LEO Delegators Still Receive 6-8% APR

First the good, then the bad

LEO is looking good for it's big event on September 23rd when staking rewards will go live on LeoDex.io. Leo is still up over 6x against Hive after the expected decline in August. It seemed unlikely that Leo could keep up its strengthh after a 12x since June. The ratio held at around 0.5 and translated to a $ price of around 10 cents. Since then Leo is gradually climbing up again and I think we can expect a stronger rally in the coming days leading up to the release. Of course then we will gain a better insight into the value of LEO since we can measure it against the staking rewards received (the other part is the curation rewards we get from hLEO).

APR for leo.voter still at 6-8%

2 weeks ago I pointed out the discrepancy for delegating to leo.voter. Delegators received only around 6-8% instead of the proclaimed 16%. I don't think it's a big deal if there are some milder fluctuations, but we can see now that the APR has been unchanged for over a month while this hasn't been communicated from the project. Khal himself stated it like this:

The APR is 16% since LEO 2.0 and the new model uses a trailing + forecast average to pay delegators.

It seems that this model for calculating delegation payouts is not working very well (at least from what I can see). I would also like to know how the "forecast average" works. Seems a bit like a black box.

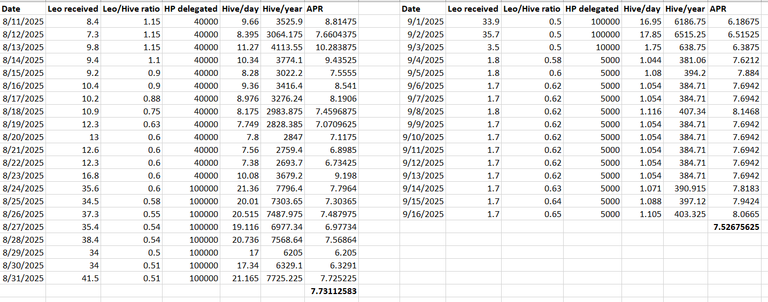

I made a table this time to show that I haven't picked a single date to calculate the APR. This is taken from my delegations in the last month:

For August and September (in the given period) we can see an average APR of ~7.6%. It's clear that the model used for calculating the delegation payouts is flawed. The main problem with this, however, is that this is not being communicated by the team.

It would be good if they change it or just simply communicate that for now a lower APR is being paid out. I don't have a problem with the APR being so low, but delegators should know that it's been like this for over a month.

It would take more than a doubling of the Leo/Hive ratio for the APR going back to around 16%. While that is definitely possible, I think more people should know that they aren't getting what they might think they get.

That said, LEO still looks strong and if the team keeps builds LeoDex with as much passion as before I have no doubt that it will be a success story!

Check out the Love The Clouds Community if you share the love for clouds!

Interesting. Sharing!

Interesting. Thanks for sharing.

!BBH

!ALIVE

up to... not a fix one

yes, but it's less than half and I doubt most think it would be this low over such a long time

As I said in your last post you are calculating this wrong

Please put disclaimers in your data that this is your opinion and not backed by data

I just fixed your excel sheet and got 21% APR.

thanks for the reply!

yes, this is my data and it does have limitations. But it is backed by data as seen in the sheet!

I would really like to see your fix! If I can verify it for myself I will gladly dismiss everything I wrote here.

my assumption was that 16% apy would mean:

($ value of Hive delegated) x 0.16 annual / 365 days / $ price LEO) => meaning always spot 0.0438% on daily basis (regardless of price speculation)

That is 16% apy , paid daily.

Yes, have you done the math for your delegation?

yeah! Your calculations check out. Received 6.9 LEO instead of 14.6 LEO (which would be 0.16/365 apy) did the math for last month and get same results as you.

it's funny how Khal is just not accepting this fact and is somehow getting 21%... He certainly is smart enough to understand the basic calculations. Don't have a problem with a low APR if that's what they choose, it's just that they should make it more transparent

Also - APY from leo.voter currently is 8.31% https://hivestats.io/@leo.voter

As there is 0 inflation and the funds are purchased on open market , the return for delegators can only be self sustainable if it is below 8.31% (curation rewards - any fee or slipperage).

Therefore if returns for delegation would be 16% - while curation rewards are 8.31% that would mean someone is sponsoring (and it would not be sustainable)

We’ll make a post and include actually transparent data. Commenting back and forth isn’t productive as I already commented and you’ve decided to keep making blogs to beat the same dead horse

The system is designed to bare minimum pay 16% APR. When adding compounding and PA from getting paid a scarce asset that isn’t being inflated (reduced in price over time), you get 21%+

The 8.3% or whatever you’re calculating here is a misrepresentation of how the system works. The continually posting of a half-baked picture is making me question the motive here — especially when I’ve already corrected and shown the math on how this system works. We’ll just put up a post with the real math so people can see how it works (again, as we’ve already done this but you seem to be hell bent on getting people to undelegate)

@khaleelkazi is this reply directed at me? I must say I am a bit surprised by this reaction.

If I asked any questions on inleo it was to do research, which I would encourage others to do their research aswell (in any investment) - but please enlighten me, where do I tell/suggest people to undelegate? I noticed this post today and did the math today based on my delegation reward I received today ($ value of delegation x apy / interval rate = $ value delegation reward).

Regardless of whatever calculation method we use, I am not really sure where the quoted hostility is coming from?

no it’s to OP

I am not trying to get people to undelegate. I simply think the system should be transparent. That said, I think I am starting to see the misunderstanding on how the system works (you seem to be basing the return on future outcomes, whereas I am looking at current returns). Definitely looking forward to your post. BTW I am really impressed by the amount of quality work you guys are putting into the Dex.

I agree that LEO is looking strong with a strong momentum going in next week

Congratulations @tobetada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 22000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for sharing it.

I understand your table and calculation logic. I agree with it.

Let's wait for the explanation from Khal as his comment.

I only delegated 1000HP to leo.voter, and a few % lower than commitment does not impact me much but with 100000HP is a different story.

It seems I got more rewards after your post :)

I got higher LEO per day even the LEO price increased.

Again, thank you for your analysis.

Let make it transparancy.