DeFi with science - How to pick assets for portfolio diversification

This is another post of my "DeFi with Science" series. The idea of this series is to try and show some of the "science" behind crypto and DeFi to help people make more informed decisions.

It won't be super in-depth stuff with a lot of mathematical formulas or blocks or code because the idea is to make it accessible to just about anyone. My main goal with this is to show a little bit of how things work "under the hood" so my readers can do a couple of things.

The first is being able to make their own decisions based on actual data instead of going with their "gut" or following what some guy on YouTube or Twitter told them to do.

And the second thing is having a foundation to build on, should they want to look for more in-depth knowledge.

While I'm not opposed to the old adage "It's better being lucky than good", the fundamental problem with luck is that it's very hard to replicate, and I, for one, prefer to make decisions that I can replicate and expect a positive outcome more often than not. I have written about this concept a few times, and I invite you to check out my blog if you want to learn more.

In a recent article, I discussed the idea of portfolio diversification, and today, I want to expand a bit on that topic.

Diverse assets

My previous article showed us that one of the easiest ways to mitigate portfolio risk is through asset diversification and also that, as a rule of thumb, somewhere between 15 to 20 assets is the sweet spot to balance risk reduction and portfolio size.

However, portfolio diversification cannot be achieved by simply picking several assets at random. To truly diversify a portfolio, the assets must be intentionally chosen in a way that ensures they are not all correlated to each other.

Correlation means a mutual relationship or connection between two or more things. In our context, when two assets are correlated, there is a good chance that their price behaviour will be "connected", meaning if the price of one of the assets changes, the same will happen to the other. That doesn't necessarily mean that one of the assets is causing the other to go up or down, but that's a topic for another time.

But how can we tell wheter two assets are correlated?

The Pearson Correlation Coefficient

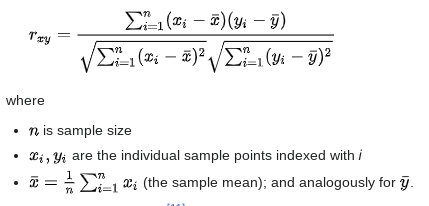

The Pearson Correlation Coefficient quantifies the estimated strength of the linear association between two variables. It ranges from +1 to -1: +1 indicates a perfect positive linear correlation, -1 a perfect negative linear correlation, 0 indicates no linear correlation.

Matematically, this coefficient can be defined as:

But fortunately, we don't need to understand how it's calculated because there are tools that do all that for us, such as DeFiLlama. All we need to understand is that the closer the number is to 0, the less correlated two assets are.

Picking diverse assets

Now that we know how to measure asset correlation, we can start diversifying our portfolio by adding assets that show weak correlation.

Note that in crypto, all assets are somewhat correlated to Bitcoin, so there is an argument that it's impossible to truly mitigate your risk in a bear market scenario. While that may be true, I stand by this strategy.

Another rule of thumb that helps pick out uncorrelated assets is exploring different segments in the crypto ecosystem. Much like in traditional finance, where there are different assets in different "industries", in crypto, we have many different projects that seek to solve different problems.

Some projects are more focused on infrastructure, such as Solana, others concentrate on Real World Assets, like Ondo Chain, and some are trying to build a P2P market for Intellectual Property, like Story, just to name a few.

Although I recommend verifying the actual correlation coefficient with the methods described above, picking assets across different "lines of work" will most likely lead to healthy portfolio diversification, and thus, it's a great starting point for anyone willing to mitigate their risk.

Final thoughts

Portfolio diversification involves more than simply picking different assets. If an investor builds a portfolio containing exclusively assets that are strongly positively correlated, it may cause the entire portfolio to perform poorly at once, neglecting the benefits of diversification.

Fortunately, there are ways to easily build real diversification into a portfolio, such as picking projects from varied segments and verifying the correlation coefficient between assets.

Posted Using INLEO

The part about everything being tied to Bitcoin anyway made me laugh a bit, it's just too true, no escape in a bear market, but hey, we try.🥹🥹🥹 Nice one tokenized

hahaha yeah! it can be sad :P

Thanks for the comment!

was a pleasure reading too