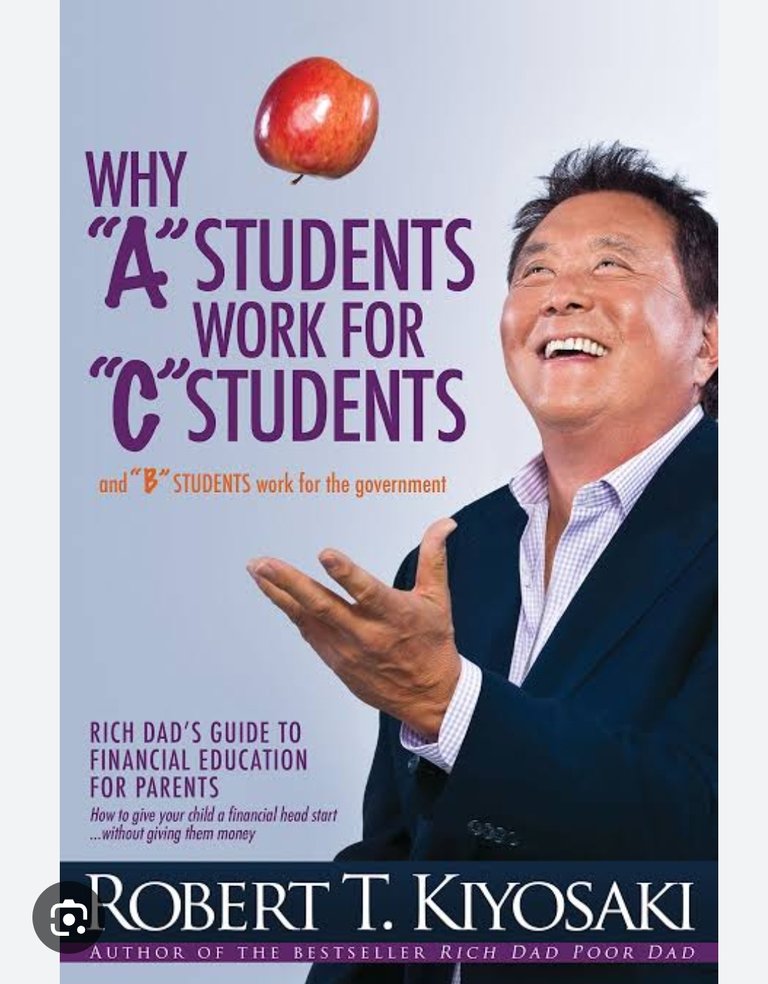

Book Review: Why "A" Students Work for "C" Students and "B" Students Work for the Government By Robert Kiyosaki

Reading this book really opened my eyes to something many of us overlook; the huge gap in our school system when it comes to teaching kids about money. Robert Kiyosaki, the author of Rich Dad Poor Dad, takes it a step further in this book and explains why smart students (the “A” students) often end up working for those who didn’t get the best grades in school (the “C” students). It sounds ironic, but when you really think about it, it makes sense.

The school system teaches us how to pass exams, get good grades, and go get a “secure” job. That’s all we hear growing up; study hard, get a good job. But no one really teaches us what to do with the money we earn. We learn how to be employees, not how to become financially free. And that’s where the problem starts.

Kiyosaki introduces something called the Cashflow Quadrant. It’s basically a simple way of explaining the different ways people earn money. You’re either an employee (E), self-employed (S), business owner (B), or investor (I). Most of us are stuck in the E or S side, working hard and paying high taxes. But real wealth; the kind that gives you time and freedom: is built on the B and I side. Unfortunately, school doesn't prepare us for that.

One major thing I took from this book is that if we want our kids to have a better shot at life, we as parents have to step in. We can’t leave it to schools anymore. Kiyosaki breaks down how to teach kids about money in three stages: from childhood (birth to 12), teenage years (which he calls the rebellious stage), and young adulthood. At each level, the way we teach needs to change. For little kids, simple games like Monopoly can help. For teens, it’s about talking openly about your own financial mistakes or wins. And for young adults, it’s about helping them apply what they’ve learned.

Another powerful lesson from the book is this: stop giving kids free money. It might look like love, but we’re only making them believe that money comes easy. Instead of weekly allowances, let them earn it by doing tasks, helping out, or even starting a small hustle. It helps them understand that money is a tool, not a gift.

Lastly, Kiyosaki makes an important point. There’s a difference between financial advice and financial education. Advice is someone telling you what to do. Education is learning how to think for yourself. Most people don’t know the difference, and that’s why they end up in debt or chasing the wrong opportunities.

In all, this book is a must-read for any parent, teacher, or even young adult who wants to break out of the cycle. It’s not just about making money. It’s about building a mindset, one that creates freedom, responsibility, and long-term success.

Delegate your Hive Power to Ecency and earn

100% daily curation rewards in $Hive!

I’ve often seen C students, even D students being very successful cause they have street skills to be successful…

That is not far from the truth. Success is not bound by the level of education.

I have not read this book. But, I think that Kiyosaki has some interesting books that he wrote.

Nice choice!

It is a good book to write and I will recommend it anytime.