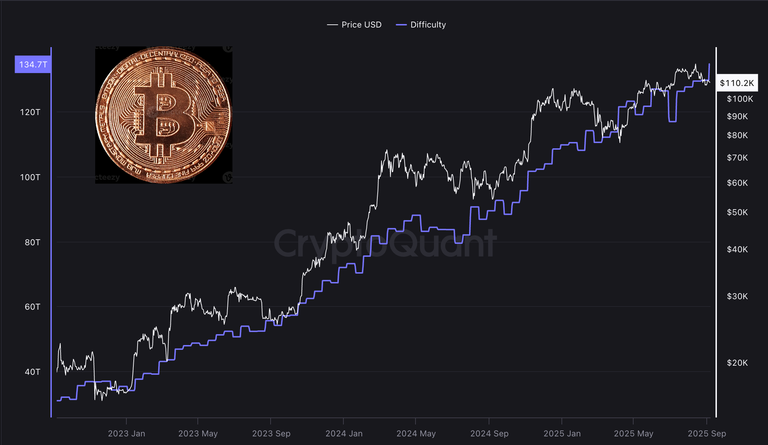

Bitcoin Mining Difficulty Soars to All-Time High of 134.7 Trillion

KEY FACTS: Bitcoin's mining difficulty has reached an all-time high of 134.7 trillion, as reported by CryptoQuant, reflecting the immense computational power required to mine new blocks and reinforcing the network's security. Despite this milestone, the network's hashrate slightly declined to 967 billion hashes per second from a peak of over 1 trillion, signaling challenges for miners following the April 2024 halving, which cut block rewards to 3.125 BTC. Rising difficulty and operational costs are intensifying competition, pushing smaller miners out while larger firms like MARA and CleanSpark boost production and hold Bitcoin reserves.

Source: CryptoQuant

Bitcoin Mining Difficulty Soars to All-Time High of 134.7 Trillion

The Bitcoin network has achieved a significant milestone as its mining difficulty reached an all-time high of 134.7 trillion, according to data from CryptoQuant. This unprecedented level shows the increasing computational power required to mine new blocks on the Bitcoin blockchain, reinforcing the network’s security but posing substantial challenges for miners operating in an already competitive and resource-intensive industry. The surge in difficulty, coupled with a slight decline in the network’s hashrate, highlights the evolving dynamics of Bitcoin mining and raises questions about the sustainability and centralization of the sector.

Bitcoin mining difficulty is a critical metric that measures how challenging it is for miners to solve the cryptographic puzzles necessary to validate transactions and add new blocks to the blockchain. The Bitcoin protocol is designed to adjust this difficulty approximately every two weeks, or every 2,016 blocks, to maintain an average block production time of 10 minutes. This self-regulating mechanism ensures the network’s stability, preventing blocks from being mined too quickly or too slowly, regardless of fluctuations in the total computational power, or hashrate, contributed by miners worldwide.

The latest adjustment, which pushed the difficulty to 134.7 trillion, marks a continuation of a long-term upward trend in mining difficulty, despite a brief decline earlier in the year. In June 2025, the difficulty fell to 126.4 trillion after peaking at 126.9 trillion on May 31, and a sharper drop to 116.9 trillion was recorded by mid-July. However, the difficulty resumed its climb in the latter half of July, reaching a previous high of 127.6 trillion on August 3 before achieving the current record. This relentless increase reflects the growing computational power dedicated to securing the Bitcoin network, driven by advancements in mining hardware and the entry of new miners into the ecosystem.

While the mining difficulty has soared, the Bitcoin network’s hashrate (the total computational power used to mine and process transactions) has seen a slight decline. According to CryptoQuant, the hashrate dropped to 967 billion hashes per second (GH/s) from a peak of over 1 trillion GH/s recorded on August 4, 2025. This reduction suggests that some miners may be scaling back operations or facing challenges in maintaining profitability, particularly in the wake of the April 2024 Bitcoin halving, which reduced the block reward from 6.25 BTC to 3.125 BTC.

The halving event, a programmed reduction in the reward miners receive for adding new blocks, occurs approximately every four years and is designed to control Bitcoin’s supply, capping it at 21 million coins. While this mechanism enhances Bitcoin’s scarcity and supports its value proposition, it significantly impacts miners’ revenue, forcing them to rely on transaction fees and operational efficiencies to remain profitable. The combination of rising mining difficulty, higher operational costs, and reduced rewards has created a highly competitive environment, squeezing profit margins for many mining operations.

The record-high difficulty has intensified the financial pressures on Bitcoin miners, particularly smaller and less efficient operators. Higher difficulty requires greater computational power, which translates to increased energy consumption and operational costs. For miners using older hardware, such as the Antminer S19 XP or S19 Pro, profitability is increasingly difficult to achieve, especially when the hash price hovers around $48 per petahash per second (PH/s), as reported by TheMinerMag in March 2025. A hash price below $50 places significant strain on miners with outdated equipment, often forcing them to shut down operations or upgrade to more efficient application-specific integrated circuits (ASICs).

The competitive landscape has also sparked concerns about the centralization of Bitcoin mining. As the cost of mining rises, large corporations and mining pools, which have access to significant capital and economies of scale, are increasingly dominating the industry. These entities can afford to invest in state-of-the-art equipment, secure low-cost energy sources, and weather periods of low profitability. In contrast, smaller miners struggle to compete, leading to a concentration of mining power among a few major players. This trend has raised questions about the decentralization ethos that underpins Bitcoin, as the network’s security becomes increasingly reliant on a handful of large operators.

Despite the dominance of large mining firms, small and solo miners continue to make their mark on the Bitcoin network, occasionally defying the odds to claim significant rewards. In July and August 2025, three solo miners successfully added blocks to the Bitcoin blockchain through the Solo CK pool, a service that supports individual miners. On July 3, a solo miner added block 903,883, earning nearly $350,000 in block rewards and transaction fees. On July 26, another miner claimed block 907,283, securing over $373,000, and on August 17, a third solo miner mined block 910,440, also earning approximately $373,000. These successes highlight the potential for individual miners to compete, albeit sporadically, in a landscape increasingly dominated by institutional players.

The Solo CK pool allows smaller miners to pool their resources while retaining the chance to claim full block rewards, offering a lifeline to those seeking to remain active in the industry. However, such victories are rare, as the computational power required to solve a block independently is immense, given the current difficulty levels. These achievements serve as a reminder of Bitcoin’s decentralized roots, even as the industry trends toward consolidation.

In response to the challenges posed by rising difficulty and reduced rewards, some publicly traded mining companies have adopted innovative strategies to maintain profitability. For example, MARA, one of the largest Bitcoin mining firms, reported a 35% increase in Bitcoin production in May 2025, mining 950 BTC and boosting its treasury reserves to 49,179 BTC. The company’s chief financial officer, Salman Khan, emphasized a “HODL” strategy, noting on June 3 that MARA sold no Bitcoin during the month, opting to retain its mined coins as a long-term treasury asset. This approach reflects a growing trend among mining firms to view Bitcoin as a store of value rather than a liquid asset to cover operational costs.

Similarly, CleanSpark, a Bitcoin miner focused on sustainable energy, reported a 9% increase in Bitcoin production in May 2025, mining 694 BTC and increasing its reserves to 12,502 BTC. The company also boosted its hashrate by 7.5% to 45.6 exahashes per second (EH/s), demonstrating its commitment to expanding operational capacity despite market challenges. These examples illustrate how larger miners are adapting to the high-difficulty environment by investing in efficiency and holding onto their Bitcoin reserves in anticipation of future price appreciation.

The record-high mining difficulty enhances the security of the Bitcoin network by making it more resistant to attacks, such as double-spending, which would require an attacker to control over 50% of the network’s hashrate. The increased computational power dedicated to mining also reinforces Bitcoin’s high stock-to-flow ratio, a metric that compares the existing supply of an asset to the new supply added through production. With approximately 94% of Bitcoin’s 21 million coins already mined, the high stock-to-flow ratio protects the cryptocurrency from price volatility caused by overproduction, distinguishing it from commodities like silver, which have lower ratios and are more susceptible to supply-driven price swings.

However, the rising difficulty and competitive pressures have implications for Bitcoin’s price dynamics. In 2023, analysts noted that heavy selling by miners, particularly smaller operators struggling to remain profitable, contributed to price suppression, with Bitcoin trading in a narrow range between $29,500 and $31,500. More recently, the accumulation of Bitcoin by larger miners and institutional investors, coupled with reduced selling pressure, has coincided with periods of price stability and growth. For instance, miner revenues reached $1.66 billion in July 2025, the highest since the 2024 halving, suggesting that the industry is finding a new equilibrium despite the technical challenges.

With this development, the sustainability of Bitcoin mining will depend on miners’ ability to innovate, particularly in securing low-cost, renewable energy sources and adopting more efficient hardware. Companies like TeraWulf, which emphasize energy-efficient mining, and others exploring waste heat utilization or alternative energy sources, are setting the stage for a more resilient industry. Additionally, the growing institutional demand for Bitcoin, driven by exchange-traded funds (ETFs) and corporate treasury strategies, could bolster miner revenues by supporting price appreciation.

For the broader Bitcoin ecosystem, the record-high difficulty is a testament to the network’s robustness and enduring appeal. As the remaining 2 million BTC are mined over the coming decades, projected to last until around 2140, the interplay between difficulty, hashrate, and market dynamics will continue to shape the cryptocurrency’s evolution.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO