Businesses and Institutions Absorb Bitcoin at 4x the Rate of Mining

KEY FACTS: In 2025, businesses, public companies, spot Bitcoin ETFs, and governments are absorbing Bitcoin at nearly four times the rate of daily mining output, according to a report by River, with institutions acquiring around 3,224 BTC daily compared to miners’ 450 BTC. Corporate giants such as Strategy, holding 632,457 BTC, lead the charge, while ETFs and governments add 1,430 BTC and 39 BTC daily, respectively, tightening Bitcoin’s available supply. Shrinking exchange reserves and a post-halving reduction in block rewards to 3.125 BTC are exacerbating the potential for a supply shock, which could drive significant price volatility as institutional demand continues to outpace new issuance.

Sources: River/ X

Businesses and Institutions Absorb Bitcoin at 4x the Rate of Mining

A seismic shift in Bitcoin’s supply dynamics is imminent as private businesses, public companies, exchange-traded funds (ETFs), and even governments are accumulating Bitcoin (BTC) at a rate far outpacing the creation of new coins by miners. According to a recent report by Bitcoin financial services firm River, institutional demand is absorbing Bitcoin at nearly four times the rate of daily mining output, raising concerns about a potential supply shock that could reshape the cryptocurrency’s market landscape in the near future.

Businesses are absorbing bitcoin at 4x the rate it is mined.

Source

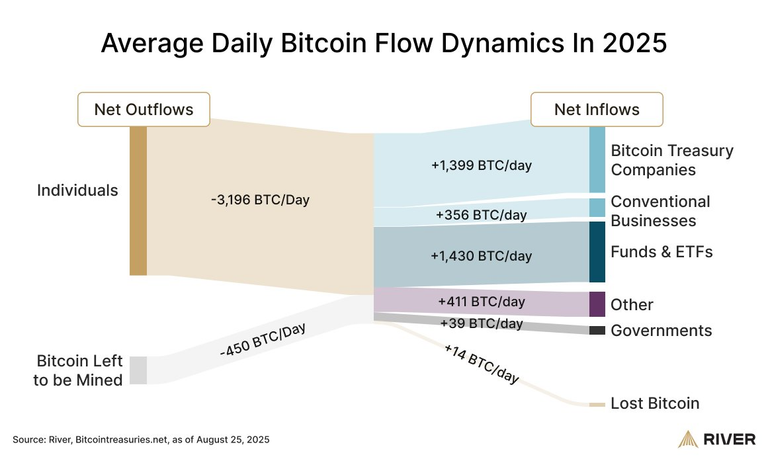

River’s data paints a striking picture of Bitcoin’s evolving ownership patterns. In 2025, private and public companies have collectively purchased an average of 1,755 BTC per day, a figure that dwarfs the approximately 450 BTC produced daily by miners. This disparity stems from the Bitcoin network’s design, which, following the April 2024 halving, reduced the block reward to 3.125 BTC per block. With roughly 144 blocks mined daily, the total new issuance hovers around 450 BTC, a number that has remained consistent since the halving event.

The institutional frenzy extends beyond corporations. Spot Bitcoin ETFs and other investment vehicles are adding 1,430 BTC per day to their holdings, while governments are quietly accumulating about 39 BTC daily, according to River’s estimates. Collectively, these entities are absorbing thousands of BTC each day, creating a significant imbalance between supply and demand. “When inflows to businesses and funds exceed new issuance from miners, available supply tightens,” River noted in its report, highlighting the potential for a supply squeeze if current trends persist.

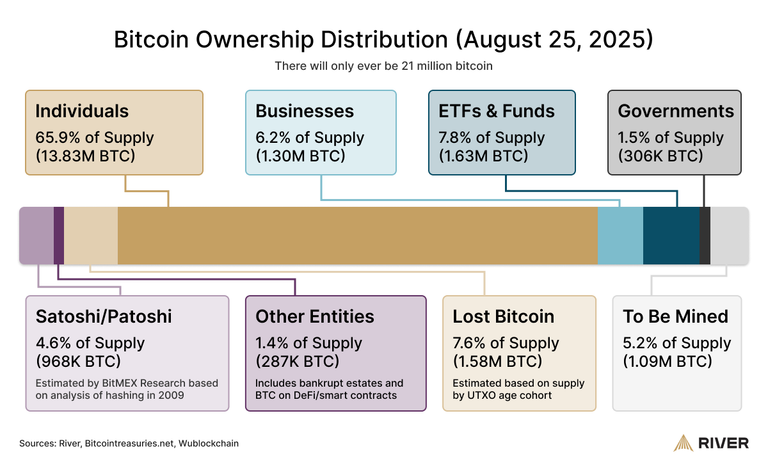

The charge is led by Bitcoin treasury companies, with Michael Saylor’s Strategy standing out as the largest known corporate holder of Bitcoin globally. As of Q2 2025, Strategy holds an astonishing 632,457 BTC in its corporate reserves, according to BitcoinTreasuries. This figure represents a significant portion of the 1.3 million BTC held by businesses overall, as reported by River, with Bitcoin treasury companies acquiring 159,107 BTC in the second quarter alone.

Adam Livingston, author of The Bitcoin Age and The Great Harvest, has described Strategy’s aggressive accumulation as a “synthetic halving” of Bitcoin’s supply, effectively reducing the available circulating supply in a manner akin to the network’s programmed halving events. However, Strategy’s corporate treasury officer, Shirish Jajodia, has pushed back against claims that the company’s buying significantly impacts short-term Bitcoin prices. Jajodia emphasized that Strategy conducts its purchases through over-the-counter (OTC) transactions, which occur off exchanges and are designed to minimize market disruption.

Other companies are following suit, with public miners like MARA Holdings, Riot Platforms, Hut 8, and CleanSpark also amassing significant Bitcoin holdings. A January 2025 report by Digital Mining Solutions and BitcoinMiningStock.io noted that many miners are adopting a “treasury strategy” similar to Strategy’s, retaining a larger portion of their mined Bitcoin to hedge against currency devaluation or in anticipation of price appreciation. This shift reflects a broader trend in which corporations view Bitcoin as a strategic asset for balance sheet diversification and inflation hedging.

The approval of spot Bitcoin ETFs in recent years has opened the floodgates for institutional investment, providing traditional investors with regulated exposure to Bitcoin without the complexities of direct custody. In 2025, these ETFs have been a major driver of Bitcoin absorption, with daily inflows averaging 1,430 BTC. This trend echoes earlier reports from 2024, when spot Bitcoin ETFs were already outpacing miner production by a factor of ten, scooping up $493.4 million worth of BTC (approximately 10,280 coins) in a single day on February 12, 2024, compared to miners’ output of just 1,059 BTC.

Governments, while less aggressive, are also contributing to the demand. River estimates that governments are purchasing around 39 BTC per day, potentially as part of strategic reserve allocations. Some analysts speculate that nation-states could be reallocating portions of their gold reserves to Bitcoin, with projections suggesting that a 5% reallocation could absorb 7.7% of Bitcoin’s total supply, further tightening liquidity.

The rapid accumulation by institutions is occurring against a backdrop of dwindling Bitcoin exchange reserves, which have reached multi-year lows, according to data from CryptoQuant. This trend suggests that more Bitcoin is being moved to long-term storage or self-custody, reducing the amount available for trading on exchanges. River’s report warns that if exchange reserves continue to shrink and institutions maintain their “HODL” strategy, it could trigger a supply shock, where demand significantly outstrips available supply.

Analysts are divided on the implications of such a shock. Some predict it could act as a bullish catalyst, driving Bitcoin’s price to new heights. Earlier in 2025, Glassnode reported that Bitcoin whales and sharks (holders of 100–1,000+ BTC) were absorbing over 300% of yearly issuance, with a technical breakout suggesting a potential price target of $100,000 by May. Others caution that the estimates are not without flaws, as River’s figures rely on a combination of public filings, custodial address tracking, and proprietary heuristics, which may misclassify some wallets or miss certain holdings.

The April 2024 halving, which cut the block reward from 6.25 BTC to 3.125 BTC, has intensified the supply-demand imbalance. With miners producing only 450 BTC per day, the reduced issuance has made it increasingly challenging for miners to meet institutional demand. The halving has also reshaped the mining industry, with rising difficulty levels (currently at 113.76 trillion at block 890,637) and increased competition forcing miners to adopt more efficient technologies, such as advanced Application-Specific Integrated Circuits (ASICs). Some miners are also diversifying into high-performance computing (HPC) and artificial intelligence (AI) to offset the volatility of mining revenue.

Despite these challenges, Bitcoin’s mining ecosystem remains robust, supported by a self-correcting difficulty adjustment mechanism that recalibrates every 2,016 blocks (approximately every two weeks). This ensures that mining remains profitable as long as market prices support the cost of hash power, even as block rewards continue to diminish.

River’s findings show a fundamental shift in how Bitcoin is perceived, moving from a speculative investment to a strategic asset for corporations, investment funds, and even governments. The firm’s Sankey-style flow infographic, released on August 25, 2025, illustrates this trend vividly, showing significant net outflows from individual-held wallets (approximately –3,196 BTC per day) into institutional wallets. River cautions, however, that this does not necessarily indicate retail investors selling off their holdings but rather a transfer of coins to institutional custody.

As Bitcoin’s total supply approaches its 21 million cap (with 19.6 million BTC (93.3%) already mined as of May 2025), the growing illiquidity of the asset is becoming a focal point for analysts. Estimates suggest that 14–18% of Bitcoin’s supply is permanently lost due to forgotten keys or dormant wallets, further constraining available supply. If institutional accumulation continues at its current pace, the combination of lost coins, HODLing, and reduced mining output could amplify price volatility in the coming years.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1n5io6n/businesses_and_institutions_absorb_bitcoin_at_4x/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.