El Salvador Persists with Bitcoin Accumulation Despite IMF Agreement

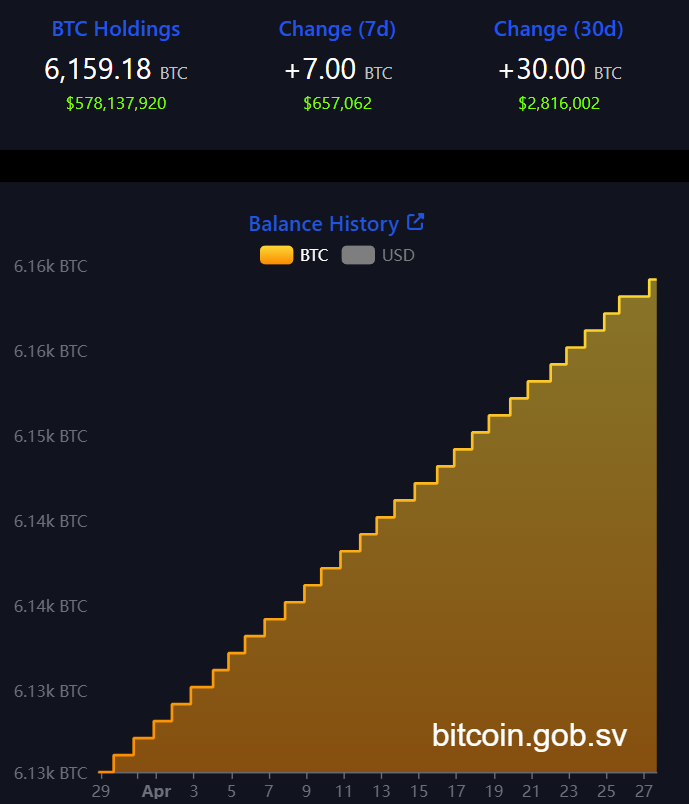

KEY FACTS: El Salvador, under President Nayib Bukele, continues to amass Bitcoin, recently acquiring seven BTC worth over $650,000, despite a $1.4 billion IMF loan agreement in December 2024 that restricts public sector cryptocurrency purchases. Holding approximately 6,111.18 BTC valued at $504 million as of March 2025, the country may use non-governmental entities to circumvent IMF conditions, maintaining its Bitcoin-friendly stance while addressing economic challenges like unsustainable debt.

Source: El Salvador Bitcoin Office

El Salvador Persists with Bitcoin Accumulation Despite IMF Agreement

El Salvador, the first nation to adopt Bitcoin as legal tender, continues its bold strategy of acquiring the cryptocurrency, even as it navigates a delicate financial agreement with the International Monetary Fund (IMF). According to blockchain data from El Salvador’s Bitcoin Office, the country’s treasury added seven Bitcoin (BTC), valued at over $650,000, in the week leading up to April 27. This move has sparked intrigue and debate, given the nation’s recent commitments to the IMF, which appeared to restrict such activities.

El Salvador’s Bitcoin journey began in 2021 under the leadership of President Nayib Bukele, who championed the cryptocurrency as a tool for financial inclusion and economic sovereignty. The country has since pursued an aggressive accumulation strategy, often purchasing one Bitcoin daily, with occasional bulk acquisitions during market dips. As of March 2025, El Salvador’s Bitcoin reserves stood at approximately 6,111.18 BTC, valued at around $504 million, according to reports from Coinpedia and CryptoPotato. These holdings have grown steadily, even in the face of market volatility and international scrutiny.

The latest purchases come amid a complex relationship with the IMF, which has long expressed concerns about the risks associated with El Salvador’s Bitcoin experiment. In December 2024, El Salvador secured a $1.4 billion loan agreement with the IMF, part of a $3.5 billion financial package to address the country’s unsustainable public debt and limited reserves. The deal, however, came with stringent conditions, including requirements to scale back public sector Bitcoin purchases and revoke Bitcoin’s status as compulsory legal tender.

Despite these stipulations, El Salvador’s government has continued to acquire Bitcoin, prompting questions about how it is reconciling its cryptocurrency ambitions with its IMF obligations. During an April 26 press briefing, Rodrigo Valdes, director of the IMF’s Western Hemisphere Department, stated that El Salvador was complying with its commitment to halt government Bitcoin accumulation. Valdes suggested that the country’s recent purchases may not violate the agreement’s terms. In his words:

“In terms of El Salvador, let me say that I can confirm that they continue to comply with their commitment of non-accumulation of Bitcoin by the overall fiscal sector...”

Source

Analysts and observers have pointed to a potential workaround that allows El Salvador to maintain its Bitcoin-friendly stance while adhering to IMF conditions. Anndy Lian, an intergovernmental blockchain adviser and author, suggested that the agreement may permit Bitcoin purchases through non-governmental entities. This interpretation aligns with reports from Forbes, which noted that as long as Bitcoin holdings increase in ways that fit within the IMF’s framework, such as through private or quasi-governmental entities, the purchases may not constitute a violation.

This nuanced approach has enabled El Salvador to retain its image as a global leader in cryptocurrency adoption while securing critical IMF funding. The strategy shows a delicate balancing act, as the Bukele administration seeks to leverage Bitcoin’s potential to attract investment and tourism while stabilizing the nation’s economy.

However, not all observers are convinced that El Salvador’s actions are entirely above board. Some reports have described the country’s continued purchases as a direct challenge to the IMF’s conditions. The IMF’s March 2025 report explicitly prohibited public sector Bitcoin acquisitions, including those through mining operations, and required the publication of all government Bitcoin wallet addresses. Critics argue that El Salvador’s persistence in stacking Bitcoin, even if through non-governmental channels, risks straining its relationship with the IMF and jeopardizing future aid.

President Bukele has remained defiant in the face of external pressure, repeatedly affirming his commitment to Bitcoin as a cornerstone of El Salvador’s economic strategy. In a March 4 X post, Bukele dismissed the IMF’s restrictions as “whining,” stating,

“No, it’s not stopping. If it didn’t stop when the world ostracized us and most ‘Bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future.”

His rhetoric receives the support of cryptocurrency enthusiasts worldwide, who view El Salvador’s stance as a bold stand against traditional financial institutions. Bukele’s resolve was further emphasized by the country’s legislative adjustments. In January 2025, El Salvador’s Congress amended its Bitcoin laws to comply with IMF requirements, repealing mandatory Bitcoin acceptance for businesses and restricting tax payments to U.S. dollars. Despite these concessions, the government has maintained its daily Bitcoin purchases.

The country’s Bitcoin Office has also continued to promote initiatives like Bitcoin City, a proposed tax haven powered by geothermal energy from volcanoes, and the development of a Bitcoin-backed bond. These projects, while ambitious, have faced delays and skepticism, with only 11% of registered Bitcoin firms in El Salvador currently operational, according to a Cointelegraph report from April 15. The lack of compliance with the country’s Bitcoin Law, which mandates anti-money laundering programs and cybersecurity measures, has raised concerns about the scalability of El Salvador’s cryptocurrency ecosystem.

The IMF agreement aims to improve El Salvador’s GDP primary balance by 3.5% and projects economic growth of 2.5% to 3% in the coming years. The IMF seeks to enhance transparency and governance, mitigating the risks associated with cryptocurrency’s price volatility by curbing public sector Bitcoin activity. Yet, Bukele’s administration has argued that its dollar-based economy remains stable alongside Bitcoin adoption, pointing to reduced sovereign spreads and successful debt buyback operations as evidence of financial resilience.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO