Decentralized Exchanges Surge to Record Highs in Q2 2025 as Crypto Traders Flee Centralization

KEY FACTS: In Q2 2025, decentralized exchanges (DEXs) achieved a record-breaking spot trading volume of $876.3 billion, up 25.3% from Q1, driven by PancakeSwap and Hyperliquid, as centralized exchanges saw a 27.7% volume decline. PancakeSwap led with a 45% market share, processing $530 billion, boosted by its Infinity upgrade, cross-chain swaps, and expansion on Solana, with 96.7% of its volume on BNB Chain. Hyperliquid dominated perpetual futures with $653 billion, capturing 73% of the DEX derivatives market. LeoDex, built in April 2025, is emerging as an innovative and sustainable option in the DEX landscape. The DEX-to-CEX trading ratio hit 27.9% in June, reflecting a shift toward DeFi, fueled by market recovery, technological advancements, and growing user trust in decentralized platforms.

Source: DEXes

Decentralized Exchanges Surge to Record Highs in Q2 2025 as Crypto Traders Flee Centralization

Decentralized exchanges (DEXs) achieved unprecedented trading volumes in the second quarter of 2025, signaling a seismic shift in the cryptocurrency trading landscape. According to data from CoinGecko, DEX spot trading volume surged to $876.3 billion, representing a robust 25.3% increase from the previous quarter, while centralized exchanges (CEXs) experienced a significant decline. This surge, driven by platforms like PancakeSwap and Hyperliquid, underscores a growing preference for decentralized trading solutions among crypto users, fueled by technological advancements, user-friendly innovations, and a broader market recovery.

PancakeSwap’s Meteoric Rise

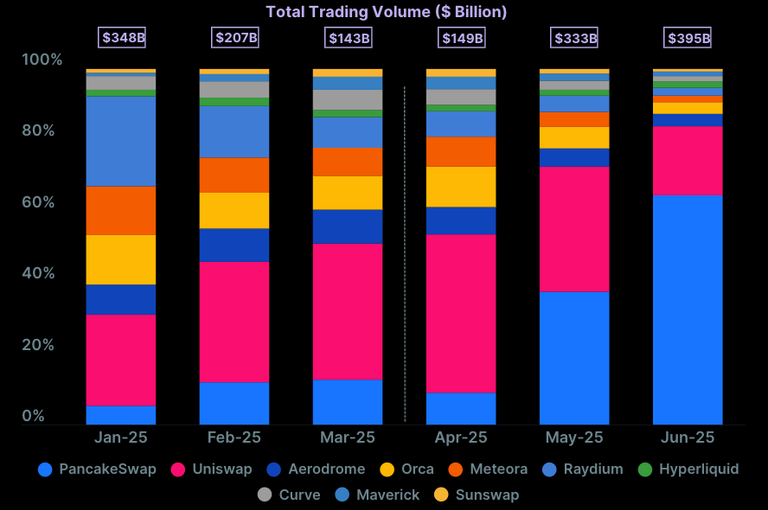

PancakeSwap, a multichain decentralized exchange built primarily on the Binance Smart Chain (BSC), emerged as the standout performer in Q2 2025, capturing a commanding 45% market share of DEX spot trading volume. The platform processed a staggering $530 billion in trading volume during the quarter, with June alone recording an all-time high of $325 billion, nearly doubling May’s $174 billion. This explosive growth, which saw PancakeSwap’s quarterly volume more than double from Q1’s $211 billion, has solidified its position as the leading DEX globally.

Several factors contributed to PancakeSwap’s dominance. The April launch of PancakeSwap Infinity introduced a suite of features designed to enhance user experience and trading efficiency, including lower gas fees, customizable “Hooks” for liquidity pools, and new pool types such as concentrated liquidity market makers (CLAMM) and limit-based automated market makers (LBAMM). These upgrades significantly improved capital efficiency and reduced trading costs, making the platform more attractive to both retail and institutional traders.

In June, PancakeSwap further expanded its capabilities with the introduction of cross-chain swaps, allowing seamless trading across BNB Chain, Ethereum, and Arbitrum without the need for external bridges or app-switching. This innovation streamlined the trading process, offering users unparalleled convenience and speed. Additionally, PancakeSwap’s expansion to Solana in early July, with the launch of v3 liquidity pools supporting tokens like BONK and PYUSD, further broadened its reach and appeal. Liquidity providers on these pools can now earn up to 84% of trading fees, incentivizing greater participation.

Despite its multichain ambitions, PancakeSwap’s growth remains heavily concentrated on BNB Chain, which accounted for 96.7% of its Q2 trading volume, totaling $513 billion. The platform’s market share on BNB Chain reached 96.8% in June, underscoring its dominance on this blockchain. However, PancakeSwap also made strides in the Ethereum ecosystem, recording $30 billion in volume on Base, $25 billion on Arbitrum, and $21 billion on Ethereum’s mainnet, signaling steady progress in its multichain strategy. Chef Kids, head of PancakeSwap, attributed the platform’s success to its community and technological innovations. With 7.4 million unique users in Q2 and a cumulative trading volume exceeding $1.8 trillion across all supported chains, PancakeSwap’s influence in DeFi is undeniable.

Monthly spot trading volume on top 10 DEXs since January 2025. Source: CoinGecko

Hyperliquid’s Dominance in Perpetual Futures

While PancakeSwap led the charge in spot trading, Hyperliquid, a decentralized perpetual futures exchange built on its own Layer 1 blockchain, dominated the derivatives market. In Q2 2025, perpetual futures trading on DEXs reached an all-time high of $898 billion, with Hyperliquid accounting for a staggering $653 billion, or 73% of the market share. This marked a significant milestone for the platform, which has seen its trading activity climb steadily since April, capturing over 6.2% of the global derivatives market by June.

Hyperliquid’s performance in Q2 was nothing short of remarkable, with the platform handling $648 billion in trading volume and generating over $300 million in revenue. Over the past 12 months, Hyperliquid processed $1.57 trillion in trading volume, outperforming its nearest competitor by a factor of ten. The platform’s native token, HYPE, also saw significant price action, surpassing $40 in June and reaching an all-time high of $45.90 earlier in the quarter. This surge coincided with a fivefold increase in total locked value (TVL), rising from $330 million in April to $1.8 billion by the end of June.

Hyperliquid’s success can be attributed to its focus on perpetual futures, a high-risk, high-reward trading instrument that has gained traction among sophisticated traders. Unlike spot trading, which involves direct asset swaps, perpetual futures allow traders to speculate on price movements without an expiration date, amplifying both potential gains and losses. Hyperliquid’s purpose-built Layer 1 blockchain ensures fast and cost-efficient transactions, giving it a competitive edge over other DEXs. Among the top ten perpetual DEXs, only Hyperliquid, Aster (formerly APX Finance), RabbitX, and EdgeX recorded volume growth, while former leader dYdX saw its monthly volume plummet from $10 billion in January to $5.3 billion in Q2.

The Broader Shift to Decentralized Trading

The record-breaking performance of PancakeSwap and Hyperliquid reflects a broader trend in the crypto market: a significant shift from centralized to decentralized exchanges. The DEX-to-CEX spot trading volume ratio reached an all-time high of 27.9% in June 2025, up from 13% in Q1, highlighting growing trader preference for on-chain platforms. While CEXs still processed $3.9 trillion in spot trading volume in Q2, this represented a 27.7% decrease from Q1’s $5.4 trillion, underscoring the outflow of users and capital to DEXs.

Several factors are driving this shift. Decentralized exchanges offer greater transparency, user control over funds, and resistance to censorship, appealing to traders wary of centralized platforms’ vulnerabilities, such as hacks or regulatory crackdowns. The integration of centralized exchanges into the DeFi ecosystem through CeDeFi (Centralized Decentralized Finance) solutions has also blurred the lines between the two models, combining CEX liquidity with DEX on-chain execution. For instance, Binance’s Alpha routing, which directs trades to PancakeSwap, has significantly boosted the latter’s volume and reinforced BNB Chain’s position as the leading blockchain for DEX activity.

However, not all DEXs shared in the Q2 success. Platforms on Solana, such as Orca, Meteora, and Raydium, saw significant declines in trading volume, dropping by 40.5%, 56.8%, and 73.4%, respectively. This shift in investor attention toward BNB Chain and other blockchains highlights the competitive nature of the DeFi space, where technological innovation and user experience are critical drivers of market share.

The Rise of Innovative DEXs - LeoDex in the Spotlight

The rise of innovative decentralized exchanges (DEXs) like LeoDex is reshaping the cryptocurrency trading landscape, driven by their focus on user privacy, cross-chain functionality, and seamless user experiences that rival centralized platforms. LeoDex, for instance, has gained attention for its industry-first fully anonymous Zcash (ZEC) cross-chain swaps, requiring no KYC, account, or even wallet connection, enabling trades via a simple QR code. Its volume-based airdrop, surpassing $1 million in swap volume, incentivizes early adopters with LEO tokens and Protocol Owned LEO strategy, while its integration with THORChain and support for privacy-focused assets like shielded ZEC demonstrate its commitment to cutting-edge DeFi solutions. As DEXs capture an increasing share of the crypto market, these platforms are poised for significant growth, fueled by innovations like automated market makers, Layer 2 scaling, and cross-chain interoperability. LeoDex’s emphasis on privacy, transparency, and user control positions it as a strong contender, with prospects to thrive in a DeFi ecosystem increasingly favoring non-custodial, secure, and accessible trading solutions.

Protocol Owned Leo Demo. Source: LeoDex

Market Context and Future Outlook

The surge in DEX volumes coincided with a recovery in the cryptocurrency market, which saw its total capitalization rise by 28.2% to $3.46 trillion in Q2, driven by Bitcoin’s rally from $83,000 to nearly $112,000 and significant ETF inflows. The market’s 24% price resurgence in Q2 erased losses from the start of 2025, creating a favorable environment for trading activity. Stablecoins and real-world assets (RWAs) also gained traction, with stablecoins reaching a combined market cap of $247.9 billion. USD1, in particular, saw its market cap jump from $57 million to $2.2 billion, fueled by a Binance listing, a $2 billion investment from MGX, and strong trading activity on PancakeSwap.

Going forward, the momentum behind DEXs shows no signs of slowing. BNB Chain’s ambitious goal to support 5,000 DEX swaps per second in 2025, backed by a Rust-based client and redesigned blockchain architecture, could further accelerate PancakeSwap’s growth. Meanwhile, Hyperliquid’s dominance in perpetual futures positions it as a leader in the derivatives market, with potential for further expansion as DeFi matures.

The second quarter of 2025 marked a turning point for decentralized exchanges, with PancakeSwap, Hyperliquid, and LeoDex leading a record-breaking surge in trading volume and innovative deliverables. PancakeSwap’s user-focused upgrades and cross-chain innovations have cemented its position as the top DEX for spot trading. Hyperliquid’s dominance in perpetual futures underscores the growing appeal of decentralized derivatives, while LeoDex is coming to the spotlight with innovative and sustainable solutions in the cross-chain landscape. It's obvious the future holds something bigger for DEXs.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.