Metaplanet Makes Record $60M Bitcoin Purchase, Expands Crypto Strategy

KEY FACT: Japanese investment firm Metaplanet has made its largest Bitcoin purchase to date, acquiring 619.7 BTC worth nearly $60 million, bringing its total holdings to 1,762 BTC valued at approximately $168 million. Dubbed "Asia's MicroStrategy," the firm's average Bitcoin purchase price stands at $75,600, positioning it as the 12th-largest Bitcoin-holding public company globally. This latest acquisition comes as Bitcoin's price dipped below $100,000, and follows a record 310% Bitcoin Yield reported between October and December. Metaplanet plans to expand its treasury strategy into Bitcoin-focused financial services and recently raised $62 million to strengthen its Bitcoin purchases, all while its stock price surged over 2,100% this year despite recent fluctuations.

Source: Metaplanet

Metaplanet Makes Record $60M Bitcoin Purchase, Expands Crypto Strategy

Japanese investment firm Metaplanet has made its largest Bitcoin purchase to date, acquiring nearly 620 BTC as the cryptocurrency's price dipped below $100,000. On December 23, Metaplanet announced the acquisition of 619.7 Bitcoin, valued at just under $60 million, with Bitcoin trading around $96,000 at the time. This purchase significantly surpasses the firm's previous record buy of 159.7 BTC on October 28, nearly quadrupling the value of its earlier acquisition.

Metaplanet purchases additional 619.70 BTC Source

Often referred to as "Asia's MicroStrategy"—a nod to the American firm known for substantial Bitcoin investments—Metaplanet's latest purchase brings its total holdings to 1,762 BTC, worth approximately $168 million. The firm's average purchase price stands at around $75,600 per Bitcoin. This accumulation positions Metaplanet as the 12th-largest Bitcoin holder among public companies, just behind medical technology manufacturer Semler Scientific.

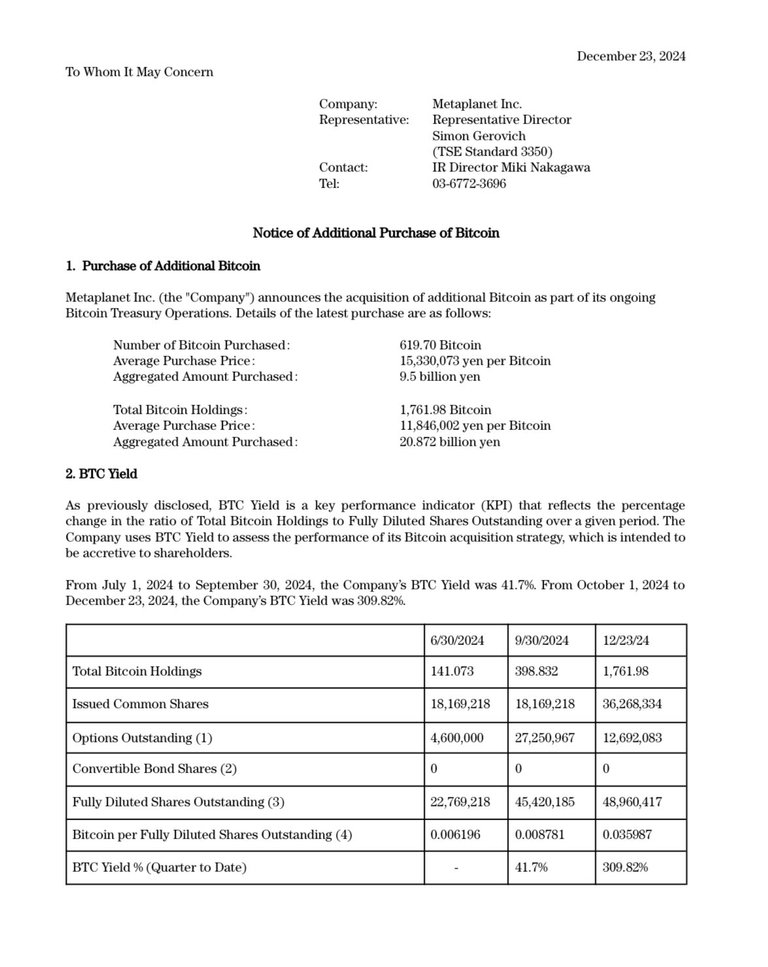

Metaplanet reported a Bitcoin Yield (BTC Yield) of 310% from October 1 to December 23, a substantial increase from the 41.7% yield recorded between July and September. The firm uses BTC Yield to evaluate the performance of its Bitcoin acquisition strategy, aimed at enhancing shareholder value.

Source: Metaplanet

On December 18, Metaplanet projected its first operating profit since 2017 and expressed intentions to expand beyond Bitcoin purchases as part of its treasury strategy. In an investor disclosure, the company announced plans to establish "Bitcoin accumulation and management" as a formal business line. This initiative includes engaging in loans, equity, convertible bonds, and other financial instruments to acquire and hold Bitcoin.

In late November, Metaplanet revealed plans to raise over $62 million (9.5 billion Japanese yen) through a stock acquisition program aimed at purchasing additional Bitcoin for its treasury.

Following the announcement of its latest Bitcoin purchase, Metaplanet's stock price rose by 5% on the Tokyo Stock Exchange. However, the stock remains down nearly 13% over the past week. Despite this recent decline, the company's shares have surged more than 2,100% this year, reaching an all-time high of 4,080 Japanese yen ($26) on December 17, reflecting investor enthusiasm for its Bitcoin adoption strategy.

Metaplanet's aggressive Bitcoin acquisition strategy adds to the growing trend of corporations incorporating cryptocurrency into their financial strategies, which hints increased mainstream acceptance and confidence in Bitcoin's long-term value proposition.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha