoter1/my-way-keni-bpc-ai-music

https://peakd.com/hive-126152/@bpcvoter2/dear-themarkymark-buildawhale-gogreenbuddy-usainvote-ipromote-and-whoever-else-is-involved-in-this-scheme-you-call-us-nutty-as

https://peakd.com/hive-167922/@bilpcoinbpc/exploring-the-possibilities-of-ai-art-with-bilpcoin-nfts-episode-102-buildawhale-scam-farm-on-hive-and-dear-steevc

https://peakd.com/hive-133987/@bilpcoinbpc/comprehensive-analysis-of-punkteam-s-wallet-transactions

https://hive.blog/hive-163521/@bpcvoter1/deep-dive-into-meritocracy-s-activity-history-and-blockchain-audit

https://www.publish0x.com/the-dark-side-of-hive/to-downvoters-scammers-and-farmers-on-hive-the-time-to-chang-xmjzrmp

https://peakd.com/hive-163521/@bpcvoter3/themarkymark-we-ve-exposed-your-actions-repeatedly-how-you-and-your-army-of-bots-manipulate-rewards-to-benefit-yourselves-it-s

https://peakd.com/hive-168088/@bpcvoter3/the-shadow-matrix-a-tale-of-deceit-and-reckoning

Decentralization isn’t just a feature—it’s a fight. Let’s model fairness, rally allies, and pressure Hive to live up to its ideals.

https://peakd.com/hive-167922/@bpcvoter3/5m1kft-themarkymark-you-can-keep-pretending-to-be-oblivious-but-the-truth-is-out-you-ve-been-exposed-it-s-time-to-own-up-to-your

#StandForDecentralization #HiveTransparency

https://www.reddit.com/r/CryptoCurrency/comments/1kl4q3e/uniswap_achieves_historic_3_trillion_cumulative/

This post has been shared on Reddit by @tsnaks through the HivePosh initiative.