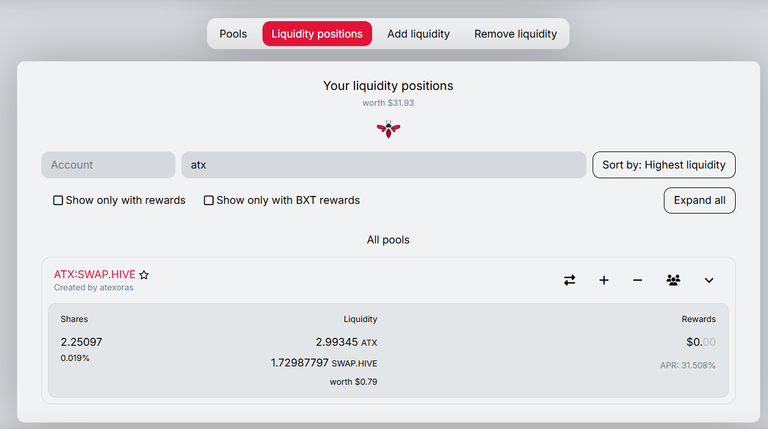

Investment in Beeswap pool - Pair ATX:SWAP.HIVE - week 2

News

- This liquidity pool hasn't started off too well as an investment, and its profitability has plummeted in a short period of time. I'm not entirely sure why this happened. I assume someone has increased the liquidity. The fact is that the rewards no longer justify the investment, so I'm monitoring it this week, and if nothing changes, I'll shift the investment to another, more profitable liquidity pool. I already have a pair in my portfolio waiting.

AteXoras is a Hive token that's been around for some time and has remained fairly stable over time. Its liquidity pool is also linked to Swap.Hive, which is something I like. It's also worth mentioning that its rewards are very long-term, and stability is one of the things I look for in an investment.

I'm going to expand the type of investments I make in Hive and have chosen pools as a good way to increase the returns I get on-chain.

Why use pools? Because they don't require a lot of time to manage, I don't have too much free time, and because I think they offer good performance.

My investment strategy in Beeswap pools:

- I will choose pairs that have currencies that I like and think have a good future.

- The minimum performance has to be higher than the 20% that can be achieved in Hive.

- If it is possible that they have good liquidity.

- Have daily transaction volume

- If possible they are linked to Swap.Hive

- 7 pairs maximum

Second pair - ATX:SWAP.HIVE -

- Liquidity - Low

- Negotiation - Low

- Profitability - 31,5% APR

- Linked to Swap.Hive - Yes

Token Name

AteXoras

Supply (Circulating / Total / Max)

109046.00000 / 109046.00000 / 1000000000.00000

Issuer

@atexoras

Website

https://atexoras-witness.gitbook.io/atexoras-atx

Description

ATX is an exploration and support token with a focus on onboarding people into the Hive Blockchain while making it fun and educational.

Precision

5

Staking

No

Delegation

No

!hiqvote

!BBH

Don't forget that the APR shown on rewards (which anyone can add to the distribution), varies also (in this case because I have ATX being distributed via rewards) depending on the price of the token on the market SWAP.HIVE:ATX... which, if you compare right now, it has almost no bids... and makes it kind of "false" the values shown on the pool.

And the market is like this:

It takes just a tiny bid for the values to constantly change...

I am going to put one just to explain to you...

There you go... and I have used a value for the bid that is equal to what the pool has... and voilá, the pool values become this...

Because most of the liquidity is in the pool (either as liquidity or as rewards to be distributed), the market (SWAP.HIVE:ATX) pressure is very unrealistic. And when this happens one has to pay attention to those things (I know, its not damn easy to understand).

I didn't create this for investment, but everyone is free to use it however they wish. Instead, I created these things to teach people... literally like what I am doing now.

Hope you have learned something. And if you have any further questions, let me know.

Thank you very much for the explanation, very interesting. I think I'll have to pay more attention. The lack of liquidity and counterparties makes it difficult to evaluate. I also don't take into account the fees charged, which are not easy to calculate.

You are welcome!

Via pools is a flat 0.25% every time you swap (for you to see this, you would need to run a node where this value is configured). If you want to go that path, I can help.

Then, the rest of the percentage goes to slippage... which you are right, if a pool have low liquidity larger amounts will slip more. But one should be able to swap small amounts with very little slippage.

On the market, there are no fees. Only to withdraw or deposit to Hive Engine.

Any questions, tag me anytime. I will eventually reply.