Metaplanet Unveils $5.4 Billion for 210k Bitcoin Acquisition Plan, Stock Surges in Response

KEY FACTS: Metaplanet Inc., a Tokyo-based firm dubbed Asia’s MicroStrategy, recently announced a historic $5.4 billion equity raise through 555 million moving-strike warrants to acquire 210,000 Bitcoin (BTC) by 2027, representing 1% of Bitcoin’s total supply. The plan, unveiled by CEO Simon Gerovich, follows a recent purchase of 1,088 BTC pushing its holdings to 8,888 BTC (valued at over $930 million), and has triggered a 12% stock surge to 1,505 yen ($10.42) with an intraday peak of 1,641 yen ($11.36), reflecting a 1,744% rise since its first Bitcoin buy in July 2024. Targeting 30,000 BTC by 2025 and 100,000 BTC by 2026, Metaplanet leverages Japan’s economic challenges and high stock volatility.

Source: Metaplanet

Metaplanet Unveils $5.4 Billion for 210k Bitcoin Acquisition Plan, Stock Surges in Response

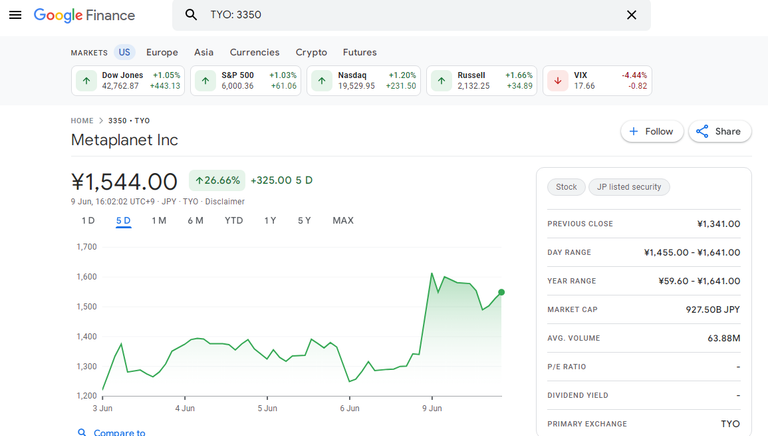

Metaplanet Inc., a Tokyo-based investment firm often dubbed Asia’s equivalent to MicroStrategy, has announced a historic $5.4 billion equity raise to turbocharge its Bitcoin acquisition strategy. The move, unveiled by CEO Simon Gerovich on June 6 via a post on X, aims to secure 210,000 BTC by the end of 2027, representing a staggering 1% of Bitcoin’s total supply. This ambitious plan marks the largest stock acquisition rights issuance in Japanese capital markets history and sets a new benchmark for corporate cryptocurrency adoption. The announcement follows a significant surge in Metaplanet’s stock price, which jumped over 12% on June 9, trading at 1,505 yen ($10.42) and peaking at 1,641 yen ($11.36), reflecting investor confidence in the company’s bold vision.

Thrilled to announce Asia’s largest-ever equity raise to buy Bitcoin — again! 🚀 This time: $5.4 billion to accelerate our Bitcoin strategy. Our new target: 210,000 BTC by 2027.

The funding will be raised through the issuance of 555 million moving-strike warrants, a financial instrument unique to Japan’s markets, allowing equity to be sold incrementally over the next two years to minimize market disruption. Notably, this issuance is priced above the current market value—a first in Japan—contrasting with the typical 8-10% discount seen in similar financings. The initial exercise price is set at ¥1,388 per share, with adjustments based on a three-day average closing price, and the exercise period runs from June 24, 2025, to June 23, 2027. This strategy leverages Metaplanet’s exceptional liquidity, boasting an average daily trading volume of 52 million shares over the past three months, enabling efficient and rapid execution.

Metaplanet’s “555 Million Plan” builds on the success of its earlier “210 Million Plan,” which raised ¥93.3 billion ($650 million) in just 60 trading days, boosting its Bitcoin holdings from 1,762 to 7,800 BTC. As of June 2, 2025, the company holds 8,888 BTC, valued at approximately $920 million, securing its position as the 7th largest corporate Bitcoin holder globally, according to data from The Block. This rapid accumulation, achieved at an average cost of ¥13,756,658 ($93,354) per BTC, reflects a 225.4% BTC yield year-to-date, a key performance indicator the company uses to measure shareholder value creation.

The new target of 210,000 BTC represents a tenfold increase from the company’s previous goal of 21,000 BTC by 2026, signaling heightened conviction amid global economic uncertainties. The company’s stock has surged 24% in the last five days since the announcement, pushing its market capitalization higher and positioning it to potentially become the second-largest public Bitcoin holder behind MicroStrategy, which holds over 500,000 BTC.

Source; Google finance - Metaplanet

The move comes as Japan grapples with a weakening yen and negative interest rates, positioning Bitcoin as a hedge against traditional financial instability. Analysts suggest Metaplanet’s strategy could redefine capital formation, drawing parallels with MicroStrategy’s pioneering Bitcoin treasury model in the United States. The company’s high volatility and deep liquidity, further evidenced by its ranking as Japan’s second-best-performing stock in 2025 with a 2500% surge over the past year since adopting its Bitcoin strategy on April 8, 2024, have fueled investor enthusiasm.

Metaplanet’s approach also benefits from Japan’s unique market conditions, including access to low-yield capital and tax-efficient investment vehicles like the NISA program. The company plans to use nearly 96% of the raised funds for direct Bitcoin purchases, with the remainder allocated to bond redemptions and income-generating strategies such as selling put options. If successful, this acquisition could make Metaplanet a global leader in Bitcoin holdings, attracting further institutional interest and reinforcing Japan’s growing role in the crypto ecosystem.

The announcement has sparked excitement on social media, reflecting widespread support from the crypto community. Industry observers note that if successful, Metaplanet could join the elite “1% Club” of entities holding 1% or more of Bitcoin’s 21 million total supply, a milestone currently dominated by figures like MicroStrategy and nation-states.

Metaplanet’s stock (3350T) shot up over 12% in the June 9 trading session, with intraday highs reflecting a 22% increase, according to Google Finance. This surge follows a year-long rally where the stock price has risen over 1,744% since its first Bitcoin purchase on July 22, 2024, when shares climbed 19% to 173 yen ($1.10). The company’s rapid ascent mirrors a trend, with 61 publicly listed firms now holding a combined 3.2% of Bitcoin’s total supply, worth over $342 billion, as reported by Standard Chartered. Other firms, like South Korea’s K Wave Media and Indonesia’s DigiAsia Corp, have also seen stock gains after announcing Bitcoin treasury plans, though not all, like Norway’s K33, have experienced similar success.

Metaplanet’s strategy echoes MicroStrategy’s five-year journey to accumulate 500,000 BTC, and some analysts speculate it could achieve a comparable milestone by 2029 if it maintains its current pace. The company’s latest 1,088 BTC acquisition on June 2, valued at $74 million, pushed its treasury past 8,000 BTC, further solidifying its position as a top-tier Bitcoin holder. With the equity raise set to begin on June 23 and an exercise period extending to June 2027, all eyes will be on whether the company can sustain its exponential growth trajectory. The next milestone, 30,000 BTC by year-end, looms as a critical test of its strategy.

Information Sources:

- Metaplanet 2025-2027 BITCOIN PLAN

- Metaplanet CEO Simon Gerovich/ X

- Cointelegraph

- Google finance - Metaplanet

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1l720e6/metaplanet_unveils_54_billion_for_210k_bitcoin/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.