Tether’s USDT Overtakes Circle’s USDC in BitPay Transactions

KEY FACTS: In 2025, Tether’s USDt (USDT) has surpassed Circle’s USD Coin (USDC) in transaction volume on BitPay, capturing over 70% of stablecoin payments by May, a stark reversal from 2024 when USDC held an 85% share. Despite the USDC’s regulatory compliance with the EU’s MiCA framework and a market cap that has doubled to $61 billion, Tether’s $158 billion market cap and $62.2 billion in daily trading volume have driven its dominance, particularly in high-liquidity markets like Asia. Circle’s public debut and institutional partnerships contrast with Tether’s defiance of regulatory frameworks, yet, USDT’s accessibility has fueled its lead on BitPay.

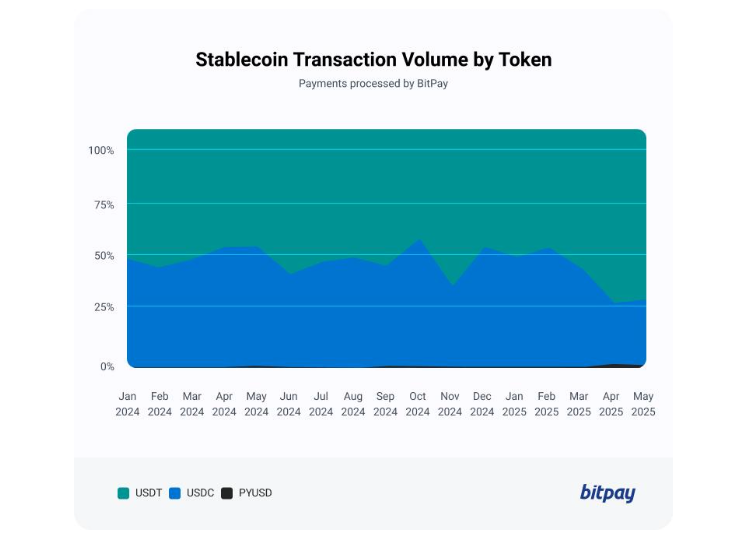

Tether USDt (USDT), USDC (USDC) and PayPal USD (PYUSD) payment volume share on BitPay since January 2024. Source: BitPay

Tether’s USDT Overtakes Circle’s USDC in BitPay Transactions

Tether’s USDt (USDT) has significantly narrowed the gap with Circle’s USD Coin (USDC) on the major crypto payment platform BitPay in 2025, challenging USDC’s long-held dominance. According to data, $USDC, the second-largest stablecoin by market capitalization, has seen its transaction share plummet on BitPay, while USDT has surged, capturing over 70% of stablecoin payment volume by May 2025. This shift marks a dramatic reversal from 2024, when USDC transactions nearly doubled those of USDT, highlighting Tether’s growing influence despite regulatory and strategic differences with Circle.

In 2024, USDC reigned supreme on BitPay, commanding an impressive 85% of stablecoin transaction share in January, while USDT lagged at just 13%. BitPay’s chief revenue officer, Bill Zielke, noted that USDC’s transaction count was nearly double that of USDT during this period, showing its popularity among users and merchants. However, by May 2025, the tide had turned. USDC’s share dropped to 56%, while USDT’s surged to 43%, reflecting a growing preference for Tether’s stablecoin. This shift was particularly striking in payment volume, where USDT claimed a commanding 70% of stablecoin transactions processed by BitPay starting in March 2025.

The reasons behind this shift are multifaceted, rooted in the differing approaches of Tether and Circle, as well as market dynamics and user preferences. Despite USDC’s regulatory advantages and Circle’s high-profile public trading debut in June 2025, Tether’s USDT has gained traction, particularly in markets prioritizing liquidity and accessibility.

Circle, the issuer of USDC, has positioned itself as a leader in regulatory compliance, securing approval under the EU’s MiCA framework in July 2024. This regulatory milestone, coupled with Circle’s successful initial public offering (IPO) on June 5, 2025, which raised $1.05 billion, bolstered USDC’s credibility among institutional investors and regulated markets. Circle’s stock surged 168% on its debut day, signaling strong market confidence in its transparent and compliant approach. Moreover, USDC’s market capitalization has seen significant growth, doubling from $30.86 billion at the start of 2025 to approximately $61 billion by July, driven by partnerships with financial giants like BlackRock and BNY Mellon.

In contrast, Tether has taken a markedly different stance. Tether’s CEO, Paolo Ardoino, has publicly rejected compliance with MiCA, criticizing the framework’s requirement that significant stablecoins hold at least 60% of reserves in European banks. This defiance has led to major EU-regulated exchanges, including Binance, Kraken, and Coinbase, either delisting USDT or limiting it to “sell-only” status, potentially reducing its liquidity in Europe. Despite these challenges, Tether has maintained its dominance, particularly in emerging markets like Asia, where its liquidity and ease of access have made it the preferred stablecoin for trading and payments.

Tether’s Q1 2025 report claims reserves of $115 billion in U.S. Treasuries and $5.6 billion in excess reserves, but concerns persist due to the lack of a certified line-by-line audit, fueling skepticism among some analysts. Posts on X have even speculated about the risk of a USDT collapse, drawing parallels to the 2022 TerraUSD (UST) depegging event, though such claims remain speculative and inconclusive.

The shift in BitPay transaction dynamics reflects broader trends in the stablecoin market. Tether’s USDT, with a market capitalization of $158 billion as of July 2025, commands a 62.54% share of the $253–257 billion stablecoin market, dwarfing USDC’s 24% share. USDT’s dominance is further underscored by its daily trading volume of $62.2 billion, compared to USDC’s $8.4 billion. This liquidity has made USDT the go-to stablecoin for traders and merchants, particularly in high-volume markets like Asia, where it supports a wide range of transactions across blockchains like Ethereum, Tron, and Solana.

USDC, however, has carved out a niche in regulated markets and institutional use cases. Its expansion on Solana, where it minted 250 million tokens in a single day in 2025, and its growing role in Bitcoin liquidity pairs, supporting 24% of BTC trading liquidity in the first half of 2025, demonstrate its resilience. Circle’s application for a U.S. national trust bank license in June 2025 further signals its ambition to integrate USDC into the traditional financial system, potentially challenging Tether’s lead in regulated markets.

BitPay, a leading crypto payment platform with a substantial user and merchant base, has become a key battleground for stablecoin dominance. Its data provides a window into user preferences, showing a clear shift toward USDT in 2025. Bill Zielke emphasized that while USDC remains the most popular stablecoin by transaction count, its lead has significantly narrowed. The platform’s focus on expanding its presence in 2025 has amplified the significance of these trends, as merchants and users increasingly adopt stablecoins for payments, from online gambling platforms to cross-border remittances.

The broader stablecoin market, valued at approximately $250 billion in June 2025, is dominated by Tether and Circle, which together account for nearly 90% of the market. Analysts from Citi and Standard Chartered project that the sector could grow to trillions in the coming years, driven by increasing adoption in DeFi, gaming, and retail. However, concerns about market concentration and systemic risks persist. A potential depegging of USDT, given its widespread use as collateral in DeFi platforms like Aave and Curve, could trigger significant market disruption, highlighting the need for diversified stablecoin liquidity.

The stablecoin landscape is at a crossroads, with regulation playing a pivotal role. The U.S. Senate’s passage of the GENIUS Act in May 2025, which mandates 100% reserve backing for stablecoin issuers, could further legitimize USDC and other compliant stablecoins. However, Tether’s refusal to align with such frameworks may limit its growth in regulated markets while strengthening its position in less-regulated regions.

Meanwhile, Circle’s strategic moves, including its trust bank application and public listing, position USDC as a formidable contender in the institutional space. Despite its declining share on BitPay, USDC’s market cap growth and increasing adoption in regulated hubs like Singapore and Hong Kong suggest it remains a strong competitor.

The rise of Tether’s USDT on BitPay in 2025 shows the dynamic and competitive nature of the stablecoin market. While USDC’s regulatory compliance and institutional backing have fueled its growth, Tether’s liquidity and accessibility have given it an edge in payment volumes and transaction counts. As the stablecoin sector continues to evolve, the interplay between regulation, market preferences, and technological adoption will determine whether Tether maintains its throne or if Circle’s USDC can reclaim its lead.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

https://www.reddit.com/r/CryptoCurrency/comments/1lsyxq7/tethers_usdt_overtakes_circles_usdc_in_bitpay/

This post has been shared on Reddit by @uwelang through the HivePosh initiative.

Congratulations @uyobong! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 480000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: