Binance Co-Founder CZ Proposes Dark Pool DEX to Combat Market Manipulation in DeFi

KEY FACTS: Binance co-founder Changpeng “CZ” Zhao has proposed a dark pool decentralized exchange (DEX) for perpetual futures trading to combat market manipulation and front-running in DeFi, following a $100 million liquidation incident on the Hyperliquid platform. Announced on June 1, 2025, via the X platform, the dark pool DEX would utilize cryptographic technologies, such as zero-knowledge proofs, to conceal trades, positions, and deposits, thereby protecting large traders from MEV bots and liquidation attacks while maintaining a trustless, non-custodial framework. CZ’s call for developers to collaborate signals a push toward innovative solutions for DeFi’s vulnerabilities.

Source: Cbb0fe/ X

Binance Co-Founder CZ Proposes Dark Pool DEX to Combat Market Manipulation in DeFi

Binance co-founder Changpeng “CZ” Zhao has proposed the creation of a dark pool decentralized exchange (DEX) designed specifically for perpetual futures trading. The proposal, outlined in a June 1, 2025, post on the X platform, comes in the wake of a high-profile $100 million liquidation incident on the Hyperliquid platform, which CZ and others attribute to market manipulation enabled by the transparency of existing DEXs. This innovative solution aims to protect large traders from front-running and maximal extractable value (MEV) attacks, sparking widespread discussion in the crypto community about the future of DeFi infrastructure.

Decentralized exchanges, a cornerstone of the DeFi ecosystem, operate on public blockchains where transaction details, including orders and liquidation points, are visible in real-time. While this transparency aligns with the ethos of decentralization, it creates significant risks for traders, particularly those executing large trades or engaging in leveraged perpetual futures contracts. CZ highlighted two critical issues in his proposal: front-running and market manipulation.

Front-running occurs when malicious actors, such as MEV bots, detect pending transactions on the blockchain and exploit them by placing their trades ahead of large orders. This practice, often facilitated by miners or validators prioritizing high-fee transactions, leads to increased slippage, worse prices, and higher costs for traders. In perpetual futures markets, where leveraged positions are common, the public visibility of liquidation points exacerbates the problem. Malicious actors can intentionally manipulate market prices to trigger liquidations, wiping out traders’ positions and profiting from the resulting volatility.

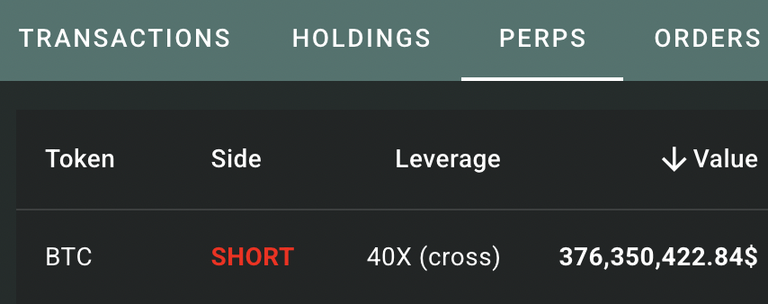

CZ’s post specifically referenced the $100 million liquidation on Hyperliquid, a decentralized perpetual futures platform, as a catalyst for his proposal. The incident, widely discussed on Crypto Twitter, highlighted the vulnerabilities of transparent DEXs, where large traders are exposed to coordinated attacks.

To address these challenges, CZ proposed the development of a “dark pool-style” DEX, a concept borrowed from traditional finance. Dark pools are private trading venues that allow institutional investors to execute large orders without revealing their intentions to the larger market. Concealing trading details until execution in dark pools can reduce the risk of front-running and market manipulation. CZ envisions a similar mechanism for DeFi, leveraging advanced cryptographic technologies like zero-knowledge proofs (zk-SNARKs or zk-STARKs) to ensure privacy while maintaining the trustless and non-custodial nature of decentralized platforms.

The proposed dark pool DEX would hide critical information such as trades, positions, and deposits from public view, shielding large traders from MEV bots and liquidation attacks. Unlike centralized exchanges (CEXs), which obscure user identities but still face scrutiny over trust and custody, a dark pool DEX would operate on-chain, preserving the decentralized ethos while addressing privacy concerns. CZ emphasized that such a platform could be particularly impactful for perpetual futures trading, where leverage amplifies the risks of manipulation.

In his post, CZ invited developers to discuss the idea further. While he clarified that he could not guarantee investment or a response, his call to action has ignited interest among blockchain developers and DeFi innovators. CZ wrote:

“This is a call to action for builders and innovators in the cryptocurrency space,”

CZ’s proposal has garnered significant attention from industry experts, who see it as a potential turning point for DeFi infrastructure. However, others caution that “the fundamental challenge in building a dark pool-style perp DEX is achieving both privacy and verifiability.” Technologies like zk-SNARKs or zk-STARKs could enable trade validation without revealing sensitive details, but it is true that “opacity is a double-edged sword. While it protects against front-running, excessive privacy could obscure manipulative behavior, particularly in leveraged markets like perpetual swaps.

Meanwhile, there is a rapid evolution in the DeFi space, with platforms like PancakeSwap on the BNB Chain boasting $1.5 billion in total value locked (TVL) and institutional adoption of blockchain technology accelerating. The $100 million Hyperliquid liquidation has amplified concerns about the scalability and security of DeFi, prompting industry leaders to explore innovative solutions. CZ’s dark pool DEX concept adds to the trending calls for privacy and efficiency in decentralized trading, as evidenced by the growing dominance of private DEXs in ecosystems like Solana.

Since stepping down as Binance CEO in 2023 following a plea deal with U.S. authorities over money laundering charges, CZ has remained a prominent figure in the crypto industry. His recent activities include advising governments like Kyrgyzstan and Pakistan on blockchain policy and advocating for the integration of cryptocurrencies like Bitcoin and BNB into national reserves. His proposal for a dark pool DEX reflects his ongoing commitment to advancing the crypto ecosystem, even as he navigates personal legal challenges, including a recent application for a pardon from U.S. President Donald Trump.

A successful dark pool DEX could redefine how large traders interact with decentralized platforms, offering a safer and more efficient alternative to existing systems. However, balancing privacy, security, and regulatory compliance will require cutting-edge technology and collaboration across the industry.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

https://www.reddit.com/r/CryptoNews/comments/1l1x106/binance_cofounder_cz_proposes_dark_pool_dex_to/

This post has been shared on Reddit by @vikvitnik through the HivePosh initiative.