Does Inflation Determine Price?

This argument seems to be popping up all the time

In my recent post about HIVE/BTC in which I argued for a bullish near term reversal and breakout for Hive in relation to BTC (and USD essentially), I received a comment from @lighteye that I want to address here. It's a position which I have often encountered over the years and while it makes sense at first, it is not as straight forward as one might think.

First, the comment that sparked the conversation:

But there is change in the air. Important trend lines arebeing broken and with around 1 year left for the bull phase I am going to cal it: Hive is going to make a strong reversal.

No, it won’t @tobetada. I like your optimism, but that will never happen because of one simple fact: Hive is inflationary currency, and Bitcoin is deflationary currency,. It’s a simple truth.

...

Well, if you don’t understand simple math, or the concept of deflation and inflation, I can’t help you...

In other words, the core idea is that inflation systematically erodes the purchasing power of currencies or assets, occurring when the supply expands disproportionately, effectively diluting the value of each individual unit while the underlying demand remains relatively constant.

So what's the problem?

I am not arguing against "simple math" (applied in a social context); it makes sense that when there is more of something, it should become less valuable - but here is the catch - if demand overall stays equal.

My simple argument is this:

The demand far outweighs the relevance of inflation (when it is kept at reasonable levels).

Inflation for Hive

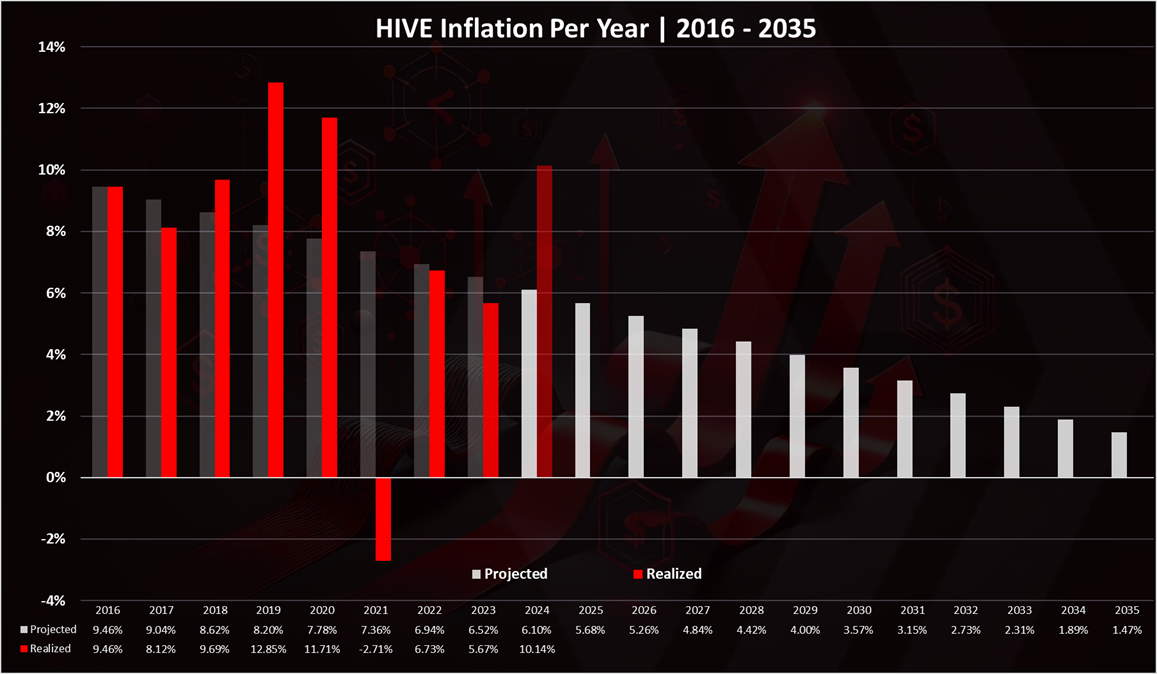

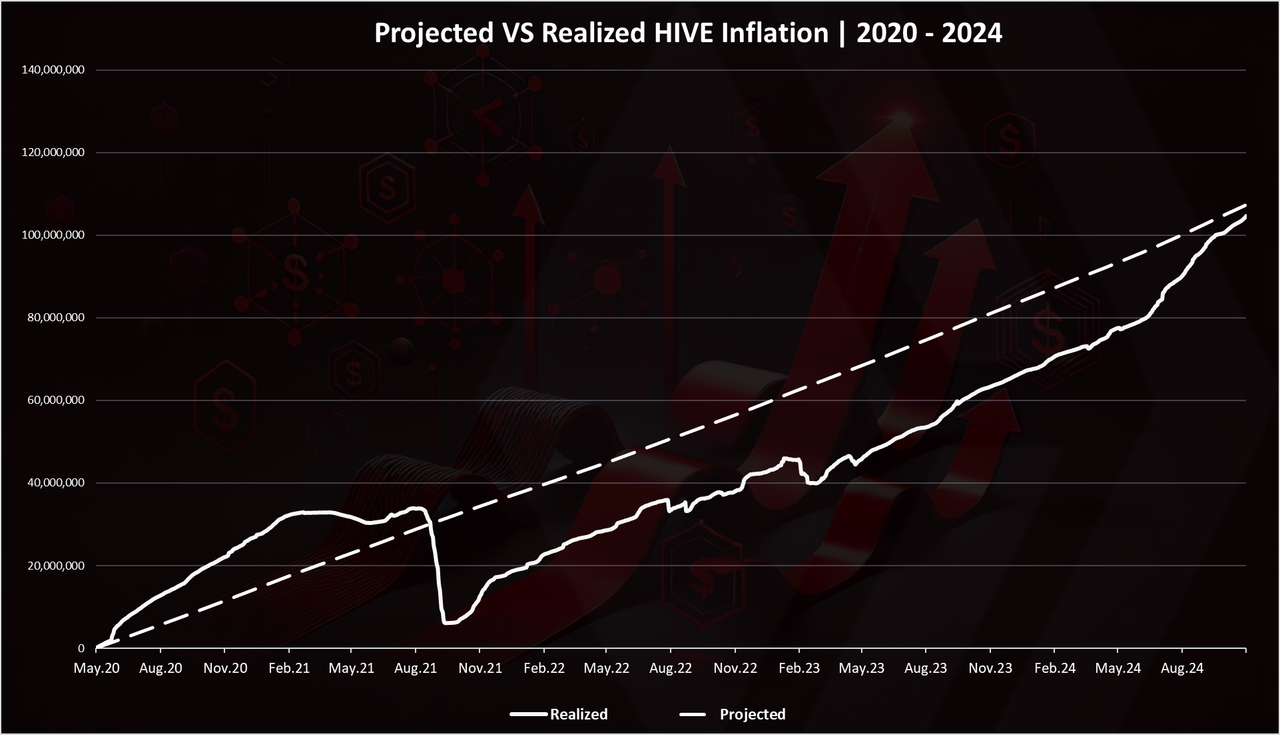

When we look at Hive, @dalz gives us a very nice overview of what inflation we have seen over the years. Overall Hive's inflation actually shrinks by around 0.2% every year and is projected to be at around 6% for 2024. It will be only around 2% in 10 years! In reality, however, Hive's inflation varies (you can read more about why in the post).

Overall, we can see that Hive is now pretty much exactly at the projected amount and has remained under it for the majority in the last 4 years (due to the bull market in 2021).

In my opinion this is a very healthy development and there is simply no cause for alarm. In fact, our inflation is actually deflationary as it is being reduced every year. I would even argue that it could be too low in the coming years. This is actually another argument about the pros of inflation: In brief, it is the idea that inflation distributes coins to a broader user base that in turn increases network activity, thereby increasing demand and price.

Demand for Hive

The best metric highlighting demand is probably price. If demand is high, price will go up and if demand is low it will generally go down. It is of course not quite that simple as we have whales manipulating price to their interests and the effects of high demand might be mitigates by the fact that Hive's design is feeless in nature, i.e. one can use the blockchain to a relatively high degree without having to buy more Hive. We also have many speculators that are essentially only interested about the price and not the project; the demand is therefore artificial.

Inflation < (artificial) Demand

When inflation is kept reasonable, demand far outweighs the effects of inflation on price. Arguing that a coin or token can not "make a reversal" or is "doomed to stay at low prices" in light of inflation not only seems questionable and is provably false when we look at the data. Take 2021, for example. Hive made a 34x in under a year when inflation was projected to be at around 7.5%. If the argument by @lighteye were correct, we should have never seen such a reversal and Hive should have apparently stayed at 10 cents (?). Clearly, market cycles are more relevant.

Conclusion

To answer the question of the post: yes, inflation does generally affect price, but it does not determine it, since we also have to look at the demand side of things (which can be artificially inflated) and has a much greater weight for price development.

Hive's deflationary inflation means that it will become increasingly harder to earn Hive making it perhaps even scarce as adoption continues. We already have the web3 killer dapps that everyone seemingly wants and I am confident that this amongst other facotrs will be reflected in price appreciation in the near future.

Check out the Love The Clouds Community if you share the love for clouds!

My argument stays, @tobetada. You are making a mistake measuring Hive with the dollar, which is even more inflationary. You should apply direct exchange value between Hive and Bitcoin, and you would see the truth: It will never grow against the Bitcoin. Never.

okay, but that is a different argument and I wouldn't necessarily disagree with it. But it completely factors out the growth potential we have here as you are assuming (I would think) that Hive wouldn't change over the years. Basing that argument solely on inflation is ridiculous as inflation is simply one metric to look at when assessing the future valuation of a coin or an asset.

No, @tobetada, that is not my assumption. That is your assumption on what I am thinking. No need to do it, I will tell you exactly. Hive will change, but until it stays inflationary, it can’t go up versus deflationary currencies. If you want to make a point, you have to decide what measure you would like to use on Hive.

yeah I have had a feeling that we are talking past each other a bit.

Your take is embarrassing and showcases your ignorance as to how this all works.

Inflation is just like any other investment.

Investments can succeed or fail just like anything else.

You're basically making the argument that every investment is automatically going to fail.

Terrible take.

You can't be blamed personally for this of course.

Every zealous Bitcoiner blindly parrots the same message as if infallible truth.

Meanwhile Bitcoin isn't even deflationary.

Logarithmic inflation is not magically deflation.

No, @edicted, I didn’t say that – that is what you said. I said one simple thing – you cannot expect inflationary currency to grow against deflationary one.

This means you really don’t know what inflation and deflation means.

And BTW, I didn’t say all of this to defend Bitcoin. It doesn’t care about what you think of it. I said it so the people does not expect Hive ever goes stronger against Bitcoin. IT WILL NOT HAPPEN. This is the trend:

1st time $BTC hit 70K, $HIVE was $0.432

2nd time $BTC hit 70K, $HIVE was $0.438

3rd time $BTC hit 70K, $HIVE was $0.305

Now $BTC hits 70K for the 4th time, $HIVE at $0.193

https://hive.blog/hive-124838/@themarkymark/re-peaksnaps-sm5pdp

And it will inevitably go down.

Bitcoin has a block reward of 3.125 BTC every ten minutes right now.

This is the INFLATION rate.

You're embarrassing yourself.

Deflation means that Bitcoin would be burning currency on every block.

You clearly don't understand what it means.

Great information!!!

It's incredibly reductive and almost embarrassing to say "it's simple math".

Nothing about economies is simple.

Inflation is an INVESTMENT.

On the Bitcoin network the only investment being made is for block security... which means they can't scale up in any other way but highly secure small blocks. Cryptocurrencies that are hyperinflating can have massive success if that money is actually going to places that generate more value than they cost. This is the definition of an investment. Inflation is only bad when a corrupt elite controls it for their own ends (aka the investment is a bad one). This is a nuance that almost no one seems to understand... and even worse everyone acts like they understand the situation perfectly because it's "so simple".

yeah it totally depends where that inflation is going, simply saying inflation = bad is ignorant to say the least

It would be like saying a company trying to spend money to scale up is always a bad idea.

It's simple math.

Scaling up costs money.